Noteworthy headlines on CNNMoney – Apple has $246B in cash, nearly all overseas. No Fed rate hike in first meeting of Trump era. 400 Wells Fargo workers’ severance payments held up. Why business is excited about Neil Gorsuch.

Some bullets from Fox Business – Senate confirms Tillerson as Secretary of State. Senate panel advances Trump’s nominee for Attorney General. Democrats vow fight on Supreme Court nominee, Trump urges “Nuclear Option.” S&P 500 down for 5th Session, Apple spike lifts Nasdaq.

“We Provide, You Decide.” ©

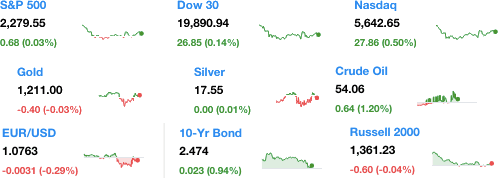

Key Commodities

Crude Oil 54.06 0.64 (1.20%) Gold 1,211.00 –0.40 (-0.03%) Silver 17.55 0.00 (0.01%)

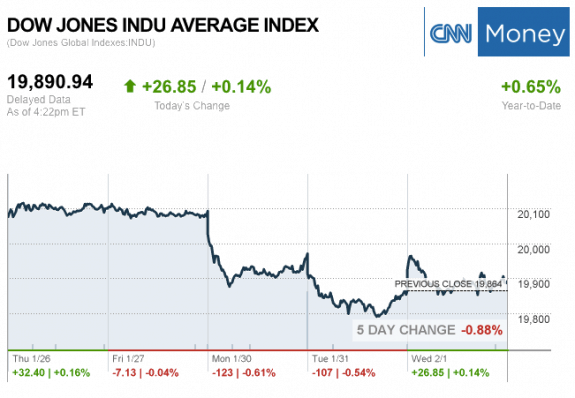

The markets at the Closing Bell Today…

S&P 500 2,279.55 0.68 (0.03%)

Dow 30 19,890.94 26.85 (0.14%)

Nasdaq 5,642.65 27.86 (0.50%)

Russell 2000 1,361.23 –0.60 (-0.04%)

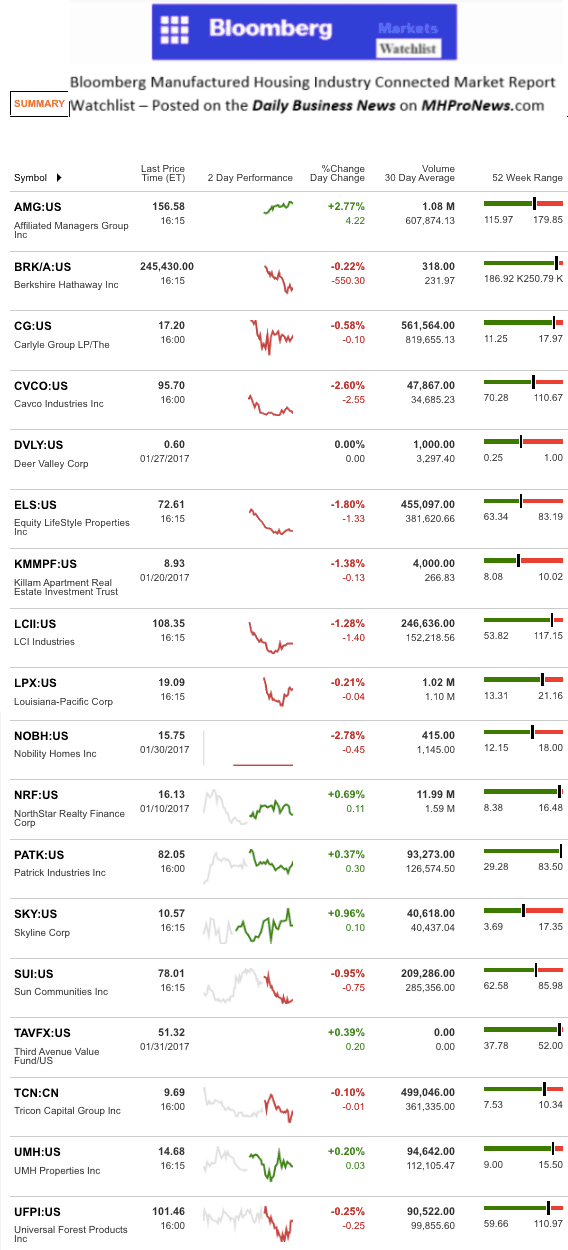

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Affiliated Managers Group Inc. (AMG) and Skyline Corp. (SKY).

The top two sliders for the day were Cavco Industries Inc. (CVCO) and Equity LifeStyle Properties Inc. (ELS).

For a more detailed report on high-flying AMG, click here.

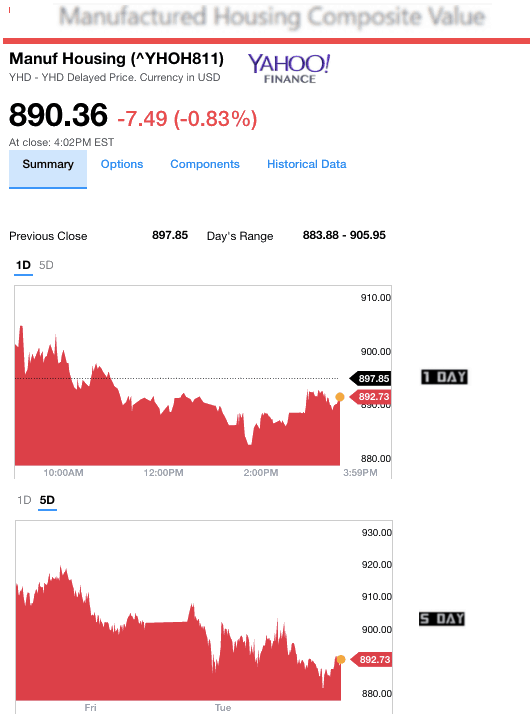

Manufactured Housing Composite Value (MHCV) Ticker

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.