Bloomberg Businessweek reports that one Carlyle European property fund has lost 80 percent in value, and another is barely breaking even. Although Carlyle’s real estate operation manages about $13 billion, that is only a fraction of the $80 billion overseen by Blackstone Group (BX).

“I didn’t even know they were in the real estate business,” Tony James, Blackstone’s president, said on a July call with analysts after buying London office buildings from Carlyle.

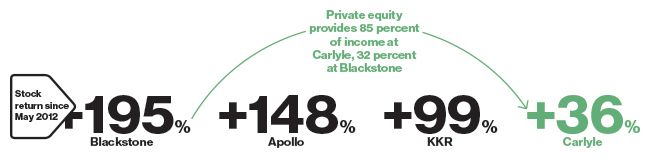

Some experts feel that when Carlyle went public in 2012, this increased pressure on the company. “Carlyle is not seeing some of the growth in assets that the other guys are, Blackstone most notably,” says Stephen Ellis, an analyst at Morningstar (MORN). “Private equity is a highly cyclical business, and shareholders have put tremendous pressure on them and on the industry to diversify away from it in order to have a more stable, reliable income stream.”

Nevertheless, in the year ended Sept. 30, 85% of Carlyle’s economic net income, a measure that includes unrealized gains, came from private equity. This dwarfs the 32% realized at Blackstone, or the 48% at Apollo.

Carlyle’s continued reliance on buyouts reflects success realized in those transactions. The business has produced 19% annual returns after fees since 1994, while the industry average over 25 years is about 14%, according to research firm Cambridge Associates. “Carlyle’s intellectual capital is housed in the private equity business, which is world-class,” says Chris Kotowski, an analyst at Oppenheimer (OPY).

Carlyle invested in two quality manufactured home communities in 2013, as reported in the story linked here. A report in October 2014 – which includes a video interview with Carlyle’s Mark Beliczky – stating the firm’s interest in the manufactured home community space, is linked here. The closing quote for Carlyle Group’s stock from Monday, is linked here. ##

(Graphic credit: Business Week)