On April 13, 2021, Tobias Peter of the American Enterprise Institute (AEI) Housing Center made the following statements to the U.S. Senate Committee on Banking, Housing, and Urban Development summarized by his nonprofit as presented by them below. His AEI colleague Howard Husock also provided relevant testimony. To set the stage for their troubling reports and the analysis of it, a few quick items merit mention. It is a fact that millions have become to some degree dependent on the federal government and/or other state/local government programs for housing or other daily needs. It is widely acknowledged by both major parties and decades of research that home ownership is a proven path to generational family wealth creation. It is also a fact the HUD Secretary Marcia Fudge, who has the potential to play a significant role over affordable housing and manufactured home policy in America, made troubling statements and admissions earlier this month. Additionally, as Peter’s and Husock’s respective testimonies reflects, virtually all Americans are impacted by federal policies on housing, financing, and how those policies drive housing costs and accessibility.

The evidence-based trends, looming risks, racial and other harms, and the consequences to our nation of current policies has been carefully presented by AEI’s Peter. Peter notes, for example, the opportunity to build eight million more homes, given modifications to federal policies.

8 million more affordable homes market potential. Other experts previously cited by MHProNews have said similarly. He Peter also says that what has been transpiring is “unsustainable.” Millions of more homes are needed, policy shifts must occur, or serious economic – and arguably social – trouble are looming. Yet, conventional housing building and resales are unable to keep up.

That sets the stage for both problems, but also opportunities in disguise.

While the AEI Housing Center summary does not mention manufactured homes specifically, there are nevertheless keen insights that AEI’s evidenced-based testimony reveals that absolutely matter to taxpayers, homeowners, renters, affordable housing seekers, professionals, advocates, investors, policy wonks, public officials, and others. Peter’s testimony can be viewed as a road map that our profession should be pointing to, thus the importance of this report and analysis.

The role that home ownership plays in creating household and generational wealth is explained by Peters. The problems caused by policies made worse by zoning, finance, and related issues are noted by AEI.

One potentially explosive fragment of a quote from Peter below is this: “…identify and prosecute bad actors…” adding that no new data collection to do that is necessary.

Among the blistering statements is the opening line from Peters.

The full AEI summary statement, including the download of the complete testimony, will be followed by additional related information, MHProNews analysis, and commentary. That second part of the report will lay out related facts, evidence, and reasons that should matter to affordable manufactured home advocates.

This afternoon [4.13.2021], Tobias Peter and Howard Husock testified before the U.S. Senate Committee on Banking, Housing, and Urban Development regarding how federal policies have impeded the creation of generational wealth for lower-income and minority households and, due their ongoing impact, there is a growing danger that housing is going to become even more separate and unequal.

Tobias’ testimony synthesized much of the Housing Center’s research into the following key takeaways:

Chairman Brown and Ranking Member Toomey, thank you for the opportunity to testify today.

Many of the housing problems we face today as a nation have occurred, not in spite of federal policies, but because of them. Two policies in particular have been major contributors to the separate and unequal housing legacy we find ourselves in today. Racial discrimination in residential zoning policies espoused by the federal government may be traced back to 1921 and foreclosure-prone affordable housing policies back to 1954. These two policies continue to contribute to disparate outcomes and put low-income and minority borrowers needlessly in harm’s way and severely limit their opportunities to build generational wealth.

- Zoning policies espoused by the federal government and widely adopted around the country have constrained the private sector’s ability to build adequate housing, thus fueling housing unaffordability.

- Starting in 1921, one-unit detached zoning policies became widespread through the actions of the federal government. Justified as actions “promoting health, safety, morals, or the general welfare”, they were in fact thinly veiled efforts to promote racial segregation of residential development.

- These policies have created an artificial supply shortage. We estimate without these policies an additional eight million homes would have and can still be built without subsidy by private enterprise.

- The supply shortage has resulted in higher home prices, higher rents, and greater levels of debt in order to become a homeowner.

- Worsening affordability has severely affected low-income households, especially Black ones, by severely restricting their opportunity to sustainably purchase a home.

- Foreclosure-prone affordable housing policies began in 1954, when Congress authorized FHA to use the 30-year loan.

- These policies have been primarily targeted at low-income and minority borrowers and have subsidized debt by providing excessive leverage and have not build wealth.

- Coupled with the supply shortage, the increased demand from additional leverage has fueled unsustainable lending and higher home prices.

- This is the paradox of affordable lending: When supply is constrained, credit easing will make entry-level homes less, not more, affordable.

