There are those who slam manufactured housing as being less expensive due to inferior quality. But a “Harvard study refutes that, labeling as “exaggerated” the “concerns about the difference between manufactured homes…and [homes] built to applicable local building codes” (Vermeer and Louie 1995, section IV, 2). The study found that code standards have little to do with manufactured housing’s price advantage.”

So wrote Richard Genz in a 22 page research report on manufactured homes for a foundation for a Government Sponsored Enterprise (GSE).

The document also stated that:

“Housing advocates might find it surprising to walk through a couple of new homes at a dealer’s lot, keeping the monthly payment in mind and mentally comparing the local rental stock available for the same price. Interiors have good light. Insulation standards are solid. Floor plans have come a long way from the time when residents said that living in a mobile home was like living in a hallway.”

Because the report was done for the Fannie Mae Foundation.

It cited sources such as Harvard, Foremost Insurance – plus other third-party, often peer-reviewed – researchers.

While some of the data points have shifted since Genz penned them, it has generally been improvements in the manufactured home product quality, as the Manufactured Housing Improvement Act of 2000 standards have fully kicked in since Genz published his insightful work.

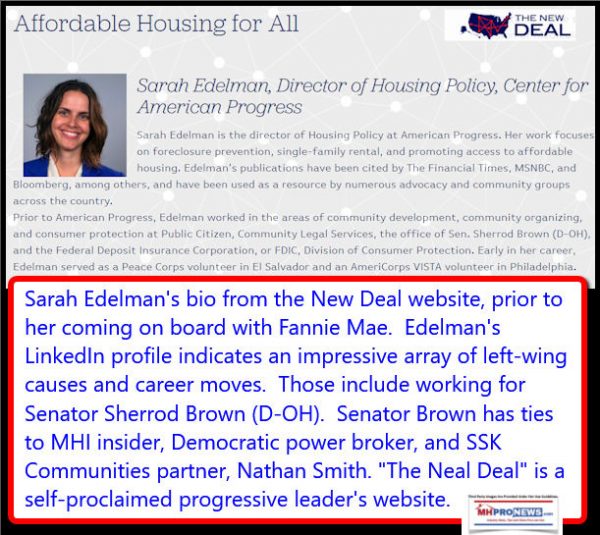

It’s equally valid to review this now, given the arguable short-shrift Fannie Mae has been giving to the legally mandated Duty to Serve (DTS) implementation. Compare what Genz said then, vs. what Sarah Edelman recently wrote. That linked report below, which includes Edelman’s article for Fannie Mae, can be read later for greater depth of understanding.

Further, because the HUD Code and new home standards keep improving, what was true when Genz said it back then, is arguably as or more accurate now.

That said, the analysis that follows notes that while Genz often praised manufactured homes, he did not turn a blind eye to problems then existing in the industry. That too will be reviewed herein, because manufactured housing cleaned up key issues that Genz identified.

