“Tony, I applaud the decision by [HUD] Secretary [Marcia] Fudge. Now is not the time to weaken FHA’s capacity to handle the economic situation challenges facing its 30-year book of business. Also reducing the MIP during the strongest seller’s market in history would be a huge mistake, as it would immediately be capitalized into even higher home prices,” said Ed Pinto, J.D., Director of the American Enterprise Institute (AEI) Housing Center to MHProNews in a response to an emailed request for comment by MHProNews on the FHA program announcement on 3.30.2021.

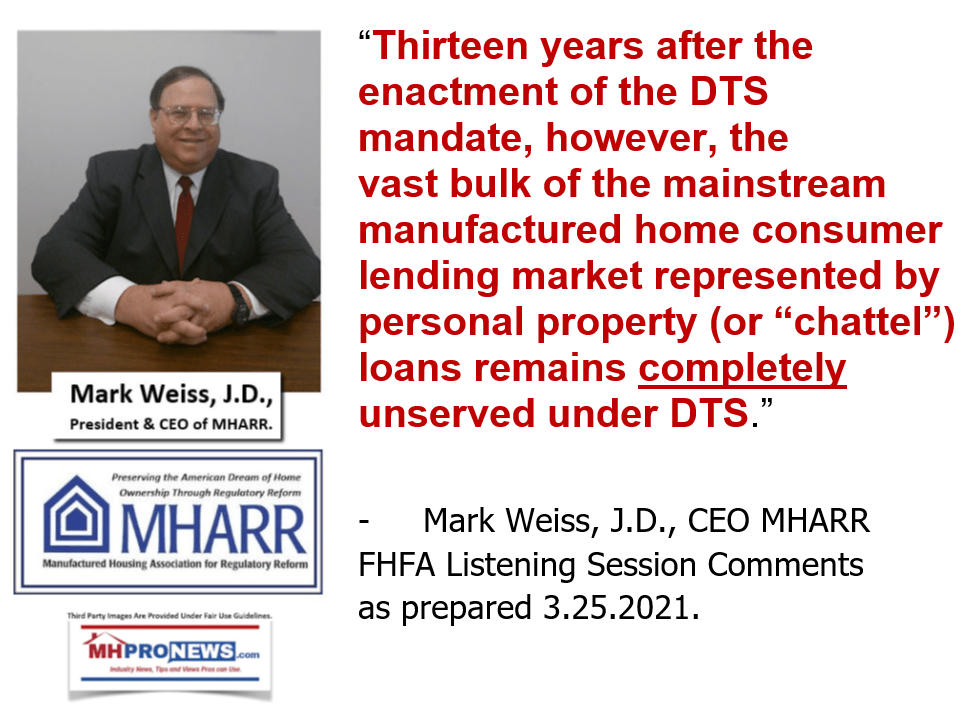

Mark Weiss, J.D., President and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR) went a different direction when asked to react to the HUD announcement which follows later below.

Weiss told MHProNews that “FHA support for manufactured housing continues to be almost non-existent due to Ginnie Mae’s baseless and arbitrary “10-10” rule. If the Biden Administration is truly interested in housing equity, it should seek the termination of that policy, which undermines the availability of inherently affordable manufactured homes for lower and moderate-income American families.”

The HUD press release to MHProNews is below, and will be followed by additional information, MHProNews Analysis, and Commentary.

Secretary Fudge Statement on the State of the FHA Mutual Mortgage Insurance Fund

WASHINGTON – Secretary Marcia L. Fudge on Tuesday released the following statement on the quarterly report to Congress on FHA Single-Family Mutual Mortgage Insurance Fund Programs:

HUD has an obligation to provide a quarterly report to Congress on the FHA insurance program and provide detailed information on the composition, credit quality, and financial position of the program. I am taking this opportunity to discuss the state of the FHA insurance program and the health of the Mutual Mortgage Insurance Fund a year after the COVID-19 health and economic fallout.

The health of FHA’s Mutual Mortgage Insurance Fund has remained resilient despite the financial challenges faced by homeowners with FHA-insured mortgages in 2020. The fund stands at more than $80 billion and remains well above the 2% minimum capital reserve required. Through the pandemic, the FHA portfolio has experienced increased levels of seriously delinquent loans and a heightened level of loans in forbearance. We continue to monitor mortgage performance trends within our portfolio, particularly related to those homeowners who are struggling financially because of the pandemic.

