If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

Selected headlines and bullets from CNN Money:

- Hedge fund billionaire to Murdoch: Give Comcast a chance

- Instagram Stories is twice as popular as Snapchat

- Oil prices spike 13% in a week. What the heck is going on?

- Foxconn breaking ground on Wisconsin plant

- Trump tariff would make the Toyota Camry $1,800 more expensive to build

- Ford chairman: Every piece of the auto business is changing

- Guinness to open its first American brewery in 64 years

- Chipotle CEO: It could take three years for new menu items to roll out nationally

- Amazon just bought itself a pharmacy

- Where’s ZTE? Execs go AWOL at China’s big smartphone fair

- China slashes tariffs for Asian countries as US trade fight escalates

- China’s yuan is falling against the dollar: Here’s what’s going on

- India’s rupee hits record low as emerging markets struggle

- New York to London in 2 hours? Boeing says sure

- T-Mobile and Sprint say they need each other to build 5G. Do they?

- New White House hire shows Sean Hannity is Trump’s shadow chief of staff

- How Chipotle plans to win you back

- Rite Aid set to sell its first cannabis-derived drug

- Britain’s royal family made even more money in 2017

- What does America’s falling birth rate mean to the economy? Just look at Arizona

- Beer is being rationed in the UK

- How a rap lyric inspired a multimillion-dollar online platform

- Disney wins antitrust approval to purchase most of Fox

- Meet the new GE: It’s a shell of its former self

- Cold comfort: ConAgra buys Birds Eye maker for $10.9 billion

- Progressive media saw the Ocasio-Cortez upset coming

- Harley-Davidson may face credit downgrade because of EU tariffs

- India may ignore US demand to halt Iran oil imports

- Texas steel pipe manufacturer becomes casualty of Trump’s trade war

Selected headlines and bullets from Fox Business:

- Bank stress tests: What to expect

- Stocks gain momentum in late day trading

- Move over OPEC, America is the new king of oil

- If Harley Davidson turns its back on America we will move on: Bikers for Trump

- The biker community firmly believes in American-made motorcycles.

- Foxconn in Wisconsin: State taxpayers bear cost of big incentives

- This tax strategy is ‘skyrocketing’ in popularity, expert says

- Amazon to acquire PillPack, CVS and Walgreens shares tumble

- Rapper Nas invested early in PillPack, Amazon’s latest buy

- Kroger to test delivering groceries via driverless cars

- The new 1040: A look at the proposed draft

- Former Equifax manager charged with insider trading

- Panasonic blames Tesla ramp for ‘occasional’ battery cell shortages

- Walmart rolls out 3D virtual shopping experience

- What Trump should focus on in US-Russia summit

- America’s most and least patriotic states[overlay type]NEWS

- America’s most and least patriotic states

- Which states bleed red, white and blue?

- California Rite-Aid blasts Barry Manilow music to discourage loiterers

- On Trump’s Harley Threats, and the Trouble With Tariffs

- How the GE Breakup Will Give Shareholders a Chance to Make Up

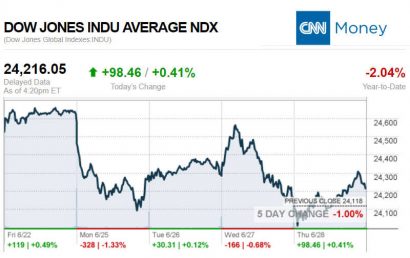

Today’s markets and stocks, at the closing bell…

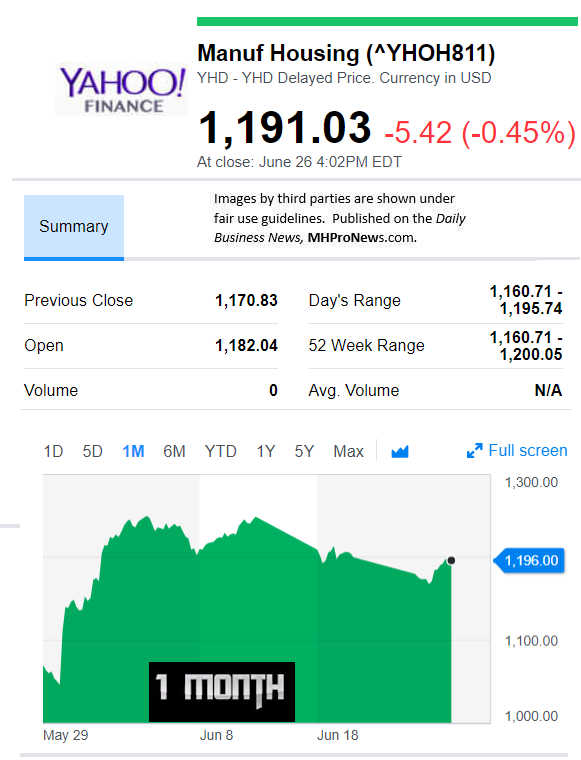

Manufactured Housing Composite Value (MHCV)