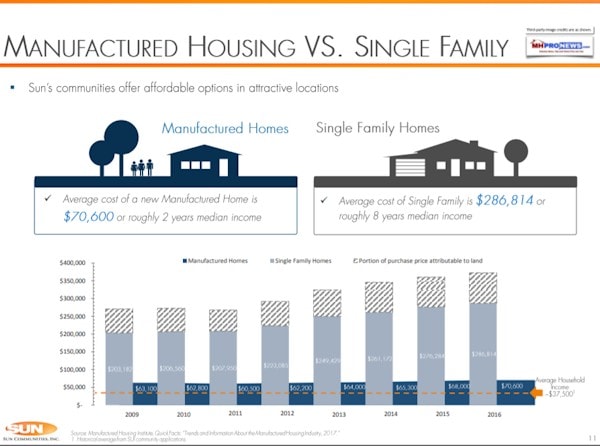

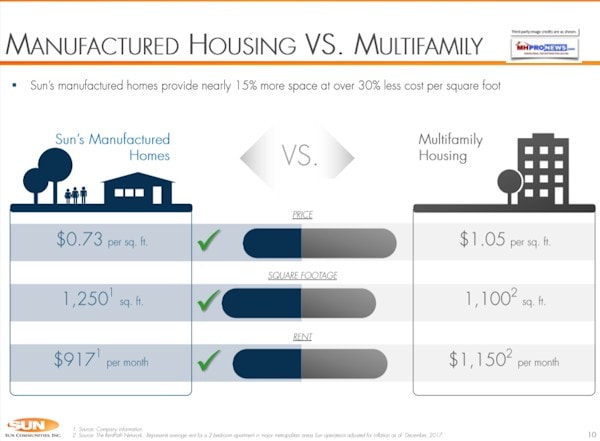

So, while the total numbers of residents and manufactured homes has grown since his report, and pricing has obviously changed, the percentage of savings remains the same. Then and now, the United States Census Bureau has noted consistently similar levels of statistical savings for decades.

Thus for a variety of reasons, Genz’s 22 page document merit the careful consideration of the manufactured home industry’s:

- professionals,

- advocates,

- public policy pros,

- politicos,

- and investors careful consideration.

With that introduction, the Daily Business News will review and analyze key highlights of what Genz unearthed.

It’s a potentially multiple billions of dollars worth of housing insights. Thus it’s a potentially rewarding, and highly insightful, reading experience. As you read this analysis of Genz, keep the points previously shared in the report below in mind, which can be read or reviewed later for related insights.

YIMBY vs. NIMBY, Obama Admin Concept Could Unlock $1.95 Trillion Annually, HUD & MH Impact

Stigma and Manufactured Homes

Genz goes after the stigma attached to manufactured homes and their owners early, and often.

Here’s an example.

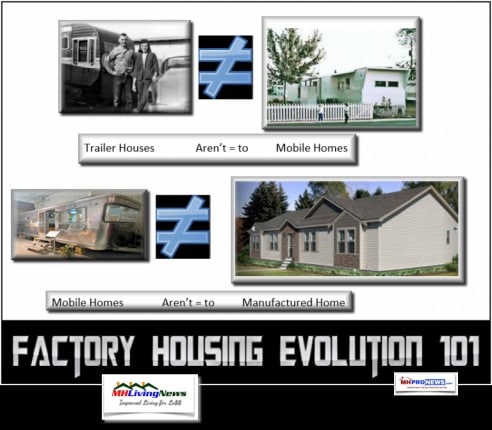

“There is a palpable stigma attached to manufactured homes, dating back to when workers towing trailers moved from city to city, chasing jobs and crowding into muddy, unsanitary trailer parks… However, these serious shortcomings [in public policies, perceptions] are not inherent in the factory-built home itself. Rather, they are the product of laws, policy choices, and business practices that are selling millions of people short.”

Genz notes that while values weren’t the same, he explains that it was because of reasons not connected with the homes themselves.

That’s arguably a valid point then, and now.

The Fannie Mae Foundation researcher also noted that the net worth of manufactured home owners was dramatically higher – even then – than the $5,000 renting households average worth now have, per data cited repeatedly by HUD Secretary Ben Carson last year.

“Median net worth is $59,000 for owners of manufactured homes, compared with $102,000 for all homeowners.”

Rephrasing that as a takeaway. Those who own a manufactured home enjoy a significant improvement in their collective standard of living. That’s a point that advocates like ROC USA, Prosperity Now (formerly known as CFED), or this trade publisher have often made.

Genz notes another point that MHLivingNews and MHProNews has hammered home repeatedly. It’s this.

“One of the industry’s strong points is its appeal to distinctly different market segments. Owners tend to be either very young or elderly (Vermeer and Louie 1995). Although most buyers have low incomes, one segment of the market is quite well off: About 10 percent of manufactured home residents report a net worth of more than $250,000, and another 19 percent are worth more than $100,000 (Foremost Insurance Group 1999).”

