If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

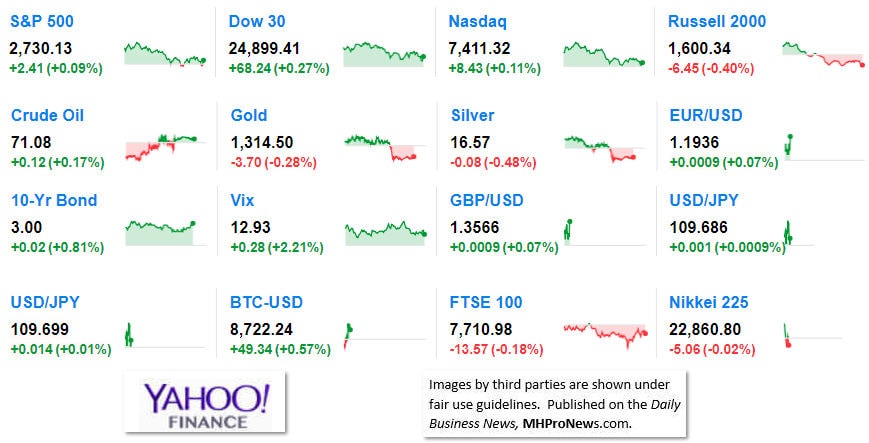

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

Selected headlines and bullets from CNN Money:

- Companies make last-ditch appeal to Trump: Tariffs are a bad idea

- Wilbur Ross: US exploring other remedies for ZTE ban

- 3 big things happening with US-China trade this week

- President Trump says he’s working with China to save ZTE

- If ZTE falls, the shock waves will be felt around the globe

- The danger of keyless cars: What you need to know

- Disney union can now represent the park’s Lyft drivers

- Trump tells his leaky staffers they are ‘traitors and cowards’

- States can legalize sports betting. That’s good news for casinos

- When can I legally bet on sports?

- American Airlines bans insects, hedgehogs and goats as emotional support animals

- Sears moves to sell Kenmore

- Siemens CEO: We can’t do new deals with Iran

- Sony is buying a stake in Snoopy

- Starting salary for the class of 2018: $50,390

- How to replace income with a bond ladder

- Young people are drawn to cryptocurrency. But what about the risks?

- Facebook suspends 200 apps over possible data misuse

- CBS sues Shari Redstone, its controlling shareholder

- NYT: More than 2 dozen people killed by carbon monoxide after leaving on their keyless cars

- Xerox pulls out of Fujifilm deal and teams up with Icahn

- Will the Royal Wedding boost the UK economy?

- Headset maker’s stock up 700% on ‘Fortnite’ mania

- ‘Fortnite’ is red hot, but EA and Activision are still thriving

- ‘Avengers: Infinity War’ hits China and becomes the fifth biggest film ever

- ‘Daily Show’ host Trevor Noah: There’s a ‘5:30 curse’

- ‘SNL’ cast members’ moms critique the show’s political sketches

Selected headlines and bullets from Fox Business:

- Seattle approves tax despite Amazon’s opposition

- Sports betting industry could fill state coffers

- Legal sports betting: NFL, NBA call for federal regulation

- Sports betting is ready to go national: DraftKings CEO

- Casino shares rally on court’s sports betting ruling

- Dow posts its eighth consecutive daily advance

- Sports betting ruling sets DraftKings and FanDuel up for cash windfall

- Both of the fantasy brands have the infrastructure needed to compete.

