Noteworthy headlines on – CNNMoney – Wells Fargo’s whistleblower problem worsens. Twitter cofounder begins selling off shares. Corona owner soars as Trump tariff fears fade. How North Korea makes its money.

Some bullets from Fox Business – US, China visit: Why Trump is in the driver’s seat. With “Nuclear Option,” Senate ends Democratic blockade of Trump court pick. Wall Street bounces back from Wednesday’s fed-led decline. Oil prices rise despite bearish inventory figures.

“We Provide, You Decide.” ©

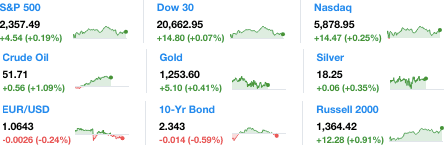

Key Commodities

Crude Oil 51.71 0.56 (1.09%) Gold 1,253.60 5.10 (0.41%) Silver 18.25 0.06 (0.35%)

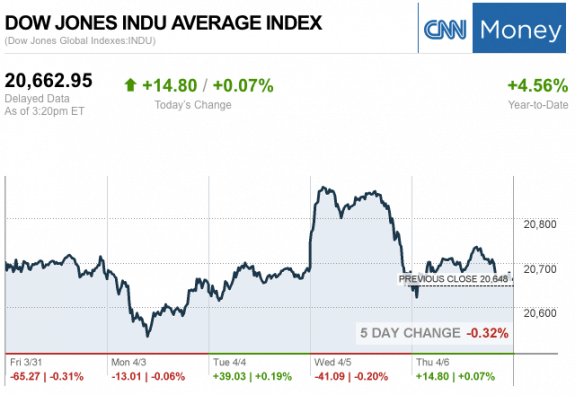

The markets at the Closing Bell Today…

S&P 500 2,357.49 4.54 (0.19%)

Dow 30 20,662.95 14.80 (0.07%)

Nasdaq 5,878.95 14.47 (0.25%)

Russell 2000 1,364.42 12.28 (0.91%)

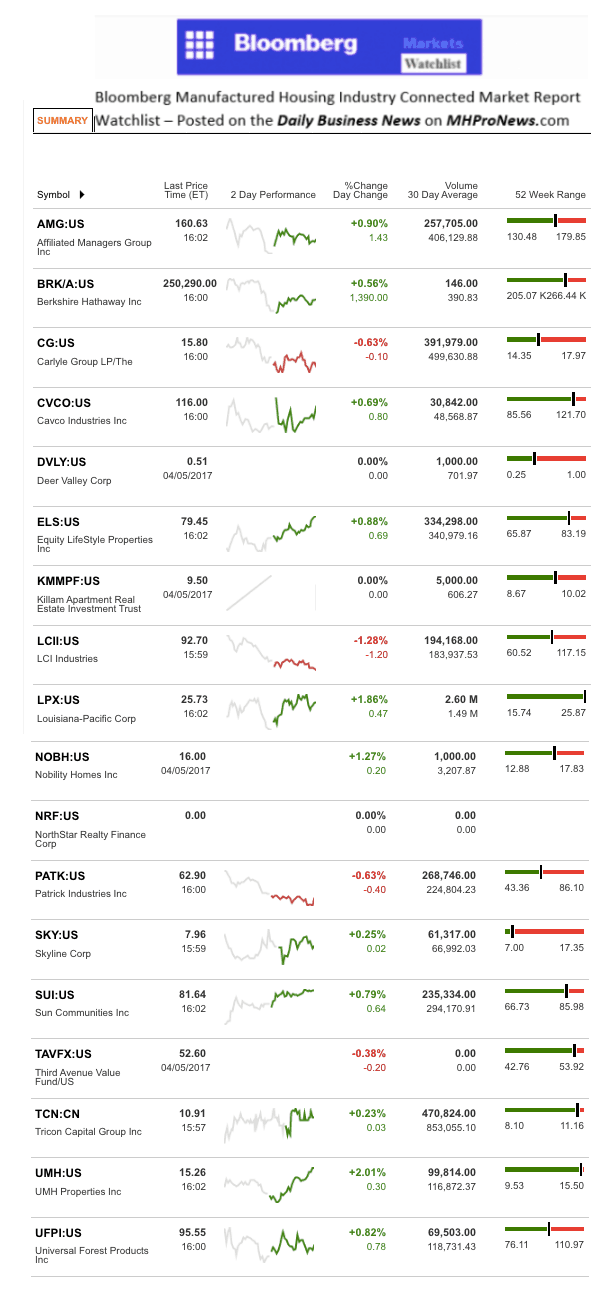

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were UMH Properties Inc. (UMH) and Louisiana-Pacific Corp. (LPX).

The top two sliders for the day were LCI Industries (LCII) and Patrick Industries Inc. (PATK).

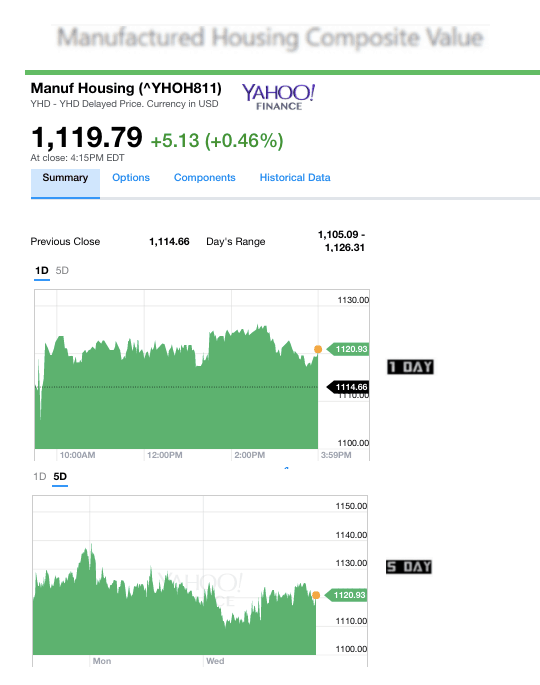

Manufactured Housing Composite Value (MHCV) Ticker

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.