Facts are whatever they are. Gravity exists on this planet, and there is only one sun in Earth’s solar system, not 10. In an environment where inflation is roaring, Anar Pitre, Lotus Capital Partners’ CEO, posted on LinkedIn about a week ago: “Thrilled to distribute a 17% cash-on-cash distribution to Lotus investors in this economy!” Part of the Lotus Capital pitch is “passive” investing and “income growth” in manufactured home communities (MHCs) over Class B/C apartments buildings. Pitre and her firm’s website assert that they have invested in both apartments and MHCs. She has “found that investing in MHCs has some advantages over Class B/C apartments.” Pitre’s Forbes column cited the Manufactured Housing Institute (MHI). This fact check will examine a Pitre cited MHI claim on a significant, but not critical item. But a far more important MHI oversight from the same document that Pitre cited is also unpacked further below. When properly grasped, these facts foreshadow a downturn that too few in MHVille are forecasting. But before going there, pivoting back to Pitre’s bio is the following.

Pitre has “a background in consulting with McKinsey and hold an MBA from Cornell. I also have Engineering and Life Sciences undergrad/grad training. As a published Forbes Finance council member, I have been recognized for my expertise in finance and business.” That’s per her LinkedIn profile, which also said: “We help individual #Investors gain returns that handily outperform the stock market through #RealEstate and #VC investments #Investing #PassiveIncome.”

Pitre opted to cite the Manufactured Housing Institute (MHI) as one of her information sources in her 4.7.2023 Forbes post on manufactured home community investing, linked here.

However accurate several of her statements and insights may be, it is sadly not accurate on a significant point where Pitre cited MHI. As was noted above, a second relevant point not mentioned by Pitre from MHI’s ‘fact sheets’ are also going to be unveiled herein below. That second theme is about another claimed MHI fact that is critical for current and future investors in manufactured housing to address.

As part of this preface, it is worth noting that for a normal trade group, a factual error in a document – once discovered – might cause them to rapidly revise the error in a document or article, remove the incorrect PDF after uploading the corrected document. That is precisely what occurred when the National Association of Realtors (NAR) was advised of an error in a journal article they published on manufactured housing. See that still relevant flashback is examined in the report linked below.

But MHI has an interesting – and troubling – history on errors and an arguably evidence-based willingness to ignore them. In the example linked above, per a well-placed source, For instance, MHI apparently failed to mention to NAR any of those errors identified and corrected by this publication and the Manufactured Housing Association for Regulatory Reform (MHARR) CEO Mark Weiss, J.D. Was Pitre aware of that history of MHI’s problematic handling of errors in documents and research that MHI ought to be motivated to see corrected?

That is unclear. An emailed inquiry from this publication to Pitre over the weekend bounced. A follow up to Lotus Capital Partner’s general mailbox is pending as of 11:58 AM ET on 4.10.2023.

This outline begins to frame one of the vexing realities that comes to light from a fact check, analysis and commentary on what Pitre’s otherwise interesting, and at times insightful, Forbes article on MHC investing has inspired.

It’s Monday, Monday 4.10.2023. In prior fact checks that exposed some error on the part of MHI, some went uncorrected for years. Let’s see if MHI corrects this error mentioned below and if so, when.

Because unlike the National Association of Realtors (NAR) – which pulled an entire journal due to an article that had errors in terminology and other information about manufactured housing in it, made the corrections needed, acknowledged them in footnote 1, and replaced the prior errant issue swiftly – MHI doesn’t seem to have that same sense of urgency. MHI’s apparent level of concern about protecting the ‘accuracy’ and integrity of the manufactured home industry it claims to support, advocate and lobby on behalf of is regrettably lacking. In Part IV of this article is an item that MHI ought to be sounding the alarm over, but there is no known evidence that they are doing so. What is that so? Why aren’t they sounding the alarm about what the evidence will reveal is a coming crash for an already underperforming industry?

One wonders if Pitre and Lotus Capital Partners are aware of such aspects of MHI’s 21st century history? Be that as it may, that preface has set the stage for a look at what she had to say on manufactured home community investing, which Frank Rolfe and Dave Reynolds would more likely call ‘mobile home park’ investing, or what some have problematically referred to as ‘trailer park investing.’

