Thousands of manufactured housing professionals – along with several million manufactured home owners – join with citizens from coast-to-coast in the final mad dash to complete and file their 2016 income tax returns by the midnight, April 18, 2017 deadline.

Thus MHProNews is hereby providing key facts from a variety of sources about the income tax that will prove eye-opening and useful, as tax policy will soon take center stage in Washington, D.C.

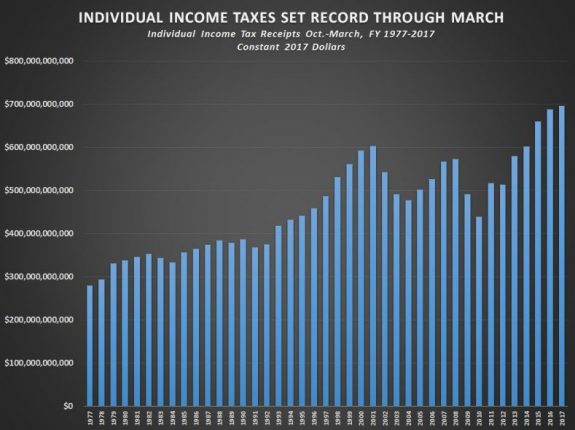

How High Are Current Federal Tax Collections?

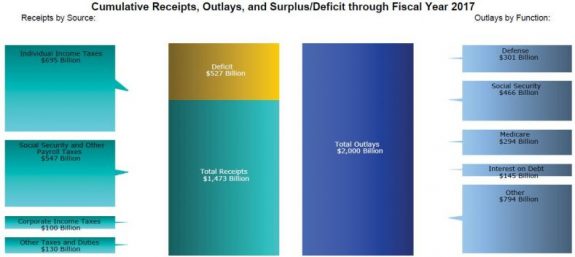

MHProNews has learned from CNSNews that, according to the federal government’s Monthly Treasury Statement, the government collected record amounts of individual and payroll taxes in the first six months of the fiscal year (Oct. 1, 2016 thru March 31, 2017), raking in $695,291,000,000 in individual income taxes. That’s $7,387,280,000 more than the $688,003,720,000 in individual income taxes that the federal government collected in the first six months of fiscal 2016. (All figures herein are using constant 2017 dollars.)

Social Security and other payroll taxes collected by the IRS for the first six months of the fiscal year (FY) amounted to $547,591,000,000, about $2,731,820,000 more than the $544,491,000,000 in Social Security and other payroll taxes that the government collected in the first six months of fiscal 2016.

However, compared to the first six months of FY 2016, total tax collections dropped from $1,513,124,070,000 in total to $1,473,137,000,000, a decline of $39,987,070,000, largely due to a drop in corporate income tax collections. Corporate receipts fell from $124,954,730,000 in the first six months of FY 2016 to $100,234,000,000 (in constant 2017 dollars) for the same period of FY 2017, a drop of $24,720,730,000.

Additionally, customs duties collections also fell $1,179,869,000 in the first six months of FY 2017 over the same period of 2016; and excise tax collections dropped as well, falling $2,745,320,000 for that same period, all in constant 2017 dollars.

This results in the federal government running a $526,855,000,000 deficit through the first six months of this fiscal year, because while the Treasury was collecting $1,473,137,000,000 in total taxes, it spent $1,999,991,000,000.

Based on the 153,000,000 people working in the U. S., the Bureau of Labor Statistics reports the $1,473,137,000,000 collected in total taxes collected equates to $9,628 for each working person. The $526,855,000,000 deficit equals about $3,443 for every person with a job.

How Much Time is Being Spent on Income Tax Related Items?

As Forbes informs MHProNews, Americans will spend over 8.9 billion hours complying with IRS requirements for tax year 2016, amounting to 225,500,000 work weeks, based on a 40 hour week. According to The Tax Foundation, compliance will cost $409 billion for the year.

Why so expensive? Why so long?

The Tax Code has grown from 409,000 words in 1955 to 2.4 million words today, adding the equivalent of 89 words per day, with more to come despite Congress being in session only 111 days in 2016.

That doesn’t include Tax Regulations (the official interpretation of the Tax Code), which alone amounts to 7.7 million words, plus Proposed Regulations which are still waiting comments and testimony. There are also some 60,000 pages of related tax-related case law. All that time and complexity is good for tax lawyers, but reduces productivity and are barriers that discourage small business creation and expansion. So simplifying the code would create jobs and more news businesses, per the experts.

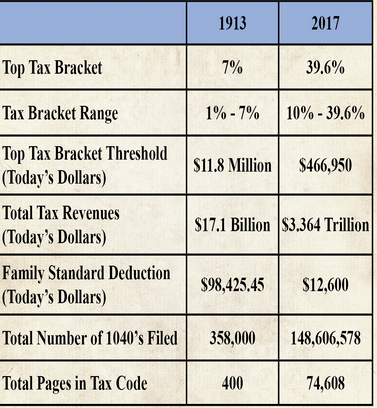

Snapshots of Income Tax History

This chart at the left documents the growth of the income tax since its enactment 104 years ago. As Grover Norquist, president of Americans for Tax Reform, said: “The American Income Tax is perhaps the most dramatic example of how government grows at the expense of liberty. Slowly. Constantly, Inexorably.”

Bottom Lines

An upcoming, follow up report will spotlight opportunities that the federal government has to save on expenditures, and thus cut the ballooning federal deficit. Armed with these facts, professionals are in a better position to discern truth from fiction as the debate over federal tax policy will soon be raging. ##

(Image credits are as shown.)