If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

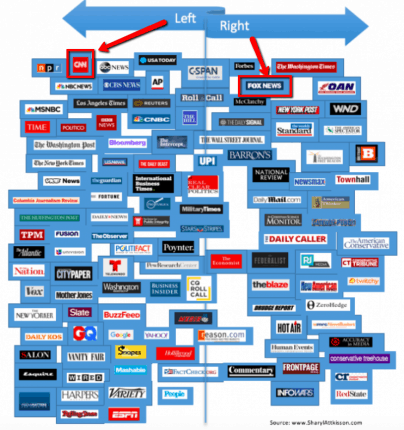

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

- Wall Street bets China trade war is almost over

- Dow soars 444 points, finishing its eighth weekly rally in a row with a bang

- Uber heads into its IPO after losing more than one billion dollars in 2018

- Jamie Dimon hated bitcoin. Now JPMorgan is pushing headfirst into the crypto space

- Ex-Goldman Sachs banker charged in 1MDB case will be sent to the United States

- Even GE’s Boston headquarters is shrinking

- Here’s another company suffering without Toys ‘R’ Us

- A sad toy story: Mattel plunges 20% on poor outlook

- Amazon invests money in electric pickups

- Pot company Canopy Growth posts nearly 300% sales jump

- Warren Buffett’s Berkshire Hathaway does a rapid U-turn on Oracle

- A company where everyone works from home. Here’s how to make it work

- Shopping Content by CNN Underscored

- How to use your pretax FSA dollars before March 15

- Uber says it lost $1.8 billion in 2018

- Amazon didn’t pay any federal income tax in 2017 or 2018. Here’s why

- When companies publish their salaries, women win

- America’s fight with Huawei is messing with the world’s 5G plans

- The iPhone is getting crushed in China. The US is partly to blame

- The US is stepping up pressure on Europe to ditch Huawei

- Huawei’s global advance is under threat

- Huawei’s smartphone sales soared 30% last year

- NO HQ2 IN NEW YORK

- Tech titan flames out in NY. Here’s why it matters

- Real estate brokers were banking on the ‘Amazon Effect.’ Their bubble just burst

- How Amazon blew its chance in New York

- These are the companies Amazon owns

- Amazon’s extraordinary evolution

Select Bullets from Fox Business…

- Dow notches 8th straight week of gains on trade optimism

- Mattel shares hit after investor day. What’s the problem?

- Trump weighs extending China tariff deadline by 60 days

- How Trump’s border wall will be funded

- Congress passes bill to avoid shutdown: Here’s what it includes

- Coke vs. Pepsi: Who is really winning?

- Amazon backs electric truck startup Rivian in $700M funding round

- Student-loan payment may soon come directly out of your paycheck

- Retail Apocalypse: These big retailers closing stores, filing for bankruptcy

- Sears vs. JCPenney: Who’s new plan will prevail?

- Colin Kaepernick wanted $20M AAF contract to play in league: Report

- Amazon’s NYC Exit

- Amazon doesn’t plan to reopen HQ2 search after backing out of NYC

- Amazon warns Philadelphia it could rethink brick-and-mortar store plans: Report

