Noteworthy headlines on – CNNMoney – Google launches servers in Cuba. 21,000 AT&T Wireless workers could strike Monday. Exxon profits surge 122 percent, ending two-year slump. A third of Starbucks sales were made online or via app.

Some bullets from Fox Business – Trump Saves NAFTA for now, U.S. borderland cheers. U.S. Congress passes short-term bill to avert government shutdown. Soft GDP weighs on Wall St but indexes up in April. Oil retreats from session high, heads for weekly decline.

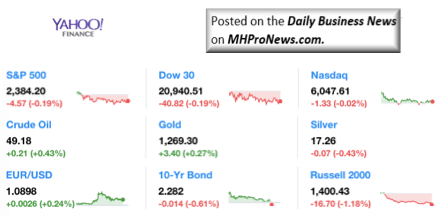

9 Key Market Indicators, per Yahoo! Finance.

- S&P 500 2,384.20 -4.57 (-0.19%)

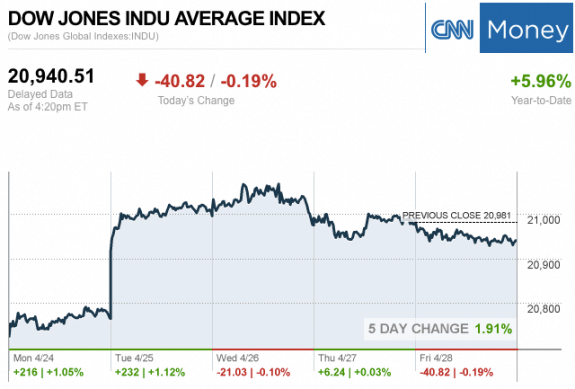

- Dow JIA 20,940.51 -40.82 (-0.19%)

- Nasdaq 6,047.61 -1.33 (-0.02%)

- Crude Oil 49.18 0.21 (0.43%)

- Gold 1,269.30 3.40 (0.27%)

- Silver 17.26 -0.07 (-0.43%)

- EUR/USD 1.0898 0.0026 (0.24%)

- 10-Yr Bond 2.282 -0.014 (-0.61%)

- Russell 2000 1,400.43 -16.70 (-1.18%)

“We Provide, You Decide.” ©

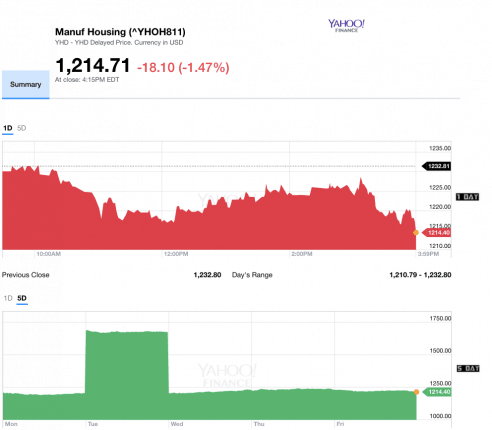

Manufactured Housing Composite Value (MHCV) Ticker

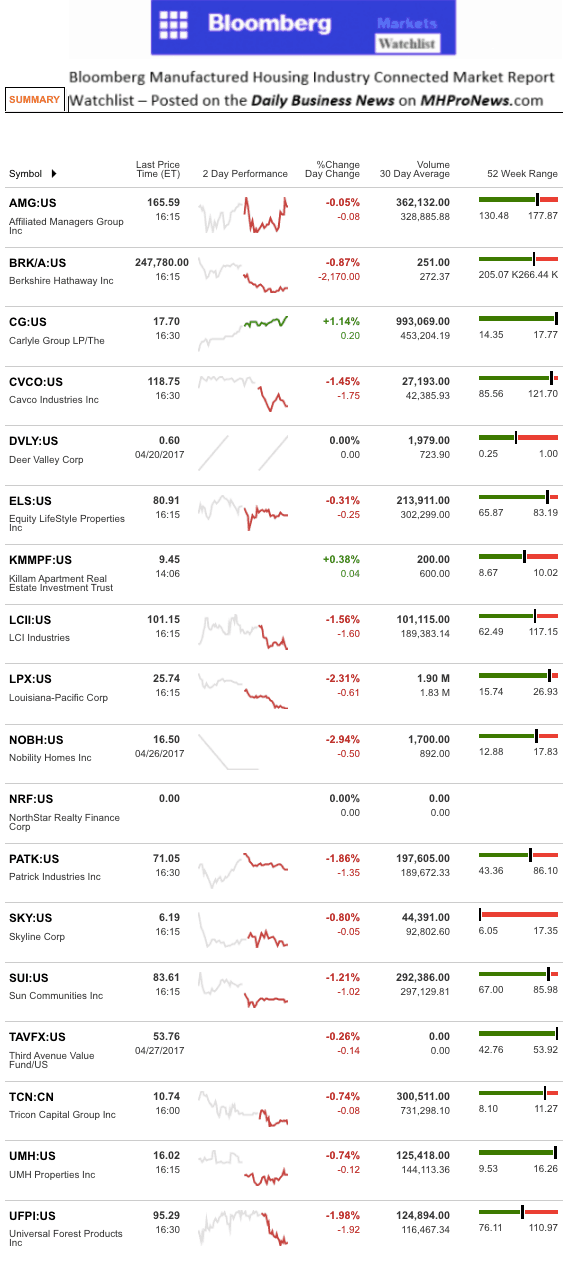

The MH Industry – Today’s Risers and Sliders

Top risers included the Carlyle Group and Killam Properties. Nobility Homes and Louisiana-Pacific Corp. led the sliders today.

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by RC Williams to the Daily Business News for MHProNews.