Edward J. “Ed” Pinto, J.D., is the Director of the AEI Housing Center, which says of itself that it is “the source for independent, objective, nonpartisan research.” That Washington D.C.-based trade group’s Director of Research, Tobias Peter, told the powerful Senate Committee on Housing, Banking, and Urban Affairs that many of the problems in America’s affordable housing crisis were a direct consequence of U.S. federal policy.

In relation to a new report from Fannie Mae, MHProNews contacted Pinto to ask some questions about his views on manufactured housing’s role in the affordable housing crisis.

Pinto’s reply follows. As regular MHProNews readers know, bold and brown are added for emphasis and to make quoted statements ‘pop.’

- I am generally in favor of private steps which will increase the supply of housing, especially entry level housing.

- This includes manufactured housing.

- Accomplishing increased supply can generally best be accomplished by the government (all levels) getting out of the way.

- I favor naturally occurring economical housing (both owner and renter), not housing made affordable by subsidization.

- I am not in favor of policies that subsidize and thus promote debt.

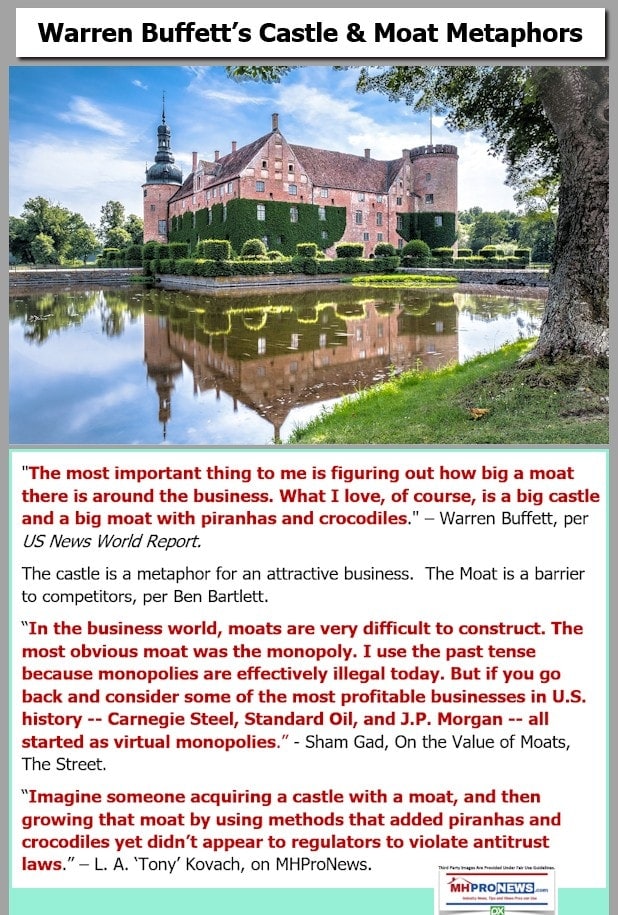

- I am concerned about rent seeking by manufactured housing companies. The benefits of extending and expanding federally guaranteed financing to manufactured housing would provide access to 30 year loan terms (a significant increase compared to what is available today) or providing access to lower GSE or Ginnie rates (a significant decline over what is currently available). Such credit easing gets capitalized into higher prices, the benefits of which would largely flow into the pockets of these companies in the form of higher profits and to existing homeowners in the form of higher property values.

- My first and foremost concern is increasing the supply of economical housing for entry-level buyers.

- I am not in favor of policies that ease credit during periods when supply is constrained (a seller’s market).

- Such credit easing gets capitalized into higher prices.

- I am in favor of policies that assist in wealth building.

Best,

Ed Pinto, Director,

AEI Housing Center, the source for independent, objective, nonpartisan research

1789 Mass. Ave, NW, Wash,. DC 20036”

##

Several issues are obviously addressed in Pinto thinking as outlined in the above on the record reply in which he copied his colleague Peter multiple times in the emailed communications with MHProNews.

Additional Information, MHProNews Analysis, and Commentary

By stating his opposition to subsidized housing, by happenstance and/or by design, AEI Housing Center’s Pinto came down on the side of longtime manufactured home community operator Marge Clark. Clark said to MHProNews that the biggest rival for our profession is subsidized conventional housing construction.