- Amazon paid no federal taxes for the second year in a row

- Dems must face embarrassment of their extremism: Varney

- Trish Regan: Socialism has robbed the Venezuelan people of their human rights

- America’s $22T debt problem: With a booming economy, now is the time to fix it

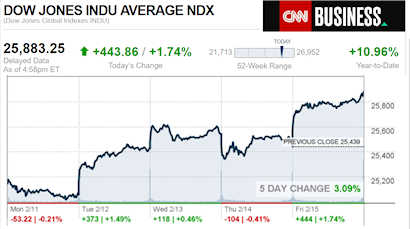

Today’s markets and stocks, at the closing bell…

Today’s Big Movers

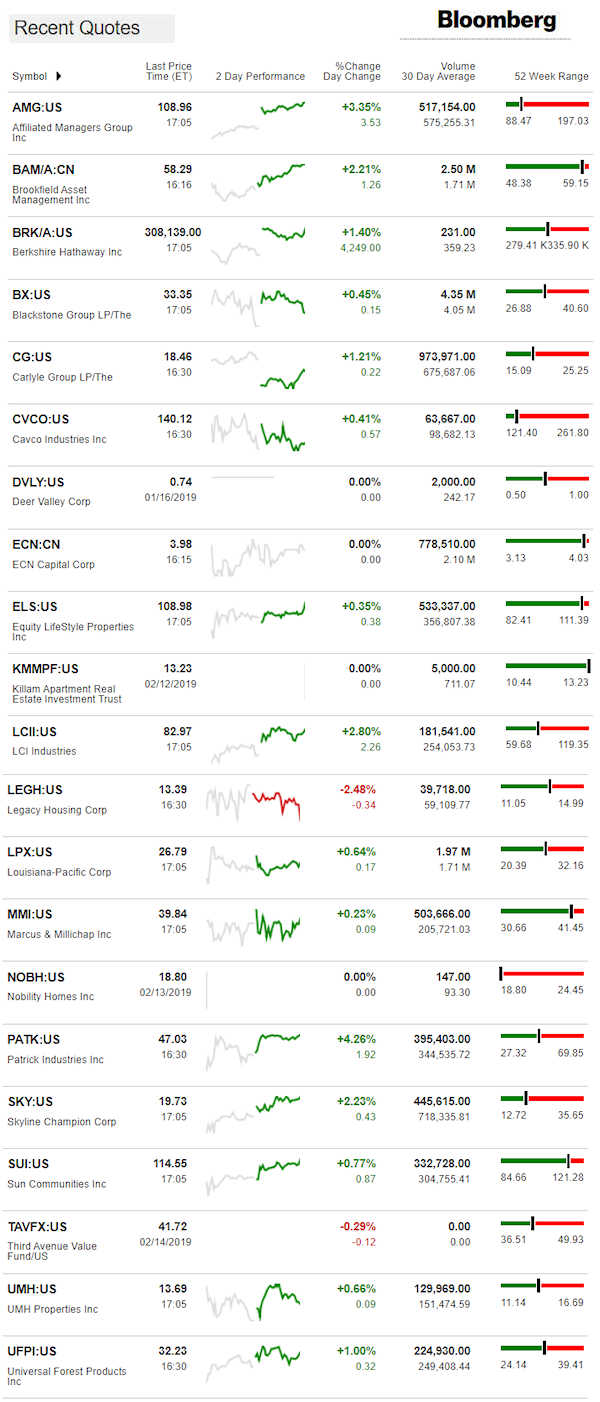

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

Following the victory of George H. W. Bush (GOP) and his “Compassionate Conservatism” and overseas adventures, there has been a steady rise in the federal debt. Candidate Senator Barack H. Obama (IL-D) blasted POTUS Bush’s debt, and once elected, proceeded to outspend his Oval Office predecessor.

The federal government doesn’t have a revenue problem. Despite political jargon, the 2017 Tax Cuts and Jobs Act did what happened under Democratic President John F. Kennedy, or Republican President Ronald Reagan. Taxes were cut, and revenues grew.

What’s going wrong is spending is not being controlled. Under our constitution, the president doesn’t have the power to control spending, that’s the Congress’ job. “No taxation without representation” – was a battle cry of the colonists in their revolt against England’s King. So the House and Senate are elected to spend, at least in theory, within constitutional limits.

The federal debt is an issue. Debt service is growing, and as interest rates rise, it will take a bigger bite out of the federal government’s spending.

POTUS Trump has told his cabinet to find savings in their respective departments. We’ll see where that goes, but at least it is being discussed.

It’s political theater to say that the issue is the fault of the President and the GOP, or only of Democrats. Both need to do at some level what occurred in the Clinton administration, a grand bargain that restores some common sense to federal spending.

That doesn’t seem likely during the next 2 years. Why? To learn more, see the Green New Deal reports, linked below.

Related Reports.

https://manufacturedhomepronews.com/masthead/grasping-true-value-of-the-green-new-deal-for-america-affordable-housing-professionals-and-advocates/

‘Updating All Buildings,’ Other AOC “Green New Deal” – Mixed Reviews Among Democrats, GOP Jeers

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.