– Warren Buffett,

Berkshire Hathaway (BH) Chairman, parent to Clayton Homes, Vanderbilt Mortgage and Finance (VMF) & 21st Mortgage Corp, other industry suppliers, et al, cited per BrainyQuote.

The essence of simplicity for business professionals is the would-have-been campaign platform teased by star performer and manufactured home owner, Kid Rock.

MHLivingNews and MHProNews highlighted Kid Rock periodically for months. Among the reasons are the simple points he made. Whatever his intent, Kid Rock told the story of the MH Industry’s home owners and independent business people’s struggles in compelling ways.

“Born Free,” “Po-Dunk” Manufactured Homeowner Kid Rock Updates Senate Race Status

Perhaps in the era of President Barack Hussein Obama, the realistic fix for Dodd-Frank’s harm was the long sought Preserving Access to Manufactured Housing Act.

But is Preserving Access still the best option in this new era of Regulatory Rollback, under President Donald J. Trump?

When the president and much of the GOP are pursuing eliminating or severely curtailing the Consumer Financial Protection Bureau (CFPB) that Dodd-Frank spawned, why tweak a law, when you can kill it or take control over it? And based on the regulatory rollbacks to date, isn’t it obvious that the president will replace Cordray with someone more business friendly?

Obtained Email Details Richard Cordray Resigning Soon, Cong. Hensarling Reacts

Kid Rock, Donald Trump and millions of others have advocated for something simple. Cut regulations, cut taxes, let the genius of American business professionals create jobs, and through business growth, create more prosperity for millions of Americans.

Facts Are, Facts Matter

“What we learn from history is that people don’t learn from history.”

– Warren Buffett,

Berkshire Hathaway (BH) Chairman, parent to Clayton Homes, Vanderbilt & 21st Mortgage, per GoodReads.

As GovTrack and the Daily Business News on MHProNews have reported for months, the odds of passing the Financial Choice Act are far better than is the passage of Preserving Access. While the odds for both have risen since the report below, that link is but one of several examples of reported news that MHI could have pro-actively responded to by pivoting from their long-held Preserving Access position.

Financial Choice Act, with MHI Bill, Heading to Floor Vote, Outlook, Analysis

Given that Nathan Smith – former MHI Chair, prominent Democratic Party activist, and partner in SSK Communities – said that it was his goal to cause the Manufactured Housing Institute (MHI) to stop being a reactive association, and to start being a pro-active one. If so, why is MHI still so reactively focused on the Preserving Access issue in the Age of Trump?

“Superficiality is the curse of the modern world.” – Matthew Kelly

Support for Preserving Access, For the Record

It is a matter of record that MHLivingNews and MHProNews actively supported Preserving Access in word and deed for years. Time, talent, and treasure were expended to create articles and videos that documented why the CFPB’s implementation of Dodd Frank were harming the industry’s consumers and businesses alike. To this moment, this publication is okay with the goal, but what we’ve spotlighted is that a far better goal for the MH Industry is now possible.

That original full-length Nathan Smith video and article were but one of dozens of examples of active support by this trade publisher of the MHI sponsored bill. That video, or dozens of articles, lobbying, etc. cost MHI not one dime.

This trade media – in association with those industry companies that we work with – paid for that video, and so much more, in time, talent, and treasure. MHI can’t legitimately claim otherwise.

MHI has allowed millions of dollars of the association’s member’s dues money to be gobbled up in this Preserving Access effort, plus the MHI PAC money in addition to the association costs.

Where are the MHI results?

Perhaps the better question is, who benefited by NOT passing Preserving Access?

Barney Frank Letter De-Bunked a Key Dodd-Frank Claim…

It should also be noted that it was an MHProNews reader who supplied this potent letter that was first published here, and was later used by MHI. This letter – linked below – was read into the Congressional record, in support of Preserving Access.

It was also MHLivingNews and MHProNews that discovered and broke the story that CFED – since renamed, Prosperity Now – was receiving CFPB funding.