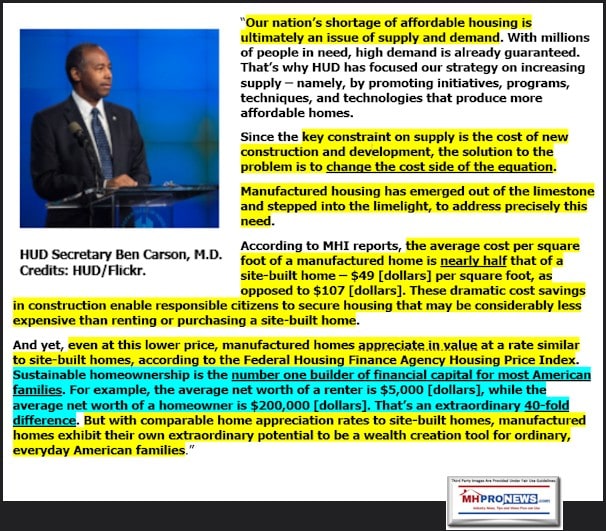

HUD Secretary Ben Carson made several comments that likewise happen to mirror what Pinto said.

While Peter did not make a direct statement about manufactured homes in the testimony provided to MHProNews by AEI earlier this week, in the light of Pinto’s remarks above, the following pull-quotes may take on a new light.

AEI stresses that it is nonpartisan.

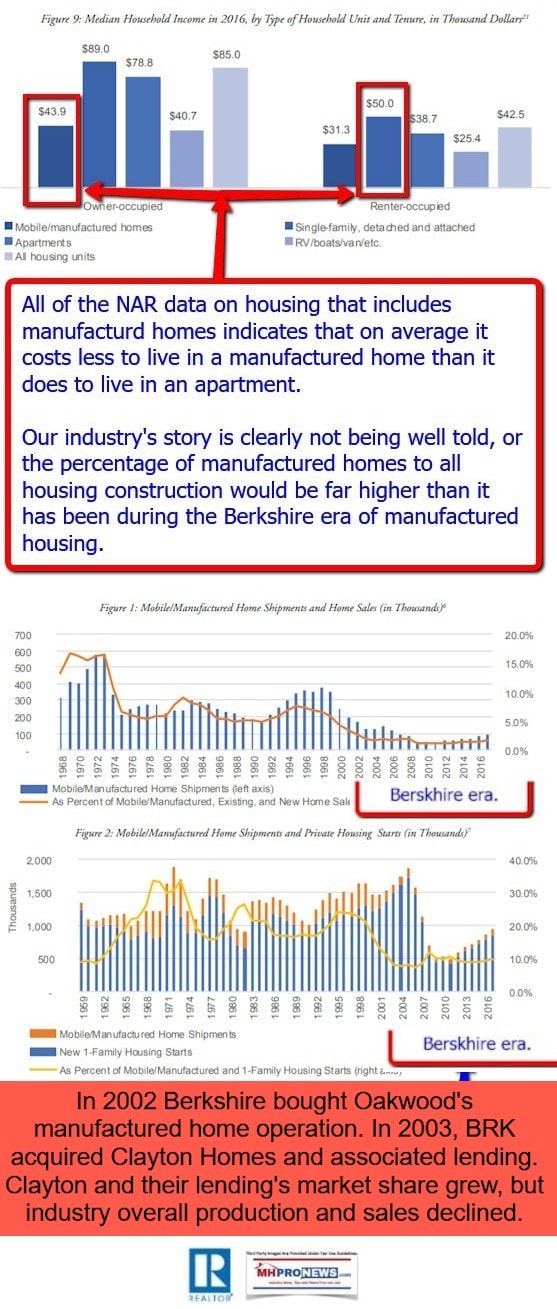

While not referencing the bipartisan state level study conducted below, Democrats and Republicans revealed that HUD Code manufactured homes were significantly less costly than even multifamily housing. That was true both for new developments as well as for redevelopment.

For those who are data, evidence, trends driven, such facts as those produced by the research from that bipartisan group of lawmakers and those involved in their study are significant.

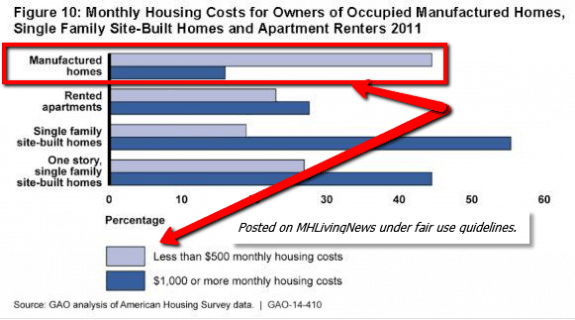

Additionally, research by the Government Office of Accountability (GAO), Fannie Mae, plus that of National Association of Realtors’ Certified Research Economist (CRE) Scholastica “Gay” Cororaton all point to a large price advantage for HUD Code manufactured homes in payment as well as price.