Genz added to that point above, “Many of the owners with high net worth live in well- planned subdivision-style communities with recreation centers, pools, and even golf courses. These high-end communities demonstrate the potential of factory-built homes, but also represent a continuing shift away from the industry’s original focus on serving the affordable housing market.”

Stated differently, he makes sure that his readers know that manufactured homes are not just housing for the poor, or those who have no other options.

It’s a key factoid that some in the industry’s association world need to take notice of, and perhaps now will begin to do so?

“Despite wide-spread perceptions of low quality and short life, Consumer Reports says that “manufactured housing can last as long as site-built housing,” (“Manufactured Housing ” 1998, 30).”

Readers should keep in mind that the improvements mandated by the industry-sought Manufactured Housing Improvement Act of 2000 (MHIA). So whatever concerns were noted then about installation have since been dealt with.

Industry professionals, policy wonks, officials, and advocates should note that it was the Manufactured Housing Association for Regulatory Reform (MHARR) that led-the-charge for the MHIA 2000. They did so by aligning the Texas Manufactured Housing Association’s leadership, and then finally found a change in leadership at the Manufactured Housing Institute (MHI) they could work with. That permitted the three to then advance the MHIA through Congress, per our sources.

That segue noted, the review of Genz’s fertile work continues.

“Fresh, new, private living space; easy shopping and financing; adequate quality; and homeownership now add up to a powerful appeal, and with a little reflection, it becomes easier to see why manufactured homes have been chosen by an average of 29 percent of new home buyers every year since 1980 (Manufactured Housing Institute 2001).”

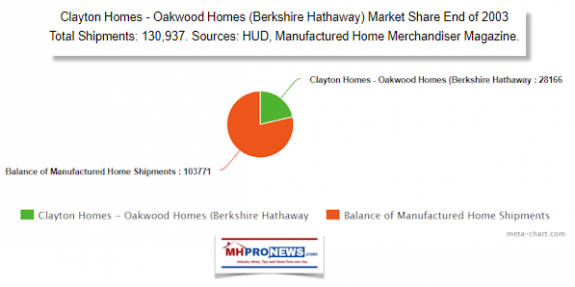

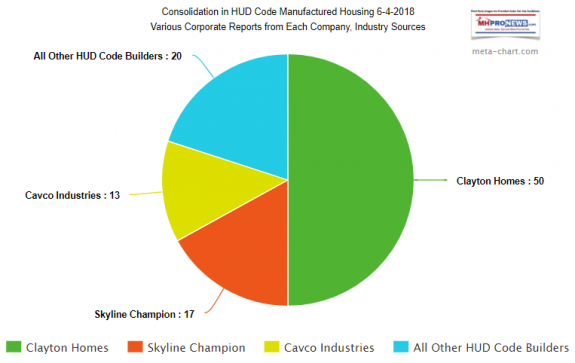

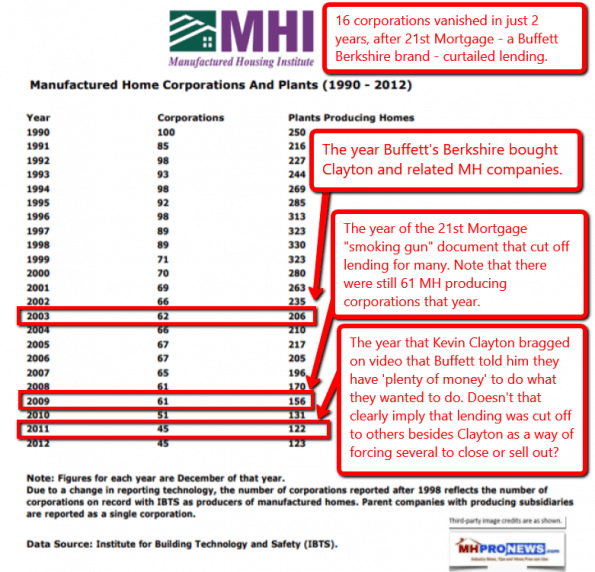

That was debatably the Manufactured Housing Institute (MHI) that was, prior to the power being exercised over the Arlington, VA based trade group by Berkshire Hathaway acquired Clayton Homes in 2003. Their related lenders were acquired too, as were several other industry connected suppliers and other firms since.