- During the Financial Crisis, these policies contributed to 8.6 million of foreclosures and other forced dispositions, which were 1.5 higher in low-income and 2 times in minority neighborhoods than in high income and more white neighborhoods.

- Today, the nation finds itself in the midst of the second home price boom in less than a generation.

- The national seller’s market is now in its 101st month and levels of supply are at record lows. Home prices are rising in the 10-15% range compared to a year ago.

- Home price appreciation is being propelled by the Fed’s low interest policies and quantitative easing, the desire for more space as more people work from home, and a wide credit box, particularly at FHA.

- Across the states you represent, affordability has worsened, especially for low-income and minority households. You can trace just how bad affordability has become from key housing market indicators for your state provided in Appendix A.

- The COVID-19 pandemic has revealed the same fault lines that were present before the Financial Crisis, thus maintaining separate and unequal outcomes in the housing market.

- Delinquencies are still largely geographically concentrated in low-income and minority neighborhoods, where federal policies provide widespread access to default-prone leverage.

Most importantly these federal policies have impeded the creation of generational wealth for lower-income and minority households and have served to perpetuate the legacy of racial discrimination and socio-economic stratification in housing. Due to their ongoing impact, there is a growing danger that housing is going to become even more separate and unequal. This is not a viable path forward.

While there are unfortunately no quick fixes to correct the zoning and affordable housing policies that have over decades helped to create a separate and unequal housing market today, the following represent sensible policy solutions:

- First, as you are now considering new affordable housing proposals providing hundreds of billions of new funding, you must be wary of government programs that promise an easy fix. Many poorly designed housing assistance programs have had many unintended consequences, which have helped to make housing separate and unequal.

- Second, a sounder approach for the federal government’s involvement in single-family financing would be to focus on wealth building, not debt. Specifically, shorter term loans would sustainably build generational wealth for low-income and minority households through home ownership. To make these loans attractive, governmental assistance could be narrowly targeted to lower-income, first-generation homebuyers so that they can build wealth.

- Third, state and local governments can greatly expand supply by unleashing the private sector by restoring owners’ property rights taken away by federal policies dating back to the 1920s.

- Fourth, identify and prosecute bad actors that propagate racial discrimination using sound data analysis developed by the AEI Housing Center, while allowing others to defend themselves using the same approach. This test requires no new data collection and we stand ready to help HUD or the CFPB to implement it.

- And finally fifth, provide and support economically sound opportunities for income and wealth growth for lower income people.

##

In addition to Peter’s testimony, is this from Howard Husock, Adjunct Scholar, Domestic Policy Studies, American Enterprise Institute (AEI). Husock mentions Levittown, which was a post-World War II era prefab or factory-built housing development. The executive summary of Husock, per AEI, reads as follows.

April 13, 2021

“Separate and Unequal: The Legacy of Racial Discrimination in Housing” Full Committee Hearing, April 13, 2021, United States Senate Committee on Banking, Housing, and Urban Affairs

Chairman Brown, Ranking Member Toomey, and distinguished members of the Senate Committee on Banking, Housing, and Urban Affairs, my name is Howard Husock, and I am an adjunct scholar at the American Enterprise Institute, where I focus on local government, civil society, and urban housing policy. I am concurrently an executive senior fellow with the Philanthropy Roundtable. Before joining AEI, I was vice president for research and publications at the Manhattan Institute and director of case studies in public policy and management at the Harvard Kennedy School. I am the author of America’s Trillion-Dollar Housing Mistake: The Failure of American Housing Policy (Ivan R. Dee, 2003) and a forthcoming book, The Poor Side of Town—and Why We Need One.

It is an honor to submit my testimony for today’s hearing, titled “Separate and Unequal: The Legacy of Racial Discrimination in Housing,” alongside my colleague Tobias Peter and the other distinguished guests. It is a special honor to testify before the distinguished senator from Ohio, my own home state.

Historical Paradigm Shifts in Housing Policy

I will begin by briefly detailing the recent history of housing policy in the 20th century and the important paradigm shifts in housing policy as it affects racial discrimination. That the United States has been marked by an ugly history of race-related housing discrimination is beyond dispute. Private deed restrictions barred African Americans from buying or renting in the neighborhood of their choice, including such iconic American jurisdictions as Levittown, New York. Government policies reinforced and encouraged such bias, as exemplified by the infamous Federal Housing Administration redlining policies, which limited African American homebuyers’ neighborhood choices by limiting government mortgage insurance. As a result, the GI Bill helped build generational wealth for returning white World War II veterans while limiting that same opportunity for black Americans.

