Here’s what others say, on each side of the left-right media spectrum.

Some bullets from CNN Money:

- Marissa Mayer leaves Yahoo with nearly $260M.Sears Canada warns it is running out of cash.

Retail bloodbath: Bankruptcy filings pile up.

Behind the ‘Bachelor in Paradise’ troubles.

Mnuchin wants more power to oversee Wall Street banks.

Record number of Brits take German citizenship. - American reverses plan to cut an inch of legroom.

- Senate bars filming of senators in Capitol hallways.

- Goldman Sachs CEO falls for prankster.

- He had the American Dream, then lost it all.

Headline bullets from Fox Business:

- Uber CEO takes indefinite leave, top executives will run company.

- Tech recovery sends Wall St to records with Fed next.

- Oil edges down as OPEC sees market rebalancing at slower pace.

- Fed set to raise rates, focus turns to balance sheet and inflation outlook.

- Adam Carolla on ‘No Safe Spaces’: Hollywood blacklists over politics.

- Obama guilty of real Hillary Clinton obstruction, Fmr. US AG Mukasey says.

- Time Inc. to Eliminate About 300 Jobs, or 4% of Workforce.

- Serena Williams, Gwyneth Paltrow team up in new ‘superfood’ startup.

- The Trump bump in the economy will slow down: Bill Gross.

- Mnuchin’s Dodd-Frank reform advice fires up Sen. Warren, Dems.

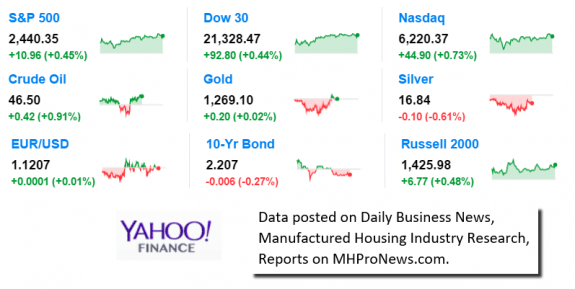

9 Key Market Indicators – at the closing bell.

S&P 500 2,440.35 +10.96 (+0.45%)

Dow 30 21,328.47 +92.80 (+0.44%)

Nasdaq 6,220.37 +44.90 (+0.73%)

Crude Oil 46.50 +0.42 (+0.91%)

Gold 1,269.10 +0.20 (+0.02%)

Silver 16.84 -0.10 (-0.61%)

EUR/USD 1.1209 +0.0003 (+0.03%)

10-Yr Bond 2.207 -0.006 (-0.27%)

Russell 2000 1,425.98 +6.77 (+0.48%)

