Noteworthy headlines on – CNNMoney – United loses $250 million in market value. Toshiba warns it may not survive crisis. White House says United episode “troubling”. Russia could soon control a U.S. oil company.

Some bullets from Fox Business – Wal-Mart cuts several hundred jobs. Trump targets Dodd-Frank, promises tax cuts at CEO meeting. Sessions visits U.S.-Mexico border to push migrant crackdown. Trump looks to IBM and others to help fix outdated U.S. computers.

“We Provide, You Decide.” ©

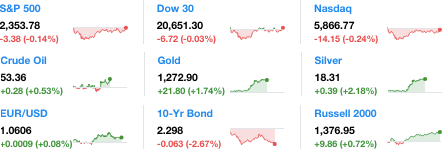

Key Commodities

Crude Oil 53.36 0.28 (0.53%) Gold 1,272.90 21.80 (1.74%) Silver 18.31 0.39 (2.18%)

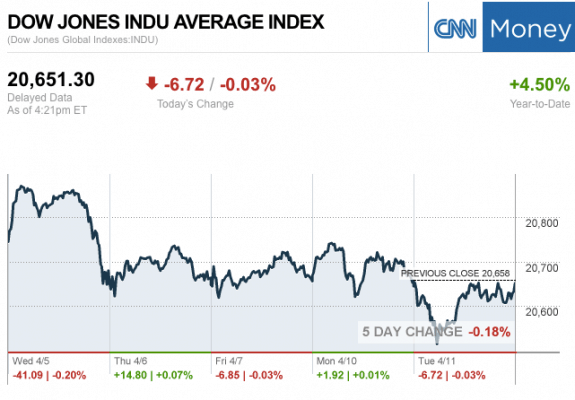

The markets at the Closing Bell Today…

S&P 500 2,353.78 –3.38 (-0.14%)

Dow 30 20,651.30 –6.72 (-0.03%)

Nasdaq 5,866.77 –14.15 (-0.24%)

Russell 2000 1,376.95 9.86 (0.72%)

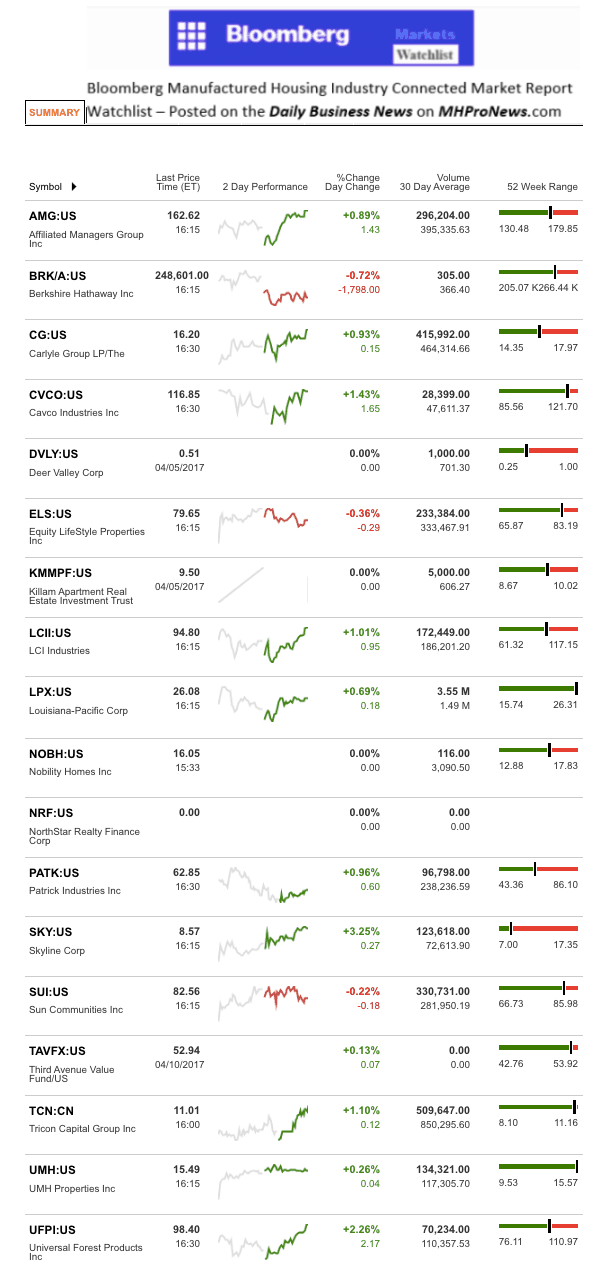

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Skyline Corp (SKY) and Universal Forest Products Inc. (UFPI).

The top two sliders for the day were Berkshire Hathaway (BRK/A) and Equity LifeStyle Properties Inc. (ELS).

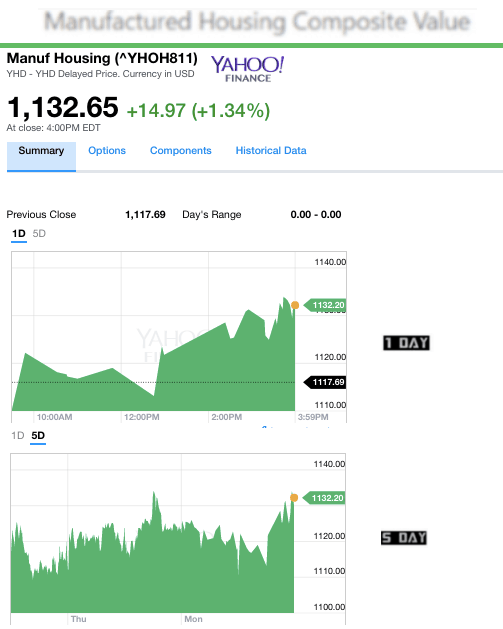

Manufactured Housing Composite Value (MHCV) Ticker

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Graphic credit, Bloomberg Ticker for Daily Business News Manufactured Housing Industry Connected Stock Market Report, MHProNews.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews..