“The Manufactured Housing Association for Regulatory Reform (MHARR) has published a talking points paper…explaining and highlighting the three main bottlenecks that are suppressing the production, marketing and sales of affordable, mainstream manufactured homes.” That MHARR press release was provided to MHProNews and is shown in Part I below. Part II is their “talking points” memo. Part III is our MHProNews analysis and commentary, which will include some items that MHARR has not included.

Part I

FOR IMMEDIATE RELEASE Contact: MHARR

(202) 783-4087

MHARR CONTINUES TO EXPOSE PRINCIPAL BOTTLENECKS SUPPRESSING MANUFACTURED HOUSING

Washington, D.C., March 1, 2024 – The Manufactured Housing Association for Regulatory Reform (MHARR) has published a talking points paper (copy attached) explaining and highlighting the three main bottlenecks that are suppressing the production, marketing and sales of affordable, mainstream manufactured homes. Two of these bottlenecks have worked to thwart the expansion of the HUD Code market for decades, while the third – of more recent origin – has the potential to decimate the historical core of the industry if not stopped and fundamentally altered.

Especially after industry production statistics for 2023 showed a drop in industry production below the 100,000 home benchmark, MHARR has received numerous inquiries and requests from interested organizations and individuals – both within and outside the HUD Code industry – seeking a brief explanation of the main causes and factors that have fueled such a decline for the most affordable segment of the housing industry.

Therefore, the attached points are a brief summarization and explanation of those principal bottlenecks.

Organizations and individuals interested in the manufactured housing industry – and particularly industry state associations – can use this easy-to-read summary to highlight and address these negative and destructive factors.

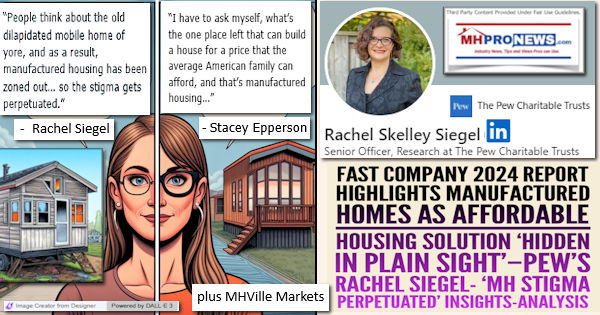

MHARR will continue to expose — and advance the resolution – of these and other negative factors affecting the industry and its ability to fully meet and exceed the affordable housing needs of American families.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 —

Part II

SUMMARY OF THE THREE MAIN BOTTLENECKS SUPPRESSING MANUFACTURED HOUSING PRODUCTION, MARKETING AND SALES

- Discriminatory and Exclusionary Zoning – Failure to Implement Enhanced Preemption of the 2000 Reform Law– Despite being the nation’s best resource for affordable homeownership, and at a time when manufacturers are building their most modern, energy-efficient homes, HUD-regulated manufactured housing is excluded from many communities and areas by discriminatory and exclusionary zoning mandates. Amendments contained in the Manufactured Housing Improvement Act of (2000 Reform Law) were designed to provide HUD the authority to federally preempt such edicts. In relevant part, 42 U.S.C. 5403(d) was amended to state that federal preemption under the Act was to be “broadly and liberally” construed. It was also amended to state that preemption applies not only to inconsistent state or local construction standards, but also more broadly to any type of state or local “requirement” that impairs the purposes of the Act and HUD superintendence of the industry. HUD, however, continues to fail to acknowledge, utilize and advance this authority to ensure the nationwide availability of manufactured homes that it regulates.

- Restricted Availability of Competitive Consumer Financing – Failure to Implement the “Duty to Serve”– In the Housing and Economic Recovery Act of 2008, congress recognized that Fannie Mae and Freddie Mac were not adequately or properly serving consumers within three designated markets, including the mainstream HUD Code manufactured housing market. The Act, therefore, contains a “Duty to Serve” (DTS) provision which directs the Enterprises to provide secondary market and securitization support for manufactured home consumer loans. Today, some 15 years later, the GSEs still provide no DTS support whatsoever for the personal property or “chattel” loans that historically comprise 70-80% of all mainstream manufactured home consumer loans. Without such secondary market and securitization support, interest rates on manufactured home chattel loans are higher than would otherwise be the case, with consumers effectively forced into “predatory loans.” Further, the absence of DTS support for such a large portion of the market allows it to be dominated by two Berkshire Hathaway/Clayton Homes-affiliated lenders, Vanderbilt Mortgage and Finance and 21st Mortgage Corporation, to the detriment of both consumers and independent producers.

