Noteworthy headlines on – CNNMoney – United and dragged passenger reach settlement. Southwest Airlines: We won’t overbook anymore. China’s Uber worth $50 billion after raising more cash. 10 things United is doing to avoid another dust-up.

Some bullets from Fox Business – Amazon’s first-quarter profit, revenue beat estimates, United continues damage control as Delta PR nightmare begins. Earnings lift Nasdaq to record while Dow, S&P drift. Oil prices fall after Libyan oilfields restart.

9 Key Market Indicators, per Yahoo! Finance.

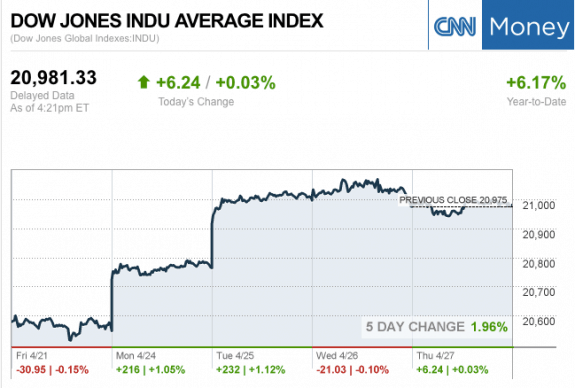

- S&P 500 2,388.77 1.32 (0.06%)

- Dow JIA 20,981.33 6.24 (0.03%)

- Nasdaq 6,048.94 23.71 (0.39%)

- Crude Oil 49.24 -0.38 (-0.77%)

- Gold 1,265.30 1.10 (0.09%)

- Silver 17.20 -0.16 (-0.91%)

- EUR/USD 1.0874 -0.0029 (-0.26%)

- 10-Yr Bond 2.296 -0.015 (-0.65%)

- Russell 2000 1,417.13 -2.30 (-0.16%)

“We Provide, You Decide.” ©

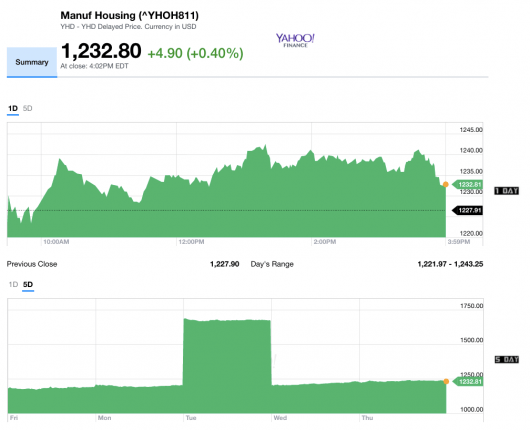

Manufactured Housing Composite Value (MHCV) Ticker

The MH Industry – Today’s Risers and Sliders

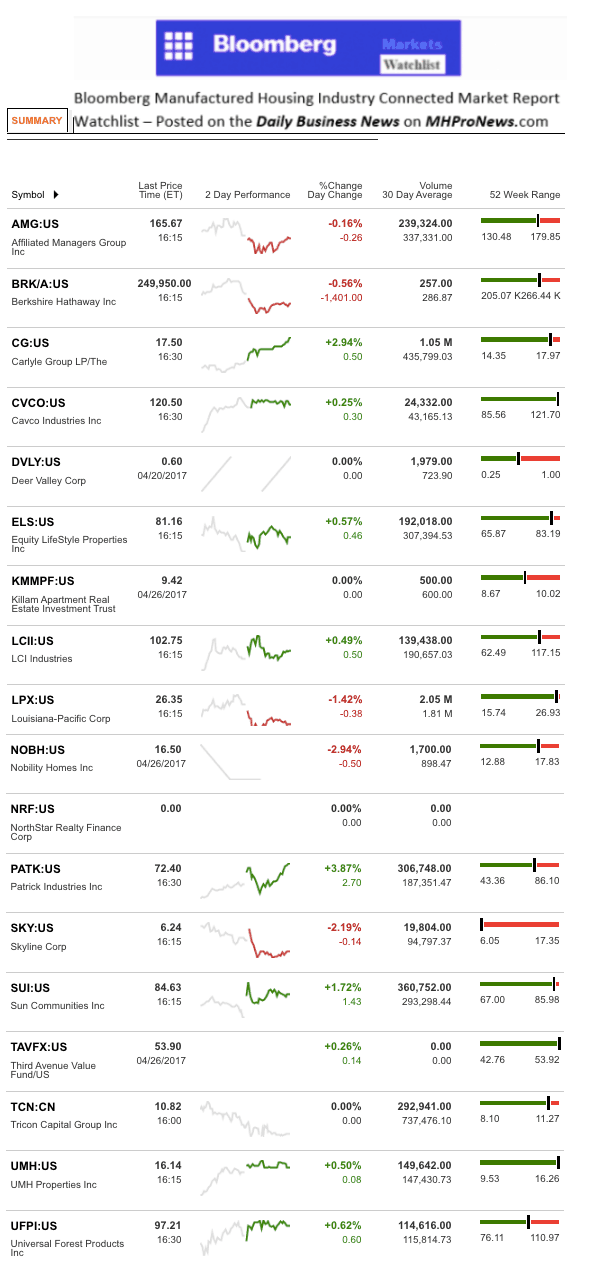

Top risers included Patrick Industries and the Carlyle Group. Skyline and Nobility Homes led the sliders again today.

Skyline’s share price was down 2.19 percent today, and is now at $6.24.

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by RC Williams to the Daily Business News for MHProNews.