“These increases are unsustainable, but prices will keep rising in double digits for another six months to a year,” says Ed Pinto, director of the American Enterprise Institute (AEI) Housing Center and the former chief credit officer for Fannie Mae. “America is running out of inventory. Buyers can’t buy houses that aren’t for sale, so they’re bidding up the prices of the relatively few on the market. That means price increases will keep racing until more inventory comes on. And new supply will come on slowly.”

That pull quote is from the more detailed report that follows.

MHProNews has reported on the research by Edward Pinto and the American Enterprise Institute (AEI) Housing Center for some time, and has done so increasingly during the COVID19 economic recession. Director Pinto emailed the following to MHProNews, which will be followed by additional information, analysis and commentary from the manufactured home industry perspective. Because what follows is spells both opportunities and problems for our segment of the affordable housing industry.

AEI’s introduction speaks for itself.

The story below appeared in Fortune and is based on an extended interview I had with the reporter. To view the article on Fortune.com, please click here.

Housing flips the recession script: Prices will keep rising for up to a year, but here’s how the party will end

Housing prices have defied the COVID economy by rising at a startling clip. But a huge buildup in delinquencies foreshadows the flood to come.

October 04, 2020 10:00 AM EDT

The single most extraordinary feature of the COVID-19 economy isn’t the stock market’s record-setting spree. It’s the phenomenal, unforeseen boom in the most fundamental, economically sensitive area of all, the sector you’d think would rank among the hardest hit from the worst recession in decades: housing. According to a top industry expert, the current rampage in prices will keep running for months to come, even as the extraordinary sales sprint over the past few months slows to a more normal pace.

“These increases are unsustainable, but prices will keep rising in double digits for another six months to a year,” says Ed Pinto, director of the American Enterprise Institute (AEI) Housing Center and the former chief credit officer for Fannie Mae. “America is running out of inventory. Buyers can’t buy houses that aren’t for sale, so they’re bidding up the prices of the relatively few on the market. That means price increases will keep racing until more inventory comes on. And new supply will come on slowly.”

For Pinto, three factors are responsible for the dearth of homes for sale.

The first is the lag time required for homebuilders to bring on new supply, following the slowdown from March through May.

Second, baby boomers are staying put in their colonials and ranches as their kids return home, curbing the traditional flow from retirees’ putting their manses on the market.

The third restraint: widespread forbearance from banks and federal agencies that’s enabling super-stressed homeowners, who would otherwise be forced to sell, to hold on for now.

But Pinto predicts that when lenders end their grace periods, a wave of foreclosures will hit the market and push down prices in the lower tiers. The most vulnerable group, he warns, are low-income Americans––and especially minorities––who bought using FHA mortgages in the past couple of years. “We’re seeing a huge overhang of FHA delinquencies that haven’t yet translated into foreclosures,” says Pinto. “But in six to 12 months, we’ll see a flood of people lose their homes. That will be the main force causing a sharp correction in prices in the lower levels.”