- DOE Energy Regulation– Although the HUD Code already contained provisions regarding energy usage and efficiency in manufactured homes, Congress, in the Energy Independence and Security Act of 2007, adopted a provision which effectively transfers regulatory authority over that issue from HUD to the U.S. Department of Energy (DOE). DOE, in defiance of the enabling legislation, has used this authority to adopt draconian energy standards that if/when implemented, would significantly increase the acquisition cost of manufactured housing. These increased costs would exclude literally millions of Americans from the manufactured housing market under metrics developed by NAHB, while providing little if any life-cycle cost benefits. MHARR urged industry litigation against these standards, which is currently pending in federal court. DOE, meanwhile, has delayed the implementation date for the standards which were originally set to become effective on May 31, 2023. MHARR is also working through the HUD Manufactured Housing Consensus Committee (MHCC), established by the 2000 Reform Law, in an effort to quash these standards and force DOE to go back to the drawing board in full compliance with all applicable law.

Part III – Additional Information with More MHProNews Analysis and Commentary

1) MHARR’s president and CEO, Mark Weiss, J.D., understands the meaning and importance of words. MHARR’s messages said: “THREE MAIN BOTTLENECKS” and “PRINCIPAL BOTTLENECKS.” Main and principal are synonymous terms. There are good arguments that zoning, financing, the looming DOE energy rule and related enforcement regime are indeed important, key, critical or “main” bottlenecks. More on that shortly.

2) That said, if someone was to forge a case – what else should the Manufactured Housing Institute (MHI) be doing that they currently are not? That list should include proper public relations, education, and media engagement. As an MHI-linked state association executive told MHProNews, umbrella style trade groups (like MHI and/or their state association affiliates) role can be summed up with a three-letter acronym. That Manufactured Housing Executive Committee (MHEC) leader said it is P.E.P. Protect. Educate. Promote.

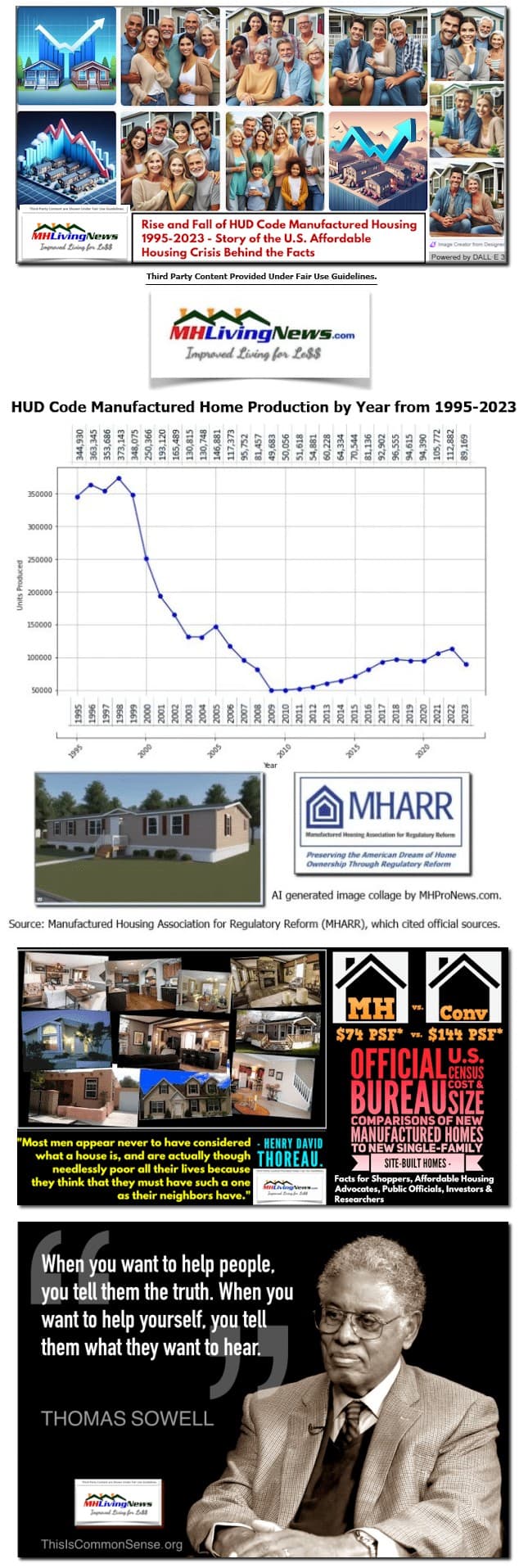

3) That noted, MHARR’s point that the industry has dropped below the “benchmark” 100,000 new shipments in 2023 is an obvious metric of how bottlenecks MHARR described above are limiting sales and production. The graphic collage below includes a production trends graphic which illustrates MHARR’s claim.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

