40 percent of American households make less than $25,000 annually in 2015, according to numbers from the National Wage Index.

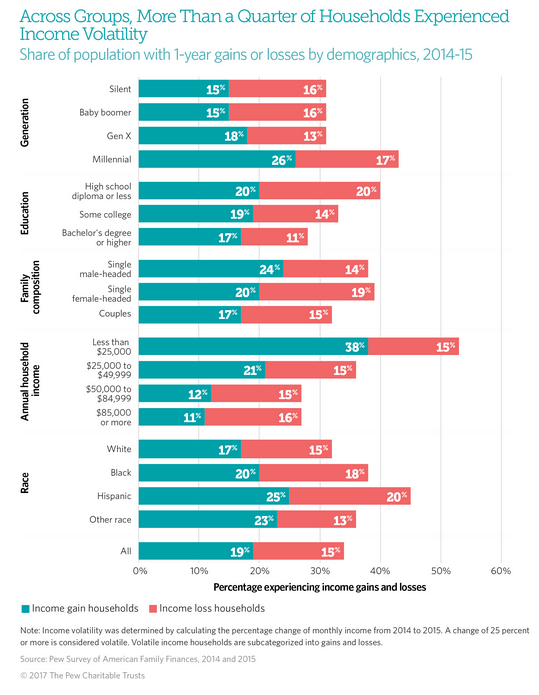

A recent report by Pew Research found that income volatility – fluctuation in income whether monthly, annually, or both – affects those with lower incomes more than others.

Income volatility, for the purpose of the Pew Research study, was defined as those with variances in their year-over-year income of at least 25 percent. That variance could be either in the form of gains or losses.

The study found that income volatility spreads across every demographic group. It affected 43 percent of families, as of 2011.

A similar report from the JPMorgan Chase Institute found that on average, 55 percent of people experience a 30 percent change in income on a month-to-month basis.

Those with the lowest incomes – often working minimum wage and other low-wage hourly jobs – saw a 30 percent change at minimum, said Forbes.

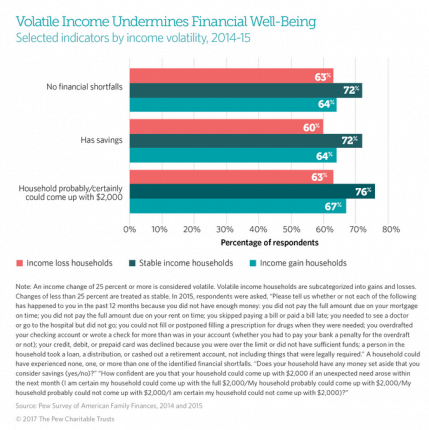

“Seventy-two percent of respondents from households with stable income said they did not experience any shortfalls in 2015, compared with 64 percent of those from households with income gains and 63 percent from those with losses. Similarly, families with stable income in 2015 were more likely than those with volatile income to report that they had savings and that their household probably or certainly could come up with $2,000 for an unexpected need,” per Pew Trusts.

For many of those making less than $25,000 each year, one of the main reasons for month-to-month and year-over-year income volatility is due to the nature of hourly jobs. Sometimes there is more work than others. That’s especially so for seasonal jobs, and ones that rely on tourism, among others.

For those with an hourly rather than a salaried job who take a sick day or leave of absence for a family emergency, they can lose a significant amount of income.

“When my son was sick, I had to stay at the hospital with him, so I couldn’t go to work; my husband had to stay home with our twin babies, so he couldn’t work. Here’s the problem: neither of us had paid sick leave, so we lost hours on the job, and we lost pay, too. The result was we could not afford to pay our rent on time, nor our light bill. From there, we became homeless,” per such a worker’s testimony to Congress in 2014, per Forbes.

It can be hard for people working low-wage jobs to work their way out of poverty. If they have relied on government or state assistance programs like SNAP (food stamps), Section 8 housing, and others that seem like a plus are actually like flypaper. They may harm chances for economic freedom.

Actively retired Rev. Donald Tye, Jr. has told MHProNews that for years, the black community often pulled together to keep members from buying into those programs. Over time, the steady promotion of federal handouts eroded those efforts for self-reliance. As a Masthead post explained, whatever you subsidize, you tend to get more of it.

76 percent of Americans are living paycheck-to-paycheck, per CNN Money.

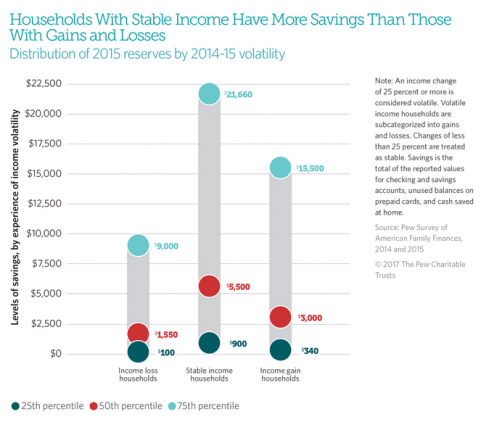

“In 2015, the typical household with an income loss had $1,550 in savings, and the typical household with a gain had $3,000. By comparison, the typical family with stable income had $5,500 saved,” per Pew Trusts.

On the lower end of income, one expensive emergency – car repair, hospital trip, or similar – could easily wipe out most or all of those savings for low income citizens.

This is clearly represented in the “Worst Case Housing Needs2017 Report to Congress” by the Department of Housing and Urban Development (HUD). The report found that there are 8.3 million people who are either spending more than half their income on rent, are living in substandard conditions, or both.

Why a Minimum Wage Hike Won’t Fix the Problem

Daily Business News readers already know that raising the minimum wage may cause an initial increase in income, but historically fails to provide the relief backers believe it will bring. The solution? Per experts, applying the law of supply and demand.

While the president’s economic proposals are controversial to some, they’re based upon pragmatic concepts of protecting and advancing U.S. businesses, and workers through an application of the law of supply and demand; as well as risk and reward. To learn more about documented results, scroll to the spotlight market feature, in the Daily Business News report, linked here.

How Manufactured Housing Could Make an Impact

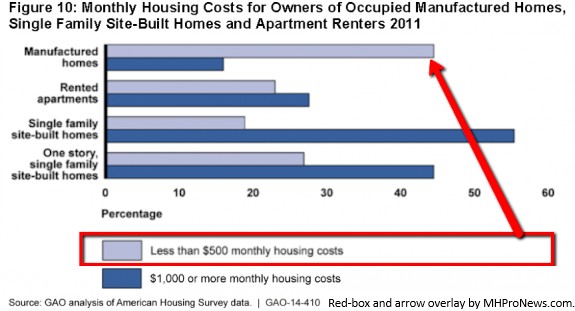

These nagging woes could find some measure of a free-market solution through manufactured housing.

With the affordable price-point of manufactured housing – especially in comparison to rents, which are through the roof and completely out of reach for many – people may have an easier time making it month-to-month.

As HUD Secretary Carson and Tye have repeatedly pointed out, affordable home ownership boosts household wealth. That in turn improves sustainability in the face of income volatility.

But HUD’s Pam Danner and her colleagues have not been applying the “enhanced preemption” that could lead to more low-income and other Americans gaining access to manufactured homes in more urban areas. For a new report, see the video with Danner and related industry commentary and analysis, at this link here.

“With households already struggling to make ends meet, income volatility places yet another burden on families’ attempts to create a financial buffer,” per Pew Trusts. ## (News, analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)