Several dozen manufactured home industry pros took their seats in Tunica to hear Paul Barretto shed light on Fannie Mae’s long-awaited chattel lending plan.

Barretto is Fannie Mae’s field point-man with the industry on the federally mandated Duty to Serve (DTS) Manufactured Housing.

The law which included the DTS mandate was passed in 2008, as part of the Housing and Economic Recovery Act (HERA).

Barretto explained that Fannie Mae’s experience with the Conseco manufactured home loan portfolio yielded poor performance.

Absent good data that demonstrated better loan performance quality than what the Conseco loan pool yielded, Fannie Mae felt they had “no choice,” he said, but to go slow and build their own loan origination and performance data in chattel lending.

So they expect to do about 1,000 chattel loans in 2019, and another 1,000 in 2020.

Barretto told attendees that they – Fannie Mae – ‘hear that chattel loans perform better on privately owned land‘ than home only loans originated in land-lease communities.

When asked by MHProNews about the data from leasehold mortgages made in manufactured home communities from the early 2000s that reportedly performed well, Barretto explained that he was familiar with that program. He added that it was a Freddie Mac, not a Fannie Mae project.

Barretto’s News Making Comments

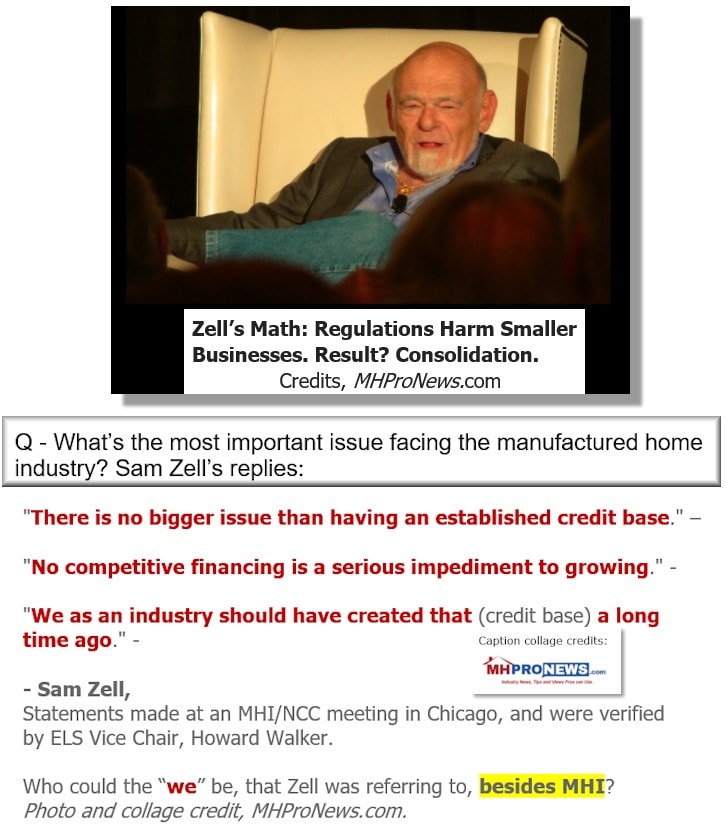

The industry’s long, slow walk to make the Duty to Serve (DTS) the manufactured housing industry by the Government Sponsored Enterprises (GSEs) has been a periodic focus for the Daily Business News. Significant voices in the industry, such as Sam Zell, have lamented the fact that manufactured housing had previously failed to gain a stable base for financing.

That meant that Paul Barretto of Fannie Mae’s comments to the industry’s professionals in Tunica, MS would be important to understand and consider.