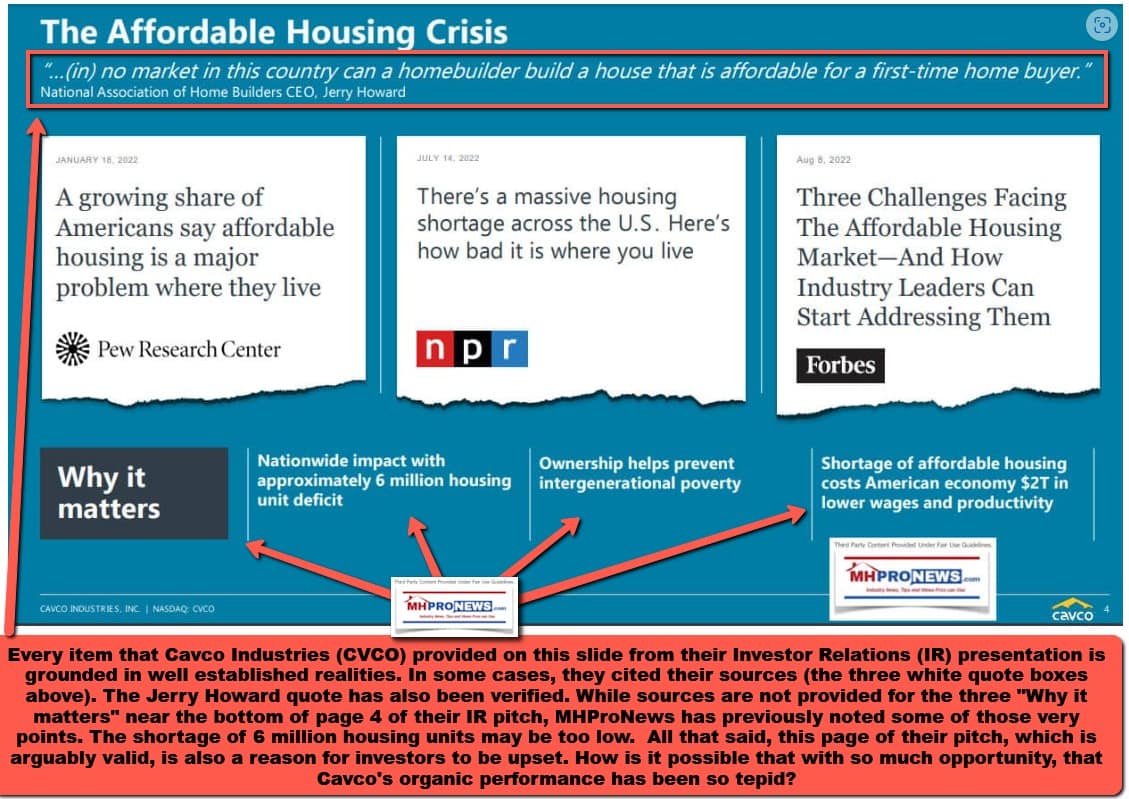

4) Sadly, the known evidence suggests that MHI has consistently failed at all three categories listed by MHARR. The dismal production and shipment trends are also an obvious educational/media engagement metric for just how poorly MHI has performed through much of the 21st century. Logically, high-profile member Cavco Industries (CVCO) remarks illustrate MHI’s own failure. By claiming that they are “THE National” trade association representing “all segments” of factory-built (and thus manufactured) housing, they are asserting responsibility and thus culpability for the outcome. From the MHI home page on this date are these remarks.

“MHI membership helps you expand business opportunities and shape the industry through information, advocacy, education, research, and networking.”