- AT&T, Novartis CEOs assailed by Elizabeth Warren, colleagues over Michael Cohen payments

- New Jersey racetrack expected to be first to take advantage of court ruling

- CBS strikes back, sues Redstone family to stop Viacom merger

- Cryptocurrency company looks for Ripple effect

- Maxine Waters playing race card: Alveda King

- Symantec mystery probe connected to public disclosures

- Karl Rove names main source of White House leaks

- FDA declares nationwide EpiPen shortage: Trump administration taking action

- Calpers chief investment officer leaving largest US public pension

Today’s markets and stocks, at the closing bell…

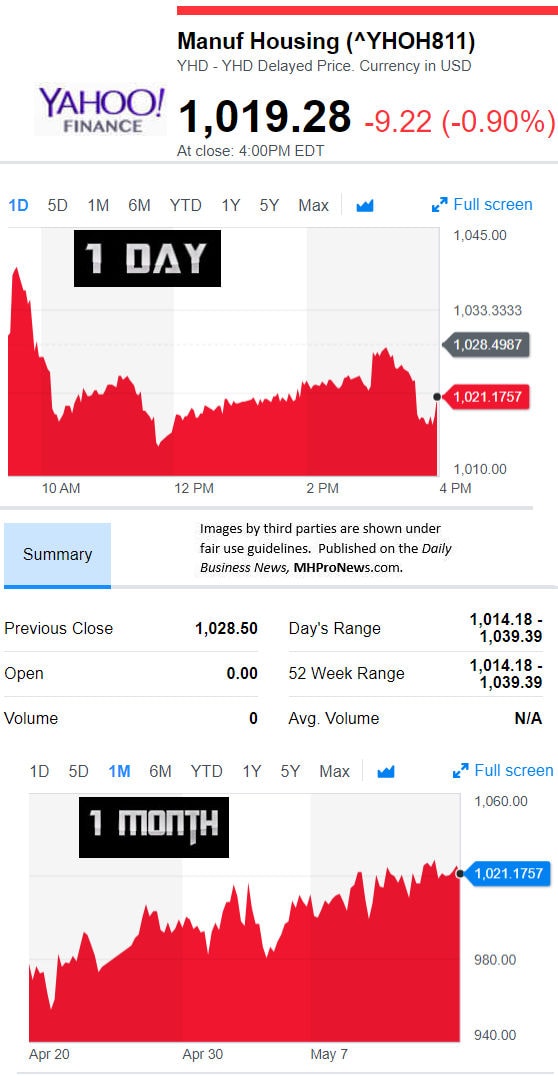

Manufactured Housing Composite Value (MHCV)