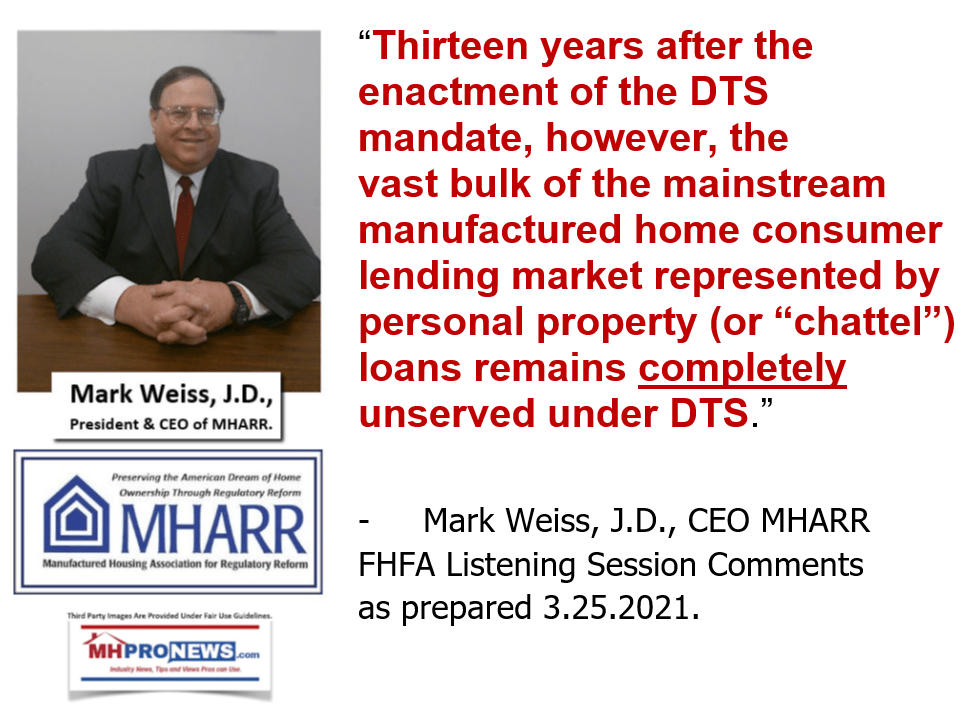

Mindful of Pinto’s qualifiers, that payment advantage of manufactured homes over other housing options would reasonably be expected to get better if less costly lending was made available.

The Manufactured Housing Institute (MHI) and Large Corporate Angles

MHProNews did not ask Pinto or Peter to weigh in on specific internal issues raging within the manufactured housing industry. Nor did either offer any specific comments on association or corporate politics, other than the ones by Pinto shown above. For example:

> “I am concerned about rent seeking by manufactured housing companies.”

> “The benefits of extending and expanding federally guaranteed financing to manufactured housing would provide access to 30 year loan terms (a significant increase compared to what is available today) or providing access to lower GSE or Ginnie rates (a significant decline over what is currently available).”

That does not name names.

But it obliquely fits specific firms that happen to be Manufactured Housing Institute (MHI) members. Furthermore, it happens to fit the issues that the independent producers trade group, the Manufactured Housing Association for Regulatory Reform (MHARR), has similarly highlighted and pushed.

Pinto’s next pull-quote is one that serious strategic thinkers in our profession who want to see a return to past glory days and beyond should put into their tool kit.

> “My first and foremost concern is increasing the supply of economical housing for entry-level buyers.”

Given the inherent affordability of HUD Code manufactured homes, plus the specific reference to “This includes manufactured housing…” and “I am in favor of policies that assist in wealth building…” there is little room for doubt as to Pinto’s general support for systemic changes that would create more manufactured home sales.

Note that those two pull-quotes from Pinto as paired above largely fits what Florida Atlantic University professor Ken Johnson told MHLivingNews in relation to the financial benefits of affordable home living in general, with manufactured home living being specifically affirmed in that mix.

In the light of research that the Urban Institute and Secretary Carson referenced from the FHFA, that manufactured homes can and are appreciating in numerous cases, the arguments in favor of a broader use of HUD-Code manufactured homes only grows. Including the potential for a roughly $2 trillion dollar annual GDP lift cited by NBER researchers and other findings of similar objective analysts, the case for manufactured housing only grows.

More on the Manufactured Housing Institute (MHI) In This Mix

Once more for emphasis, Pinto did not directly comment on MHI or specific firms.