This tragic path led to the landmark Fair Housing Act of 1968 and its key guiding assumption: that racial prejudice should not preclude any American household from buying or renting a home they can afford. One can think of this as a watershed moment in which government reversed course from the negative discrimination of redlining and the acquiescence in deed restrictions, which were formally struck down by the courts in 1948 (but still socially enforced during much of the mid-20th century)…

##

· To view Tobias’ full testimony and supporting documentation, please click here.

· To view Husock’s testimony and supporting documentation, please click here.

Additional Information, MHProNews Analysis, and Commentary

First, it merits emphasis that the summary of Peter’s testimony above from the AEI Housing Center provided to MHProNews should become a routine reference for future reports by any sincere housing and financing policy advocate. It is a road map to the historic trends that placed us where our nation is today. Husock’s statements also make several useful points that manufactured home professionals who think long-term should become familiar with.

If problems can be an opportunity in disguise, then understanding the nature and genesis of problems that led to this current set of housing disparities can reveal how our profession can best present its case to officials and the broader public.

Spotting problems in advance can be useful and profitable.

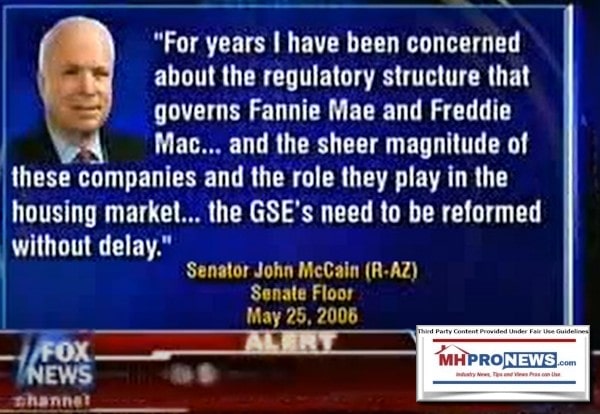

But the reverse of problem solving and problem avoidance are sadly also true. There are those who are literally invested in the problem instead of the solution. This is not new, as some of the pull-quotes and the video below reflect.

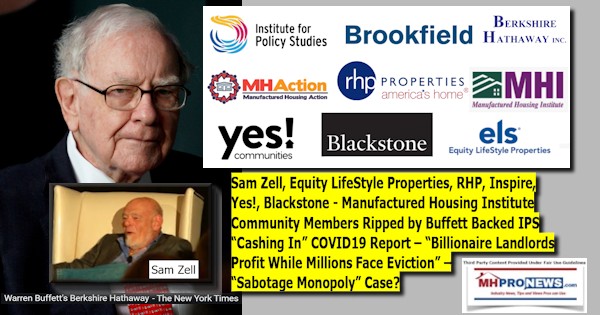

There are those who are sometimes referred to as disaster capitalists. What some may not realize is that they may see the disaster coming, may even participate in the fostering of a looming crisis, and then sit back and wait for the disaster to occur. Once the economic upheaval happens, those with deep pockets routinely reap large rewards.

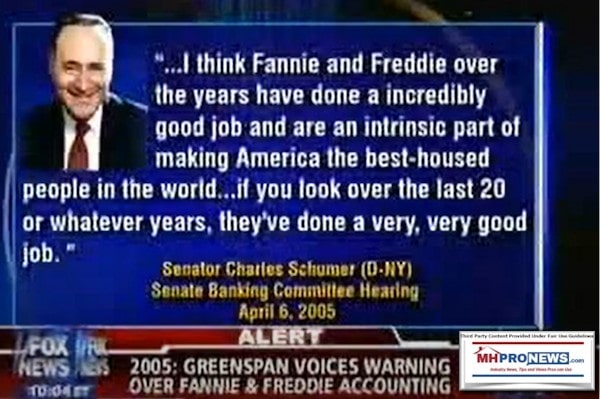

To illustrate that pattern that were exemplified by the 2008 housing/financial crisis is the video below. As long-term, detail minded readers of MHProNews may recall, parts of this video have been show previously. This version is a bit longer, but still under 4 minutes. It recalls expert warnings that began in 2001 and periodically occurred until the once avoidable crisis in fact occurred.

Lurking in the background of this issue reported above, but not mentioned by Fox, was the lobbying that fueled this looming tragedy that took millions out of homes, and harmed much of the population. But a few profited wildly, as the recent report linked below reflects.