5) That quoted statement above is similar to remarks sworn to under penalties of perjury by MHI in their IRS Form 990 annual filing. Quoting the screen capture of the MHI IRS 990 it says their mission or most significant activities are to: “Improve the overall operating environment for the manufactured housing industry and expand the demand for manufactured homes by seeking fair and equitable treatment in the marketplace and the regulatory and legislative arenas.” By MHI’s own “mission” standards, they are failing.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

6) It isn’t just those quoted statements by MHI above. The items quoted below are also from the MHI home page on today’s date.

MHARR’s tagline beneath its logo says: “Preserving the American Dream of Home Ownership Through Regulatory Reform.”

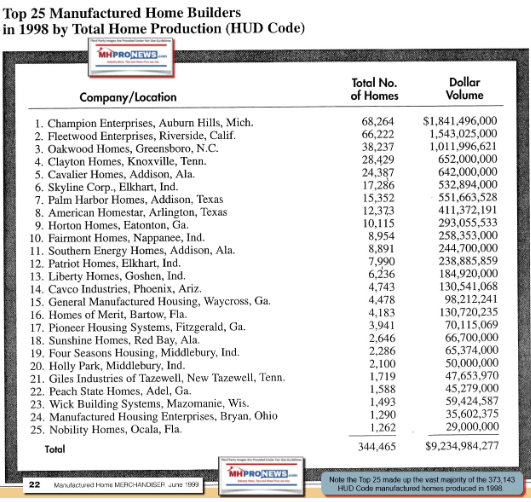

8) The report linked below provides the hard numbers. They support the points raised by MHARR in Part I and Part II. Manufactured housing production in 2023 was only about 24 percent of what it was in 1998. Here is the math, based on official data and reflected in the graphic in #3 above: 89169/373343 = 0.23883935148. That isn’t speculation, or mere opinion. Those are hard facts which it is difficult to spin into MHI’s ongoing claim that they have ‘expanded’ in any sense, OTHER THAN the steady expansion of industry consolidation by several key MHI members.

9) It is about 2 decades since the MHI commissioned Roper Report was published. It documented the needs for education, public relations, marketing and messaging, which MHI has yet to properly or successfully address. Restated, despite MHI’s obvious understanding of the issue of public perception they have – for whatever reason(s) – allowed the status quo to languish. Perhaps among the reasons for that seemingly odd behavior by MHI are obliquely highlighted in two recent reports linked below. Stigma may be seen as a benefit to consolidators. Those are remarks based on insights from both research and investors in manufactured housing. Those recent reports below are followed by linked information on the MHI commissioned Roper research.

10) It has been said that hindsight is 20/20. While manufactured housing was expanding in the late 1990s, ‘old’ Champion and ‘old’ Fleetwood made extensive efforts to consolidate the industry’s retail, and thus production. It ultimately led to bankruptcy for reasons explored in several reports on MHLivingNews and MHProNews, including one linked here.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

From the above scan of the now defunct Manufactured Home Merchandiser, which cited official sources, are the following facts placed in a spread sheet.

| 1 | Champion Enterprises | 68264 |

| 2 | Fleetwood Enterprises | 66222 |

| 3 | Oakwood Homes | 38237 |

| 4 | Clayton Homes | 28429 |

| 5 | Cavalier Homes | 24387 |

| 6 | Skyline Corp | 17286 |

| 7 | Palm Harbor Homes | 15352 |

| 8 | American Homestar | 12373 |

| 9 | Horton Homes | 10115 |

| 10 | Fairmont Homes | 8954 |

| 289,619 |

Restated, the first 2 builders above produced more homes in 1998 that all of manufactured housing did in 2023. Here is the math. 68264+66222 = 134486. Compare that to total MHVille production in 2023 of only 89169. Doing the math, the top two HUD Code builders in 1998 produced 45317 more homes than the entire industry in 2023. That’s a stunning indictment of MHI’s so-called leadership.

But it is also thus a call for public accountability. As will be examined in a pending report, neither MHI’s latest email, nor their ‘news’ section provided any response to the reports linked below. It is Bing AI powered Copilot that said MHI should be ‘transparent’ and needs to be held accountable if it is to be an effective advocate for manufactured housing.