Instead of MHI’s allegedly weaponized ‘research’ and maneuvers to promote a controversial, “new class of homes,” and the like – why hasn’t MHI provided encouragement for more such independent study as Genz did?

Or why does MHI fail to publicly mine such useful research today?

Those questions noted, continuing with the Genz’s analysis, there are far more gems to discover. They are potentially as useful now as then.

Not Enough Advocacy, Said Genz

“Some consumer advocacy is taking place, but not much in view of the scale of the manufactured housing sector. Government, nonprofit, and philanthropic involvement is strikingly less than in the world of “real homes.”

When one ponders the foot-dragging by the GSEs, apparently brooked by the FHFA, this quote is also noteworthy: “…a majority of buyers have held the same job for 5 to 10 years, a Freddie Mac economist notes that “except for lower incomes, the profile of manufactured home buyers seeking financing does not appear to differ greatly from site-built loan borrowers” (Bradley 1997, 4).”

Note that in a systematic fashion, Genz cited his third-party, often peer-reviewed sources. Again, as the Daily Business News analysis above noted, much of what has changed since 2001 have been equally well documented improvements.

So the case made by Genz is still useful. It is also historic.

Genz provides an independent yardstick to see what the industry’s ‘leaders’ have or have not done.

Identifying Valid Concerns

For those who never knew or witnessed sellers loading up customers with years of insurance or credit life, etc. the next quote will be a dose of reality.

For those pros who will recall, it’s a blast-from-the-past that explains some of the stiff losses by the subprime lenders of that era. “[manufactured housing] retailers can and frequently do earn commissions, rebates, or other payments on loan originations, credit life insurance, property insurance, and other services arranged for at the time the loan is closed” (HUD and NAHB 2000, 41).”

That was then, not now. Thus the report by Genz isn’t all glowing, as he takes on some industry practices in lending, some that apparently had a level of MHI support.

Rephrased, this researcher for Fannie didn’t mind questioning MHI.

By contrast today, Fannie and MHI seem to be “playing footsie,” according to several sources in MHI.

Among the examples that have been cited by those sources, MHARR and others, is that Fannie is now a MHI member. Furthermore, Fannie and MHI have reportedly held closed door meetings, without producing for the public those meeting minutes.

What’s there to hide?

GSE Commitment Canceled?

As recently as last week, Sarah Edelman, Director of Duty to Serve, Single-Family Mortgage Business at Fannie Mae and others there respectfully declined to provide minutes or any explanation of such meetings with MHI, in inquiries by this publication to the federally regulated mortgage giant.

Note that a communications team member committed to MHProNews that Edelman would answer several questions on-the-record.

Those promised replies to several specific inquiries were later delayed. Finally, the same communications team member at Fannie said they were not going to answer the questions asked.

Why not?

So much for transparency at Fannie today?

It is also worth mentioning for later review that House Financial Services Committee Chairman Jeb Hensarling has told MHProNews via a statement that he has serious concerns about lobbying by the GSE. If so, that’s important because it would be in contravention to federal law while they are in receivership under FHFA. That related report can be reviewed later, and is linked below.

Update on Fannie Mae Lobbying, and Manufactured Housing Controversy

How Many Pre-HUD Code Mobile Homes?

Back to the research by Genz, he stated then that nearly 3 million pre-HUD Code mobile homes were still in service.

According to Gentz, “As many as 3 million homes in the nation’s current manufactured housing inventory were built be- fore the implementation of the HUD building code in 1976, when some homes had a useful life as short as 10 years (Meeks 1995; Vermeer and Louie 1995). Many of these were built in the boom years of 1968 through 1973, when 2.7 million new homes were sold.”