Tens of millions of families have been devastated by this pandemic, and housing has been a critical part of how we keep people safe. The FHA insurance program provides crucial access to credit and homeownership for first-time homebuyers, low-to-moderate income families, and households of color who have been historically underserved. We are committed to an equitable recovery and recognize the unprecedented moment and opportunity for HUD to lead the way.

In order to provide assistance to those struggling as a result of the pandemic, FHA took proactive policy steps in February to assist homeowners by extending foreclosure and eviction moratoria through June 30, streamlining COVID-19 loss mitigation options, and allowing longer forbearance for borrowers whose plans were expiring. We are already starting to see the positive effects of the President’s immediate actions during the first weeks of his Administration to help the nation’s homeowners, but we have much more work to do.

The American Rescue Plan recently signed into law by President Biden includes crucial and unprecedented resources for housing, including nearly $10 Billion Homeowner Assistance Fund, to help homeowners behind on their mortgage and utility payments and avoid foreclosure and eviction. The actions we are taking now will help position the FHA program to continue to fulfill its critical mission in the future.

Given the current FHA delinquency crisis and our duty to manage risks and the overall health of the fund, we have no near-term plans to change FHA’s mortgage insurance premium pricing. We will continue to rigorously evaluate our strategy and work transparently with Congress. Our number one priority is helping families keep their homes and remain safe as we work toward an equitable recovery.

##

HUD’s mission is to create strong, sustainable, inclusive communities and quality affordable homes for all.

###

Additional Information, MHProNews Analysis, and Commentary

AEI Housing Center’s Ed Pinto recently released a report focused on the large numbers of FHA loans that are delinquent or seriously delinquent. That report is linked below.

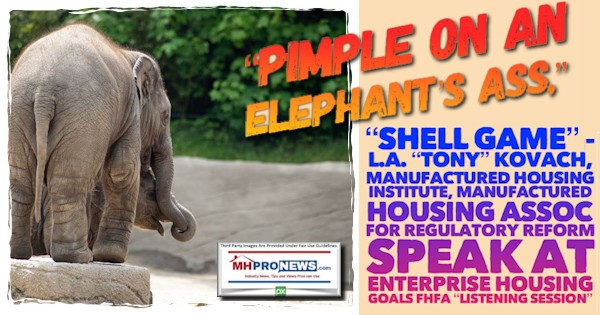

MHARR’s Mark Weiss recently addressed the FHFA “Listening Session” regarding the proposed Enterprise Housing Goals, which he sharply described as a “shell game” – a method employed by dishonest tricksters.

Weiss’ evidence-based thoughts and those of Lesli Gooch, CEO of the Manufactured Housing Institute (MHI) on the same topic are linked above.

L. A. “Tony” Kovach, speaking in his capacity as a manufactured home industry veteran and consultant, citing a range of third-party sources including Weiss, Gooch, and numerous others, made the hot-linked evidence-based case that FHFA and the GSEs were de-facto thwarting the law and their excuses for purported foot-dragging did not stand up to close scrutiny.

That commentary by Kovach caused a sharp reaction by FHFA staff. However, after a serious of formal protests by this writer, FHFA officials quickly reversed course the next morning. For those details, see the report linked below.

What is certain is that several key issues are hampering manufactured housing’s ability to meet the needs of potentially millions seeking affordable housing. Who says?

James A. Schmitz Jr., a Minneapolis Federal Reserve researcher, and 3 of his colleagues have made the argument that HUD – in alleged collusion with builders – has deliberately subverted manufactured housing by what they call “sabotage monopoly” practices. See the two reports linked above for their thoughts with MHProNews analysis.

Left-leaning Wikipedia defines an oligopoly in this fashion. “An oligopoly is a market form wherein a market or industry is dominated by a small group of large sellers. Oligopolies can result from various forms of collusion that reduce market competition which then leads to higher prices for consumers and lower wages for the employees of oligopolies.”

EconomicsHelp provides this useful infographic.

That tends to fit the fact pattern in what several researchers have called the “Iron Triangle.” The evidence-based case for the operation of the Iron Triangle in manufactured housing is outlined in some detail below.