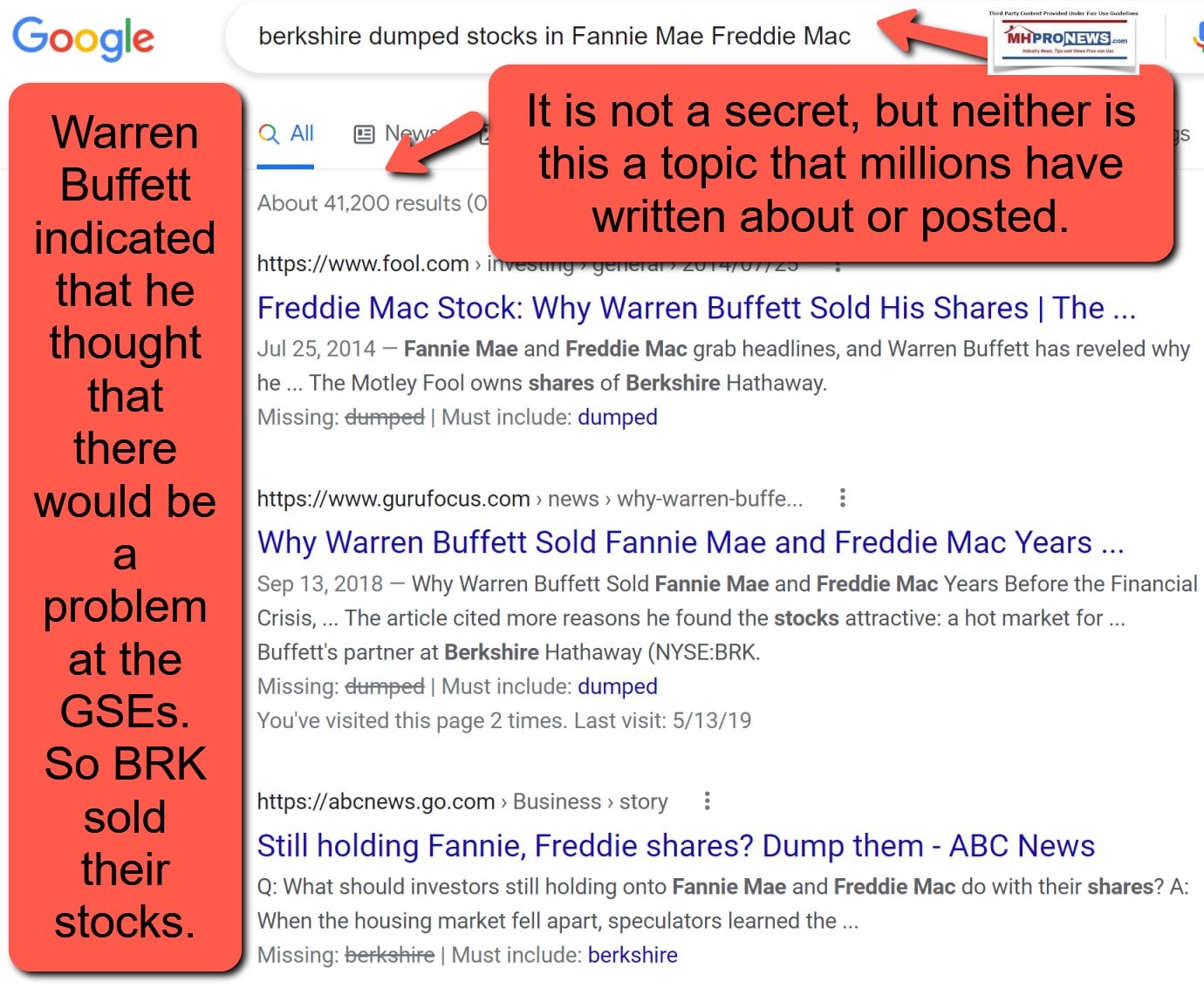

It must also be recalled that Warren Buffett led Berkshire Hathaway bailed out on their GSE investments well in advance of the 2008 crisis. Buffett and apparently others saw the problems coming. They were thinking and planning long-term. They waited and a massive transfer of wealth occurred as a result.

While AEI, for whatever reason, fails to go beyond a mention of Levittown, and that was not necessarily stated in the context of factory-based home building. That is not a slam, it simply is what it is.

But the Manufactured Housing Association for Regulatory Reform (MHARR) and MHProNews have made affordable housing, zoning and placement, and financing issues front-and-center topics for years. In the case of MHARR, they have made it part of their advocacy efforts for decades.

