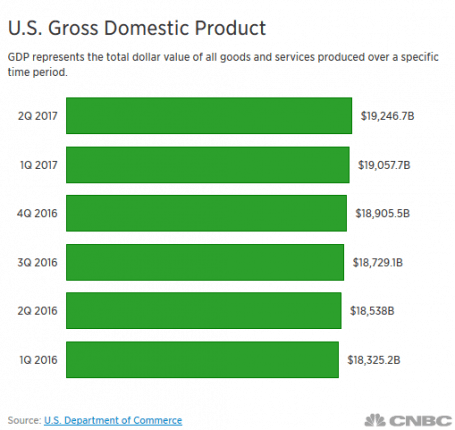

The revised second quarter estimate from the Commerce Department shows that the U.S. economy is stronger than originally thought, per CNBC.

The boost has been in part due to stronger business investments, and more consumer spending.

Last month’s gross domestic product (GDP) was reported to be up 2.6 percent during the second quarter. Economists had predicted that the revised number would likely be slightly higher, at 2.7 percent.

GDP Revised

When the Commerce Department’s revised report was released Wednesday was an even bigger increase than expected – at 3.0 percent.

Businesses made a significant impact on the economy in the second quarter. Spending on equipment jumped 8.8 percent, up from 8.2 percent the month before.

Investments on nonresidential structures grew by 6.2 percent – an increase from the originally reported 4.9 percent rate.

Consumer spending, which makes up more than two-thirds of the economy, grew at a rate of 3.3 percent. Originally, in July this was reported at 2.8 percent. This increase is due to more spending on items like vehicles, cell phones, housing and utilities.

“Underlying domestic demand in the economy is consistent with near three percent growth but the supply-side of the economy is not capable of delivering such a pace of growth at this point,” said John Ryding, chief economist at RDQ Economics in New York.

Reports indicate that consumer spending came in part out of savings. The savings rate dropped from 3.9 percent in the first quarter, to 3.7 percent in the second.

Since consumers cannot continue to spend from savings forever, there are doubts as to whether increased consumer spending at this pace is sustainable.

So far, in the third quarter business spending and retail sales appear to have held steady. Of course Hurricane Harvey will be factored in soon too.

As Daily Business News readers know, Hurricane Harvey will increase demand for manufactured housing, as was reported Texas and Louisiana last week.

“The impact on the national economy will be minor,” said Gus Faucher, chief economist at PNC Financial Services in Pittsburgh. “While some output will be lost in the wake of the storm, most of the difference will be made up in the months ahead.”

Damages from the storm are estimated to be upwards of $100 billion. Tens of thousands have been forced to leave their homes. Even with aid from FEMA, HUD, and regional manufactured home professionals, it’s going to be months-to-years before things start getting back to normal for survivors of Harvey.

“Our point estimate remains for a small drag on growth in Q3: measured Q3 real GDP growth will be only slightly (~0.1ppt QoQ SAAR) lower due to Harvey,” Citi’s Andrew Hollenhorst said in a note Tuesday.

“The output reduction could be greater if the disruption is longer lasting or if there are larger knock-on effects outside the region. For instance, stoppages at oil refineries could curtail activity further down the supply line.” ## (News.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)