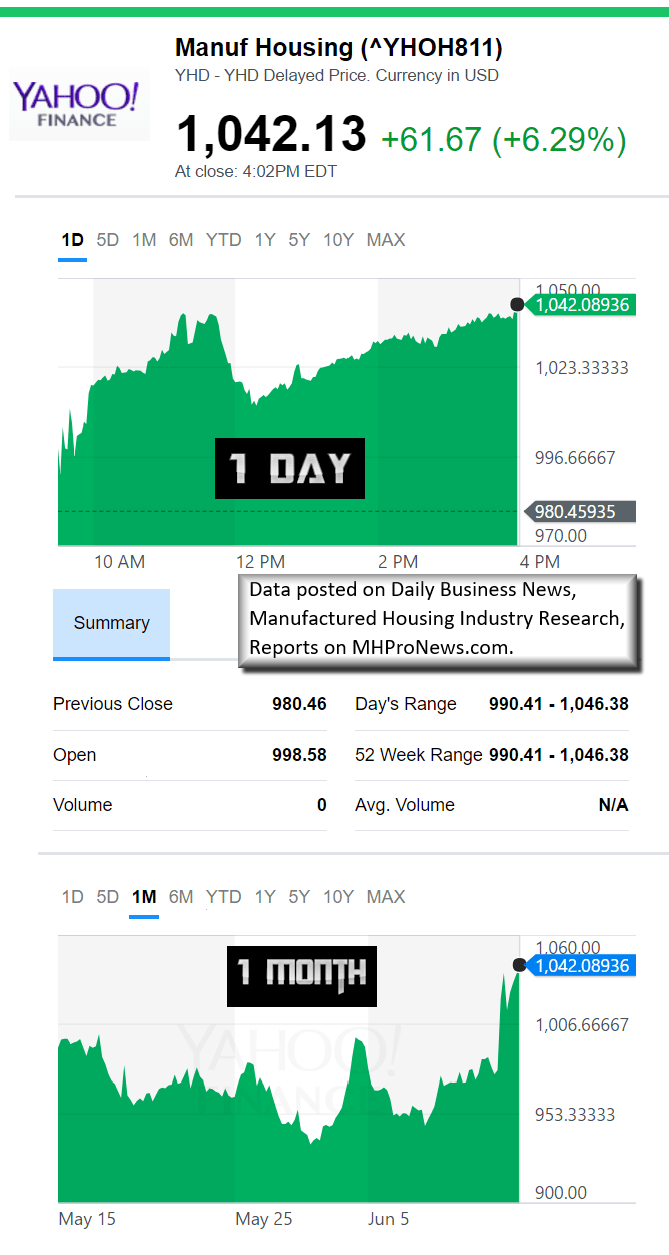

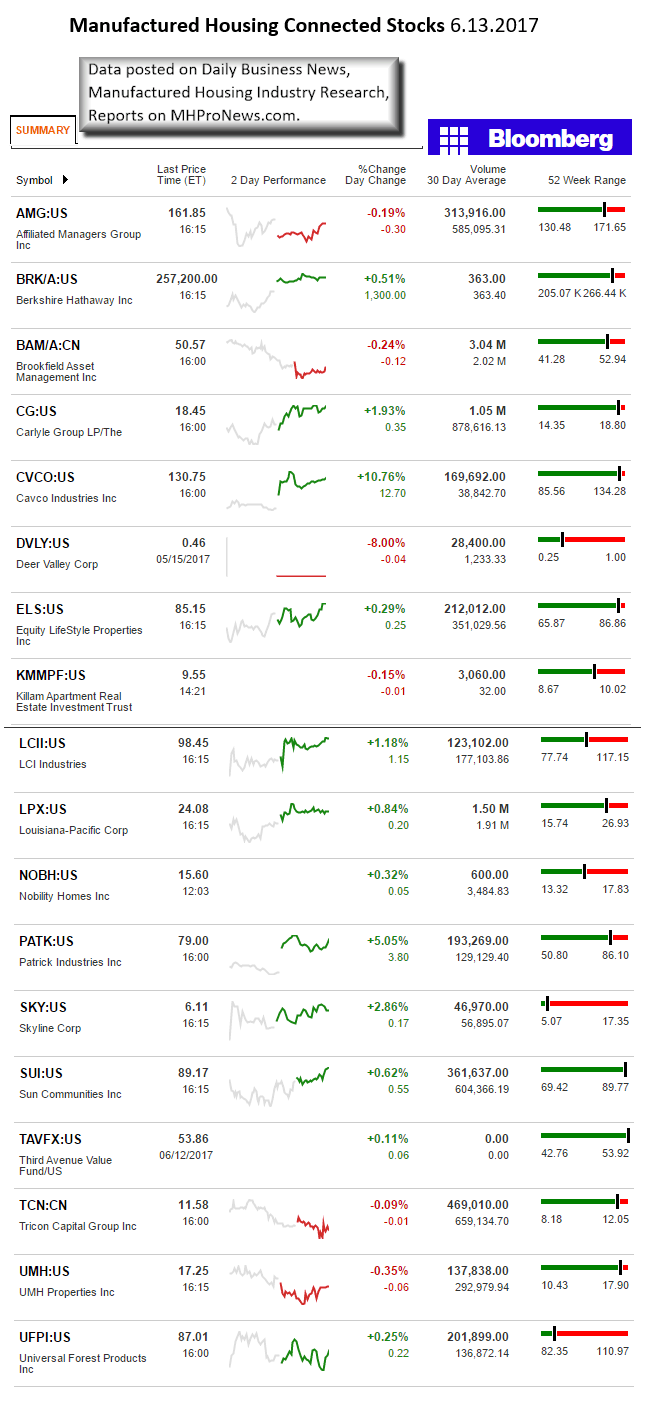

Manufactured Housing Connected Stocks 6.13.2017

Today’s Big Movers

Cavco and Patrick lead the gainers. UMH and BAM lead decliners.

Today’s MH Market Spotlight Report

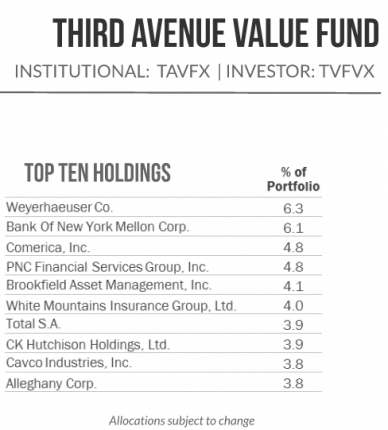

AMG holds a significant position in Third Ave, which we profiled recently, which in turn holds stock in manufactured home production operations.

AMG’s investor page says in part:

AMG has generated strong growth in earnings since its initial public offering in 1997, with compound annual growth in Economic earnings per share of approximately 14%. AMG’s growth is driven by:

- The investment performance and organic growth of its existing Affiliates

- Accretive investments in new and existing Affiliates, and

An efficient capital structure, with a focus on generating attractive returns for shareholders through effective capital management.

Wikipedia says, “Affiliated Managers Group Inc. is an American international investment management company headquartered in Massachusetts that owns stakes in a number of boutique asset management, hedge fund, and specialized private equity firms.”

In today’s mentions, SP Market News says:

“KBC Group NV decreased its stake in shares of Affiliated Managers Group, Inc. (NYSE:AMG) by 27.6% during the first quarter, according to its most recent Form 13F filing with the SEC. The fund owned 6,928 shares of the asset manager’s stock after selling 2,640 shares during the period. KBC Group NV’s holdings in Affiliated Managers Group were worth $1,136,000 as of its most recent filing with the SEC.

A number of other institutional investors have also recently added to or reduced their stakes in the stock.

BP PLC bought a new stake in Affiliated Managers Group during the fourth quarter valued at about $1,017,000.

ING Groep NV raised its stake in Affiliated Managers Group by 57.1% in the fourth quarter. ING Groep NV now owns 3,150 shares of the asset manager’s stock valued at $453,000 after buying an additional 1,145 shares during the last quarter.

Bessemer Group Inc. bought a new stake in Affiliated Managers Group during the fourth quarter valued at about $721,000.

State Board of Administration of Florida Retirement System raised its stake in Affiliated Managers Group by 3.2% in the fourth quarter. State Board of Administration of Florida Retirement System now owns 71,756 shares of the asset manager’s stock valued at $10,426,000 after buying an additional 2,252 shares during the last quarter.

Finally, Comerica Bank raised its stake in Affiliated Managers Group by 0.5% in the fourth quarter. Comerica Bank now owns 13,289 shares of the asset manager’s stock valued at $1,908,000 after buying an additional 63 shares during the last quarter. Institutional investors and hedge funds own 95.89% of the company’s stock.”

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)