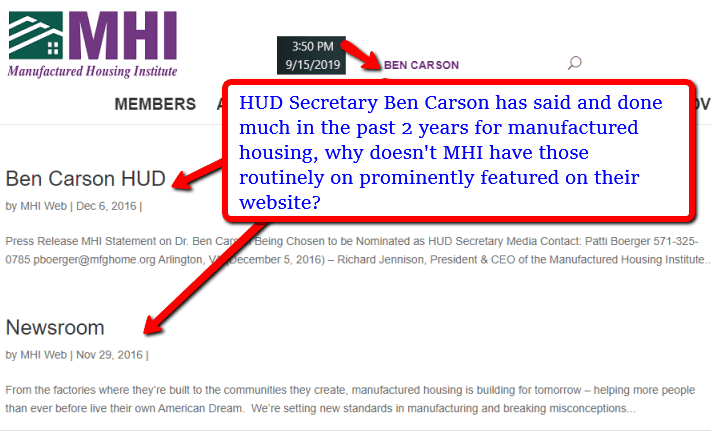

While the Manufactured Housing Institute (MHI) CEO Lesli Gooch recently promoted a racially framed argument – and did so reasonably well – it also begs the question. Where was that same argument by MHI one year, 5 years, or a decade ago?

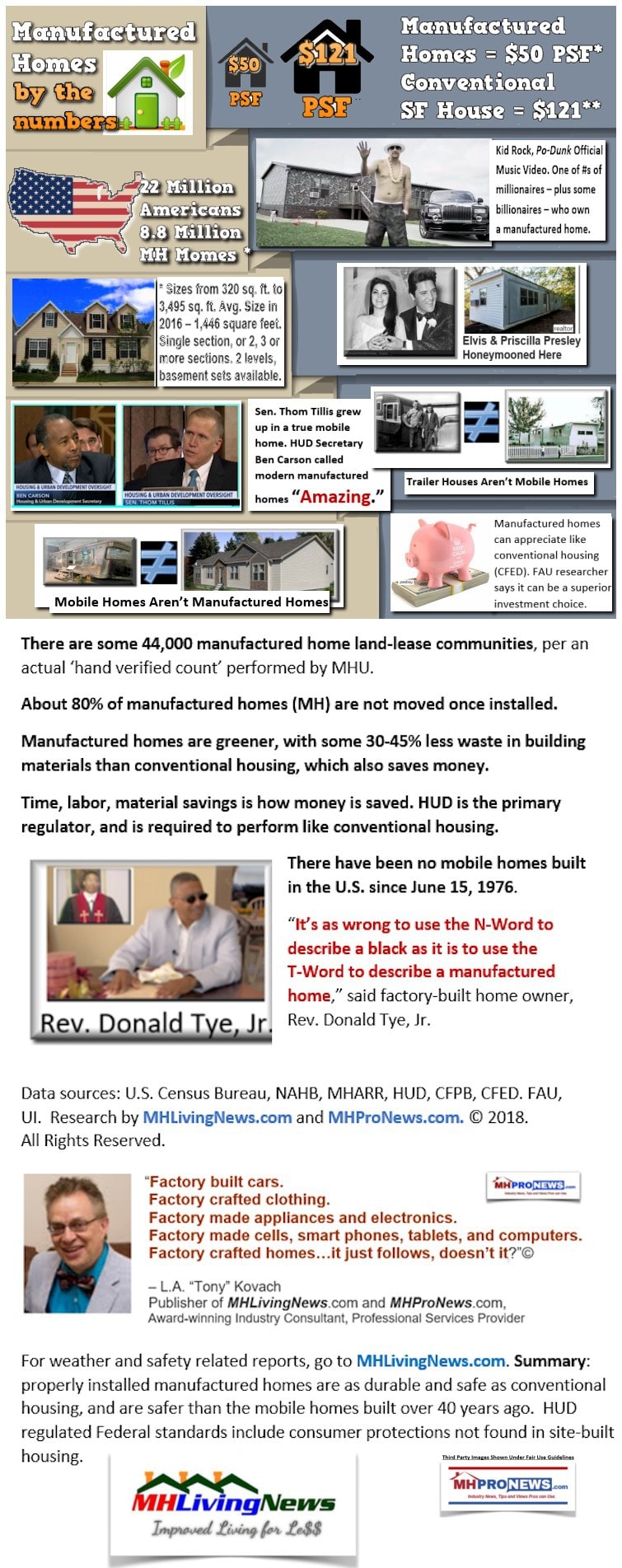

The nation, says AEI and others, is heading toward a new crisis. We are already in an affordable housing crisis. Some 8 million housing units are needed, says AEI. Roughly one plus million souls legally immigrate into the U.S. every year. More people are born than die. Then, there is a surge of illegal border crossers that has occurred since Joe Biden moved into the White House. Some estimate that 1.2 million will cross into the U.S. if that wave of migrants is not stemmed. These are just some of the looming elements of an affordable housing crisis that is about to get much worse.