Part I – More Background Insights to Pitre’s Forbes MHC Investing Introduction

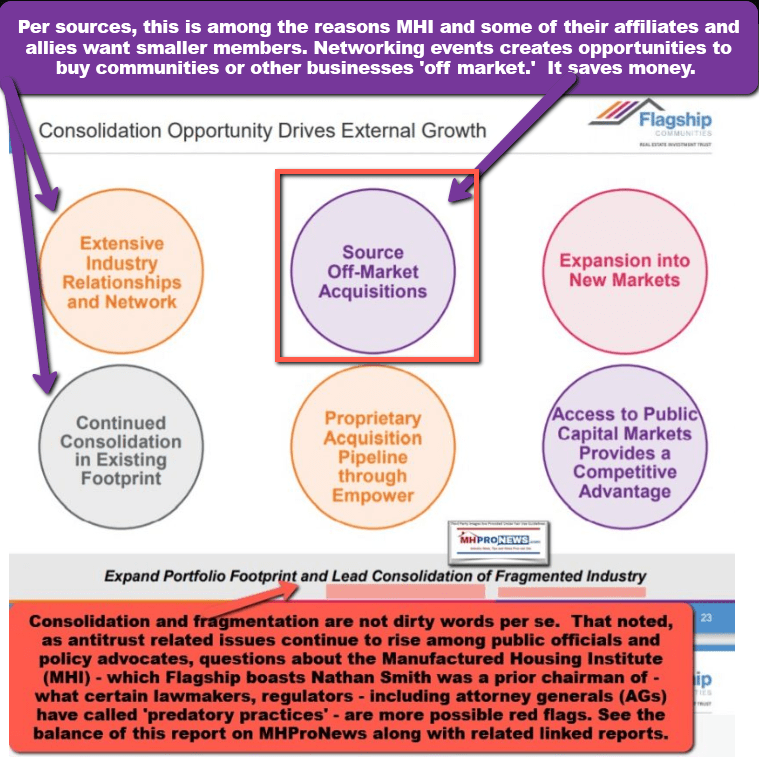

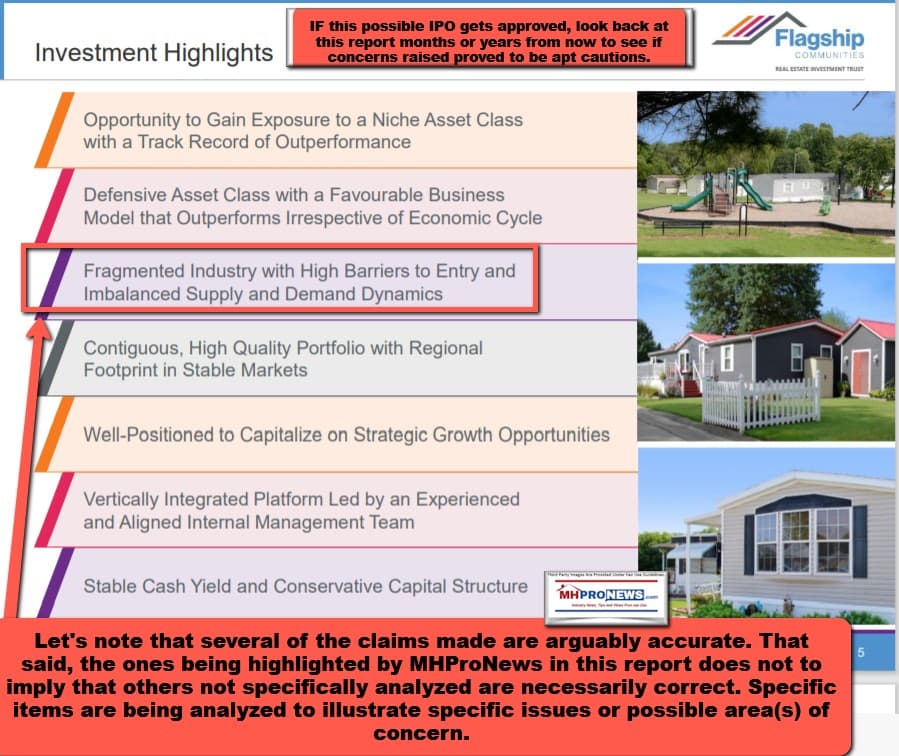

In exploring Pitre’s column in Forbes, it is useful to look to other larger firms to see what they have said about some of the issues raised in this fact check, analysis and commentary. For instance. As MHProNews has previously reported, MHC giant Sun Communities (SUI) CEO Gary Shiffman has previously noted that there is no national repository of information on manufactured home communities. Shiffman led Sun is an MHI member. Per the MHI website, Sun holds an MHI board position. Not unlike a point made by Pitre, below, Shiffman stressed the scarcity of manufactured home communities.

