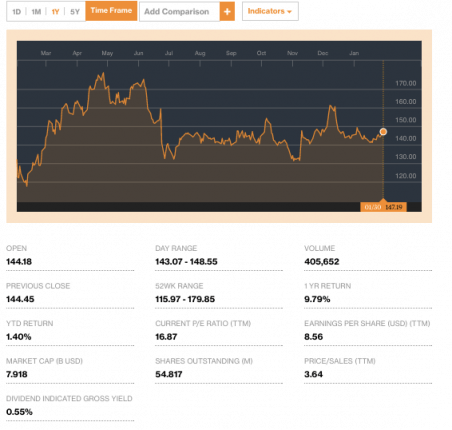

Affiliated Managers Group, Inc. (NYSE: AMG) reported its results for the fourth quarter and full year 2016 today.

For the fourth quarter of 2016, diluted earnings per share (EPS) were $2.67, compared to $2.67 for the same period of 2015; net income was $150.2 million, compared to $147.5 million for the same period of 2015.

Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) were $289.7 million, compared to $263.1 million for the same period of 2015, and fourth quarter revenue was $550.3 million, compared to $589.8 million for the same period of 2015.

For the year ended December 31, 2016, diluted earnings per share were $8.57, compared to $9.17 for 2015. Economic earnings per share were $12.84, compared to $12.47 for 2015, and net income was $472.8 million, compared to $509.5 million for 2015.

Net client cash flows for the fourth quarter of 2016 were $4.1 billion, and for the full year were $7.4 billion.

“AMG generated strong results for the fourth quarter and the full year 2016, including Economic earnings per share of $3.80 for the fourth quarter and $12.84 for the full year, both at record levels and representing earnings growth of 6% and 3% for each period, respectively,” stated Sean M. Healey, Chairman and CEO.

“Against the backdrop of earnings declines across the asset management industry broadly, we continued to produce growth in our earnings, even with only a partial impact from investments closed during the second half of the year. With assets under management increasing 16% year-over-year to $727 billion, we enhanced the earnings power of our business through successful execution across all aspects of our growth strategy – including positive organic growth from net client cash flows in 2016, the long-term investment outperformance of our Affiliates, and the addition of outstanding new Affiliates during the year.”

Dividend Announced

AMG has also authorized the initiation of a quarterly cash dividend commencing in the first quarter of 2017, and declared an initial dividend of $0.20 per common share, payable February 23, 2017 to stockholders of record as of the close of business on February 9, 2017.

Additionally, the board authorized a share repurchase for a total of four million shares.

The program allows AMG to “repurchase issued and outstanding shares of its common stock in open market or privately negotiated transactions, with the timing of purchases and the amount of stock purchased determined at the discretion of AMG’s management,” the company said in a statement.

“The initiation of a dividend and ongoing repurchase of our shares evidence our confidence in AMG’s future business prospects and commitment to maximizing returns for our shareholders through the disciplined allocation of the strong and growing free cash flow generated by our business,” said Healy.

AMG is one of the various manufactured housing industry-connected stocks monitored each business day on the industry’s only daily market report, featured exclusively on the Daily Business News. For the most recent closing numbers on all MH industry-connected tracked stocks, please click here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.