The evolving Daily Business News market report sets the industry’s stocks in the broader context of the overall market stocks.

By spotlighting the headlines – from both sides of the left-right media divide – this report also helps readers see what are the trends and topics that may be moving the investors that move the markets.

Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks.

MH “Industry News, Tips and Views, Pros Can Use.” ©

- Trump couldn’t save these jobs at Carrier

- NAFTA negotiations set to begin August 16

- Social Security Administration warns about scam

- Renegotiating NAFTA — in 15 easy steps

- United: Involuntary bumpings are down 85%

- Apple, Google, Microsoft hoarding billions in cash

- Colorado passes a milestone for pot revenue

- Millions of Brits must work extra year to get pension

- Chipotle reopens restaurant where people got sick

- Comic-Con wrestles with digital-age challenges

- Will Obamacare really fail?

Selected headlines and bullets from Fox Business:

- Morgan Stanley tops Goldman Sachs in market value: Gasparino

- Stocks hit record highs as tech rallies

- Can North Korea launch a ballistic missile attack in U.S.? ‘Be concerned’, Gorka says

- USPS financially imploding as new political scandal emerges

- US-China trade tensions mount as bilateral talks begin

- S. Supreme Court partly rejects Trump on travel ban

- Ezekiel Elliott: Suspension could cost Cowboys star cash, report says

- American-made cars are the hottest summer buys

- RadioShack brand to survive under new owner: sources

- Amazon is a ‘total beast’: Former Walmart US CEO Bill Simon

- How the US-Mexico sugar deal could impact food prices

- Pizza Hut to hire 14,000 drivers, unveil new delivery technology

- Pizza Hut to hire 14,000 drivers, unveil new delivery technology

- American companies don’t want a trade war with China, says Bob Hormats

- Microsoft’s Surface Hub production moving to China

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

Today’s markets and stocks, at the closing bell…

S&P 500 2,473.83 +13.22 (+0.54%)

Dow 30 21,640.75 +66.02 (+0.31%)

Nasdaq 6,385.04 +40.74 (+0.64%)

Crude Oil 47.12 +0.72 (+1.55%)

Gold 1,240.90 -1.00 (-0.08%)

Silver 16.26 -0.00 (-0.02%)

EUR/USD 1.1515 -0.004 (-0.35%)

10-Yr Bond 2.268 +0.005 (+0.22%)

Russell 2000 1,441.77 +14.16 (+0.99%)