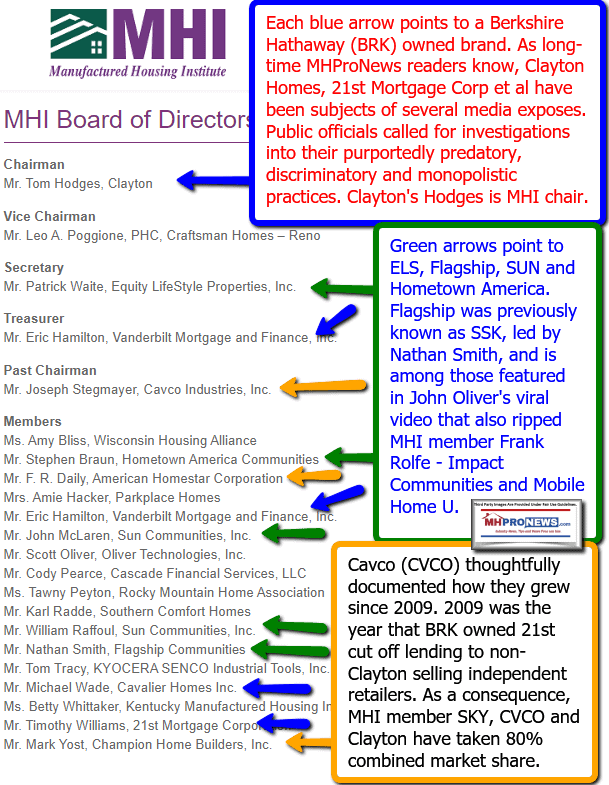

That noted, logically by default, the Manufactured Housing Institute (MHI) has demonstrated that its critics are correct. This is not an incidental matter. It goes to the core of the why behind the criticism or MHI and what Marty Lavin, J.D. has called it’s “big boy” dominating companies.

Like Pinto, Lavin did not name names. But even a short glance at the MHI board of directors makes it clear which direction the organization leans.

Those critics of MHI include serious voices from within the manufactured home industry’s ranks. Beyond Lavin or MHARR, the reports linked below and herein each routinely state specific misses by MHI.