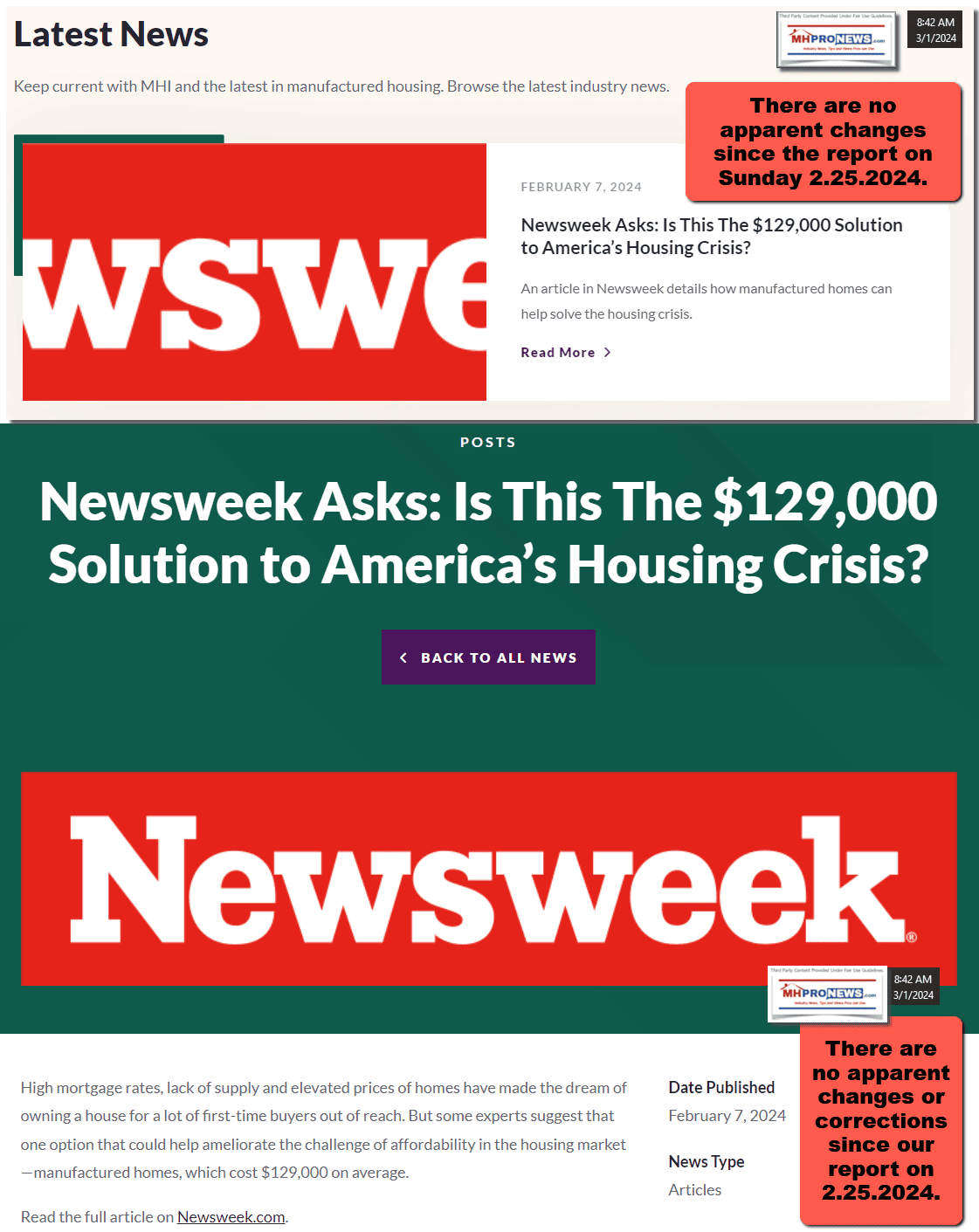

11) A recent example of MHI’s lack of effective media engagement is shown below. That example below was also explored by Bing’s AI powered Copilot. Copilot’s analysis of MHI’s behavior was not kind, to be polite. Nor has MHI apparently made any corrections, per our fact check on this date (see two screen captures below the lined article’s featured image). So, MHI is leaving apparently incorrect and misleading information linked up on their own website.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

12) These facts both support the MHARR thesis but go beyond it to the extent that MHI is not doing its own self-stated mission description. Let’s look at a broader comparison with the industry’s last highwater mark of 1998 (see #10 above). Instead of just the top ten for that year, let’s look at the top 25.