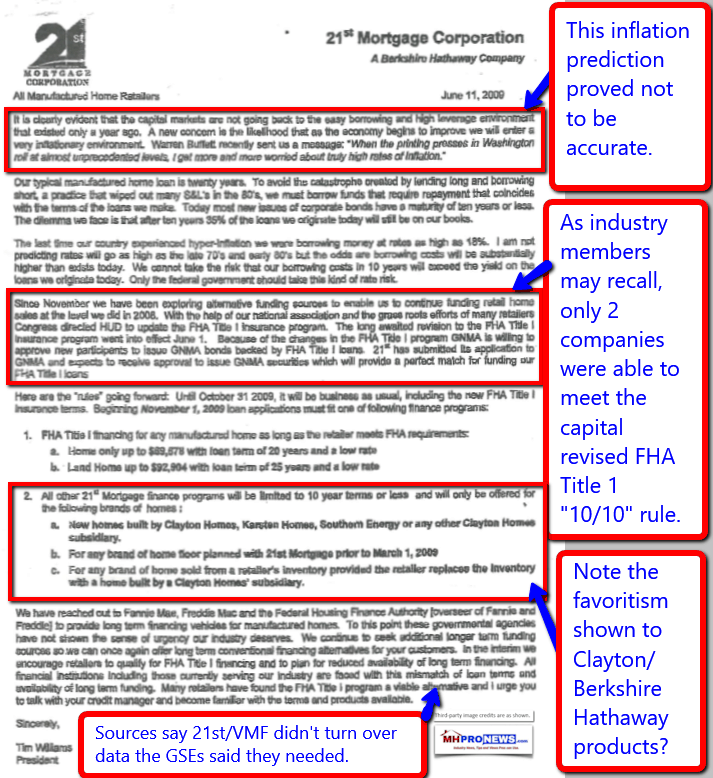

Barretto may or may not be aware of the reports by MHProNews that indicated that part of the slow-walk of DTS was de facto the outcome of the Manufactured Housing Institute’s (MHI) prior Chairman, Tim Williams of 21st Mortgage.

Williams, and his colleague Eric Hamilton at Vanderbilt Mortgage and Finance (VMF), per sources in MHI, reportedly failed to provide the GSEs with the data they needed to make chattel loans happen in sooner, and in a more robust fashion.

Barretto – responding to a question from MHProNews – publicly confirmed that both 21st and VMF did not turn over loan performance data to Fannie Mae.

It’s a significant admission for the industry, in the wake of months of allegations and reports on the topic. One of those reports is linked below.

The document below reflects an alleged ‘smoking gun’ by Berkshire Hathaway owned 21st aimed at the independent retailers, and the producers that supplied them. By choking off lending to those companies that weren’t buying Clayton product, hundreds of companies failed.

MHI has been accused of allegedly weaponizing their housing alerts to their own members, and via at least some state associations, to the broader industry.

While MHI claims to have been championing the advance of the DTS program for chattel lending, how can that be so? Isn’t it obvious that Barretto’s statement – coupled with those of MHI’s own chairman and prominent members of MHI, 21st and VMF – make it clear that their actions resulted in slowing the use of chattel lending by the GSEs in manufactured housing?

Doesn’t common sense suggest that what Mark Weiss at the Manufactured Housing Association for Regulatory Reform (MHARR) alleged weeks ago was accurate? Namely, that every day that the GSEs don’t provide robust, securitized loans for the industry and its consumers, its like a financial gift to Berkshire Hathaway’s manufactured housing units? “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Related:

The Masthead

Not necessarily in this order of importance, but count us as true believers in: Manufactured Homes, America as a Constitutional Republic with free enterprise, and in the four F’s – Faith, Family, Flag, and Fortune (career). Count me as a pragmatist too.

Kevin Clayton Interview-Warren Buffett’s Berkshire Hathaway, Clayton Homes CEO

(Third party images, and cites are provided under fair use guidelines.)

Notice: for professional business development services, click here.

Sign Up Today!

Click here to sign up in 5 seconds for the manufactured home industry’s leading – and still growing – emailed headline news updates. You’ll see in the first issue or two why big, medium and ‘mom-and-pop’ professionals are reading these headline news items by the thousands. These are typically delivered twice weekly to your in box.

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.