Earlier this month, the Manufactured Housing Institute produced a handout to their members. One of those was provided to the Daily Business News on MHProNews.

It came with a question.

“Has former MHI Chairman, Nathan Smith violated federal law? Isn’t that what MHI’s FAQ #6 implies, given SSK’s past and more recent marketing practices?”

It is an interesting topic.

This isn’t the first time that SSK Communities has been accused by others in manufactured housing for allegedly violating federal advertising, and possibly other laws. As the Daily Business News noted last week, SSK Communities has had several legal woes.

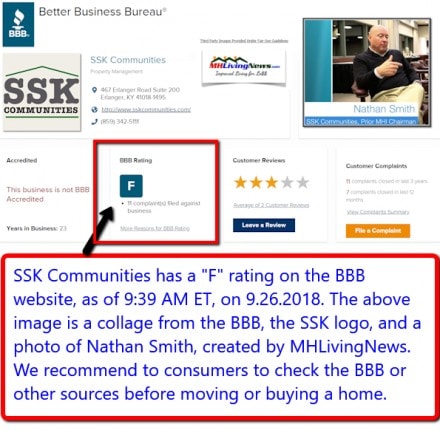

Nathan Smith’s SSK Communities also has an “F” rating by the Better Business Bureau (BBB).

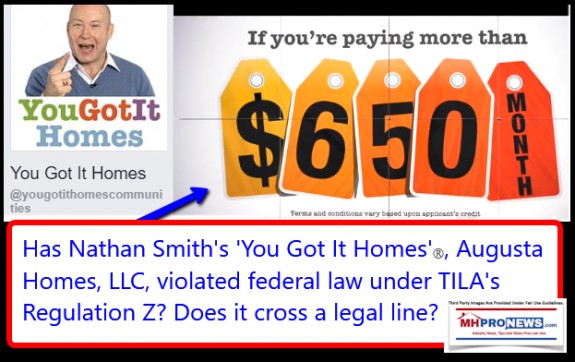

Further below, you can see a marketing item from Augusta Homes Sales, LLC, YouGotItHomes® from their Facebook page. This is one of a number of such questioned marketing items over the years that has been brought to MHProNews’ attention by industry readers.

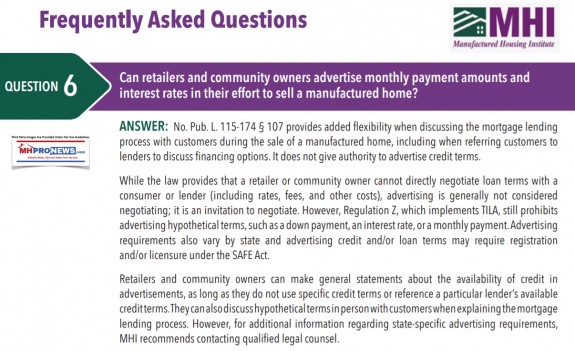

MHI’s new FAQ guide asks this question, among others, “Can retailers and community owners advertise monthly payment amounts and interest rates in their effort to sell a manufactured home?”

Here’s how MHI answered that question.

ANSWER: “No. Pub. L. 115-174 § 107 provides added flexibility when discussing the mortgage lending process with customers during the sale of a manufactured home, including when referring customers to lenders to discuss financing options. It does not give authority to advertise credit terms.

While the law provides that a retailer or community owner cannot directly negotiate loan terms with a consumer or lender (including rates, fees, and other costs), advertising is generally not considered negotiating; it is an invitation to negotiate. However, Regulation Z, which implements TILA, still prohibits advertising hypothetical terms, such as a down payment, an interest rate, or a monthly payment. Advertising requirements also vary by state and advertising credit and/or loan terms may require registration and/or licensure under the SAFE Act.

Retailers and community owners can make general statements about the availability of credit in advertisements, as long as they do not use specific credit terms or reference a particular lender’s available credit terms. They can also discuss hypothetical terms in person with customers when explaining the mortgage lending process. However, for additional information regarding state-specific advertising requirements, MHI recommends contacting qualified legal counsel.”

Was Richard Cordray – who led the CFPB until leaving the federal agency to run as a Democrat for Governor of Ohio – too busy to look into concerns about Nathan Smith, a prominent Democratic supporter of former President Barack Obama? ICYMI, you can later read these 2 related reports, linked immediately and further below.

MHProNews is hereby spotlighting and raising anew such concerns, noting that Nathan Smith, his companies, and MHI may have an explanation or defense, and that they are ‘innocent until proven guilty‘ by law. Smith, MHI, and the CFPB will be asked to comment about this matter.

Stay tuned for a planned follow up on this report, based upon their response(s).

This should also serve as reminder to others who may or may not be using similarly questionable or legally risky advertising messages.

As a final point, MHI’s handout busily patted their own back hard several times for their role in the passage of S 2155. To understand the background and facts about that topic, please the related reports, linked further below. That’s this evening’s manufactured housing “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” ## (News, analysis, and commentary.)

NOTICE: You can join the scores who follow us on Twitter at this link. You can get our ‘read hot’ industry-leading emailed headline news updates, at this link here.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

S 2155, Manufactured Housing,”Economic Growth, Regulatory Relief, and Consumer Protection Act” Back Story

S. 2155 is poised to pass the House today. It’s styled ” Economic Growth, Regulatory Relief, and Consumer Protection Act.” Should the bill pass – and Skopos Labs/GovTrack say there is a 56 percent chance of enactment – then the following is what you can expect from the Arlington, VA based national manufactured housing association and their surrogates.

Manufactured Homes Could Help Solve the Affordable Housing Crisis, So, Why Aren’t More Manufactured Homes Being Sold? – manufacturedhomelivingnews.com

People generally don’t buy something that they don’t understand, misunderstand, have concerns about, aren’t motivated to have, or are otherwise unable to buy. Until understanding, interest, desire, opportunity, need, and the means to buy all come together, no purchase is made. There are more details.

https://www.manufacturedhomelivingnews.com/nathan-smith-from-mobile-home-resident-to-ssk-communities-owner-and-president-barack-obama-connection/

Warren Buffett, Charlie Munger, Fannie Mae, Freddie Mac, Berkshire Hathaway Backstory