Who says? HUD’s Marcia Fudge.

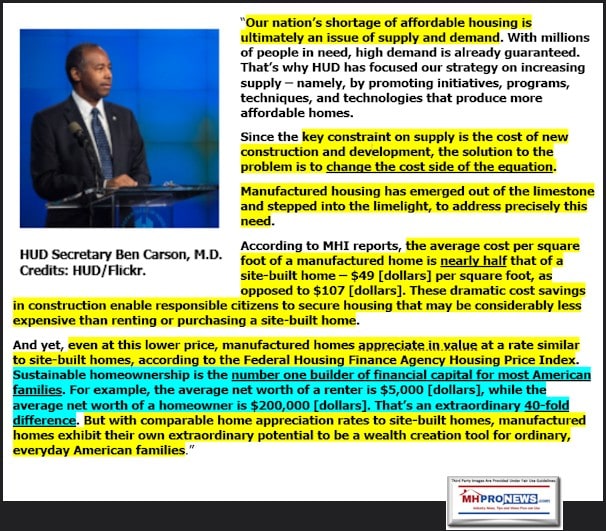

But Fudge in her comments cited above, for whatever reason, failed to mention the role that HUD Code manufactured homes could be playing in solving this affordable housing crisis. Perhaps she did not think it relevant in that context.

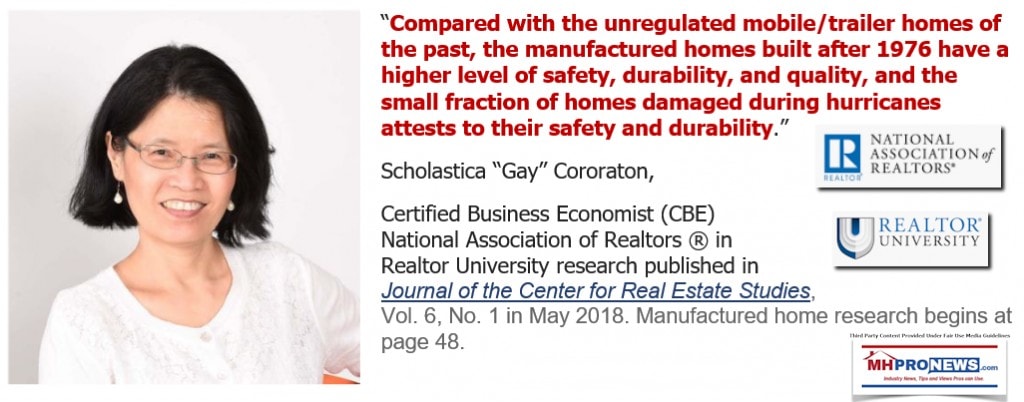

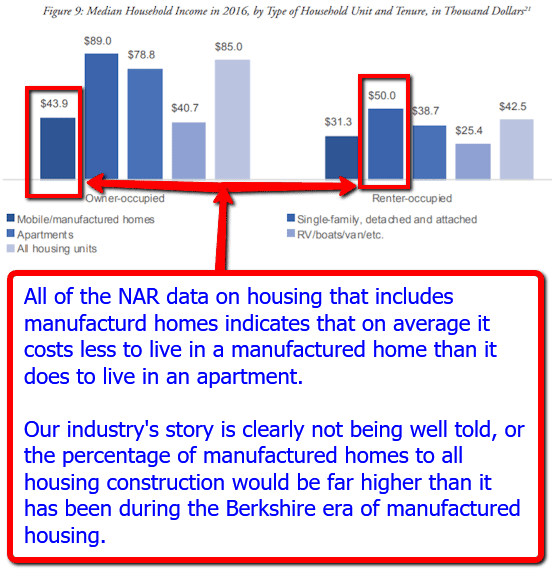

But by contrast, Minneapolis Federal Reserve researcher James A Schmitz Jr. and his fellow researchers have made the evidence-based argument that manufactured homes – which they thing are a common sense part of the American home landscape, one that could benefit millions – have been subverted by “sabotage monopoly” forces. They specifically mention HUD and builders as part of the mix of their admittedly developing, and thus incomplete, research. They have further argued that the housing crisis and homelessness exist in significant measure precisely because manufactured homes have not been sufficiently deployed.