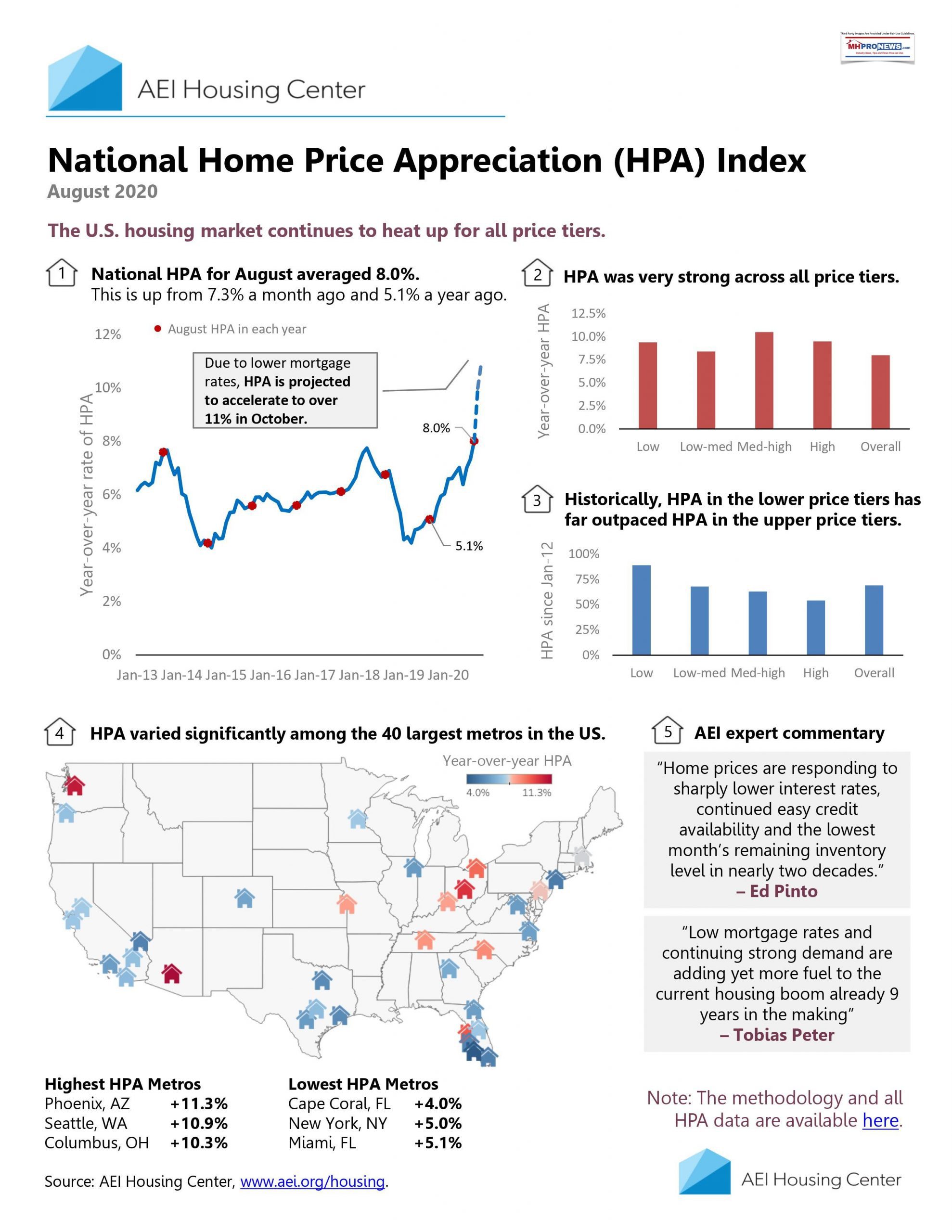

Prices are rising faster than pre-pandemic

In August, home prices nationwide rose 8%, according to a survey from the AEI Housing Center, beating the 5.1% year-over-year increase posted in 2019’s final summer month. Believe it or not, the trend is now speeding into double digits, where Pinto expects the rate of appreciation to remain: For the week ended Sept. 11, prices nationwide jumped 12.5%.

Of course, it’s the confluence of hordes of families shopping for homes and the lack of for-sale signs in America’s neighborhoods that are driving prices at that spectacular pace. Bargain home loans offering extra-low monthly payments are exerting a powerful pull on buyers. Since mid-2019, the rate on the 30-year mortgage has dropped steadily, from 4% to today’s 2.94%, an all-time low. Millennials are moving into their prime years for home ownership at an average age of 30 to 31. A relatively small proportion of young middle- and upper-middle-class couples on track to buy houses have lost their jobs. Now, the COVID-19 economy is motivating many young couples to move out of cities and do something they’d never even thought of––buy a home in the suburbs––or do it a lot sooner than they’d originally planned.

So far this year, signed contracts are running 27.5% above the level of 2019, according to AEI, which measures the volume of buyers who’ve just obtained loans, data that’s a proxy for pending sales. (Because they’re based on pending sales, the AEI numbers reflect closings that will happen in 30 to 60 days. Hence, they anticipate the widely reported monthly price data from final sales.)

That average 27.5% is depressed by the steep drop in March and April. From May through August, new contracts exceeded the 2019 count by over 50%. But since the start of September, the numbers are dropping again. “We’re seeing a decline in activity, although sales will remain above last year’s levels,” says Pinto.

The lever that’s now taking charge as demand recedes is the ongoing big shrink in inventory.

An inventory shortage

The severe inventory shortage plagues both the existing and new home markets. Each is facing special barriers that will continue to delay the jump in new listings that usually arises from a sustained period of strong price increases, when the prospect of pocketing big gains entices more and more owners to place properties on the market. Pinto notes that the inventory in the existing market that furnishes 90% of all sales is at an extraordinarily slender 3.0 months. That’s the time it would take at today’s strong pace of buying to sell all the homes on the market. Today’s three-month supply is down from an already tight four months in August of last year. “That’s a big move,” says Pinto. “Scarce inventory has been a problem for many years; it’s just gotten much worse recently.” A balanced market, he notes, has six months of inventory in existing homes.