Today’s Big Movers

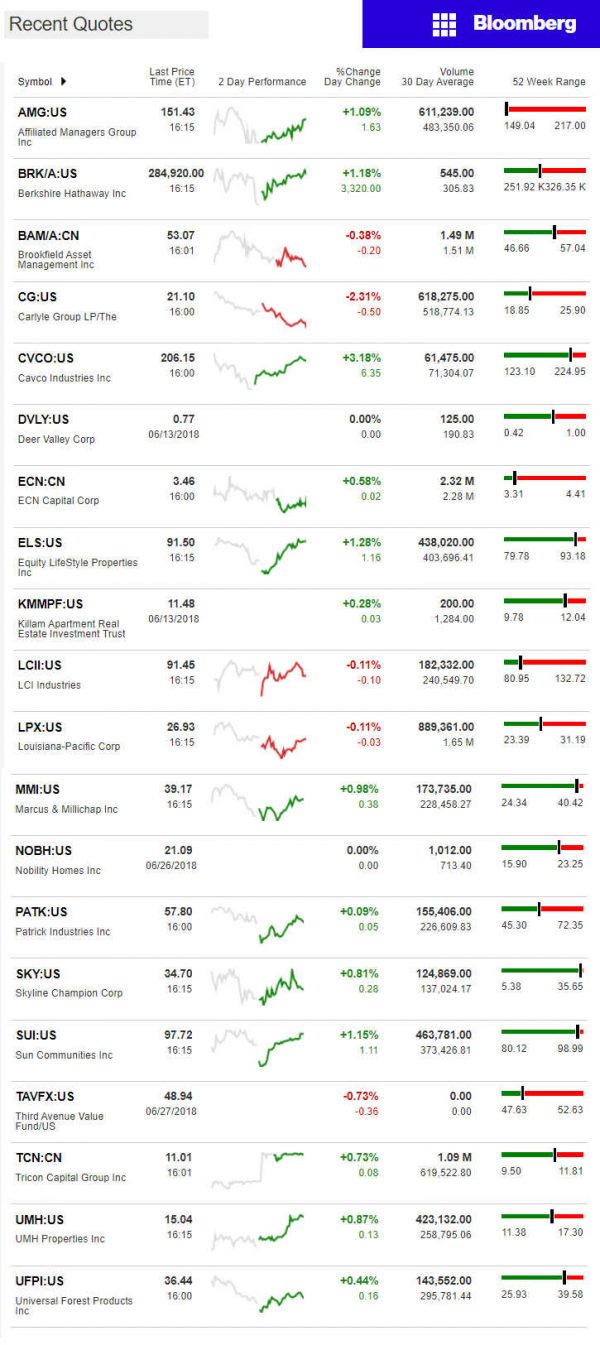

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

Crude continues to rise, which of course drives all prices, including that of conventional and manufactured housing. But that rise is also fueling, pardon the pun, the growth in the U.S. domestic drilling, refining and exporting industries.

Former Federal Reserve Chairman Alan Greenspan told Fox News that much of the the economic stability of the U.S. is due to the extraordinary rise of domestic crude oil production.

U.S. oil production is booming, and oil exports are following. In its latest weekly update, the U.S. Energy Information Administration (EIA) reported:

- that oil refining hit its highest level on record last week.

- U.S. crude exports surged to a record 1.76 million barrels per day (bpd) in April.

- This is a big change for a country that just a few years ago wasn’t exporting any crude.

- Part of the driving force behind the decision to restart exports in 2016, following a ban in 1975 to export was the shale oil boom.

- The U.S. has turned into a major oil producer.

- The U.S. is producing oil at a record pace of 10.9 million bpd, a level which it first reached earlier in June.

The oil boom is good for the U.S. economy. “The second quarter is going to be a very strong quarter. One of the leading indicators of this is the extraordinary rise in crude oil production,” said former Fed Chairman Alan Greenspan told FOX Business’ Maria Bartiromo on Thursday.

“I’ve been following the oil industry back to year one, and, I’ve never seen anything rushed this fast, he added. Fracking has made extraordinary changes in crude oil production and our output (of oil) is now close to the highest (in the world),” Greenspan said.

The increase in U.S. production comes while oil prices have rallied to multi-year highs as production in Venezuela has tumbled amid an economic crisis. Further, the U.S. is pressing its allies to halt oil imports from Iran.

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, analysis and commentary.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.