Of course, CFED backed the CFPB — they were being paid by them.

Follow the Money?

Among the articles that MHI President Richard “Dick” Jennison asked MHProNews to publish was this one by Jason Boehlert.

Industry Voices

In a communiqué to MHProNews, MHI’s Vice President of Regularly Affairs, Jason Boehlert shared the following report to Industry members

Shortly after it was published, Jennison contacted MHProNews in what could be described as a panic.

Jennison’s urgent request? That MHProNews unpublish the article that they had previously asked just days before that we publish for them. Please note the footnote under the article, linked above.

Per Jennison’s call – and what other MHI sources later revealed to MHProNews – it seems that Jennison, Boehlert, and MHI had failed to check with the consumer groups before announcing their “victory.” As MH industry history tells us, their was no victory to announce.

Here are some of the dozens (if not, hundreds) of articles that MHLivingNews and MHProNews published in support of Dodd-Frank, CFPB related news, and reform efforts.

Can MHI – or any of their most ardent supporters – find any others in the industry’s trade media that provided more published support for their Preserving Access bill?

Thousands of others – including us – wrote in support of their bill. But in hindsight, in spite of all those efforts, wasn’t Preserving Access a flawed plan from the start?

Those and numerous other pro-Preserving Access steps were taking place, even though Jennison was allegedly already undermining MHProNews/MHLivingNews, which will be the subject of a separate, upcoming report.

While word, deeds, and rumors were coming to MHProNews about Jennison’s and his allies effort to undermine this pro-industry trade media – which we where then an MHI member company – MHProNews continued to support Preserving Access. Why? On principle, based upon what we knew at the time, it seemed like a sound plan.

Furthermore, the evidence shows that MHProNews continued to allow MHI to provide content to be shared with the industry to promote that effort. One of several possible examples is linked below.

Industry Voices

As the national association serving as the voice of the manufactured housing industry, Tim (Williams) asked that MHI respond to your inquiry. Our official response is provided below.

Note that in a prior message to MHProNews, MHI’s then VP admitted that Barack Obama’s winning in 2012 was a significant setback for any roll-back of Dodd-Frank.

Industry Voices

While commentators will be picking over the remains of the 2012 elections for weeks to come and discussing what the political landscape will look like over….

That being the case, as MHI’s own VP stated, why did MHI continue to pursue Preserving Access?

Why did MHI continue to promise passage of Preserving Access – as Jennison publicly did in 2015 at Louisville – when their own Vice President of Government Affairs laid out the facts as to why it was not going to happen?

In hind-sight, where was the logic of the MHI stance? Or as Berkshire Hathaway’s chairman has said,

“Chains of habit are too light to be felt until they are too heavy to be broken.”

– Warren Buffett,

Berkshire Hathaway (BH) Chairman, parent to Clayton Homes, Vanderbilt & 21st Mortgage, et al, per Investing.

As quoted in Medium, his partner at BH said, “Warren Buffett has become one hell of a lot better investor since the day I met him, and so have I. If we had been frozen at any given stage, with the knowledge we had, the record would have been much worse than it is. So the game is to keep learning, and I don’t think people are going to keep learning who don’t like the learning process.” – Charlie Munger, Berkshire Hathaway – parent to Clayton Homes, Vanderbilt & 21st Mortgage, et al.

Isn’t it time for the industry’s business professionals to follow Buffett’s lead on three things: reading, planning long term, and learning from the lessons of history?

What MHI, Industry Insiders Have Told MHProNews

Several industry success stories, plus association, non-profit and other informed sources and insiders have told MHProNews that Dodd-Frank has proven to be a windfall for Buffett’s brands.

The Masthead

We’ve heard for some time the whispers about the now announced closure of U.S. Bank’s indirect manufactured housing lending program. To protect source…

U.S. Bank clearly stated that that they exited manufactured home lending, due in part to low volume, and regulatory risk.

The volume, knowledgeable sources at U.S. Bank said was okay, as their loan portfolio was profitable.