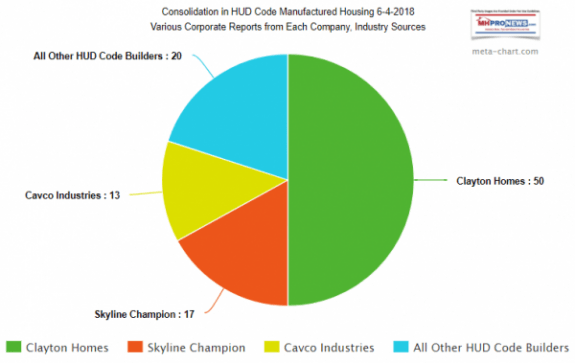

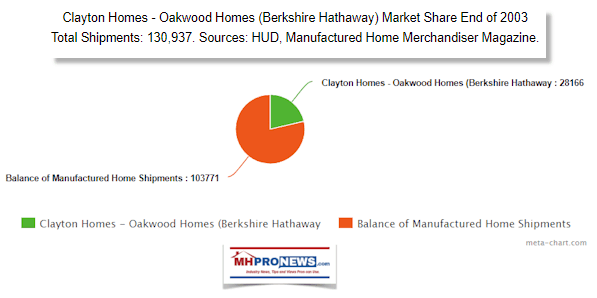

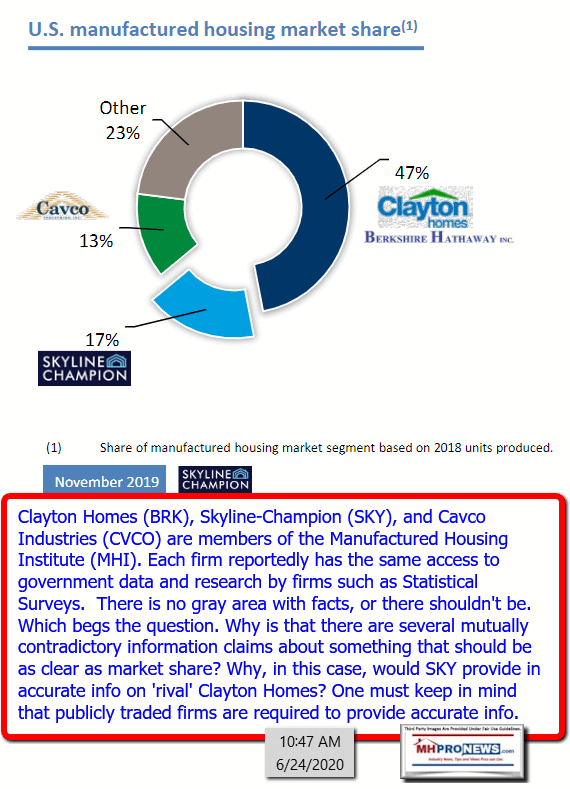

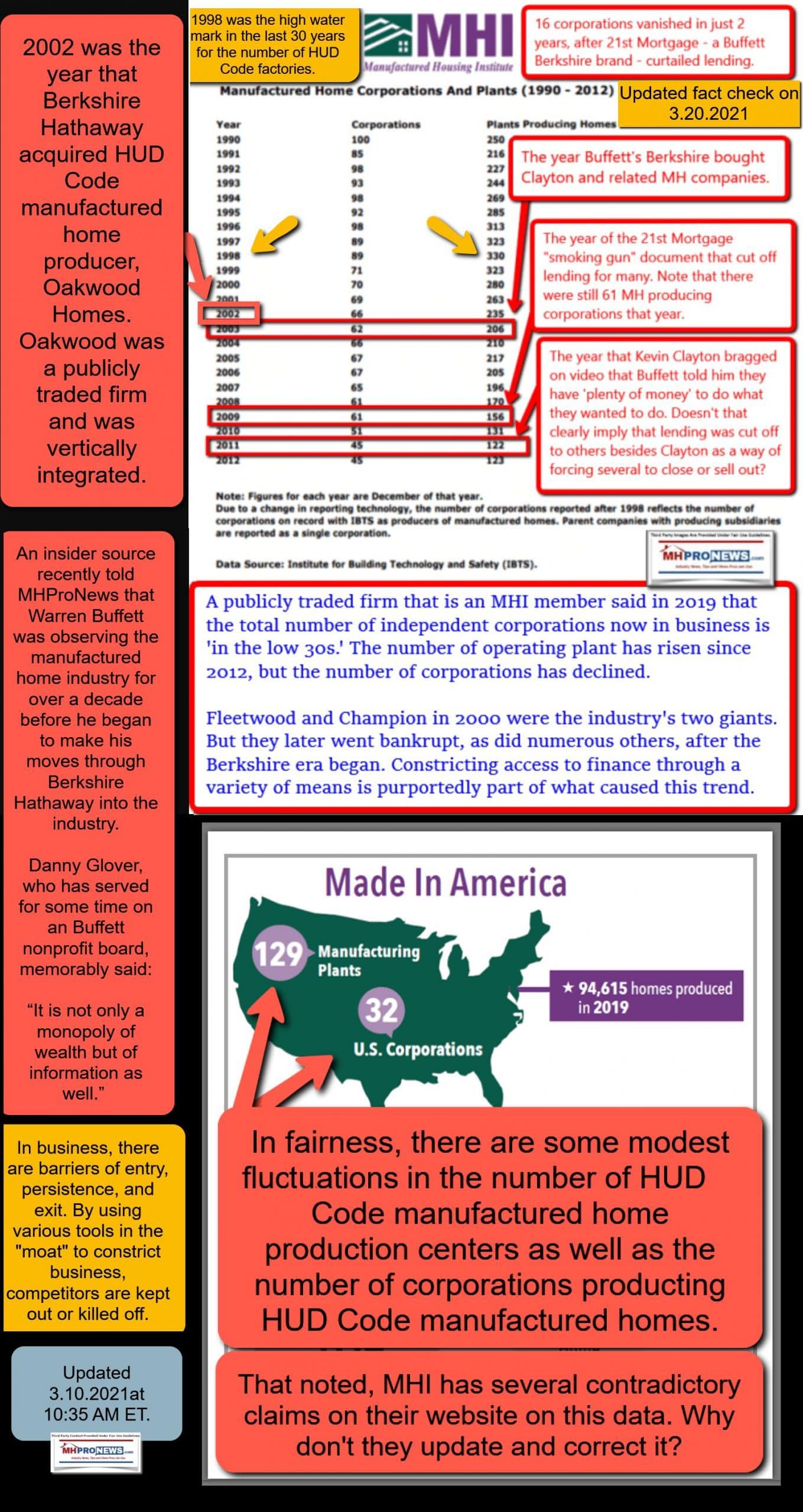

Note that EconomicsHelp oligopoly infographic says that is true for industries where 5 companies dominate some 50 percent or more of the marketplace. In HUD Code manufactured homes, as regular readers of MHProNews are likely to know, 3 firms – all MHI members – have some 80 percent of the total market share.

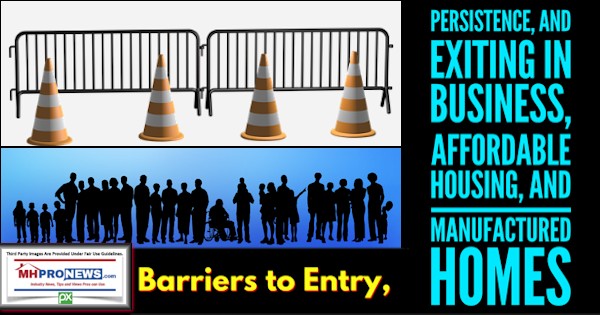

That same oligopoly infographic also notes that this structure tends to be a barrier for entry. While that can be true, it is also true that “barriers” act in three ways.

- Barriers for entry.

- Barriers for persistence.

- Barriers for exit.

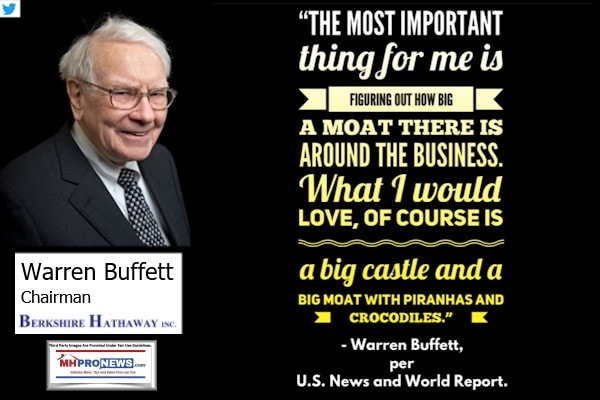

When market domination or manipulation is at play – and there are numbers who say that financing and capital access play a keen role in these “barriers” or “moat” processes – then the value of independently-owned businesses that are not part of the dominating oligopoly are also potentially undermined.