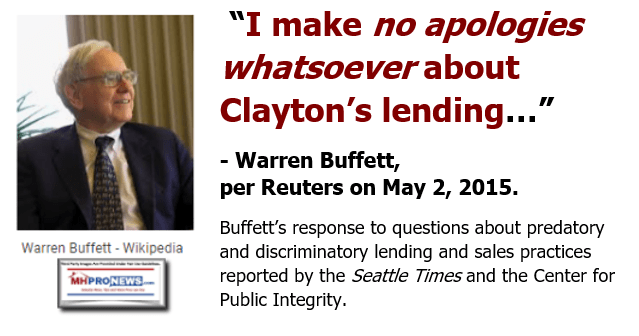

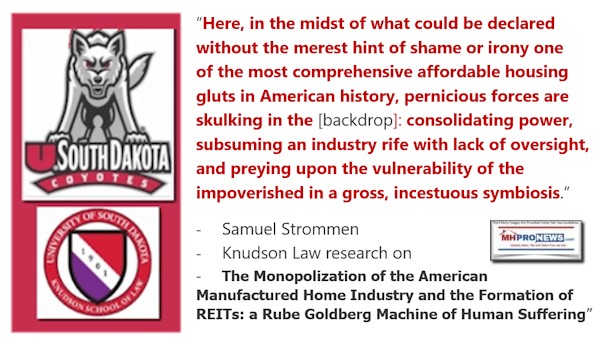

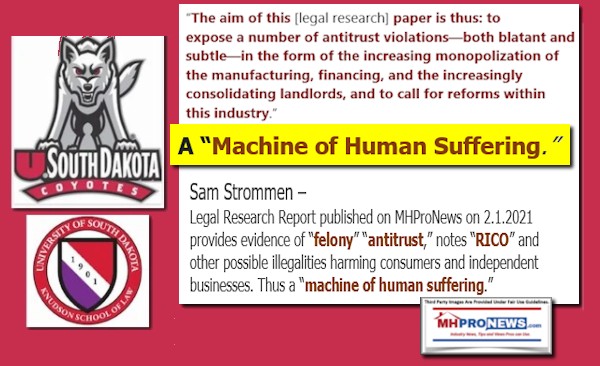

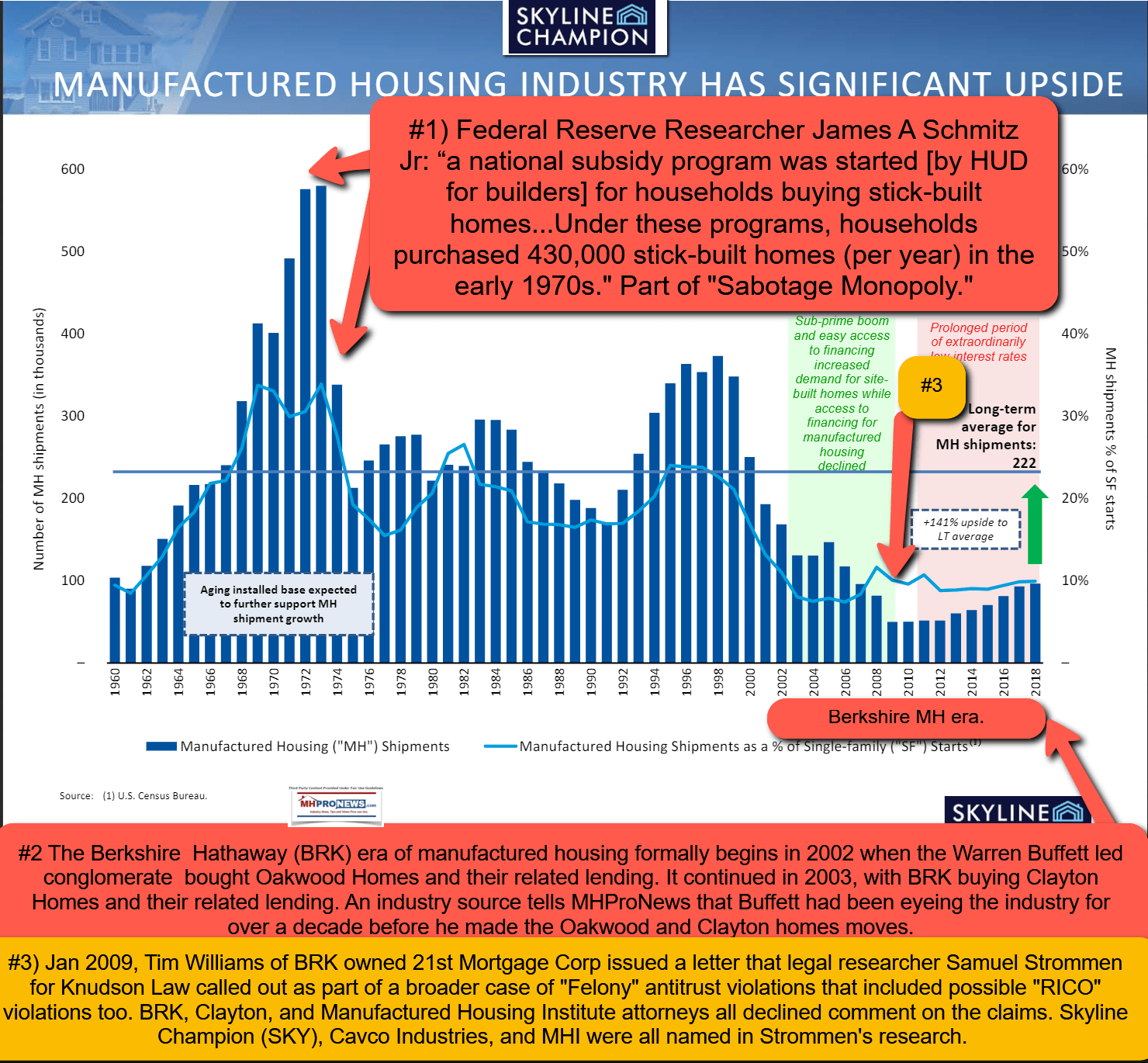

But those critics also include academic and legal minds that have sharply denounced MHI as a tool that is corruptly giving cover to purportedly unethical as well as illegal actions. Who says? Samuel Strommen at Knudson Law. By failing to publicly answer those charges, MHI, along with executives, attorneys for Berkshire Hathaway (NYSE:BRK), Clayton Homes, 21st Mortgage Corporation, Vanderbilt Mortgage and Finance (VMF), Skyline Champion (NYSE:SKY), Cavco Industries (Nasdaq:CVCO), have left the industry’s members with ample reasons to wonder why the behavior of the Arlington, VA based trade group and its corporate masters posture without measurable performance with respect to production during a growing affordable housing crisis.

Winners and Losers

The beneficiaries of that trend of the past two decades are arguably the consolidators of the once-thriving numbers of independents in our profession.

Among the documentable losers are the independently owned businesses by the thousands which have either vaporized or in many cases sold out to consolidators for less than the intrinsic or potential value of their business. That trend happens to fit, in an arguably dark fashion, the Buffett mantra of making bargain acquisitions.

