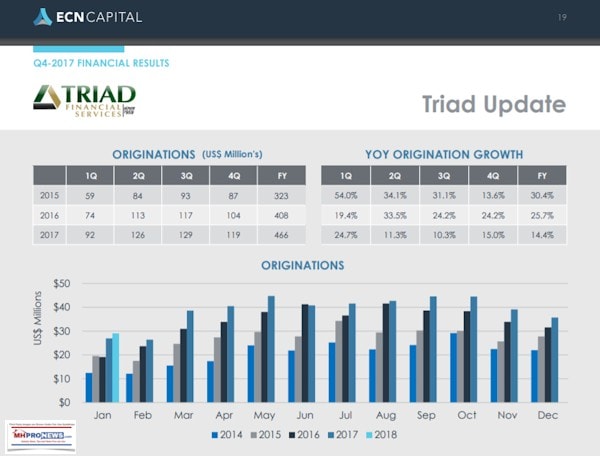

ECN Capital, the new parent company for Triad Financial Services, has reported year-over-year growth of 14.4 percent in 2017, vs. 2016.

That translates into some $466 million in loans.

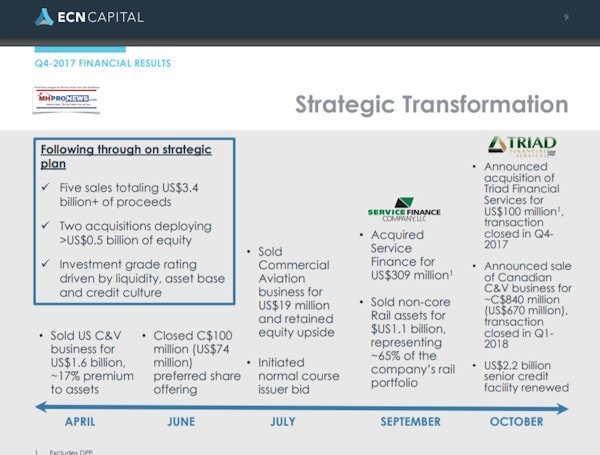

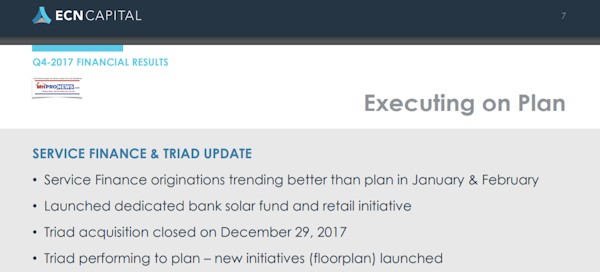

Triad formally closed their deal with ECN on December 29, 2017.

The significance for manufactured housing is this. Unlike some lenders that are focused on ‘buying deep’ – meaning making loans on lower FICO scores – Triad has historically been an “A” paper lender. The profile of the Triad buyer is more like the credit profile of a conventional site-built home.

Per ECN’s investor Relations website.

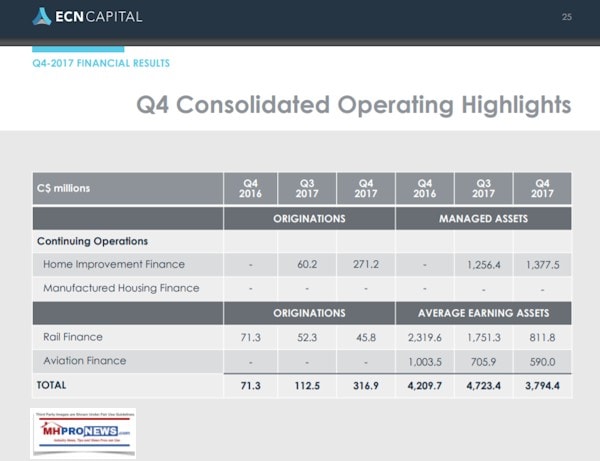

KEY HIGHLIGHTS Q4-2017 FINANCIAL RESULTS

- Triad acquisition closed on December 29, 2017

- Manufactured Housing (“MH”) industry experiencing increasing orders as consumers recognize the affordable alternative versus site-built

- Origination projections reflect continued organic growth pace

- Successfully launched on balance sheet floorplan program in January

- 19 manufacturers/dealers quickly on board with applications following

- 2018 guidance for on-balance sheet floorplan funding expected to meet or exceed

- Actively engaged to implement additional plans to enhance growth

- Growing servicing penetration

- Tuck-in MH portfolio opportunities building ($10 mln portfolio purchase in process)

- Offering complimentary financing products through existing dealer network (i.e. insurance)

The full ECN report is linked here as a download. ## (News, analysis and commentary.)

(Third party images are provided under fair use guidelines.)

To sign up in seconds for our industry leading emailed news updates, click here.

To provide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

Marketing, Web, Video, Consulting, Recruiting and Training Resources

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.