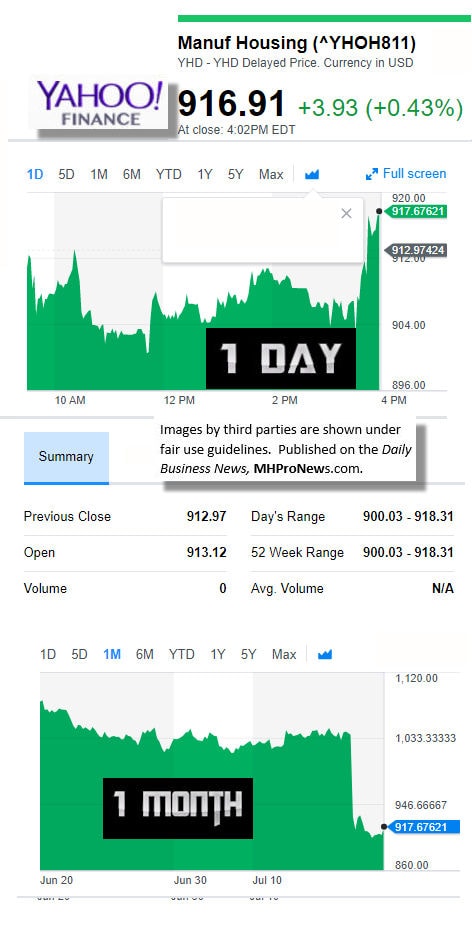

Manufactured Housing Composite Value

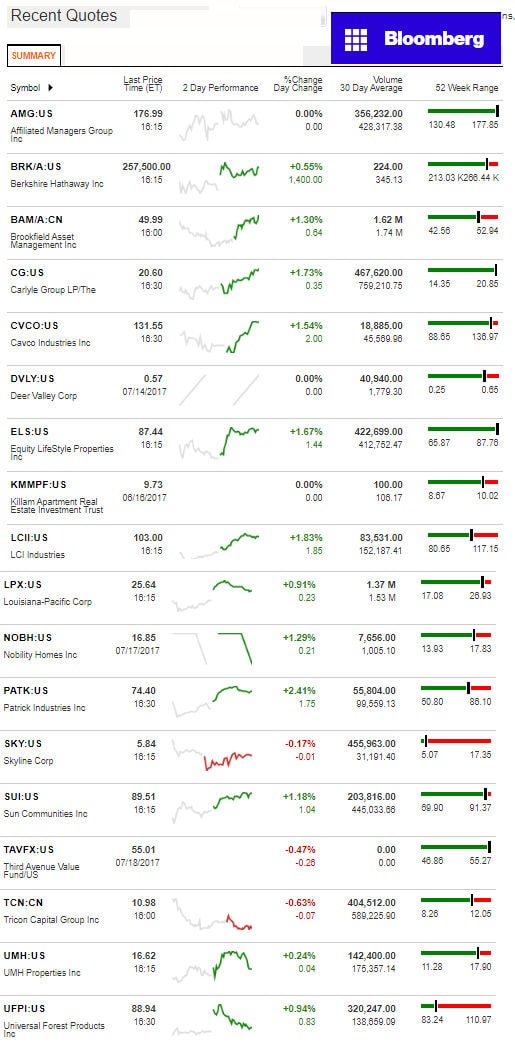

Patrick & ELS lead movers up. Tricon lead sliders today.

For all the scores and highlights on tracked stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report – AMG

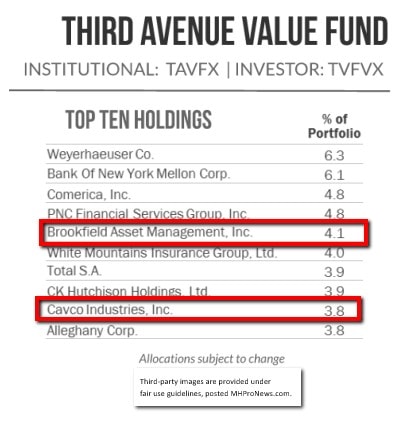

As we reported last June, 13, 2017 – AMG holds a significant position in Third Ave, which we profiled recently, which in turn holds stock in manufactured home production operations.

Third Ave also held a sizable stake in BAM, which has manufactured home community interests.

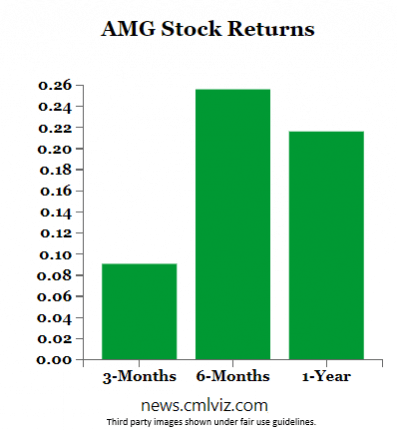

AMG has attracted a significant amount of news, as the headlines shown below reflect. We’ve picked CMLviz’s report to share with the AMG spotlight today.

Breaking: Affiliated Managers Group Inc (NYSE:AMG) has hit maximum technical strength — watch the technical oscillators for momentum gaps. The company has broken out to a five bull momentum rating — that is extreme strength and through technical resistance.

The risk now is that the stock is overbought, but as of this moment, the price is moving abruptly higher, through resistance, and the bulls are leading the charge.

AMG is up +9.1% over the last three months and up +25.6% over the last six months. The stock price is up +21.6% over the last year. The current stock price is $177.55.

The technical rating goes from a rating of one, the weakest upside technical, to a rating of five, the highest upside technical. This is strictly focusing on price and technical — that means we focus on real-time stock price movement and then position it relative to the simple moving averages. To make the technical rating meaningful, the moving averages are also compared to each other. If you’re looking for the simplest version of this, here it is — when the short-term moving averages are above the long-term moving averages that indicates relative strength in the technical. Then see the current price relative to the highest moving average and you will have a “back of the envelope” technical indicator in your back pocket for any stock at any time. The blending and weighting of numbers above created the technical model built by Capital Market Laboratories (www.CMLviz.com). Note the stock price at publication ($177.55), since the technical rating is based on intraday stock prices.

Golden Cross Alert: The 50 day MA is now above the 200 day moving average. As we noted above — the back of the envelope rule here is that when shorter-term moving averages move above the longer-term ones, momentum is building. We have that right now.

We can set aside oscillators, stochastics, and any other precise measure of momentum, this is easy to see: Affiliated Managers Group Inc has a five bull (highest rated) technical rating and may be having a technical breakout right now because it’s trading through resistance.

We now turn to the actual numbers driving this rating:

Affiliated Managers Group Inc (NYSE:AMG) rating statistics:

- 10-day moving average: $172.87

- 50-day moving average: $161.62

- 200-day moving average: $155.29

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Manufactured Home Industry Connected Stock Markets Data

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses.

You will find only the very best manufactured home industry coverage, every business day.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)