But to Pinto’s points, and that of those referenced in the NIMBY vs. YIMBY report, the general public plus taxpayers are losers too.

As evidence for the data-driven and evidence-based claim are reports like those linked above and below.

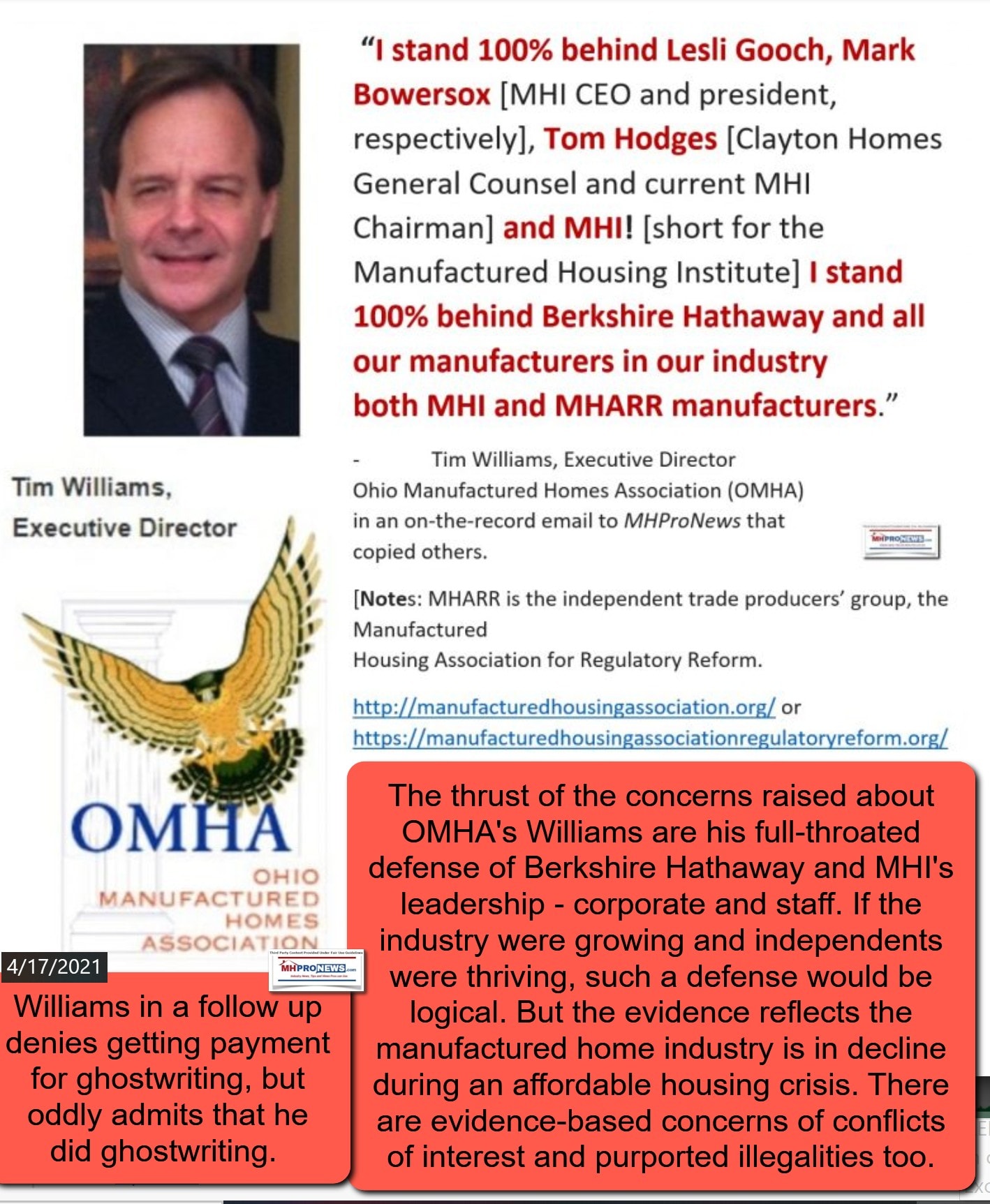

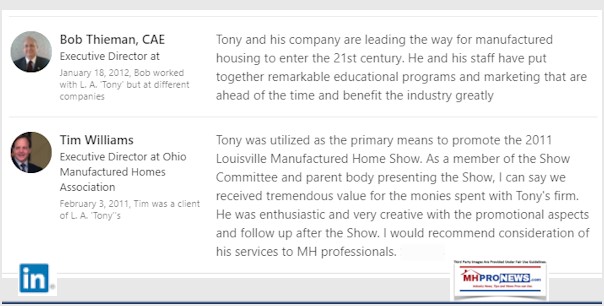

Among the interesting developments this past week on the side of those who wish to deny these realities were comments from the Ohio Manufactured Home Association (OMHA) Executive Director Tim Williams and OMHA General Counsel Elizabeth Birch.

