Noteworthy headlines on CNNMoney – Treasury pick Mnuchin faces committee vote. Starbucks unveils chatbot app for ordering. What is ExxonMobil doing in Iraq? Why NY’s “tuition-free” colleges will still cost $14k.

Some bullets from Fox Business – Trump to add CIA Director to National Security Council. Does Verizon want to buy Charter or block AT&T-Time Warner? Rite Aid shares plunge on reduced deal price with Walgreens. Data bolsters case for Fed rate-hike outlook.

“We Provide, You Decide.” ©

Key Commodities

Crude Oil 52.71 –0.46 (-0.87%) Gold 1,198.20 7.10 (0.60%) Silver 17.14 0.00 (0.01%)

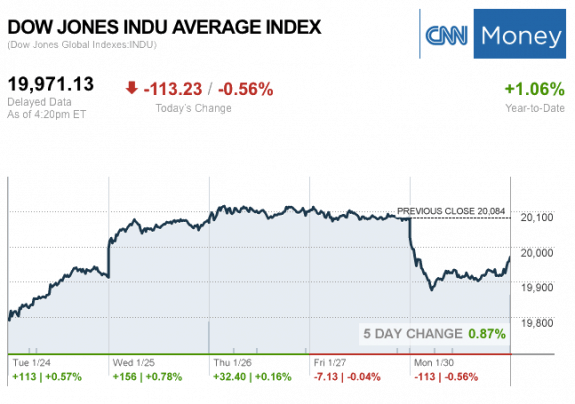

The markets at the Closing Bell Today…

S&P 500 2,280.89 –13.79 (-0.60%)

Dow 30 19,971.13 –122.65 (-0.61%)

Nasdaq 5,613.71 –47.07 (-0.83%)

Russell 2000 1,352.67 –18.04 (-1.32%)

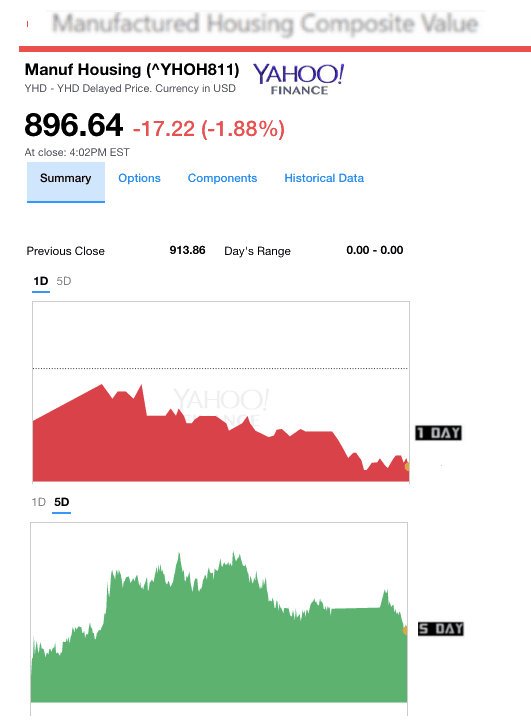

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Affiliated Managers Group Inc. (AMG) and NorthStar Realty Finance Corp. (NRF).

The top two sliders for the day were LCI Industries (LCII) and Skyline Corp. (SKY).

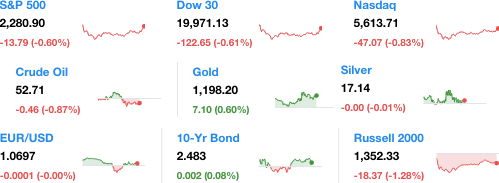

Manufactured Housing Composite Value (MHCV) Ticker

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.