Once more an aside is warranted. Because the data that Genz cited demonstrates that the Rollohome experience was not a one-off.

What occurred during the Rollohome era in terms of the rapid ramp up and production of more factory built housing pre-HUD Code could arguably be done today too.

Investors, public officials, advocates, and industry pros? Are you seeing how enormous the manufactured housing industry’s potential is? This is a theme that MHProNews and MHARR have said for years can be accomplished, because it has in fact already been previously proven to be doable.

Given the correct support, the 8.3 million housing unit shortages cited by Lawrence Yun at the National Association of Realtors (NAR) could rapidly be corrected. But if HUD Code producers don’t step up to the plate more seriously, other prefab builders cited at the end of this report have already said that they will.

Potentially tens to hundreds of billions of dollars in business annually is up for grabs.

Once more, it is almost inescapable how these facts point to what award-winning independent retailer Alan Amy said. Manufactured Housing could be the future, which is why he and others have said that the billionaires are gobbling up the industry’s assets.

Ouch, and another Ouch, but then…

Regarding gains or losses in value, “…Consumers Union reports that two-thirds of units depreciate. However, the converse is that one-third of manufactured homes have held their value or appreciated (“Manufactured Housing” 1998). Several other studies establish the simple fact that some manufactured homes increase in value, and some decline.

But Genz uses logic akin to what MHProNews has utilized, noting that “Research is needed to sort out the factors that cause values to go up or down. With better information, policies and practices that build wealth for owners of manufactured homes can be designed.”

In fact, Genz has outlined several of the causes of a loss in value. He also suggested some of the keys to supporting value, like no more credit life or others previously noted.

Thus, the initial groundwork for more appreciation – which even the problematic Urban Institute report noted by the Daily Business News said is already underway – is now largely in place.

Rephrased, there are no valid reasons for the GSEs to slow-walk implementation of robust yet sustainable chattel and other manufactured home lending. There is no need for yet another apparent dodge, this time in the form of a MHI’s questionable “new class of homes.”

Secretive “NEW” Class of Manufactured Housing Raises Serious Concerns

So in retrospect, what Genz laid out was this.

When insurance is loaded up on a contract at the time of sale, or prices may vary 5k-10k per identical homes in the same market, the natural outcome is those homes ‘lost’ value. That’s similar to concerns that MHI award winner Marty Lavin raised for years.

But it must also be noted that Lavin said in a video interview with MHProNews that the industry cleaned up that act.

So once more, the rationale for slow-walking the potentially robust GSE entry into manufactured housing is missing.

Quite the opposite exists. Genz gave a veritable road map of why and how manufactured housing lending could and should be done successfully in ways that are as sustainable, as Titus Dare exclusively encouraged in statements to MHProNews.

So those abuses Genz reported then were wrenched from the chattel lending system by the lenders who remained in the market during the post-Conseco/GreenTree meltdown.

Rephrased, as Lavin noted, the remaining marketplace lenders corrected the issues.

Said Genz, “The accurate answer to the question “Can manufactured homes appreciate?” seems to be “It depends.” Like the value of any home, the value of a manufactured home over time is contingent on many factors. Unfortunately, the perception that depreciation is somehow inherent in manufactured homes is widespread. It is at the root of disinterest about them among development bankers, advocates, planners, and nonprofit developers. These professionals are rightly concerned that housing should be a foundation for building wealth, but if advocates simply write off the preference of so many home buyers for lower-cost manufactured units, we passively contribute to a problem we should be helping to solve. Available data suggest that depreciation is not a mystery. It can be understood and, in many cases, reversed.”

What Genz did was argue that the industry could reverse much of its image and fortunes.

Make some common sense changes, and much could be done.

“More than 8 out of 10 manufactured homes placed in 1998 were titled as personal property, or chattel (U.S. Bureau of the Census 1998).” That number is similar today.

