If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

- Consumers spent big at Home Depot

- Tesla: Should you buy, sell or short?

- Google parent company invests $375 million in Oscar Health

- Royal Bank of Scotland will pay record fine for crisis-era misconduct

- Tinder co-founders sue app’s owners, claiming they’re owed $2 billion

- Tinder co-founder: ‘They lied about the financial performance’

- Tesla: Not clear yet whether Elon Musk’s plan to go private makes sense

- The threat Turkey’s crisis poses to the world

- Uber hires chief security officer to help earn back user trust

- Elon Musk says he’s working with Goldman Sachs and Silver Lake to take Tesla private

- FBI warns banks about potential ATM hacking scheme

- How America’s foreclosure capital came back from the dead

- South Korea is banning thousands of BMWs after engine fires

- Coca Cola is fighting Gatorade by investing in BodyArmor

- Analysis: Facebook doesn’t have an obligation to support journalism

- Southwest will only allow cats and dogs as emotional support animals

- Carl Icahn abandons effort to kill Cigna’s Express Scripts deal

- China’s ‘Tesla-fighter’ plans to go public in New York

- Look out Apple! Another company nears $1 trillion

- Corporate America is raking in fat profits. Will it last?

- What happens next in Turkey? It probably won’t be good

- 4 things you can do to be recession-ready

- Lee and Wrangler jeans get the boot as VF Corp moves to Denver

- RELIABLE SOURCES

- Three theories why Omarosa’s book is not a #1 best seller

- Could she become Wall Street’s first female bank CEO?

- Cinemark’s Movie Club is the anti-MoviePass

- Drones and bluetooth sneakers: What’s with all the pizza gimmicks?

- Papa John’s is helping out franchisees hurting from the PR crisis

- The big business of Frankenfoods

- How an iced tea company became a marketing phenomenon

- White anxiety finds a home at Fox News

Select Bullets from Fox Business…

- Tesla chief Elon Musk imploding?

- US stocks rising, Dow posts triple-digit gain

- FBI warns of impending ATM hack

- Tinder co-founders sue parent company for $2 billion

- Berkshire boosts Goldman stake, confirms Apple purchase

- This team just unseated Michigan for college football’s top-selling ticket

- Boston-area mayor boycotts Sam Adams after founder praises Trump

- McDonald’s details $6 billion US restaurant modernization

- Lockheed Martin, Air Force reach deal on $480M hypersonic weapons contract

- Toxic red tide butchers Florida tourism and wildlife

- These are the best and worst states for middle-class Americans

- Florida algae hurting business

- Americans will pay for ‘08 financial crisis with ‘lifetime income loss’

- NFL anthem protests: Florida police union offers olive branch to players

- Blue light from phones, tablets can impair your vision, study finds

- Harley-Davidson overseas move was years in the making: Bikers for Trump

- China feeling the brunt of trade war

- Has big tech become untouchable?

