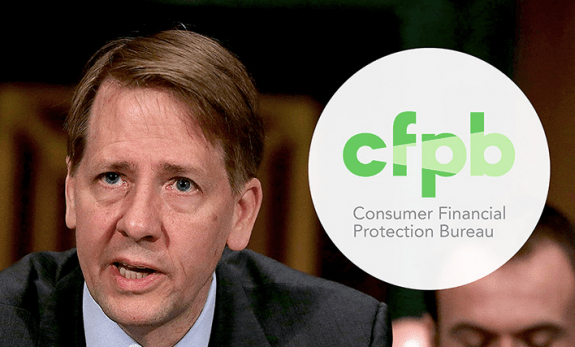

As the Daily Business News has covered recently, the saga of the Consumer Financial Protection Bureau (CFPB), and its embattled director Richard Cordray, has been one for the record books.

Last Friday, the Trump Administration doubled down.

According to USA Today, the Administration officially joined a legal challenge aimed at sharply reducing the authority of the CFPB, a move that has drawn cheers and jeers from lawmakers.

Jumping into the PHH Mortgage vs. CFPB federal appeals court case, the Department of Justice argued in an brief that the structure of the CFPB is unconstitutional.

“Comparing the CFPB to other independent agencies that are run by a commission with multiple members, the design of the CFPB may violate the Constitution because it is run by a single director that the president cannot remove at will,” said the brief.

“There is a greater risk that an ‘independent’ agency headed by a single person will engage in extreme departures from the President’s executive policy.”

According to the Washington Post, legal experts say that even though the brief does not make the Justice Department an official party in the case, it shows that the department is actively opposing the CFPB, and could signal that it may not defend the current structure of the agency if the battle reaches the Supreme Court.

“It’s certainly not good for the CFPB,” said Michael Landis, litigation director for U.S. Public Interest Research Group, a consumer advocacy group.

“The D.C. Circuit will put weight on the views of the Justice Department.”

If the case continues through the court system it could create serious issues for the CFPB.

“The organization can defend itself in the D.C. Circuit court, but it would need to be represented by the Justice Department if it wants to take the challenge up to the Supreme Court,” said Landis.

In that scenario, the CFPB would need another group to join the case on its behalf to argue against PHH before the Supreme Court.

Democrats and other consumer advocates tried to do so when they requested to intervene in the case earlier this year, but the court rejected them.

In support of the CFPB, they say that the agency being independent is the entire point, to shield it from shifts in presidential administrations to provide a more consistent approach to regulation.

“It is independent from the political process, just like the other bank and financial regulators,” said Brian Simmonds Marshall, policy counsel for Americans for Financial Reform.

The Manufactured Housing Industry Speaks

As Daily Business News readers are already aware, while the CFPB had the support of the Obama Administration, the Trump Administration has had the organization in its crosshairs since the election.

Those in the industry have not been shy about their feelings on the matter.

The information on this case also has indirect ramifications for the Manufactured Housing Institute (MHI), and others in the industry, as the Preserving Access bill is being floated, which would modify portions of Dodd-Frank.

For more on what the Preserving Access bill means for the industry, check out the latest article on The Masthead.

For more on the CFPB’s impact on the manufactured housing industry, click here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.