“Invisible Credit” is when individuals or families have paid their bills – like utilities, phone, and internet – on time. But they still don’t have any – or a good – FICO credit score.

- FICO scores are typically based on such items as: credit card and loan debt and repayment,

- the degree of credit utilization,

- length of credit history,

- and outstanding debts,

- among other factors.

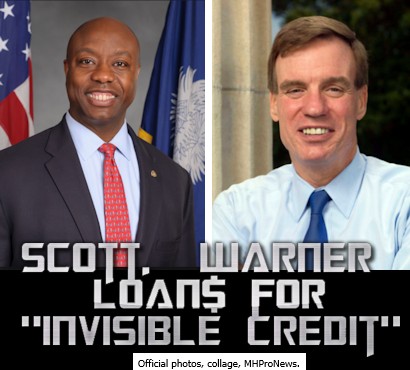

Such as change would allow the Federal Housing Finance Agency (FHFA) to use non-traditional credit scoring models to determine creditworthiness of applicants. That would increase the numbers who qualify for loans, and allow the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac to approve these types of loans, per American Banker.

“I’m focused on encouraging sustainable homeownership over a simple homebuyership. One way to do so is the [Federal Housing Finance Agency] updating the accepted credit scoring models of the GSEs,” Scott said at a Senate Banking Committee hearing last month. “If a family pays their utility bills or their phone bills on time for a decade, it ought to count towards their ability to have a home.”

“Providing financing for more middle-income people who can pay their mortgage is so important,” Sen. Sherrod Brown, D-OH, “because there is such a terrible housing shortage for moderate-income people.”

MH Industry Professionals, Interests and Concerns

That there are manufactured home industry professionals – including lenders – who are open to providing more moderate-income or even low-income Americans with access to home loans through alternative credit is a step in the right direction.

But expanding access to chattel loans is the current hot-button topic in manufactured housing.

According to HousingWire, though the Scott-Warner bill has been introduced and appears to have some support, FHFA Director Mel Watt says that anything changing before 2019, would be a “mistake.”

Watt vows that no changes will go into effect before then.

“First, based on the overwhelming feedback we have received from the industry, it is clear that it would be a serious mistake to change credit scoring models before mid-2019 when the Common Securitization Platform is fully operational and the Enterprises implement the Single Security,” Watt said.

He added, “For this reason, any credit score model change would not go into effect before 2019 even if I announced a decision today.”

“Second, we believe that, regardless of the decision we make on credit score models, the short term impact on access to credit will not be nearly as significant as was first imagined or as the public discourse on this issue has suggested,” says Watt.

“Credit scores are only one factor the Enterprises use to evaluate loan applications and the Enterprises currently use the same or even greater levels of credit data in their underwriting systems as the credit scoring companies use.”

So while members of Congress attempt to move in one direction, the FHFA intends to hold off on that for at least another two years until mid-2019.

Both groups admit that in order to determine creditworthiness fairly under guidelines other than the FICO score that there will need to be more data, which will take time to collect.

“Adding more credit scoring models to the market would require some data validations … time periods that adds costs,” Brenda Hughes, senior vice president at First Federal Savings Bank of Twin Falls in Idaho, said during testimony at a Senate Banking Committee hearing last month.

“We think it’s very important for them to begin updating their credit models to take advantage of those other sources, which we think will widen the net of folks who become eligible for conforming mortgages” purchased by Fannie and Freddie, said Charles M. Purvis, president and CEO of Coastal Federal Credit Union in Raleigh, N.C.. # #

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)