Birch obliquely gave ‘the game’ away this week in her written statement to MHProNews, which said in part: “Ignoring you is not the same as agreeing with you or hiding from the truth.” “The silence means that your allegations are not worthy of acknowledgment.” In her defense of OMHA’s Williams, she failed to focus on the primary issues, instead opting to focus her reaction of evidence-based allegations that Williams did ghostwriting for others, which Williams ironically confirmed. The fact that he now denies getting payment contradicts the definition of “ghostwriting” which includes the notion of writing for others for payment. Restated, Birch’s response failed to disprove or deflect the volume of evidence against her colleague’s arguably misplaced defense of Berkshire Hathaway and MHI.

But arguably far more important are these points from Birch: “Solving issues together is far more constructive than personal attacks for no other discernable reason.” As an attorney, one might think that she would have provided evidence for that allegation? Besides, as she knows – because it was messaged to her and Williams directly, the “discernable reason” is accountability for poor performance during an affordable housing crisis. That reasoning would be discernable for any objective minded researcher or investigator.

Where are her examples of “solving” issues “together” when there is a pattern by MHI leaders and their flatterers of dodging the hard questions that are evidence based. That evidence includes the hard data that makes it clear that the industry is in decline.

Ironically, beyond the ‘tells’ or giveaways, Birch let slip a stunning statement: “Of course, Tim and OMHA support others in the industry who are working hard to build the viability of and the perception of manufactured housing.”

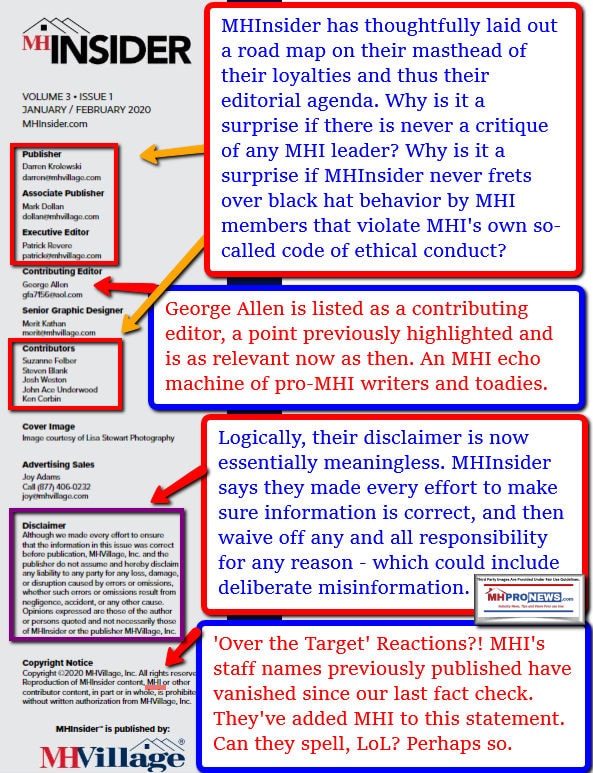

First, what Lavin calls the “big boys” have arguably created a literal ‘amen corner,’ which is evidenced by the masthead of the so-called MHInsider.

While Kurt Kelley admits that he is not in the business of critiquing and holding MHI accountable, ironically, his publication has published articles that when carefully examined are hits – not helps – for the MHI ‘claims.’

In that context, OMHA’s Williams and Birch have literally thrown in with that echo chamber of ‘all is well,’ when the data and trend lines reflect that all is not well.

Second, and moving beyond the amen corner aspect to Birch’s missive, is a stunning admission, likely not realized when she wrote it. “…Tim and OMHA support others in the industry who are working hard to build the viability of and the perception of manufactured housing.”

- Viability? During an affordable housing crisis?

- Perception? After MHI has been claiming for years that they have reached millions of Americans with their media outreaches? If so, then how can they explain the utter failure to move the needle upward in sales and production?

- When a peer-reviewed doctoral dissertation was written on the topic of community perceptions of manufactured housing being largely (and unfairly) negative, the irony of Birch’s choice of words should echo in the minds of all truth-seeking professionals. Note that Lisa Tyler, who wrote that dissertation is now a Ph.D. In Dr. Tyler’s acknowledgements, she specifically thanked this writer by name. While we promoted her research, MHI repeatedly ignored it.

