Noteworthy headlines on CNNMoney – Massive ransomware attack hits 99 countries. Department stores have lost more jobs than coal mines. Trump again suggests ending daily White House briefings. Now robots can teach other robots.

Some bullets from Fox Business – These five department stores shed $4.2B in market value this week. Wilbur Ross: “Gigantic‘” China trade deal gives US access to $2B market. Wall Street falls, department stores take a drubbing. Oil dips as U.S. adds rigs for 17th straight week.

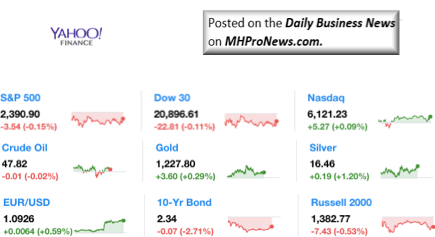

9 key market indicators, per Yahoo! Finance.

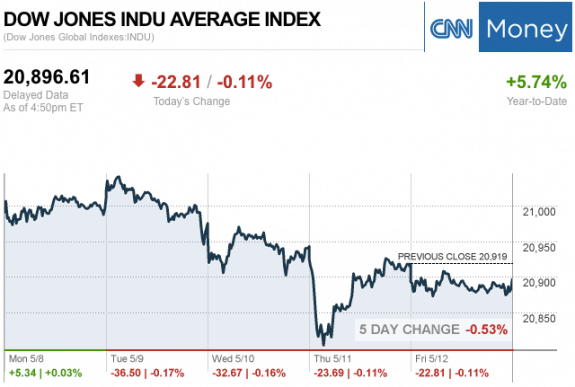

- S&P 500 2,390.90 -3.54 (-0.15%)

- Dow JIA 20,896.61 -22.81 (-0.11%)

- Nasdaq 6,121.23 5.27 (0.22%)

- Crude Oil 47.82 -0.01 (-0.02%)

- Gold 1,227.80 3.60 (0.29%)

- Silver 16.46 0.19 (1.20%)

- EUR/USD 1.0926 0.0064 (0.59%)

- 10-Yr Bond 2.34 -0.07 (-2.71%)

- Russell 2000 1,382.77. -7.43 (-0.53%)

“We Provide, You Decide.” ©

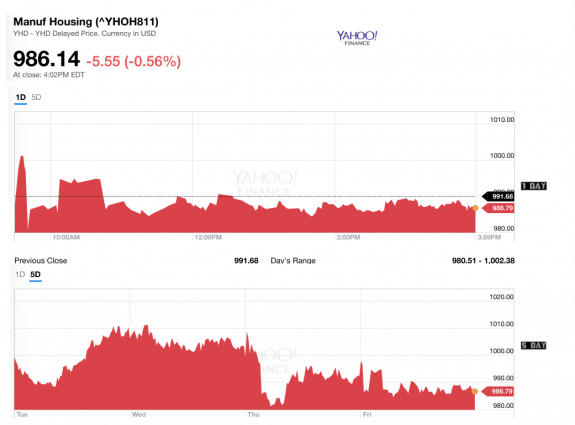

Manufactured Housing Composite Value (MHCV) Ticker

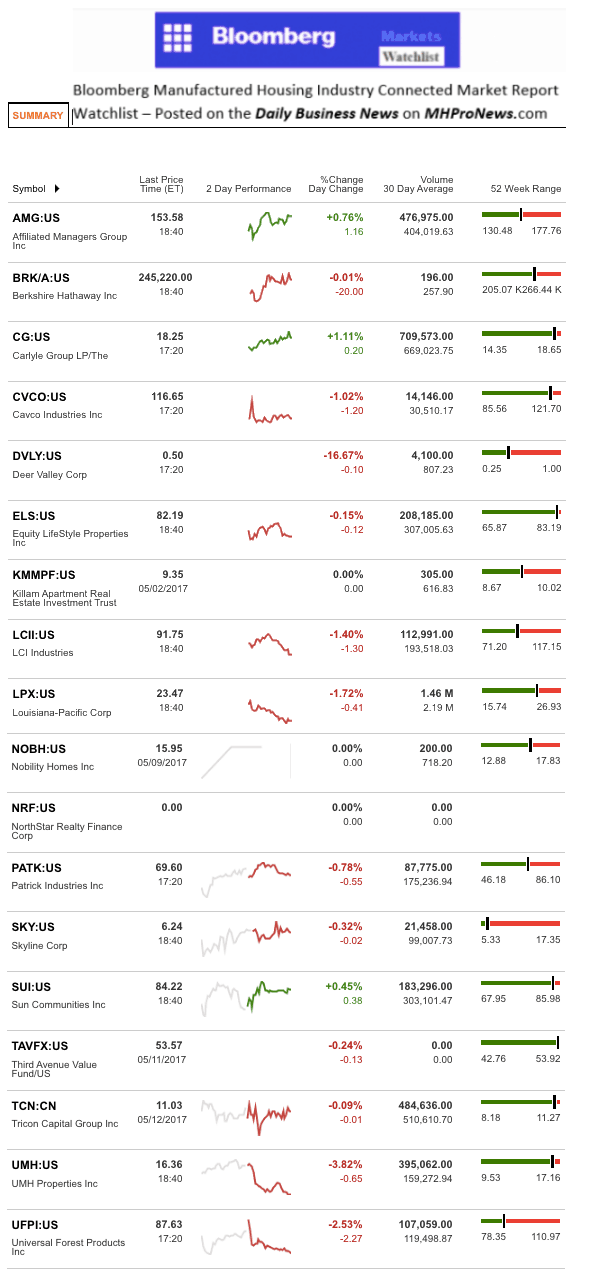

The MH Industry – Today’s Risers and Sliders

Top risers included the Carlyle Group and Affiliated Managers Group. Deer Valley and Universal Forest Products led the sliders today.

MH Market Spotlight

Cavco stock is up over 19 percent since September 2016, and saw CEO Joseph Stegmayer sell 25,000 shares on March 31st, at an estimated value of $2.91M.

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by RC Williams to the Daily Business News for MHProNews.