“It has gotten so low because buyers robbed a couple of months from future inventory when very few homeowners were putting their houses up for sale, and hence adding to the supply,” says Pinto. “The big price increases did little to increase the number of houses for sale, so the inventory shrunk.” He notes that shoppers managed to find some relief by going door-to-door and asking owners who hadn’t listed their homes if they’d consider selling. “That shadow supply added a little to inventory, but not much,” he says. “Nor did many owners who were renting out their houses decide to put them on the market.”

The pattern is similar for new homes. In 2019, the inventory in the category most crucial to holding prices in check stood at around 5.7 months. This year, it has dwindled to just 3.4. The surge in sales started in June. By August, purchases of newly built homes jumped to 83,000 homes, from 57,000 the year before, an almost 50% increase. “That’s huge. We stole from the future in both existing and new home markets,” says Pinto. He adds that builders have some flexibility, since they can speed up construction in ready-to-go lots where all the roads and utilities were installed. But that safety valve didn’t release enough pressure to prevent inventories from dropping by one-third as sales rose rapidly.

Pinto points out that new supply can only come from three sources: lots of new building, a big increase in the ranks of baby boomers who put their homes on the market, or a surge in foreclosures.

The flow of new houses springing up in America’s subdivisions will be slow for some time. In that sector, America can be roughly divided into two domains: what we’ll call the “zoned world” and the “spacious Sunbelt.” The former are mainly Northeastern and Pacific Coast metros where local laws make it extremely time-consuming and expensive to obtain approvals for new construction. So when demand surges in times of strong income or population growth, buyers find few if any new homes to buy. Instead, they bid up the prices of existing houses. That gridlock leads to extremely expensive housing overall and huge price spikes in strong markets such as today’s.

Pinto notes that it takes around eight years for a builder to go from buying land to delivering houses in Los Angeles, and even in rural Riverside and San Bernardino counties, the process fills three years. “Look what’s happening in Connecticut,” he says. “It’s having a boom, and the cupboard for existing homes is now bare. It might take two or three years for any new construction to come on.”

So in the zoned world, new construction will play little part in curbing today’s soaring prices for the foreseeable future.

In the “spacious Sunbelt,” fresh supply will come on sooner, but relief is still far enough away that prices should keep galloping for months to come. “We’re seeing more building permits in three major Texas markets where [housing] stocks are also depleted: Houston, Dallas, and Austin. Metros in the Southeast such as Raleigh and Charlotte are also seeing more construction,” says Pinto. Even in North Carolina, he adds, it takes builders a year to buy a tract of land, get all the entitlements in place, add roads and sewers, then put up the homes. Pinto believes that new building should start curbing price increases in the most active cities such as Houston and Dallas within six to nine months, while it will take a year more in most Florida metros.

Seniors are downsizing at a far slower rate than in the past, further constraining supply. “We were predicting that baby boomers, like past generations at their age, would move into apartments, condos, or to their second homes en masse,” says Pinto. That isn’t happening. “A main reason they aren’t moving is that their adult children move back in and work from the home they grew up in,” says Pinto. The boomers not only enjoy having their nests full again, they also appreciate lounging in the backyard a lot more than before the pandemic, and are reluctant to sacrifice that newly prized outdoor space for the confines of an apartment. “That’s why we’re seeing so much remodeling, while little inventory is getting freed up,” says Pinto. “What’s the chance that folks who own a nice single-family home would want to move to more crowded housing—to a high-rise condo or retirement community?”

Looming foreclosures

Pinto predicts that the strongest impetus for new supply will come from foreclosures. They’ll also provide the principal force in taming prices. “It isn’t the older, repeat buyers who are in trouble,” he says. “It’s lower-income people who bought at high prices in the last one to three years and are heavily leveraged.” These are families typically earning between $40,000 and $70,000, who work in higher-end retail jobs, in construction, or in modestly paying positions in health care, and their unemployment rate in the pandemic far exceeds the national average of 8.4%. So far, those lost paychecks have brought relatively few foreclosures, since banks and government bodies that guaranteed the loans have been granting forbearance that, for now, enables folks to keep their homes even if they can’t make payments.

It’s unclear when lenders will end the abeyance awarded all of those delinquent mortgages. But the end of forbearance will break the logjam by forcing large numbers of stressed owners to either sell if they can obtain a price exceeding their loan balance, do a “short sale,” or surrender their homes to their banks, which will put the properties back on the market.