But U.S. Bank could not overlook the risk of the loans. That statement dovetails with what UMH President Sam Landy told MHLivingNews about their own loan program, and Landy pointed to others that exited for the same reason – regulatory risk – as was reported.

Some of that regulatory risk could have been eliminated, per our sources, by trading the MLO rule for the 21st/VMF sought points and fees rule.

The Bottom Lines?

Warren Buffett has said that his favorite hold time is forever. Unlike many in the industry, which is often short term in thinking, Buffett’s patient. In 2003, Buffett began his run on taking over the manufactured housing industry.

It has not been without controversy, as MHProNews has previously reported, and more veteran industry professionals know first-hand.

In hindsight, isn’t it true that Buffett and his brands win regardless if Preserving Access passes or not? Sources have made precisely that claim, and those sources include voices within MHI’s circle of influence.

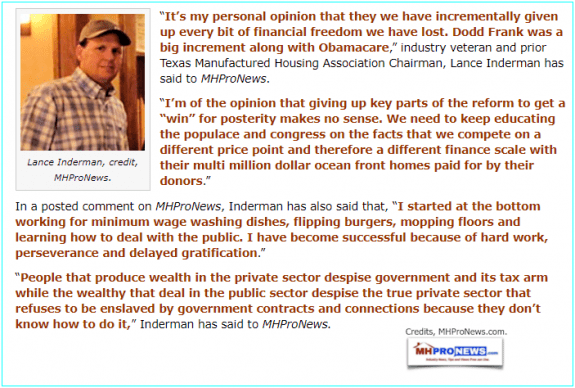

Beyond that circle that speak off-the-record, are comments like Alan Amy, Lance Inderman, Bob Crawford, or others who have spoken on the record on various aspects of the Preserving Access and related issues.

MHI/NCC member Frank Rolfe made it clear that MHI’s communications and pushing for Dodd-Frank made no sense to him.

Solutions, Not Whining

Jim Ayotte’s statement, quoted below, was sent to MHProNews regarding a different topic, one that will be published soon. But isn’t Ayotte’s observation a keen one for not only associations, but also businesses or pro-industry trade publishers too?

Don’t the facts reveal that MHI has supported one ineffective policy after another? Where is their self-proclaimed clout?

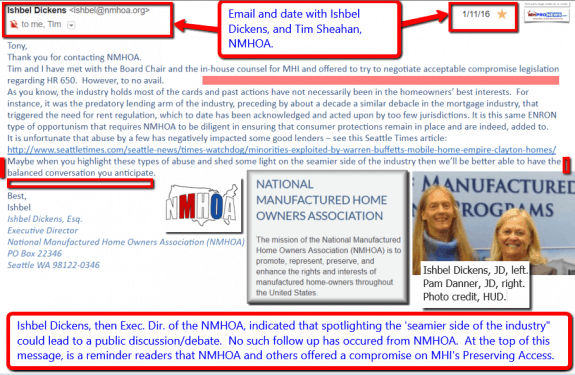

Exclusive – HUD’s Manufactured Housing Program Administrator Pam Danner, Update

While MHI has failed to advance its agenda, even before MHProNews began to more aggressively fact check the association, doesn’t the history above clearly reflect that MHLivingNews and MHProNews supported Preserving Access?

Even while supporting MHI’s bill, and prior to this publication more aggressive fact checks of MHI, the Daily Business News will further allege that Dick Jennison was working against this operation’s interests.

That’s not a light comment. Others associated with MHI have said similarly, that their interests (not just ours…) are being undermined by the Monopolistic Housing Institute (oops, Manufactured Housing Institute…MHI) – too.

ELS’ Sam Zell – Compliance Costs Destroys Smaller Businesses = Consolidation

Perhaps more significant, as MHI presses on with its over half-decade failed agenda, for whatever reasons, the industry continues to consolidate.

That consolidation is taking place due to the heavy burdens of regulations.

