Today is a big day in the history of the Consumer Financial Protection Bureau (CFPB), as it heads to an appeals court in a case brought by PHH Corp.

That case could completely reshape the organization.

As Daily Business News readers are already aware, critics of the CFPB point to leadership structure, data collection and so-called “trophy wins” as issues that need to be addressed. A D.C. Circuit Court ruled that the CFPB was unconstitutional, in the legal action brought by PHH.

The court ruled that the CFPB’s structure was constitutionally flawed and that its director should be removable at the will of the president.

In advance of today’s hearing, the House Financial Services Committee, led by Chairman Jeb Hensarling (R-TX) debated the future of the Financial CHOICE Act during a hearing on April 26th.

Originally introduced by Hensarling in 2016, the CHOICE Act included a proposal to replace the CFPB with a five-member bipartisan commission that would be subject to congressional oversight and appropriations.

“The Financial CHOICE Act re-establishes this rogue agency as a civil enforcement agency, patterned after the Federal Trade Commission. One that is responsible for actually enforcing the enumerated consumer protection laws written by Congress, instead of making up its own law in an unfair, deceptive, and abusive manner,” said Hensarling.

“True consumer protection is only to be had in competitive, transparent and innovative markets which are vigorously policed for fraud and deception. That’s what the Financial CHOICE Act is all about.”

And, both experts and other politicians had their say on the matter at the hearing.

“The CFPB is an unaccountable federal agency, as exemplified in the case PHH Corp., et al. v. Consumer Financial Protection Bureau,” said Norbert Michel, senior research fellow, Financial Regulations and Monetary Policy Institute for Economic Freedom and Opportunity at The Heritage Foundation.

“The PHH incident is a clear-cut case of an unaccountable federal agency flouting the basic principles of the rule of law. Private firms—financial or otherwise—cannot safely operate in such an environment without the expectation of being wrongly persecuted by the government that is supposed to protect all of its citizens from such actions.”

“Congress can do even better by consolidating the various consumer financial protection statutes under one existing federal agency, such as the [Federal Trade Commission.]”

Another Texas Republican was more to the point.

“The CFPB is one of the most unacceptable and unaccountable agencies in the United States,” said Rep. Roger Williams. “This is what Dodd-Frank gave us and that is why it is so important to fix this disastrous law.”

A View From the Other Side…

Recent motions filed by U.S. Senator Sherrod Brown (D-Ohio) and U.S. Rep. Maxine Waters (D-Calif.), argued that Congress wanted a single director for the agency, because lawmakers who drafted the Dodd-Frank Act, which established the CFPB, “understood that the nation needed a regulator that could respond quickly and effectively to new threats to consumers … and it knew that the CFPB’s effectiveness could be hampered by the delay and gridlock to which commissions are susceptible.”

Sixteen state attorney generals and the District of Columbia also filed a motion, defending the CFPB in its current incarnation.

“As the representatives of millions of citizens across the country, the state attorneys general have used their express statutory authority to bring civil actions to enforce consumer financial protection laws and to pursue regulatory actions in coordination with the CFPB to protect consumers against unfair, deceptive and abusive financial practices,” the motion said.

“The current ruling, if permitted to stand, will undermine the power of the state attorneys general to effectively protect consumers against abuse in the consumer finance industry.”

Could MHI Have Killed the CFPB? Another Opportunity Missed?

As we reported here, prior to the close of filings, MHProNews asked the Manufactured Housing Institute (MHI) if they would be filing an amicus brief in the closely followed PHH vs. CFPB case.

Several operations and organizations have been among those who filed an amicus brief in the case. Was MHI among those organizations?

MHProNews sources say no, and MHI won’t comment.

Why?

“The folks at MHI – the industry lobby group – are nice people, but what’s with the concept of silence is golden? Negative articles on the industry are met with ‘no comment.’ Positive news opportunities are met with ‘no comment.’ I’ve never seen anything like it,” says Frank Rolfe.

“When you refuse to talk, it looks to the public like an admission of guilt, and when you refuse to promote your product it looks like you are embarrassed by it.”

Silence, according to Rolfe, isn’t golden.

The appearance, per Rolfe, is that someone – in this case, MHI – is hiding something.

The View From the MH Industry

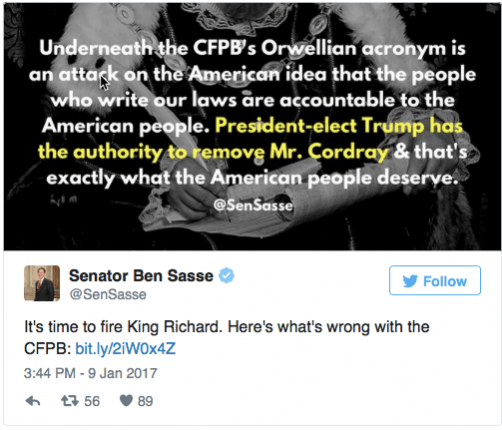

While the CFPB had the support of the Obama Administration, the Trump Administration has had the organization in its crosshairs since the election.

Those in the industry have not been shy about their feelings on the matter.

The information on this case also has indirect ramifications for the Manufactured Housing Institute (MHI), and others in the industry, as the Preserving Access bill is being floated, which would modify portions of Dodd-Frank.

For more on what the Preserving Access bill means for the industry, check out the latest article on The Masthead.

The Daily Business News will continue to follow the hearing and provide updates.

For more on the CFPB’s impact on the manufactured housing industry, click here. ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by RC Williams to the Daily Business News for MHProNews.

(Copyright Notice: This and all content on MHProNews and MHLivingNews always have been and are Copyrighted, © 2017 by MHProNews.com a dba of LifeStyle Factory Homes, LLC – All Rights Reserved. No duplication is permitted without specific written permission. Headlines with link-backs are of course ok. A short-quoted clip, with proper attribution and link back to the specific article are also ok – but you must send a notice to iReportMHNewsTips@mhmsm.com of the exact page you’ve placed/posted such a use, once posted.)