If you’re new, already hooked on our spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

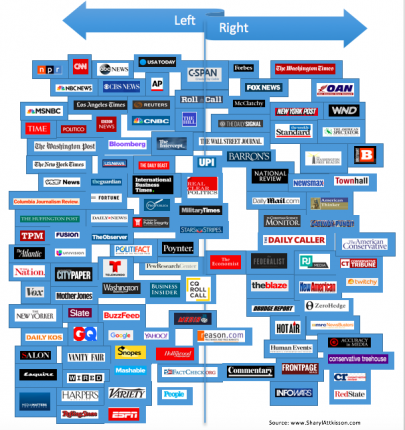

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

- The 7 trips Steven Mnuchin took on gov. planes

- Blue Origin to take tourists to space within 18 months

- Bump stocks selling briskly since Vegas attack

- General Electric is taking away executives’ cars

- Mnuchin travel probe: No legal violation found

- The Dow could be so hot that it melts

- Harvey Weinstein apologizes, intends to sue NY Times following sexual harassment story

- Equifax breach: 6 things Congress can do to help

- Trump hits a new low in attacks on the free press Trending

- Netflix is raising its prices Trending

- Is it too late to buy stocks?

Selected headlines and bullets from Fox Business:

- Mercer bucks ally Bannon in not supporting Grimm comeback

- Kevin Hassett throws down gauntlet in tax reform battle, slams think tank

- House passes GOP budget in key step for upcoming tax debate

- Wall St extends record run on tax overhaul optimism, solid data

- Oil rises 2%, boosted by potential OPEC deal

- As tax overhaul unfolds, some investing angles to consider

- Harvey Weinstein to take leave amid sexual harassment report

- Las Vegas massacre forces hotels to re-evaluate security measures

- NFL’s Cam Newton loses sponsor over ‘sexist’ remarks to female reporter

- Costco’s quarterly profit, sales beat estimates

- Trump expected to decertify Iran nuclear deal, official says

- Diamond Resorts founder challenges NRA head to come to Las Vegas, debate

- Mnuchin’s travel violated no laws, Treasury report says

- Whirlpool wins key US vote in bid to curtail cheap imports from rivals Samsung, LG

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

Today’s markets and stocks, at the closing bell…

S&P 500 2,552.07 +14.33(+0.56%)

Dow 30 22,775.39 +113.75(+0.50%)

Nasdaq 6,585.36 +50.73(+0.78%)

Crude Oil 50.74 -0.05(-0.10%)

Gold 1,271.30 -1.90(-0.15%)

Silver 16.64 +0.00(+0.01%)

EUR/USD 1.1708 -0.0003(-0.03%)

10-Yr Bond 2.35 +0.02(+0.86%)