When sales are depressed, the possible entrants into a profession and/or a combination of existing companies that might buy a production center are limited. This limits the exit opportunities and thus the value of such an enterprise.

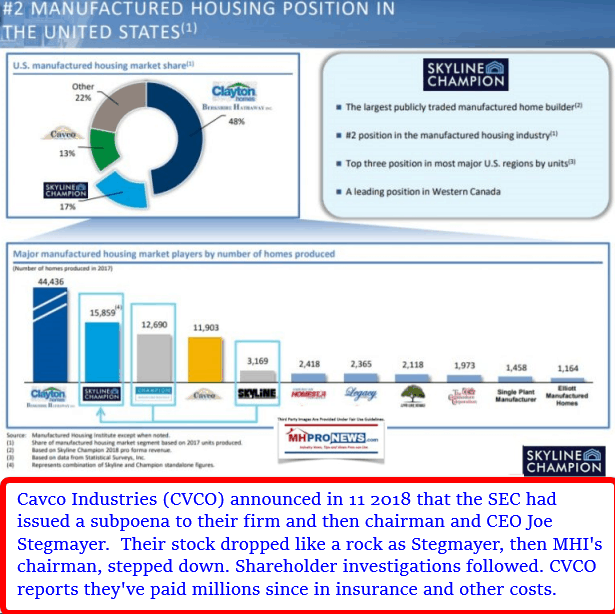

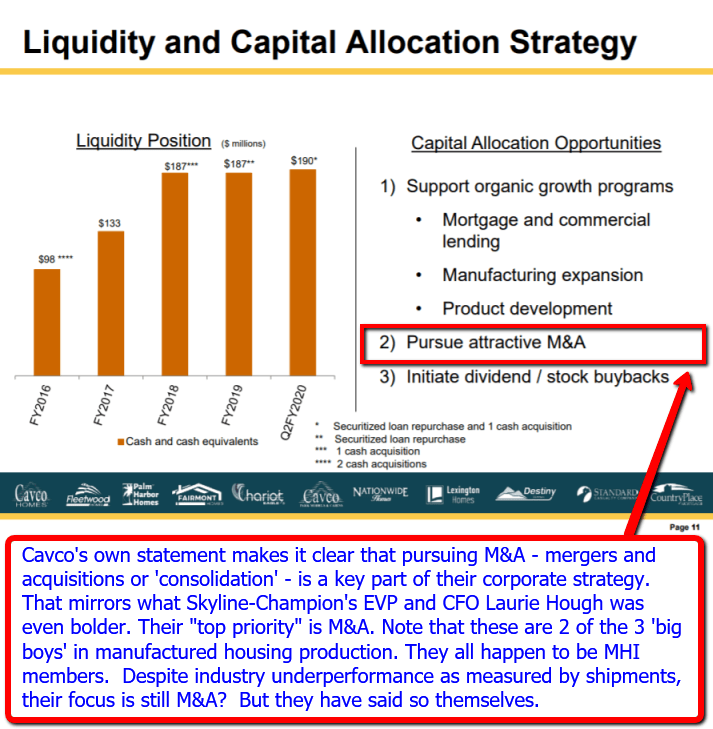

Another Take From An MHI Member Builder

That noted, an MHI member-producer has told MHProNews that the M&A or mergers and acquisition process that has been occurring in our profession – primarily among the ‘big three’ of MHI – in some ways – makes little sense. Why? Because, said that producer, it is usually less costly to build a new production center than it is to acquire one. While there are other factors to consider, such as the time to ramp up and build a retail or wholesale customer base, that producer has suggested that shareholders in publicly-traded firms who are witnessing more M&As than new production centers are not being well-served.