Sun’s Shiffman has also noted during earnings calls for the publicly traded firm he leads that there are times that new communities can be developed at a superior rate of return to buying an existing manufactured home community. Shiffman said that this is particular true where cap rates have become compressed.

To some extent, Pitre’s column can be framed as a kind of competition for investor dollars into the MHC space. That’s a valid effort.

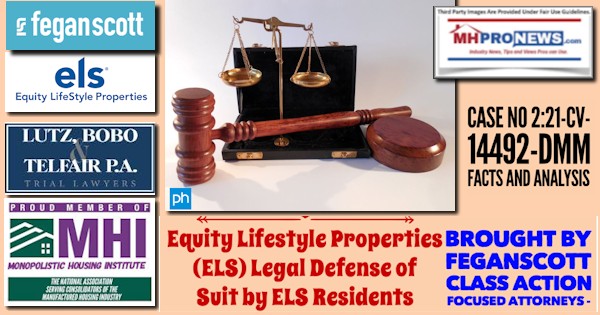

Lotus is competing against some far larger firms, many of which are MHI members. Sun (SUI), Equity Lifestyle Properties (ELS), UMH Properties (UMH), RHP Properties, Frank Rolfe’s and Dave Reynolds’ various brands, The Carlyle Group (CG), Havenpark Capital, and others are on that ‘list.’ They and others routinely have ties to MHI and/or an MHI ‘state affiliate.’ Pitre’s column ends with this disclosure on the Forbes website: “The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.” The Lotus website has a download for the investment profile of multifamily properties, specifically apartments. There is no similar pitch on the Lotus site that is as visible which covers the MHC sector.

That noted, for purposes of fact checking, significant excerpts of Pitre’s under 800-word column in Forbes follow. The featured image and some of the copy are omitted, but can be found at this link here.

Part II – Extended Quotes from Lotus Capital Partners CEO Anar Pitre 4.7.2023 column in Forbes – “An Intro To Manufactured Home Communities: What Investors Need To Know”

What Are MHCs?

MHCs, one of my company’s areas of focus, refer to properties that are designed to accommodate prefabricated manufactured homes that are built in factories and transported to the property for installation. MHCs consist of individual sites that have been hooked to utilities such as water, sewer, electric and gas. Each site can be leased to tenants, who typically own the prefabricated manufactured home. …”

Pitre elaborated as follows.

Having invested in both classes, I have found that investing in MHCs has some advantages over Class B/C apartments. (Class B/C apartments are more affordable apartments and more entry-level with basic amenities as opposed to the luxury Class A apartments.)

First, according to a recent National Low Income Housing Coalition study, no state in the U.S. has enough affordable homes for lowest income renters. The severe national affordability crisis makes MHCs a prime affordable option. Communities that are professionally managed can offer clean, safe, affordable homes for families priced out of other housing options as a renter or an owner.

Roughly 22 million people live in MHCs for these affordability and quality of life factors, such as having a yard and a private parking spot, community events and amenities.

MHCs can also produce higher cash returns given they have much lower operating cost ratio than apartments. This is because tenants own their homes, so they take care of repair and maintenance expenses themselves. Additionally, there is a big cost in apartments associated with unit turns and leasing when a tenant vacates the unit. But in MHCs, tenants own their homes and move out of their communities more infrequently given higher cost to move homes.