| Then (1998) | Now 3.1.2024 | |||

| 1 | Champion Enterprises | 68264 | Skyline Champion | SKY |

| 2 | Fleetwood Enterprises | 66222 | Cavco Industries | CVCO |

| 3 | Oakwood Homes | 38237 | Clayton Homes | BRK |

| 4 | Clayton Homes | 28429 | Clayton Homes | BRK |

| 5 | Cavalier Homes | 24387 | Clayton Homes | BRK |

| 6 | Skyline Corp | 17286 | Skyline Champion | SKY |

| 7 | Palm Harbor Homes | 15352 | Cavco Industries | CVCO |

| 8 | American Homestar | 12373 | American Homestar | |

| 9 | Horton Homes | 10115 | ||

| 10 | Fairmont Homes | 8954 | Cavco Industries | CVCO |

| 11 | Southern Energy | 8891 | Clayton Homes | BRK |

| 12 | Patriot Homes | 7990 | Out of Business (OOB) | |

| 13 | Liberty Homes | 6236 | ||

| 14 | Cavco Industries | 4743 | Cavco Industries | CVCO |

| 15 | General Manufactured Housing | 4478 | ||

| 16 | Homes of Merit | 4183 | Skyline Champion | |

| 17 | Pioneer Housing System | 3941 | ||

| 18 | Sunshine Homes | 2646 | Sunshine Homes | |

| 19 | Four Seasons Housing | 2286 | ||

| 20 | Holly Park | 2100 | ||

| 21 | Giles Industries | 1719 | Clayton Homes | BRK |

| 22 | Peach State Homes | 1588 | ||

| 23 | Wick Building Systems | 1493 | ||

| 24 | Manufactured Housing Enterprises (MHE) | 1290 | Still MHE | |

| 25 | Nobility Homes | 1262 | Nobility Homes | NOBH |

| 344465 |

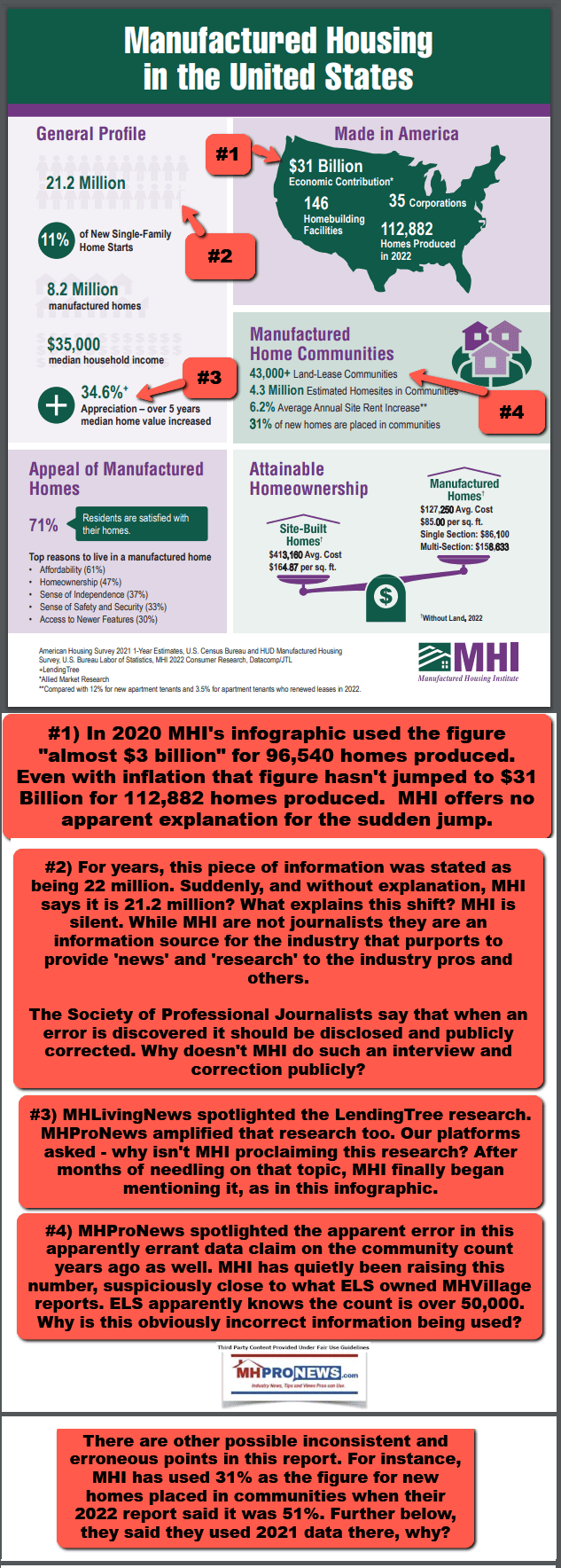

So, the Merchandiser’s math seems to be accurate. 373,143 was the total production for that year. Per MHI, that year (1998) there were 89 corporations and 330 plants. Per MHI’s graphic below, there are 146 homebuilding facilities (plants or factories). As Copilot recently pointed out, MHProNews had called several times for MHI to correct their previously erroneous economic contribution data, which was vastly understated by MHI before. But MHI is still erroneously reporting the number of communities, which below says 43,000 plus when the Lincoln Institute said that per FEMA research there are over 50,000.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

13) Perhaps one of the most dramatic – and thus ironic – sources for just how poorly MHI has performed its claimed advocacy for “all segments” of manufactured housing is presented by Cavco.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

See the reports linked here and here that cites some of those points above, but also explores others.

14) In summary, MHARR’s 3 main bottlenecks are supported by the evidence. In addition to those bottlenecks, MHProNews would point out that the facts and evidence reveal that MHI’s messaging is also a problem. No less a source that Kevin Clayton with Clayton Homes said over 12 years ago that the industry was ready to do a national information/educational campaign. Alas, no such campaign has emerged.

15)

Learn more