- Additionally, it bears mention that neither Tyler, Cororaton, Carson or other research statements that might be useful to truly make manufactured homes better understood – or that might shed light on how badly the industry is underperforming – are not to be found on MHI’s own website. Doesn’t that lack of engagement on their own website speak more to the strategy that the Capital Research Center has periodically referred to in relation to dark money billionaire political manipulations as “deception and misdirection” – a contention that could be applied to manufactured housing?

- “But be advised, that silence is not an agreement to your allegations of any kind” – Birch to MHProNews in ‘defense’ of Tim Williams and MHI. Ironically, and not mentioned by Birch who clearly read the report, MHProNews specified in the original that under American constitutional law, silence is the right of every accused individual. However, when evidence-based allegations mount and silence is the reply, it leaves discerning minds to wonder why they won’t respond. Birch’s letter provides several clues. When MHI backers do speak or write in a way that can be unpacked, the case can be made that their obvious failures to perform during an affordable housing crisis – with shipments sliding instead of rising. MHI has stopped issuing their monthly economic reports some time ago. Were the trends and data too embarrassing, when they had to make tortured admissions like the one below?

It is nothing less than stunning that Birch would have said what she did. But therein lies the rub for those in the Berkshire-backed MHI amen corner. Because the last – one might say, the only – authentic debate over MHI and their big boy backed corporate masters performance ended problematically for them. Andy Gedo, a loyal MHI member made the effort. He finally tossed in the proverbial towel. But he only did so after making admissions that proved useful to the thesis of those who alleged that the market is being rigged to favor consolidators.

The status quo will logically not be changed without a serious effort to push for positive changes inside manufactured housing itself. Given that existing federal laws are not being properly enforced, the path ahead should be clear. Enforce good existing laws. Only through proper law enforcement can the free market solutions that HUD Code manufactured homes provide be able to escape the Buffett-Berkshire Moat’s deadly and arguably illegal as well as immoral constraints.

There are those who decline comment, for whatever reason. Some do not want to be in any news. Some shy away from controversy, for example. But as fellow Floridian and 45th President of the United States, Donald J. Trump has observed, controversy can be useful in focusing attention on important topics. Even negative publicity, billionaire businessman and media-maven-turned-President Trump observed, can be better than no publicity at all.

Thus, logically, when someone like OMHA’s Williams, more recently his colleague Birch, and others in MHI – who are not media shy and previously would reply promptly to our inquiries and requests for comments – their more recent desire to avoid responding to allegations of improprieties and/or failures should logically raise objective questions and concerns, while still being mindful of their constitutional rights.

Barring the unforeseen, there will be a special report tomorrow that home in on the latest on Berkshire, Birch, Williams, MHI, and the effort for accountability, transparency, and justice in the fight for the American Dream in manufactured housing. Stay tuned.

###

Note to regular readers. The Friday evening market data charts recaps are shown as normal this Saturday morning. But the left-right headlines are omitted today below. In our featured focus segment, are some related reports on various aspects connected to this topic.

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus –

Where Business, Politics and Investing Can Meet

That is not to say that some mainstream media have at times shined a useful spotlight on the issues that MHProNews and our MHLivingNews sister site have stressed. The list below are examples that span the left-center-right partisan divides.

- Kori Hale from CultureBanx writing in Forbes called out Buffett, Clayton Homes, and their lenders in April 2019 for racial bias and other problematic business practices.

- GuruFocus said “Warren Buffett Can’t Escape Unethical Strategic Moats,” their specific points are linked here.

- The Atlantic, without specifying how the monopolization was being accomplished, noted that the independent retailers in manufactured housing were being rapidly eliminated/consolidated, that report is linked here. That clearly impacts state associations, as well as MHI. Why have so many state executives not acted in a robust manner to defend their association membership’s independents?

- The Nation called it “The Dirty Secret Behind Warren Buffett’s Billions…” and specifies Clayton Homes among those using the strategic moat in ‘dirty’ ways.

- The Jacksonville Florida Times Union summarized the connection between the John Oliver viral hit video dubbed “Mobile Homes,” MHI, Clayton Homes, and their related lenders. That op-ed was first fact-checked by an editor, before it was published not only in the one newspaper it was submitted, but at least in 5 Florida newspapers.

- Seattle Times | The Mobile Home Trap– This includes items referenced by Ellison, Feir, and others.

- Robin Harding, “How Warren Buffett Broke American Capitalism.” Financial Times

Related, Recent, and ‘Read-Hot’ Reports

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

-

-

-

-

-

-

-

Spring 2021…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12the year of serving the industry as the runaway most-read trade media.

Sample Kudos over the years…

It is now 11+ years and counting…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.