The NY Post warns, “They are facing a crisis of confidence and potential lawsuits amid unprecedented fund closures, job losses and — most critically — low investment returns.”

The NY Post warns, “They are facing a crisis of confidence and potential lawsuits amid unprecedented fund closures, job losses and — most critically — low investment returns.”

“Get out,” per John Aidan Byrne, about what financial adviser Stephen Ng, said about more unwelcome news hitting ‘the hedgies.’ Ng, said, “I have been talking about this — and now I think more and more investors are beginning to realize it.”

Byrne says, that “With just over $3 trillion in assets under management globally, hedge fund magnates are anxiously awaiting a recovery from last year’s feeble industry returns of 5.5 percent, compared with 10 percent for the S&P 500-stock index.”

Investors already withdrew $111.6 billion from hedge funds last year, per eVestment. About 1,100 funds — the largest total since the 2008 financial crisis — closed, and thousands of professionals were axed.

Investors already withdrew $111.6 billion from hedge funds last year, per eVestment. About 1,100 funds — the largest total since the 2008 financial crisis — closed, and thousands of professionals were axed.

So how are the various funds with significant ties to manufactured housing doing? Let’s look.

The View from the MHVille Prism.

5 Vehicles with MH Components

Let’s reference five investment vehicles that we track on the Daily Business News market report.

AMG, which we spotlighted today on the Daily Business News Market Report, says on their site: “Affiliated Managers Group, Inc. (NYSE: AMG) is a global asset management company with equity investments in leading boutique investment management firms. For over 23 years, we have generated superior growth by partnering with the highest quality boutique investment management firms, using direct equity ownership in a framework that closely aligns our interests with those of our Affiliate partners.”

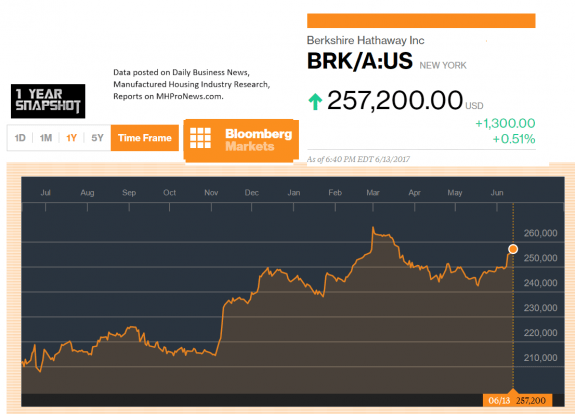

Quora called Warren Buffett’s brand, “Berkshire is the ultimate Hedge Fund. It generally outperformed the broad market index S&P 500, whereas most hedge funds lag before and after fees.”

Carlyle (CG) says of themselves, “Founded in 1987 in Washington, DC, The Carlyle Group is one of the world’s largest and most successful investment firms with $178 billion of assets.”

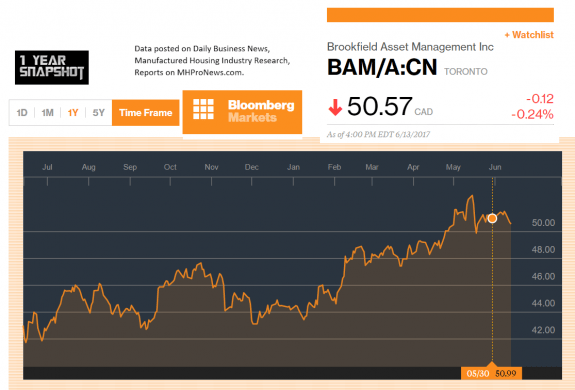

BAM’s brag on their website reads as follows, “Brookfield Asset Management is a leading global alternative asset manager and one of the largest investors in real assets. Our investment focus is on real estate, renewable power, infrastructure and private equity assets.”

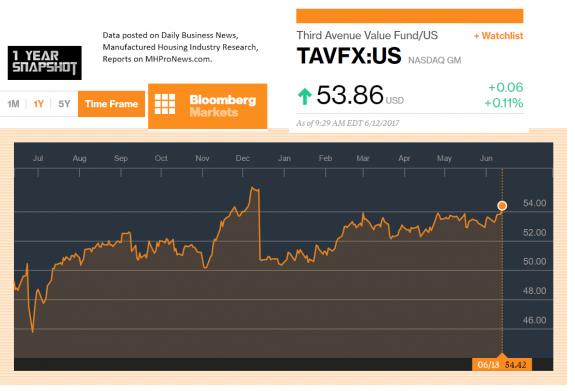

GuruFocus says of Third Ave., “Founded by legendary value investor Martin Whitman, Third Avenue Management manages mutual funds, separate accounts and hedge funds.”

As with all of our stock and market reports, the Daily Business News isn’t making a recommendation or taking a position on the organization in question. Rather, we share data and reports, per our motto, “We Provide, You Decide.” ©.

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)