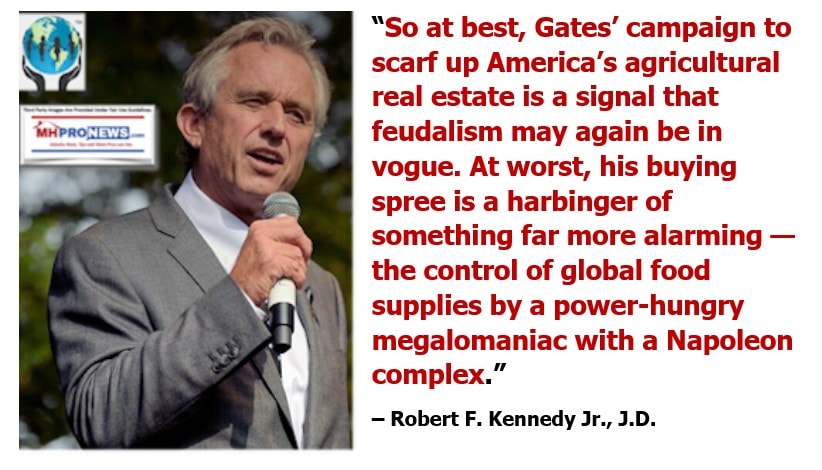

The quote below makes it clear that these concerns are not just hypothetical.

An M&A focus are SKY’s stated position. That raises legal issues illustrated herein.

Nevertheless, the trend toward consolidation of the industry through M&A continues. Much of it – though not all – has clear ties to MHI-member brands. Each of the examples above and below fit that description. It also happens to fit the description above of an oligopoly.

Financing and its sustainability are clearly important to the mainstream housing market as well as to the manufactured housing market. To MHARR CEO’s Weiss’ point that the FHA could – and should – eliminate that restraints of the 10/10 rule for Title I manufactured home loans makes sense. Similar principles would apply to that as apply to the Duty To Serve or DTS mandates: see that linked here.

Ironically, once more, the evidence-based case for the sustainability for prudent manufactured home lending already exists. See the video interview below, and listen to those lenders say it in their own words.

Additionally, there is the research report linked below.

MHI award-winner and industry finance expert Marty Lavin blew the whistle on what reflects a faux effort to provide ‘more lending’ to support more competitive and additional manufactured home sales.

But perhaps more revealing – and closer to the specific point that Weiss raised in the statement cited above – this writer sat in an MHI meeting while award-winning MHI member Dick Ernst explained to regulators years ago in a step-by-step, methodical fashion how those FHA Title I loans could be made in a safe and sustainable manner without the 10-10 rule.

FHA/Ginnie Mae 10-10 rule requires $10 million dollars and 10-percent reserves. That tends to push that lending capacity into a fairly limited number of potential sources, such a Berkshire Hathaway owned lenders. As was previously noted, Berkshire owned 21st Mortgage Corp – which serves independents – quietly stopped making FHA Title I loans. By contrast, Clayton Homes captive lender Vanderbilt Mortgage and Finance (VMF) still makes FHA Title I loans.

Put differently, there is ample evidence, and years of time that have elapsed, that reflects that a few consolidators using barriers or “castle and moat” methods are steadily consolidating the manufactured housing industry from within. Once more, the evidence comes from MHI member statements, like the ones below.

Despite the evidence, the same conversations are being had, time and again, and year after year. These discussions and formal comments occur with regulators like FHFA, FHFA or the so-called Government Sponsored Enterprises (GSEs or Enterprises) such as Fannie Mae, Freddie Mac, and Ginne Mae. Meanwhile, a few corporate interests are benefiting by consolidating the industry and the steady erosion of competitors. The evidence for that pattern of consolidation once more comes, ironically, from MHI. Yet, they deny that they are doing anything to foster this pattern or otherwise to violate antitrust laws.

Samuel Strommen’s seminal research for Knudson Law on manufactured housing referred to the pattern as “a Rube Goldberg Machine of Human Suffering.”

Wikipedia defines that as: “A Rube Goldberg machine, named after American cartoonist Rube Goldberg, is a chain reaction-type machine or contraption intentionally designed to perform a simple task in an indirect and overly complicated way. Usually, these machines consist of a series of simple unrelated devices; the action of each triggers the initiation of the next, eventually resulting in achieving a stated goal.”

Entirely apart from that description as used by Strommen was this description in 2020 by MHProNews.

All of this seems to confirm the broad description of sabotage monopolistic practices advanced by Federal Reserve researcher Schmitz and his colleagues. The status

What HUD/FHA will do regarding Weiss’ observation remains to be seen. But under the Obama-Biden administration, and under the Trump-Pence years, the 10-10 rule persisted. The outlook isn’t pretty, unless some new effort is launched that collaborates with MHARR and others of good will who truly want to see more affordable and sustainable home ownership made possible by access to better lending that Berkshire-owned brands offer, rather than just merely talking about it.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in-your-face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.