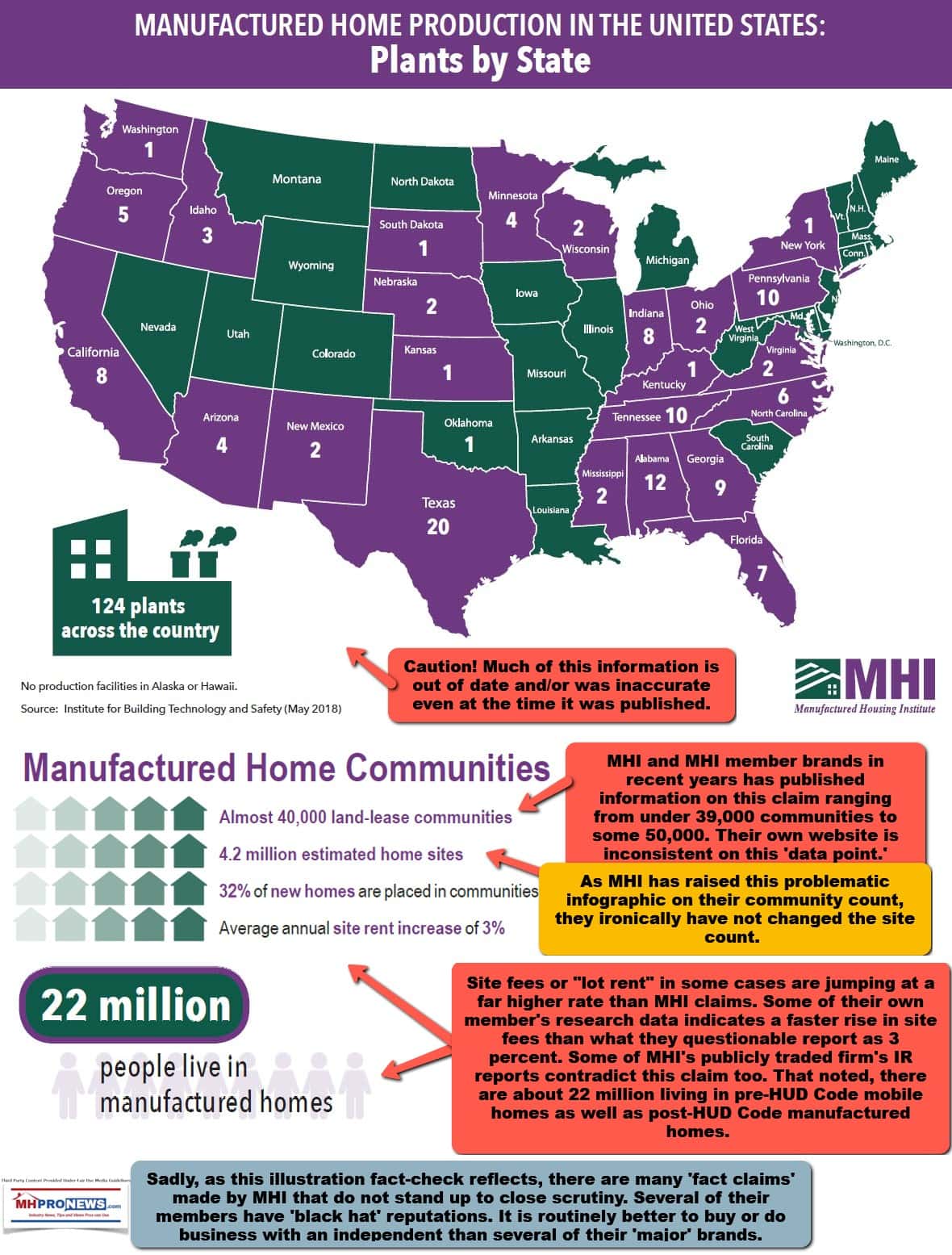

The estimated number of MHCs in America is over 43,000, according to the Manufactured Housing Institute, and new zoning is not easily approved, which limits supply. This limited supply coupled with increasing demand can create organic long-term appreciation. This is not always the case for apartments, which have seen construction soar in recent years, potentially reducing the value of existing complexes. With MHCs, the risk of overconstruction destroying an investment’s value is relatively much lower.”

In the paragraph immediately above, the link she provided was a download on the MHI website. That and the claim about 22 million Americans living in manufactured housing cite the same MHI download, linked here.

Part III The ‘Facts’ According to MHI…

Per that MHI 2022 download Pitre referenced, there is this statement.

- 43,000+ Land-Lease Communities

While the ‘source’ for that claim is not entirely clear, near the bottom left of that page is the following.

Presumably, MHI is citing Datacomp/JTL – an MHI ‘endorsed’ company. As MHProNews has previously noted in a prior fact check, as Datacomp/MHVillage began increasing their number of listed communities, magically, MHI began to share a similar data point in their ‘facts.’

To be clear, citing a corporate source that is accurate in sharing their information is fine.

However, MHI has presumably known for weeks or months that the claim of “43,000” plus communities is at best an understatement. According to remarks provided by George McCarthy with the Lincoln Institute for Land Policy, there are over 50,000 manufactured home communities found in a federal database. See that and more in the report linked below.

To Pitre’s point on problematic behavior by numbers of manufactured home community operators is the fact-packed report and analysis, linked below.

As to more examples of problematic behavior by community operators and their ripple effects in manufactured housing are the reports linked below. Note how often the report above and others that follow are connected to MHI and or an MHI state affiliate.