> “Copilot, can you find any response by the Manufactured Housing Institute to the evidence and allegations made in the report that you linked in 1 of 30? MHARR on 2.29.2024 emailed an item posted on their website on 3.1.2024 that said this: https://manufacturedhousingassociationregulatoryreform.org/manufactured-housing-association-for-regulatory-reform-mharr-continues-to-expose-principal-bottlenecks-suppressing-manufactured-housing/ can you find any factual inaccuracies in their report and analysis? Last for now, despite the fact that MHI claims that they promote the industry, do you see any evidence of a national campaign like what Kevin Clayton said to Robert Miles over a dozen years ago that the industry was ready to launch? Or any evidence that their Roper Report recommended image/education campaign has launched? Can you find any example of a response by MHI and/or their media relations Molly Boyle or any other Institute linked professional has responded to any misinformation online about the industry? Link your results.”

16)

> “Bing, quoting from the Manufactured Housing Institute home page on this date are the following remarks: “Keep current with MHI and the latest in manufactured housing. Browse the latest industry news.” But there is no news reported in 3 weeks. The report that they linked was fact checked by Manufactured Home Pro News and was found to have several apparent errors, none of which MHI appears to have corrected. The Manufactured Housing Institute home page also has this remark: “Grow your business Get the tools, platform and information you need.” But manufactured home production is down 21 percent from 2022 in 2023. And manufactured home production is down about 76 percent since 1998, isn’t that correct? MHI’s website claims that “We are your trusted partner, advocate and industry leader.” Yet, you’ve previously said that MHI appears to lack transparency, fails to hold professionals like Lesli Gooch accountable for apparent conflicts of interest, and that some of what they have said appears to fit the definitions of paltering, a lie, and misinformation. Provide feedback on those concerns and link your results. Answer the question, is MHI making factually supported claims or are they posturing efforts that appear to be more focused on industry consolidation, based on investor relations information published by several of their own members.”

Learn more

> “Useful, thanks. However you didn’t directly address this part of the question: MHI’s website claims that “We are your trusted partner, advocate and industry leader.” Yet, you’ve previously said that MHI appears to lack transparency, fails to hold professionals like Lesli Gooch accountable for apparent conflicts of interest, and that some of what they have said appears to fit the definitions of paltering, a lie, and misinformation. Given the evidence-based allegations by legal researcher Samuel Strommen, the multiple antitrust lawsuits filed against certain higher profile MHI members, and the concerns raised by Minneapolis Federal Reserve senior economist James A. “Jim” Schmitz Jr and his colleagues, aren’t there serious reasons to have market manipulation, possible RICO, fraud, and antitrust violations concerns about MHI and their claims?”

Learn more

While MHARR and the author of this article are long-time advocates for implementation of the enhanced preemption of the Manufactured Housing Improvement Act of 2000 by HUD, in order to eliminate widespread zoning discrimination against affordable manufactured homes and the Americans who own and reside in them, others — including some within the industry itself — have either downplayed this major issue or have been missing in action for far too long.”

