The evolving Daily Business News market report sets the industry’s stocks in the broader context of the overall market stocks.

By spotlighting the headlines – from both sides of the left-right media divide – this report also helps readers see what are the trends and topics that may be moving the investors that move the markets.

Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks.

MH “Industry News, Tips and Views, Pros Can Use.” ©

- Venezuela oil production dives as debt bills loom

- GOP health care bill: Cheaper plans, fewer benefits

- It’s a good day for retailers! Here’s why.

- Senate GOP keeps Obamacare taxes on the rich

- Rice wants women to use golf the way men do

- Trump protestors expected at U.S. Women’s Open

- Cruz’s Obamacare repeal plan would cripple market

- Trump calls on Chinese journalist instead of American

- Trump budget could reduce deficits

- Yellen: We need to guard against another financial crisis

- Elizabeth Warren begs Yellen to go after Wells Fargo

Selected headlines and bullets from Fox Business:

- Sun Valley: Miami Marlins bidding war still hot, while CBS acquisition prospects cool

- Sun Valley: 5 things to know

- Oil steady as higher output balances Chinese demand

- OPEC compliance with oil cuts worsened in June

- US budget deficit jumped in June

- Senate’s revised health care bill: What’s different?

- Yellen: Trump’s 3% GDP growth target ‘challenging’

- Verizon customer information exposed in data breach

- Disneyland wait times skyrocket

- Britney Spears won’t perform Super Bowl halftime show: report

- C. Penney to open toy shops in all brick-and-mortar stores

- Bank lending shows economy in bad shape: Dick Bove

- NASCAR promotes Brent Dewar, names him president

- DOJ busts 115 medical professionals in $1.3B fraud case

- Tax reform wish list: What American businesses want

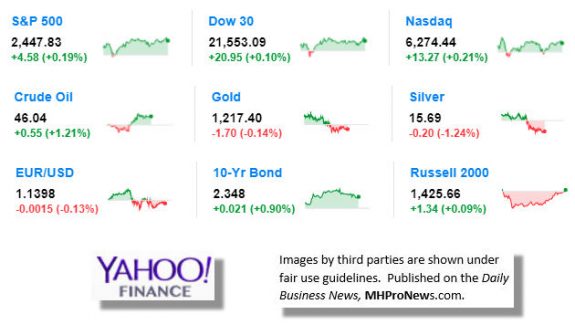

The numbers at the closing bell…

S&P 500 2,447.83 +4.58 (+0.19%)

Dow 30 21,553.09 +20.95 (+0.10%)

Nasdaq 6,274.44 +13.27 (+0.21%)

Crude Oil 46.04 +0.55 (+1.21%)

Gold 1,217.40 -1.70 (-0.14%)

Silver 15.69 -0.20 (-1.24%)

EUR/USD 1.1401 -0.0013 (-0.11%)

10-Yr Bond 2.348 +0.021 (+0.90%)

Russell 2000 1,425.66 +1.34 (+0.09%)

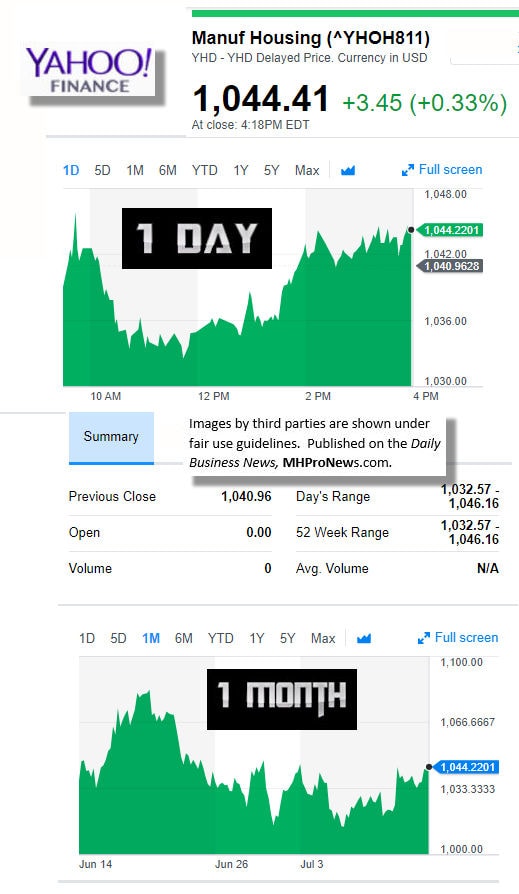

Manufactured Housing Composite Value

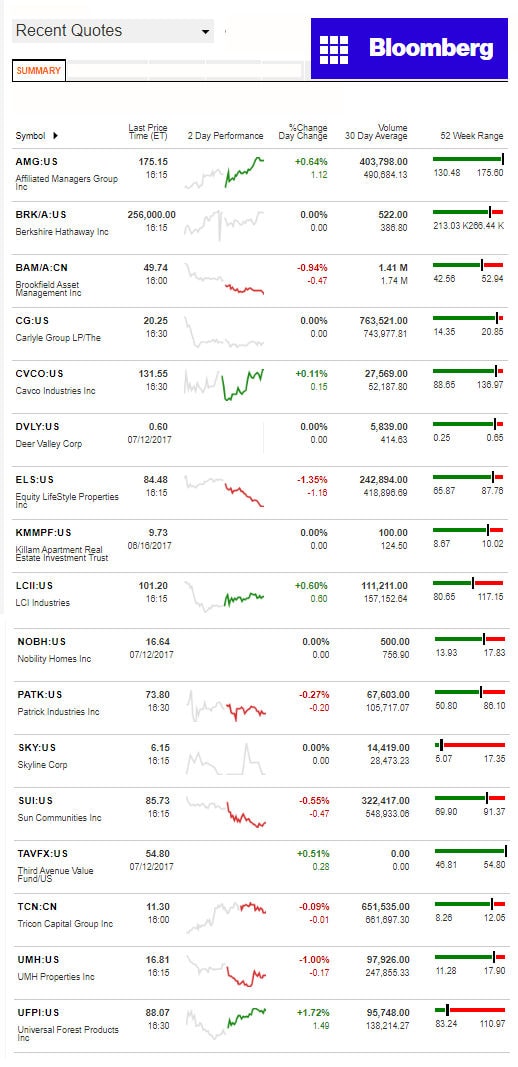

UFPI and AMG lead the gainers. Communities mostly took a slide. Note that in the Bloomberg ticker report below, Killam’s graphic rise is not from today.