The huge buildup in delinquencies foreshadows the flood to come. Most endangered are borrowers that hold loans from the FHA, the agency that guarantees most of the mortgages for lower-income families, and typically allows for low downpayment and credit scores. Of the 7.98 million FHA loans outstanding in August, 1.39 million or 17% were delinquent, meaning more than 60 days past due, and 891,000 or two-thirds of those were classified as “seriously delinquent,” where borrowers typically hadn’t made payments in months, and the chances many of them will catch up look remote.

Overall FHA delinquencies have almost doubled in the past year, yet the foreclosures have barely budged because of the grace periods granted by the lenders. The most vulnerable metro is Atlanta, followed by Houston, Chicago, Washington, D.C., Dallas, and Riverside–San Bernardino. “It will take six to 12 months for the foreclosures to start arriving in large numbers,” says Pinto. “By that time, supply will also be getting a boost in the Sunbelt markets from new construction.” Housing is marching to a different drummer than most of the stricken U.S. economy. It will be the loss of homes by blue-collar Americans that changes the tune.

Edward J. Pinto

Director, AEI Housing Center

American Enterprise Institute

1789 Massachusetts Ave, NW

Washington, DC 20036

##

The graphic below is from a prior AEI Housing Center report.

Additional Information, MHProNews Analysis and Commentary

First, let’s note that some what Pinto said is similar to what the National Association of Realtor’s chief economist has said previously, as previously cited several times here on MHProNews. Rephrased, the economic side of Pinto’s thinking is on solid ground.

Next, let’s focus on two sections on Pinto’s analysis as reported by Fortune, with each of the following bullets reflecting a quote from above.

- The surge in sales started in June. By August, purchases of newly built homes jumped to 83,000 homes, from 57,000 the year before, an almost 50% increase. “That’s huge. We stole from the future in both existing and new home markets,” says Pinto.

- Pinto points out that new supply can only come from three sources: lots of new building, a big increase in the ranks of baby boomers who put their homes on the market, or a surge in foreclosures.

Compared to manufactured housing industry data, our industry is experiencing a shrinkage in sales during the timeframe that Pinto and other mainstream sources are reporting a surge in new and existing housing sales.

“More Punitive Regulatory” Regime Looms Warns New Manufactured Housing Industry Insider

Put differently, AEI’s Pinto and other research arguably once more belies the claims by cheerleaders of the Berkshire Hathaway dominated Manufactured Housing Institute (MHI), who routinely posture via photo and video opportunities about all that they are doing to “advance” the interests of “all segments” of the manufactured home industry. In reality, numerous reports and analysis reflect that the manufactured home industry is being artificially constrained, as Mark Weiss, President and CEO of the Manufactured Housing Association for Regulatory Reform put it recently.

Who benefits from these artificial limitations? In a word, ‘consolidators.’ Those who are laser focused on acquisitions obtained at an artificially low rate are not hiding their focus, the publicly traded firms say so openly, only they don’t make it sound sinister.

When asked by MHProNews to respond to these concerns, MHI leaders and their allies alike dodge discussion. What do they think they are hiding that the facts and trends aren’t making more visible day by day?

Pinto’s analysis may mean that another transfer of wealth is about to occur from those ho will lose their housing to foreclosure to the waiting arms of deep pockets investors who can obtain foreclosed housing at a discount.

Examples of purported wrongdoing by MHI members are being raised by public officials, or others in mainstream media, not just MHProNews. Which begs the question, where are the bloggers and other so-called pro-manufactured home industry trade publishers on issues that are harming the industry’s remaining independents and millions of current and would-be consumers? Doesn’t the failure of would be trade rivals to cover obvious issues explain MHProNews’ dominance in manufactured housing readership and engagement by readers?

It is a different cause than the 2008 housing/finance crisis. But it may yield some similar outcomes for the billionaire class. It may also yield similar harm to the minorities and lower income whites that are going to take it on the chin through a crisis that has arguably been ginned up and manipulated to the harm of the Disruptor in Chief of the elites, President Donald J. Trump and his supporters.

MHProNews has also been reporting on the looming impact of the Wuhan China Virus created recession and the looming wave of possible foreclosures and evictions.

To learn more, see the related reports linked above and below the byline, offers, and notices.

There is always more to know. Stay tuned with the runaway largest and documented number one most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Manufactured Housing Institute Warns Members – Pondering Legal Action, Insider Insights

“More Punitive Regulatory” Regime Looms Warns New Manufactured Housing Industry Insider

Frank Rolfe, MHU/RV Horizons Protest by MHAction; Nathan Smith/SSK/MHI Flashbacks?

Barriers to Entry, Persistence, and Exiting in Business, Affordable Housing, and Manufactured Homes