While MHARR and the author of this article are long-time advocates for implementation of the enhanced preemption of the Manufactured Housing Improvement Act of 2000 by HUD, in order to eliminate widespread zoning discrimination against affordable manufactured homes and the Americans who own and reside in them, others — including some within the industry itself — have either downplayed this major issue or have been missing in action for far too long.”

Mark Weiss

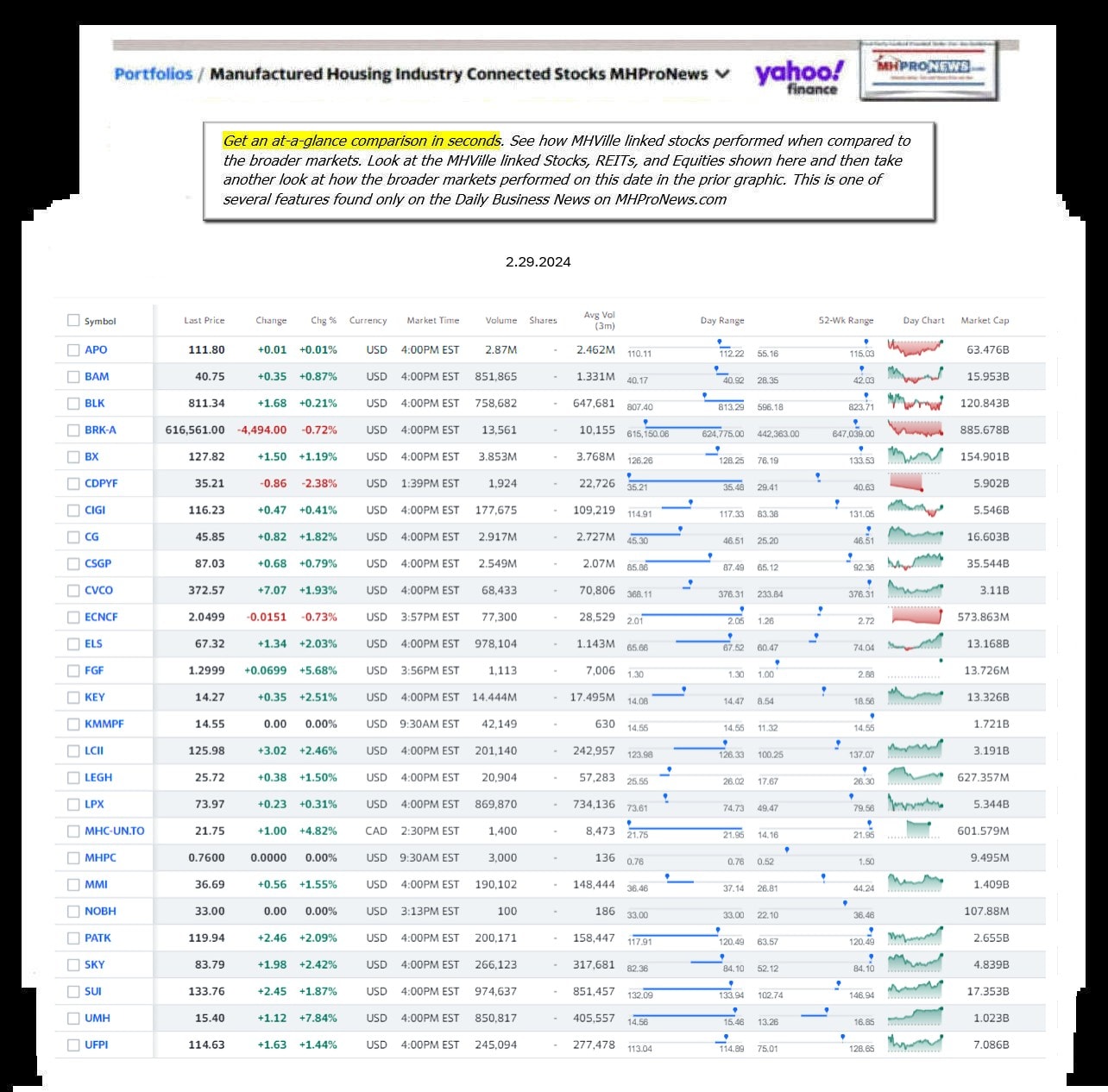

Part IV – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from 2.29.2024