For all the scores and highlights on tracked stocks today, see the Bloomberg graphic, posted below.

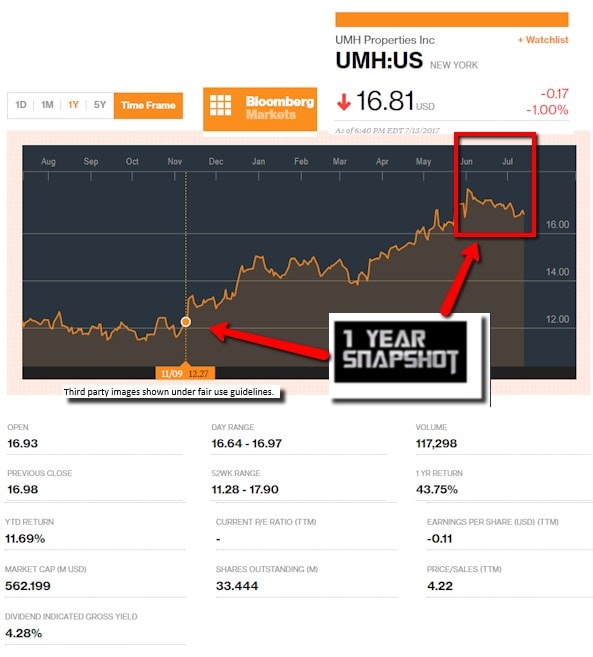

Today’s MH Market Spotlight Report – UMH Properties (UMH)

UMH Properties is our spotlight report for today. As regular Daily Business News readers know, UMH Properties operates one of the largest publicly traded Real Estate Investment Trusts (REITs) in the nation, generally seen as being one of the top ten community portfolios in size, in third-party lists.

By way of disclosure, while we are not sponsored by UMH at this time, they have featured our publisher in the past at their annual event, where he was met with rave reviews (see video). We don’t hold stock in this firm, nor other companies reported in this market report.

We selected one third-party report published today that was ‘middle of the pack’ in their coverage, which you can get a quick sense of from the screen capture above.

UMH Properties, Inc. (NYSE:UMH) Coverage Initiated at FBR & Co

July 13th, 2017 – By Amy Steele

Equities researchers at FBR & Co assumed coverage on shares of UMH Properties, Inc. (NYSE:UMH) in a note issued to investors on Tuesday.

The brokerage set an “outperform” rating and a $18.50 price target on the real estate investment trust’s stock. FBR & Co’s target price would indicate a potential upside of 8.95% from the stock’s current price.

A number of other research analysts have also commented on UMH. Wunderlich lifted their price objective on shares of UMH Properties from $16.00 to $18.00 and gave the company a “buy” rating in a research note on Thursday, May 11th.

BidaskClub lowered shares of UMH Properties from a “buy” rating to a “hold” rating in a research note on Saturday, July 8th.

Finally, Sidoti lifted their price objective on shares of UMH Properties from $18.00 to $21.00 and gave the company a “buy” rating in a research note on Thursday, May 25th.

Two research analysts have rated the stock with a hold rating and three have given a buy rating to the company. The company has a consensus rating of “Buy” and a consensus price target of $17.88.

UMH Properties (NYSE:UMH) opened at 16.98 on Tuesday. The company has a 50 day moving average price of $17.07 and a 200 day moving average price of $15.39. UMH Properties has a 52-week low of $11.28 and a 52-week high of $17.90. The firm’s market capitalization is $531.12 million.

UMH Properties (NYSE:UMH) last announced its quarterly earnings results on Tuesday, May 9th. The real estate investment trust reported $0.17 EPS for the quarter, missing the Thomson Reuters’ consensus estimate of $0.20 by $0.03. UMH Properties had a return on equity of 0.46% and a net margin of 0.59%. The company had revenue of $26.45 million for the quarter. On average, equities analysts forecast that UMH Properties will post ($0.11) EPS for the current fiscal year.

The company also recently announced a quarterly dividend, which will be paid on Friday, September 15th. Stockholders of record on Tuesday, August 15th will be issued a $0.18 dividend. This represents a $0.72 annualized dividend and a dividend yield of 4.24%. The ex-dividend date of this dividend is Friday, August 11th. UMH Properties’s [sic] payout ratio is -720.00%.

A hedge fund recently raised its stake in UMH Properties stock. Creative Planning increased its position in UMH Properties, Inc. (NYSE:UMH) by 227.1% during the second quarter, according to its most recent filing with the Securities and Exchange Commission.

The institutional investor owned 6,049 shares of the real estate investment trust’s stock after buying an additional 4,200 shares during the period. Creative Planning’s holdings in UMH Properties were worth $103,000 as of its most recent SEC filing.

45.36% of the stock is owned by institutional investors and hedge funds.

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Manufactured Home Industry Connected Stock Markets Data

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses.

You will find only the very best manufactured home industry coverage, every business day.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)