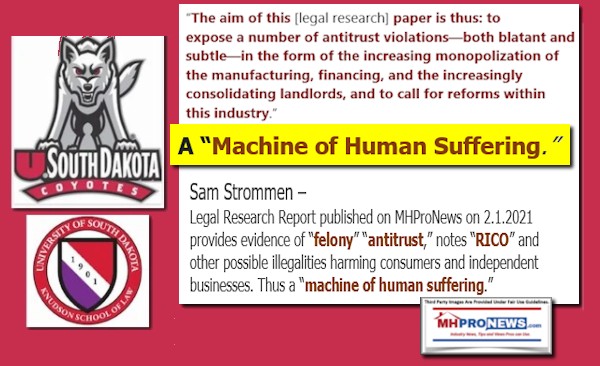

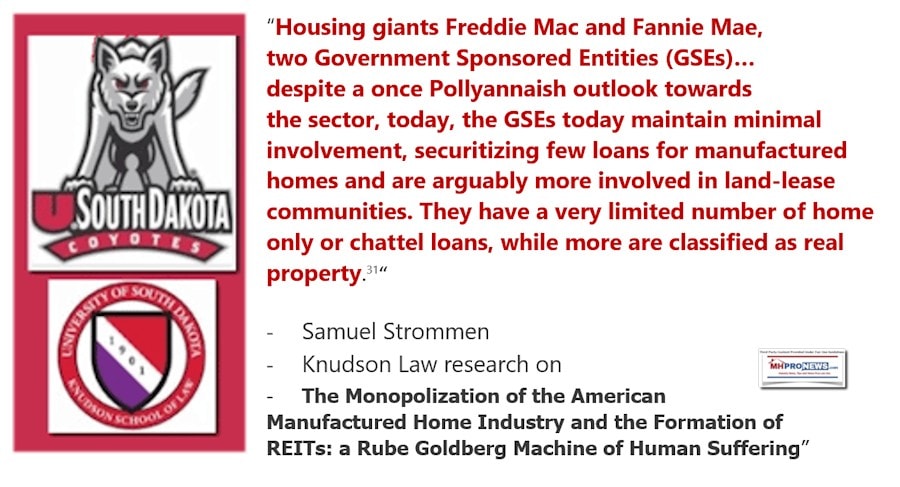

One of those researchers has expressed to MHProNews an interest in learning more after reading the Samuel Strommen Knudson Law report. Understandably so. This is relevant to Peter’s commentary, because Strommen specifically mentions vexing issues related to the GSEs.

The solution to the affordable housing crisis has been hiding in plain sight for years. Numerous university level researchers have come to similar and often glowing conclusions about the realities and potential for manufactured homes.

Such facts beg questions. For examples.

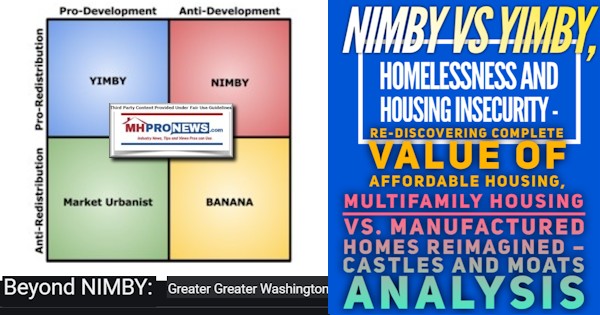

- Why are federal, state, and local policies often de facto thwarting what could be a solution that spreads generational wealth?

- Why are they instead supporting policies that are fueling the next housing/financing/capital crisis, if changes are not swiftly made?

After decades of a see-sawing economic and concurrent social upheavals, isn’t it time to step back, understand the dynamics, and stop the repeated insanity?

For those who mistakenly place an outside trust in the federal or other government behavior, aren’t the stark lessons of the late 20th and early 21st century sufficient to make clear that government is often at the root of the problem, as Peter’s opening statement suggested?

While there are more honest and less honest elected and appointed public officials, the fact that they are human is all that is necessary to know that they are subject to error, temptation, and corruption. This is part of the reason why the founders created checks and balances in government, so that government overreach would not threaten the people and good social order. Despite those Constitutional checks and balances, arguably because they and good existing laws have been ignored, twisted, and/or otherwise bypassed, significant harms have occurred for decades.

How that has been playing out in housing policies in general, and manufactured homes in particular, demands evidence-based legal action. As Peter’s suggested, there may be cause for legal actions. Quite so. Additionally, Peter said there already has been sufficient research. In housing policy in general, and manufactured homes too, once more, quite so.

The solutions are hiding in plain sight.