- Kroger grocery unit bans Visa credit cards

- Trump hopes economy will help drive ‘red wave’ in midterms

- The economy is moving forward very swiftly: Rep. Faso

- NY Senate candidate will push to make rent tax deductible if wins

- Small business optimism at 35-year high

- From sales rep to salad vending machine tycoon

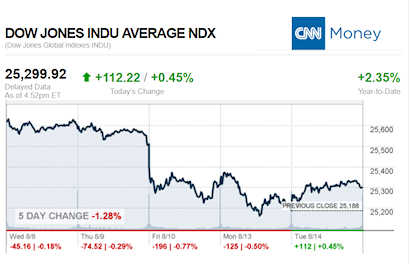

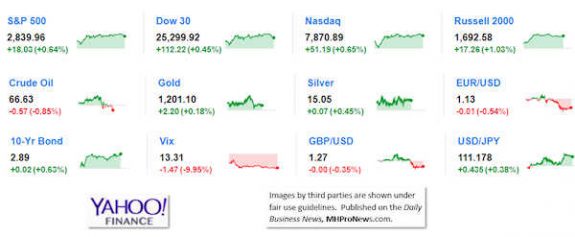

Today’s markets and stocks, at the closing bell…

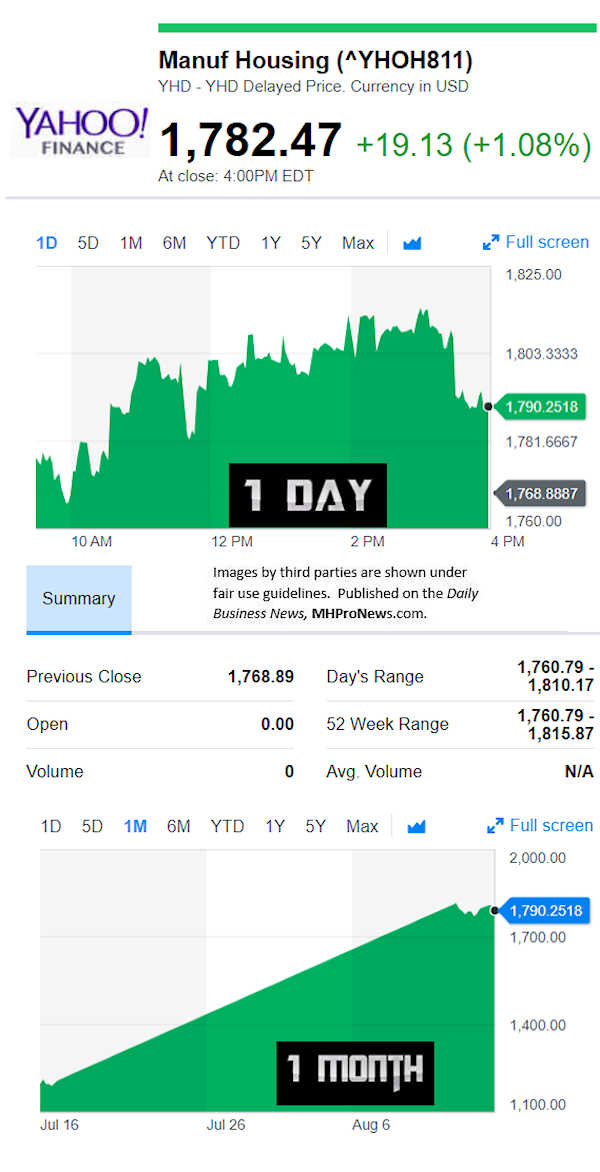

Manufactured Housing Composite Value (MHCV)

Today’s Big Movers

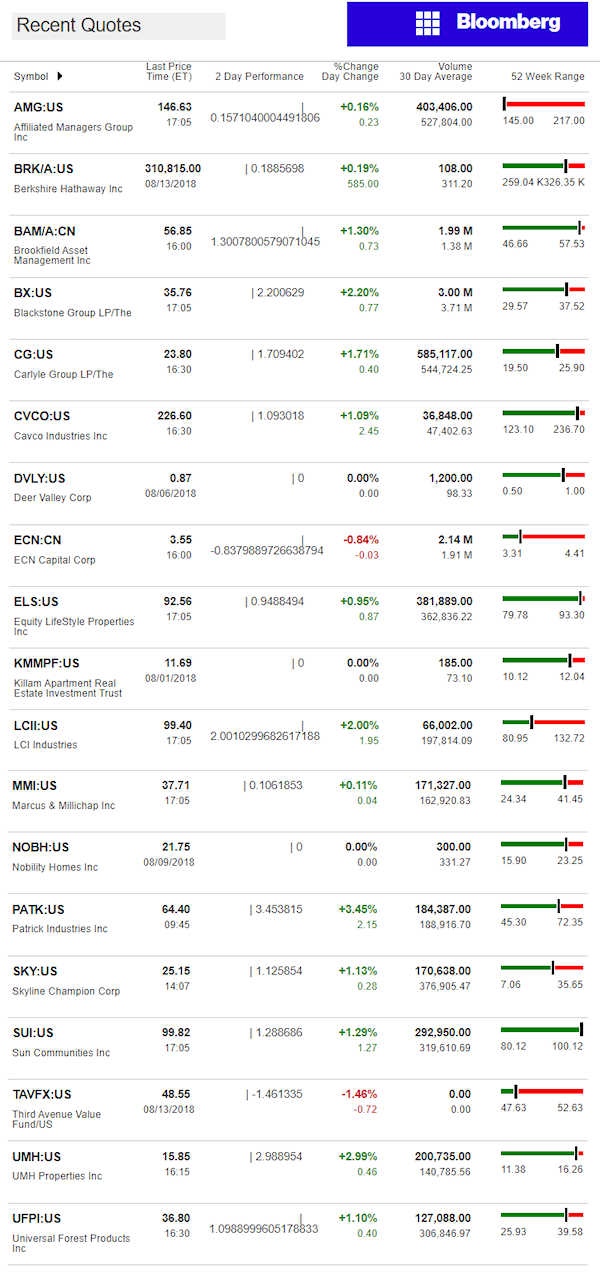

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

Per CNBC today:

- Berkshire Hathaway loaded up on Apple, Delta, Southwest and Goldman in the second quarter.

- In May, Buffett told CNBC that Berkshire had added 75 million shares of Apple and exited its stake in IBM in the first quarter.

“Warren Buffett’s Berkshire Hathaway increased its stake in Apple by 5 percent, according to a regulatory filing Tuesday that discloses positions through the end of the second quarter.

Berkshire also upped its holdings of Goldman Sachs by 21 percent, Delta by 18.8 percent and Southwest by 18.7 percent, the filing said, and it added another 6.7 percent to its Teva stake, which it had doubled in the first quarter of this year. Buffett’s conglomerate has been steadily building its Apple stake for two years to become its second-biggest shareholder.”

Related Report:

Kevin Clayton, Leslie Gooch Sound-off; Left & Right Agree? Manufactured Homeland, MHI, & You

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.