Regulation Nation – Manufactured Housing Associations, Companies, and Professionals

The non-profits and MHI company members have informed the Daily Business News that MHI had in its power to ‘cut a deal’ to eliminate the so-called MLO, several years ago by agreement. The trade? Give up the points and fees in exchange for the MLO rule. MHI’s leadership, per those sources, said no.

While other industry companies and so-called “Lonnie Dealers” could have benefited from the points and fees rule too, the primary beneficiary were the Berkshire Hathaway brands of 21st, and Vanderbilt.

Simple reason tells the objective observer that Warren Buffett’s companies have not only dominated MHI, they’ve used MHI to the detriment of thousands of others in the industry.

So where is the logic for independents to support MHI?

The Racket?

It is Democratic lawmakers who are calling leading light Democratic supporter Warren Buffett’s MH brands a “near monopoly.”

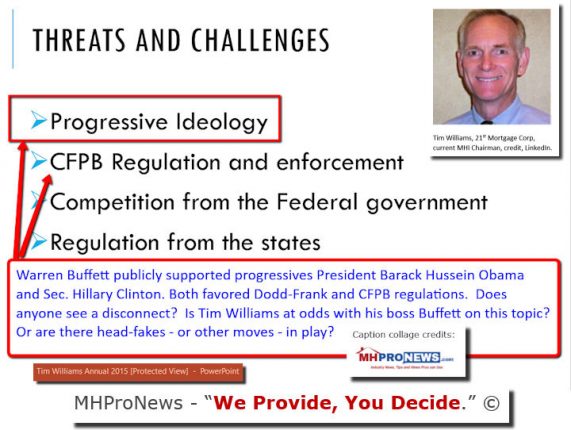

It was Tim Williams who made the statement below, one that thousands in manufactured housing would agree with.

But isn’t it ironic that his statement flies in the face of what Warren Buffett supported?

Namely, Hillary Clinton and Barack Obama, both of whom supported Dodd-Frank. Where’s the logic?

“Chains of habit are too light to be felt until they are too heavy to be broken.” – Warren Buffett.

“What we learn from history is that people don’t learn from history.”

– Warren Buffett,

Berkshire Hathaway (BH) Chairman, parent to Clayton Homes, Vanderbilt & 21st Mortgage, per GoodReads.

Is Buffett and MHI hoping small to mid-sized companies keep paying for MHI, so that Buffet’s brands benefit from MHI’s actions?

Are companies pressured into being MHI members, if they want to do business with Buffett’s brands?

The Solution?

The industry needs a post-production association, one that will replace the tongue-in-cheek “Monopolistic Housing Institute.” MHARR has long supported that call.

MHARR has long supported that position.

Isn’t it long overdue? If not now, when the evidence is so clear, when?

Before another year of dues are sent by a company like your’s to MHI, isn’t it time for businesses to re-assess, and plan for a new national association platform?

Possible concepts are in the report linked above.

INspirations for Manufactured Housing Professionals

Nothing is changed, until it is challenged. “If you are willing to abandon your principles for convenience, or social acceptability, they are not your principles, they are your costume.” Joe Concha, The Hill,

As a trade publication, akin to Ayotte’s insight, the best that we or any professional can do is do the best with the facts when known. MHProNews’ understanding of Preserving Access and MHI have evolved through painful experience. It is thus proper to attempt to inform the industry of the facts, allegations and concerns as they are known and alleged.

Simplicity is supporting the kind of proven pro-business positions advocated by Kid Rock, and President Donald Trump.

We can and would support a new national post-production association effort, that is pro-business, pro-consumer, and based upon sound ethical principles.

“We Provide, You Decide.” © ## (News, analysis, and commentary.)

Note 1: For those who want to sign up to our industry leading headline news updates – typically sent twice weekly – please click here to sign up in just seconds. Thanks to for those who directly and/or through social media are sharing their appreciation for our pro-Industry, pro-growth, pro-bottom line solution oriented industry coverage.

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Soheyla is a managing member and co-founder of LifeStyle Factory Homes, LLC the parent company to MHProNews and MHLivingNews.