Genz buys into the argument made by those who want to reclassify manufactured homes, forcing all to be real estate loans. That’s a non-starter for most lenders in the industry. It is an example of how the “wheat and chaff” approach must be used with any person, or any organization.

That said, he next makes another point similar to what Marty Lavin has made.

“Discriminatory treatment of manufactured home residents flows from the unexamined matrix of law, finance, taxation, land use regulation, and custom within which manufactured housing exists.”

Lavin put it more bluntly, by calling the HUD Code “a discrimination code.”

But discrimination – past or present – could be a motivation in urging industry pros to act for change in the future.

That said, what exists today are policies that can include “…many tax systems automatically depreciate manufactured homes like vehicles, regardless of their actual market value. This practice worsens the budget drain.”

Genz demonstrates how a simple change of mind can yield positive change.

“Recognizing the real character of manufactured housing contributes to the asset base of an entire community. For example, the tax assessor of Henderson County, NC, decided to begin taking manufactured homes seriously in the early 1990s. Once values were established, the assessor determined that the use of depreciation schedules had systematically undervalued this stock of residential property. The result was a $53 million increase in the tax rolls over two years,” Genz said.

Then he stated a point routinely made by MHLivingNews and MHProNews. How education by that North Carolina county and discipline in the proper use of terminology could yield positive changes measurable in dollars and cents.

“They [local officials] repeatedly had to explain to concerned taxpayers that a “trailer” is something you haul around behind a vehicle and that their increased valuation was based on the actual market value of a home that happened to have been built in a factory.”

Today, there are numerous studies that demonstrate that manufactured homes can and do appreciate for the same reasons as conventional housing. But the way to accomplish that isn’t by creating a problematic, unnecessary, and controversial “new class of homes” promoted by MHI.

Rather, an important part of the industry’s potential progress is achieved by education of consumers on existing homes.

That education comes in part by speaking with those who know on camera.

Education also can obviously be accomplished in part by engaging the mainstream media.

Retiring MHI Ann Parman previously praised MHProNews publisher L. A. “Tony” Kovach for promoting that plan. But as numerous industry members – like Frank Rolfe, who previously blasted MHI for not properly engaging the media – know, MHI has allowed most slurs, miscues, and errors that slight manufactured housing to go unaddressed.

Rephrased, the facts and legitimate third-party research needed to successfully promote the manufactured home industry are available.

While the Arlington, VA based trade group has done problematic advertorials – which have at times cited ‘facts’ that other MHI ‘data’ contradicts – has posted a few lightly viewed items to YouTube, or social media, there’s been no discernible, systematic and robust effort by them to defend and/or promote the industry as needed.

MHI member MHVillage’s own data proves just how ineffective the efforts to date are.

So it is little wonder that a pair of state associations broke away from MHI, and have announced they are forming a new post-production association.

Rephrased, there is a growing body of evidence and numbers of industry voices that in various ways have alleged that MHI is debatably blowing it for the small to mid-sized operations that make numbers of that trade group’s members.

As attorney Lavin succinctly put it in the report linked above, the big boys work for the interests of the rest of the industry only to the extent that it benefits the big boys.

Genz Makes the Case Concerned Industry Voices Have Advocated

Said the Fannie Mae Foundation’s researcher Genz. “Low- and moderate-income people should not be left to learn about asset-building and the meaning of homeownership from their tax assessor. The protests from mobile home dwellers confirm what our housing system has inculcated in them: that their housing is a depreciating asset, like a vehicle. How many buyers of conventional homes would trade a lower annual property tax bill for depreciating home value?”

As a Deer Valley Homes sales manager James McGee, and their current president, Chet Murphree said, “It’s all about education.” as they and others praised the work done here and on MHProNews to educate.

Meanwhile, sources and evidence suggest that MHI, their surrogates and masters, have arguably sought to stymie the education necessary for the industry’s robust growth.

Why?