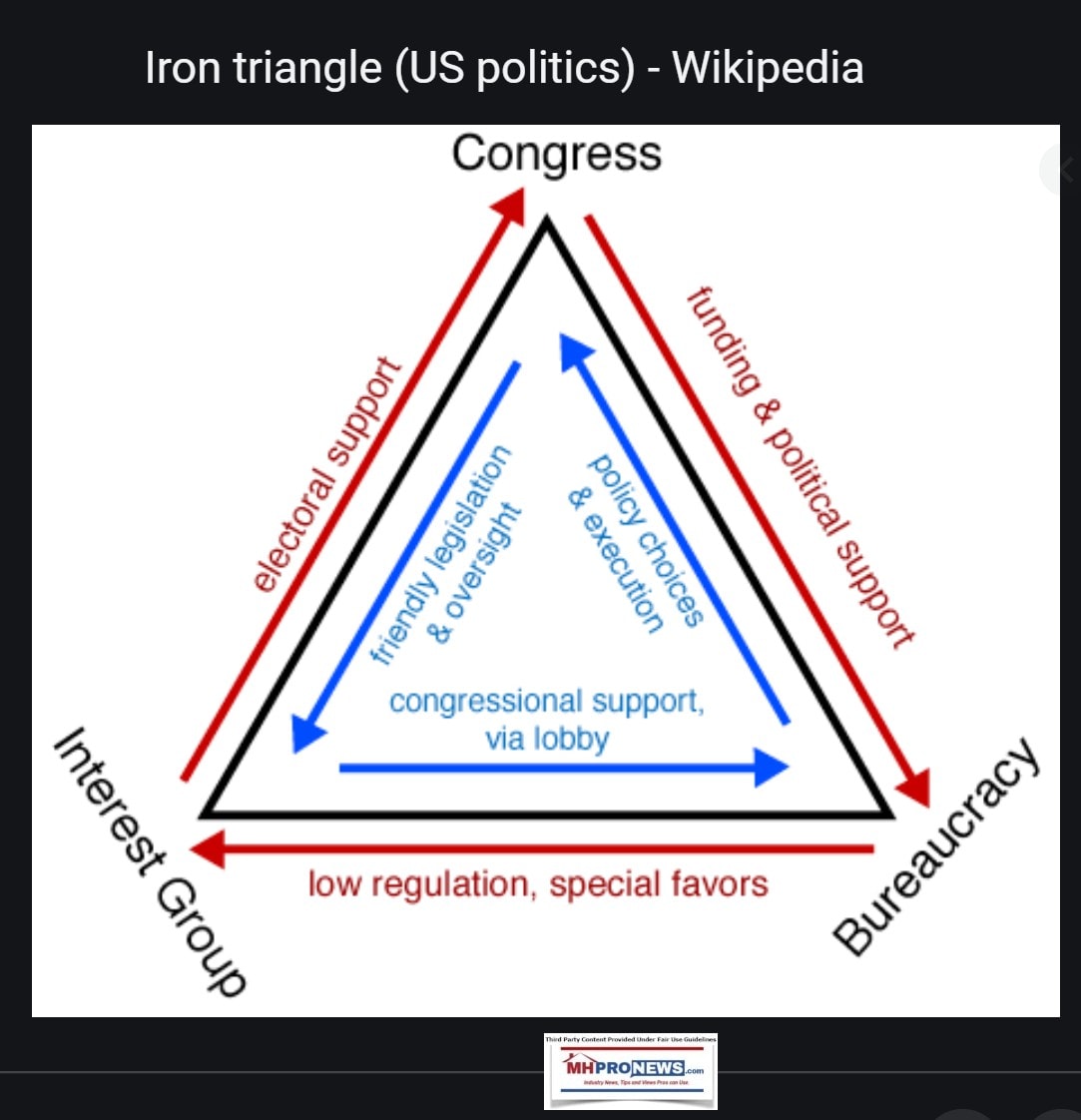

But prejudice, ignorance, and agenda-driven “Iron Triangle” and “sabotage monopoly” patterns that are lurking in the mix have for too long upended the white-hat independents in our profession. Those same circumstances have also proven harmful to the nation at large.

It is long past due that the much, but not all, of the so-called advocacy of our profession that comes from smiling but purportedly Judas-style paid betrayals with a kiss that should be carefully examined by trade groups, perhaps using third-party investigators, and the outcomes lawfully dealt with.

Turning a blind eye to such issues, for whatever motivation, has been costly.

It will continue to be so until the patterns of behavior that rewards the few at great cost to the many are ended.

To learn more about these issues, see the related reports linked from within and further below the byline and notices.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in-your-face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.