Today’s Big Movers

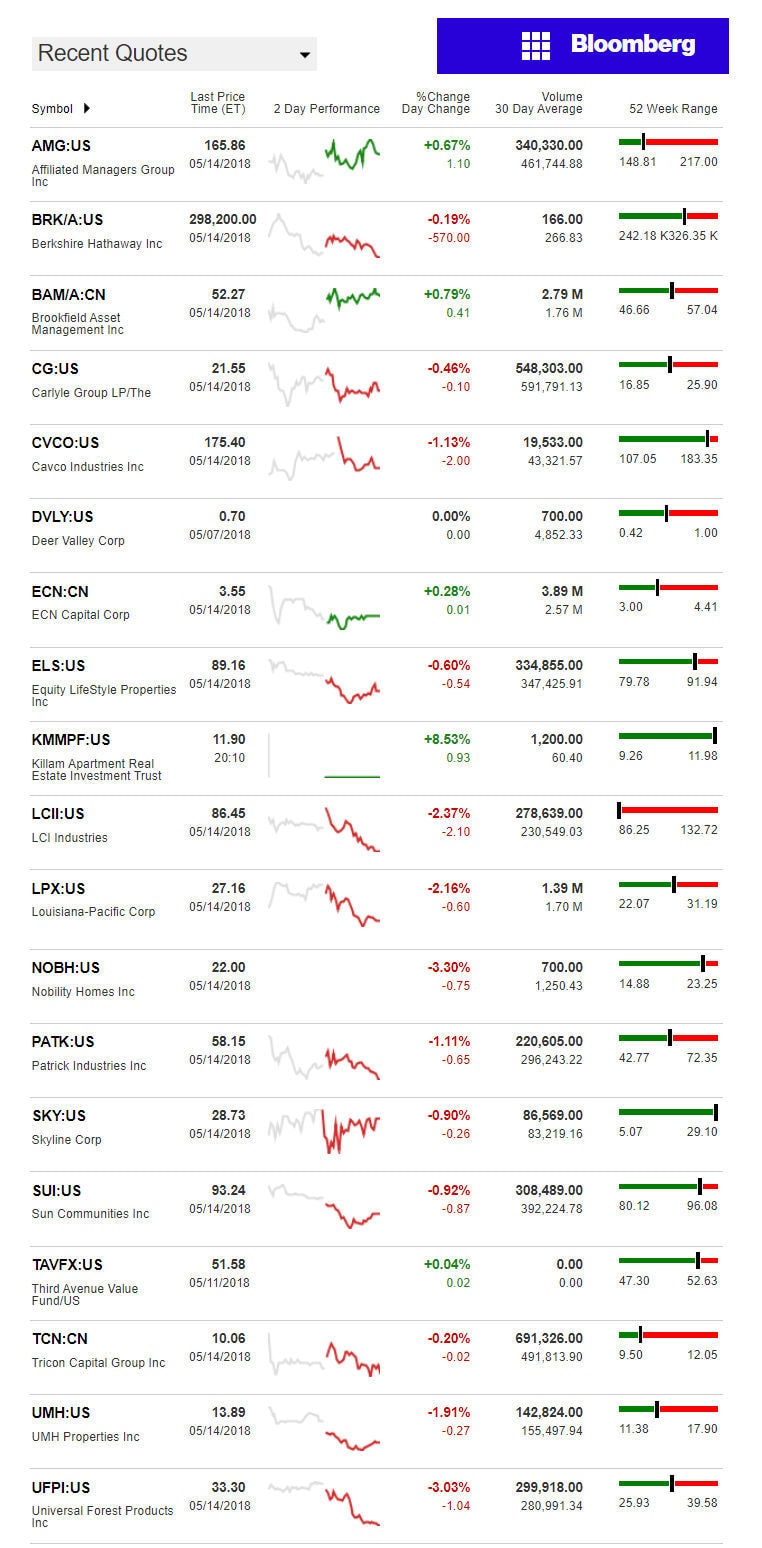

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

The numbers below are from MarketWatch, but the same data can be found from a variety of sources.

What’s going to be surprising-to-some is that the tax cuts that boosted federal revenues for Presidents Jack Kennedy (D) and Ronald Reagan (R), has provided another early reward to the Trump Administration too.

A federal surplus for the month.

Here are the facts.

The Numbers:

“The U.S. took in $510 billion in receipts in April and spent $296 billion, leaving the Treasury with a record monthly surplus of $214 billion. The prior record, set in April 2001, was about $190 billion,” per MarketWatch.

What Happened:

“Tax receipts poured in during April, when tax returns and certain taxpayers’ quarterly estimated payments are due. Individual receipts climbed by $66 billion over last April, something the Congressional Budget Office has attributed to stronger-than-expected income growth in 2017, as well as “larger-than-anticipated payments for economic activity in 2018.””

That surplus occurred even though spending rose in April. It rose 8%, due to higher payments on Social Security and interest on the public debt.

The projections are still for a deficit this year. But the norms of history suggest that continued economic growth will in time reduce that budget gap. With a combination of rising federal receipts, adding some fiscal discipline, and other plans advocated by the Trump Administration for economic growth continue to take hold, the outlook is hopeful.

Of course, any number of factors could provide wrinkles to the plan and time line. But the fact that receipts are up over last year, after a big tax cut should be a wakeup call for all of those who failed to understand the historic lessons being applied by the Trump tax cut team.

It goes without saying that a healthy economy is good for the nation, and the manufactured housing industry. The Daily Business News will continue to monitor this topic.

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, analysis and commentary.)

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)