There are already some 22 million in the U.S. living in

pre-or-post HUD Code homes, but what is the potential for the market?

Several reports independent of the manufactured housing industry in 2018 established the value of modern manufactured homes. Several stated that manufactured homes were an important part of the solution for the affordable housing crisis.

A summary on several of those third-party studies that reflected positively on manufactured homes is linked here and further below, following the byline and notices.

So, there are already groups that see the value of manufactured homes, but there are also those outside of MHVille that think of our form of factory-built housing as homes for the poor, working, or lower middle class. Some in our industry believe something similar. But is that a fair assessment?

The short answer to that subtopic is ‘yes and no.’ How so?

On the one hand, researchers reveal that the average income of HUD Code manufactured home residents is significantly lower than that of conventional housing. That’s a large market that is worth serving.

But it would ignore the reality that thousands who make far more than the average – and chose manufactured home living. Manufactured homes are desirable regardless of income.

- MHLivingNews has interviewed millionaires who live in manufactured homes. There are also reports there of billionaires who own manufactured homes – even a single sectional.

- MHLivingNews has also interviewed upper middle class owners of manufactured homes. There are likewise numbers of prior owners of conventional housing that own and praise their manufactured homes.

- There is also Kid Rock video with the performer, his Rolls Royce, private jet and his manufactured home.

First, to understand the answer to the question, first time readers and those new to manufactured housing must realize that for decades, there have been upscale manufactured homes and entry level HUD Code homes. It is somewhat similar to entry level cars, boats, RVs, other big ticket item industries.

With those thoughts in mind, here’s a snapshot of who could be a potential manufactured home customer.

- Renters,

- First Time Home Buyers.

- Upsizers – including those who may own a conventionally built or other house, but want a larger floorplan home,

- Downsizers – including those who own a conventional housing unit,

- Retirees, and

- Second or vacation home seekers.

Rephrased, almost anyone who is properly exposed to the realities vs the myths might want a manufactured home. Renters alone represent some 100,000,000 in the U.S., per CityLabs. iPropertyManagement says that about 33 percent of all households are in rental housing. That one demographic group – renters – is enough to keep manufactured home producers busy growing in a sustainable way for years to come. And the 2018 research by the National Association of Realtors (NAR) reflects the fact that millions of those make enough money to qualify for a manufactured home.

One more Factoid – What’s the Potential in Your Market?

Pointing to Census Bureau information, Melisa Data says that every year in the U.S. “an overall percentage of 14.19 percent annually” are moving from one housing unit to another. That means about 1 in 7 on average in your market are going to be moving every year. Imagine that every 7th driver, every 7th person at a store, house of worship or wherever you encounter Americans are going to be moving this year.

Viewed as a marketer or sales professional should see this, that’s a huge and ongoing pool of potential prospects. Which begs the following questions.

- So why are so relatively few prospects coming into your manufactured home community or street retail sales center?

- Why are significant numbers of those coming into a sales center or community credit challenged than the pool seeking conventional housing?

Each of those 2 bullets are marketing, public relations, and educational issues. But the fact that some prospects are well qualified, means that others like them can be attracted too. The fact that some millionaires and billionaires own a manufactured home, mean that more could be attracted too. A look at the data with clear eyes tells the savvy that properly understood, the potential for manufactured housing is astronomical.

Which also means that the industry is underperforming, and it also means that those willing to apply the Sam Zell dictum could soar. “When others are going left, look right.” That ‘right’ is manufactured homes, communities, and other segments of the business. Many underperforming means others could and should be outperforming and wildly prospering.

Bottom Line Takeaways for Industry Professionals?

Whatever the agenda or reasoning process of others who seek to explain manufactured housing’s relatively low performance, the outline above reveals something brighter and more opportunity laden.

It’s an obvious advantage to be able to sell a product or service that costs less than competing alternatives. At present, manufactured homes are the lowest cost permanent housing choice made in the U.S. or Canada. Here in the U.S., manufactured homes have the advantage of enhanced preemption. There are also multiple story options for manufactured homes that are rarely consider outside of this publication.

Those looking to explore this potential for their own business or location should check out the article linked from the text-image box below.

Rocking Manufactured Housing Shows, Events, and Marketing Promotions

The trump card the industry must use are the power of enforcing existing federal laws. Enhanced preemption is just one of the existing laws that could catapult the industry ahead, at the local level.

There are numerous reasons for a motivated operation with sufficient access to capital and other resources to be able to grow significantly.

The facts outlined herein provide reasons for the industry’s investors and professionals to grow at a far more robust clip. Some of the reasons that the industry isn’t growing faster are found in the linked reports, below. “We Provide, You Decide” © ## (News, analysis, commentary.)

NOTICE: You can get our ‘read-hot’ industry-leading emailed headline news updates, at this link here. You can join the scores who follow us on Twitter at this link. Connect on LinkedIn here.

NOTICE 2: Readers have periodically reported that they are getting a better experience when reading MHProNews on the Microsoft Edge, or Apple Safari browser than with Google’s Chrome browser. Chrome reportedly manipulates the content of a page more than the other two browsers do.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

Positive, Uplifting Third-Party Reports Favor Modern Manufactured Housing, So What’s Going Wrong?

Drilling Down on State Manufactured Housing Shipment Data, Shocking Revelations, Warning Signs

Warren Buffet’s Quotable Quotes on Business, Institutions, Behavior, and News Reporting

HUD Code Manufactured Home Production Decline Persists – Time For Action Not Excuses | Manufactured Housing Association Regulatory Reform

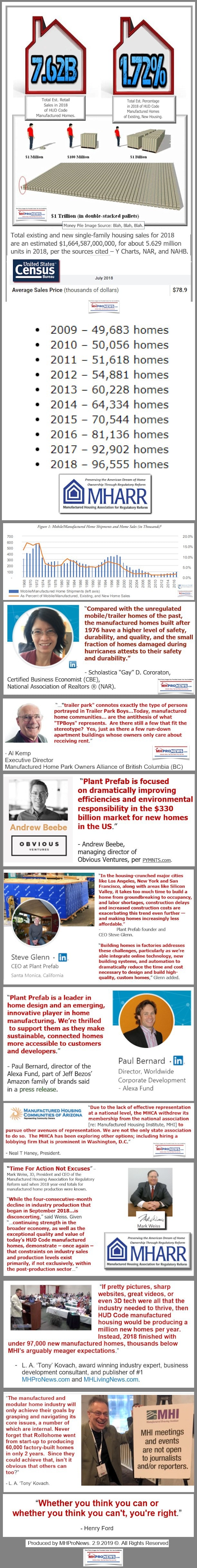

Washington, D.C., February 4, 2019 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured home production declined again in December 2018.

“The Illusion of Motion Versus Real-World Challenges” | Manufactured Housing Association Regulatory Reform

Motion – or, more accurately, activity – in and of itself, is not necessarily synonymous with, or equivalent to, realprogress, or, in fact, any progress at all.