Despite the sound advice of former MHI president and CEO, Chris Stinebert – quite in line, it should be noted, with Pitre’s contention in her Forbes article, cited above – there is a troubling pattern of MHI members apparently pushing an agenda that is harmful for the image of the industry.

Lawsuits, state, and federal probes are among the challenges that increasingly face manufactured home community operators. The causes for those suits and investigations are the tempo and evidence of what MHC residents are often calling ‘predatory’ behavior.

The troubling reality of MHVille in 2023 is this. While Pitre is correct in saying that manufactured homes and communities are a good investment opportunity, there are scores of examples from mainstream media (see examples linked above) that paint the industry in a troubling light. That to some degree sadly offsets the positive reports that emerge about manufactured housing, like the research and reports shown below.

But instead of focusing on reams of positive research and opportunities, MHI often points to its own, outdated, an relatively opaque ‘research’ that they decline showning the underlying methods or facts to the public. Or showing ‘data’ on communities that was and remains demonstrably inaccurate. Why do they do so? Apparently, because several of MHI’s leading brands want it or tolerate this type of messaging.

To Pitre’s point about scarcity of communities and the difficult on getting zoning, that too appears to be supported by others.

But when even some of the leaders of the largest brands in MHVille put out incorrect, misleading, or otherwise challenged information, perhaps it is no surprise that MHI is seemingly comfortable with that vexing pattern.

Dotting a Key i In the MHI Document…

For the detail mined, MHI’s annual update of these facts would have noted that there has been a dramatic shift in 2022 in the destination mix for the majority of new manufactured homes. In years prior to 2022, MHI was reporting that some 60+ percent of production would go to private property. Over 30 percent of new manufactured home production was going, per MHI, into land-lease communities (what Pitre aptly refers to as MHCs). In contrast to that trend, MHI said in the document Pitre cited the following.

Per MHI’s “Quick Facts” August 2022 update (page 4).

- 49% of new manufactured homes are placed on private property and 51% are placed in manufactured home communities.

That same MHI “Quick Facts” document updated in May 2021 (page 4) said the following.

- 69% of new manufactured homes are placed on private property and 31% are placed in manufactured home communities.

Or how about MHI’s Quick Facts for May 2020 (page 4) said this.

- 63% of new manufactured homes are placed on private property and 37% are placed in manufactured home communities.

This is a far more important data point than numbers of manufactured housing professionals may realize. Why? Because the vacancy rate of manufactured home communities, per corporate sources that are often MHI members, continues to decline. As national occupancy of MHCs begins to approach 100 percent, instead of the mid-90 percentiles, what will happen to many manufactured home producers that have a sizable share of their products going to land-lease operators?

MHProNews raised this concern in an MHI meeting in 2017. Shortly thereafter, MHI – in an unsigned document – claimed that there was no membership category for MHProNews, terminated membership, and refunded that year’s dues (but not the prior ones). Apparently, even asking the wrong question can be problematic for MHI, why? Because accurate information is valuable in an industry where inaccurate information is all too common.

Refocusing the importance of the above data points and analysis is merited. If there is no swift and robust effort to open up zoning and placement barriers in manufactured housing, it should be apparent that any producer that depends on MHCs for a large slice of their sales is heading towards a wall. MHI need to explain how they plan to solve this problem. Instead, they keep trying to tell members and industry professionals how great they are, how they get to rub shoulders through PAC donations and other methods with public officials and speak at the National Housing Conference (NHC), among other venues.

MHProNews has been sounding the alarm, first softly, but as time goes on, with increasing intensity, for years. For anyone that cares about manufactured home sales and production, this is a big issue.

When a law professor effectively slammed MHI, without perhaps intending to do so, it is time for the industry to look beyond its current leaders to fresh, goal- and solution-oriented personalities. Will Pitre or others fit into that mold? Time will tell. But the opportunities for such investors ought to be evident for those who carefully unpack this report and linked information. So, despite some concerns outlined above, Pitre has a point. “Not all MHC investment offerings are created equally, so it is important to do your research before jumping in. Still, the potential benefits make this real estate investment niche one to keep a close eye on in 2023 and beyond.” Will that potential be ethically and sustainably tapped? For clues for and against, see the linked reports. As a programming note, there is more to unpack from this Pitre column. MHProNews/MHLivingNews plans to do a follow up on this in the days ahead, perhaps with some input from the firm should they respond to the inquiries sent. Stay tuned. ###

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’