Warren Buffet has arguably given the correct answer. He likes a bargain.

The Masthead

Best Warren Buffett, Kevin Clayton, Clayton Homes, Berkshire Hathaway Annual Meeting, Competition, and “the Moat” Video Collection, Jim Clayton, Oakwood Homes, largest manufactured housing builder, largest HUD Code Manufactured Housing producer, largest manufactured home retailer, not mobile home, not trailer house,

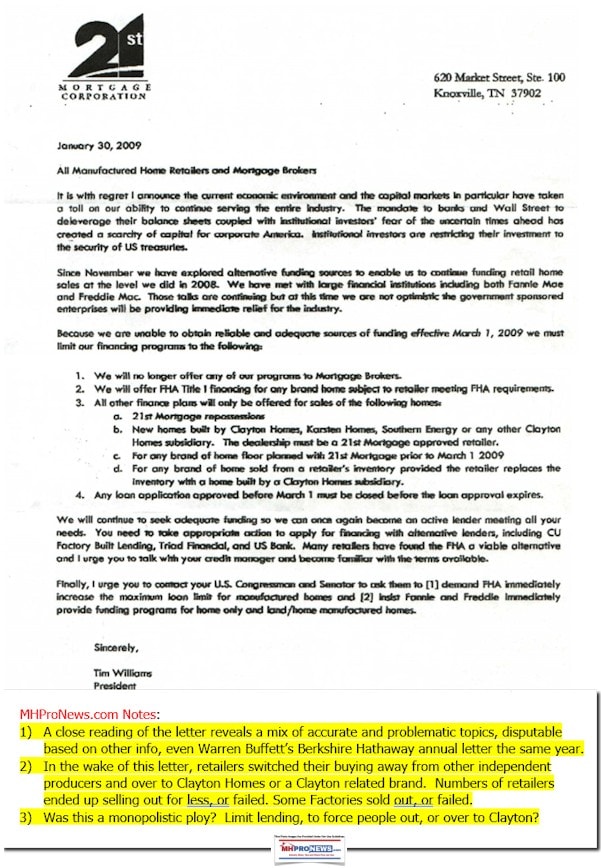

By choking off other sources of lending, and limiting the capital flow into the industry, Buffet’s Berkshire Hathaway has gobbled up large chunks of the industry.

MHI’s President Richard “Dick” Jennison, and others there or working for Berkshire Hathaway units have declined or ducked public discussion and debate on such vexing questions.

Isn’t that a kind of tacit admission that these published concerns are valid?

When The Daily Business News has given repeated opportunities for MHI or Berkshire brands to respond publicly, why have they instead remained silent?

Genz’s Finale “Conclusion”

“Clearing up misperceptions about manufactured housing and addressing the problems of buyers, owners, and renters should be the first priority for advocates. On a separate front, it should be possible to incorporate the cost advantages of manufactured homes into nonprofit housing developments (Wallis 1991). If stereotypes can be overcome, the nonprofit development community could eventually help reinvent manufactured homes as quality, wealth-building, affordable housing.”

The report said that author “Richard Genz is Principal of Housing & Community Insight and a Project Manager with ICF Consulting, Inc.”

Genz’s report was written for the Fannie Mae Foundation. The entire document is available as a download, linked here.

“We Provide, You Decide.” © ## ## (News, event, and announcement.)

(Third party images, and content are provided under fair use guidelines.)

Related Reports:

Manufactured Home Owners – Satisfaction Survey Redux – manufacturedhomelivingnews.com

Manufactured Home Owner Satisfaction Survey, NPR correspondent, Daniel Zwerdling, “Mobile Home Park Owners Can Spoil An Affordable American Dream” Mark Weiss, Tim Williams,

Progressive “Nation” Reports on Monopolies Cites Buffett, Clayton, Others – MH Industry Impact?

Clayton Homes, Top 25 Manufactured Housing Industry Report, Trend Lines

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To provide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Resources