“U.S. Manufacturing Hits Rough Spot in Possible Warning on Growth,” says Bloomberg, which also notes that “It’s Hard to Overstate How Quiet Stock Markets Are Right Now.” In the wake of their spectacular explosion on the launch pad, CNBC asks – “Why was Facebook launching a satellite?”

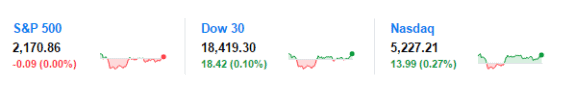

The three main U.S. Markets closed mixed, as shown by the numbers, below.

Dow +0.10% 18,419.30 / +18.42 +0.27%.

Nasdaq 5,227.21 / +13.99.

S&P 500 -0.00% 2,170.86 / -0.09.

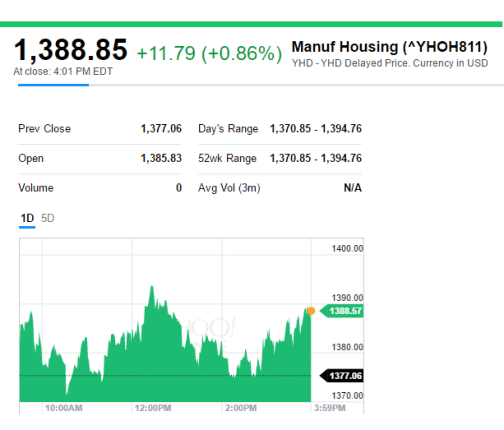

The Yahoo! Manufactured Housing Composite Value closed today at: 1388.8, with Today’s Change: +0.86%.

Manufactured Housing Composite Value Ticker

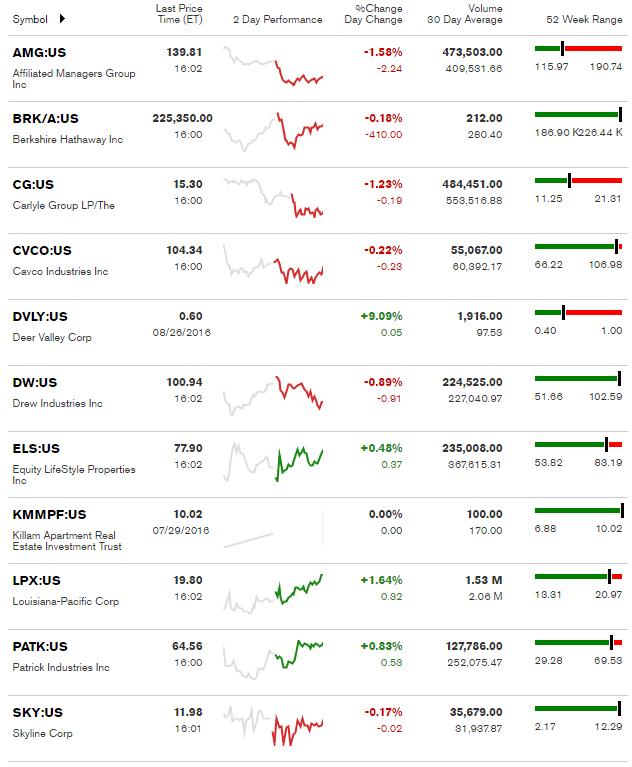

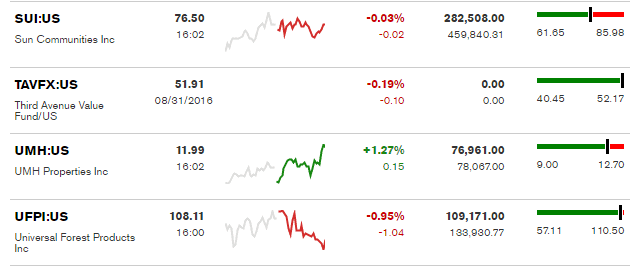

AMG was the largest loser on the day, while LPX was the biggest gainer, followed by UMH (note: for those eagle eyes out there, DVLY may look to be the day’s largest gainer, but note the date posted for their last trades…).

*Note: the chart below includes stocks not included in the MHCV

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown.)

(Editor’s Note: As the insightful report today by Joe Dyton reflects, MHProNews is welcoming periodic guest writers. ICYMI, Matthew Silver is taking some much needed and well-earned time off, and L. A. “Tony” Kovach will be helping fill the Daily Business News role in the interim).

MH Industry Market Report by L. A. “Tony” Kovach, to the Daily Business News for MHProNews.