Russell 2000 1,512.09 +4.32(+0.29%

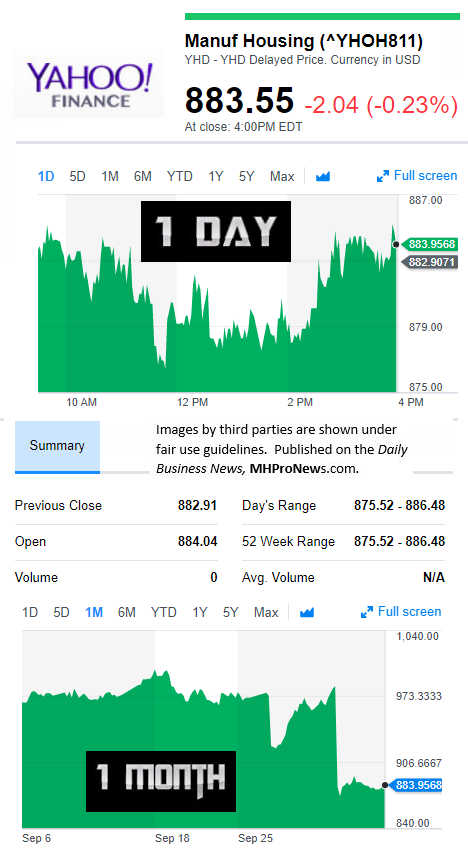

Manufactured Housing Composite Value

Today’s Big Movers

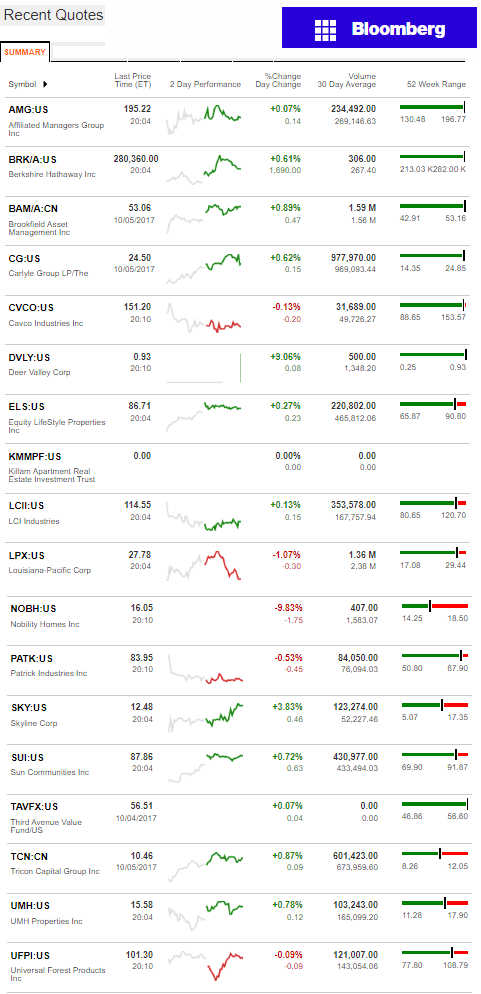

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

In a media release, Berkshire Hathaway, and Clayton Homes’ long-time “captive” controversial lending unit, Vanderbilt Mortgage has dived into a competition with the industry’s commercial mortgage brokers.

“The national home lender previously originated loans exclusively for consumer manufactured housing,” said the VMF release on Markets Insider, “but now it is expanding its operations to include lending to land-lease communities (manufactured housing communities and parks). Vanderbilt will offer commercial financing in select states, with a focus on making loans in the $1 million to $5 million range.”

That would put them in direct competition with other industry commercial loan originators and brokers, several of which are Manufactured Housing Institute (MHI) members.

Congressional and Non-Profit Allegations, CFPB Investigation

As was reported recently at this link here, VMF has been accused by congressional lawmakers of “near monopoly” practices, along with:

- Racism,

- Steering, and

- Predatory Lending practices.

MHProNews reached out again today to VMF President, Eric Hamilton, asking him to confirm or deny claims of current and pending fines against their firm, as well as giving him an opportunity to denounce all racism.

Once more, as of this publishing, Hamilton declined comment.

MHProNews readers will be advised if Hamilton, MHI or other Berkshire Hathaway units will make a statement on these thorny issues.

MHI has been scrutinized for allegedly tilting towards Berkshire Hathaway in its operation, and for engaging in controversial practices questioned by some of its own members. Three of several examples that involve lending are linked here, here, and here.

Which begs the question. Will MHI now tilt towards VMF in matters relating to commercial finance, to the detriment of other industry members?

Their release notes that they’ve been “In business for more than 40 years, the company currently services more than 180,000 home loans…”

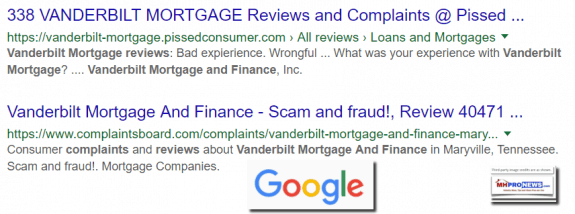

Consumer Affairs website gives an overall positive review of the firm, but they include a posted statement that says, “Vanderbilt Mortgage pays a monthly fee to participate in the Consumer Affairs accreditation program and may also pay a referral fee for links on our site.” The screen capture below reflects the other side of VMF’s public reviews.

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to a recent round of industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, Analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)