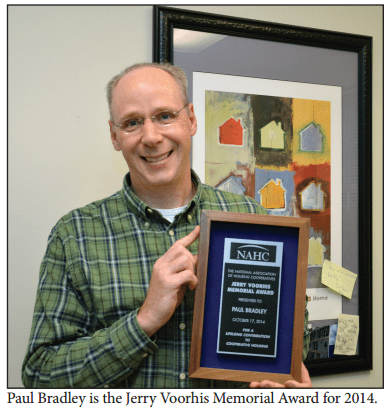

Paul Bradley, President, ROC USA, LLC, Concord, NH.

2) Background (Educational/Professional before entering the factory-built housing arena).

1986 – University of New Hampshire; and 2006/7 – Executive Education at Harvard University.

3) When and How: (When and how you got into the Manufactured/Modular Home/Community Industry).

I came into MHC industry in 1988, left for 18 months to serve as project manager on new 38,000SF plant for a local company, and then came back!

4) Since our first Cup of Coffee interview with you, has your interests or hobbies changed much? What’s the latest and greatest things in your personal life? How do you like to spend non-work time?

My wife and two daughters are my greatest joys.

The girls are 15 and 18 and life with them just keeps getting more fun. This weekend was typical: Dinner out with my wife on Friday night, my younger daughter’s pre-season soccer tournament and the annual soccer team pool party at the house on Saturday, and tennis on Sunday morning with our oldest before the four of us went kayaking at a friend’s house. We followed that with dinner and “60 Minutes,” my favorite bookend to a great weekend.

5) Let’s retrace some of that work history of yours, prior to founding ROC USA.

I come about my position by having personally done a lot of what our Network affiliates and lenders in ROC USA Capital do every day. I started working with homeowners to structure acquisitions, arrange financing and coach on organization development.

When we started to staff up, I would ebb into one of the key skill areas – real estate/finance and organization development – depending on the strength and interest of my teammate at the time, I’m the same way in basketball. I can play all five positions, so my focus depends on who’s on the floor and what the need is. I pride myself on that.

In the early 2000s, I led the team’s expansion into new MHC development with a 44-site community and some infill as well as a now award-winning home-only finance program.

By the mid-2000s, we had calls for assistance from across the country so we had to figure out how we could serve multiple states with resident ownership services.

We launched ROC USA, LLC as a nonprofit social venture in May of 2008 to do just that. And, despite launching four months before the Great Recession was so-named, we did a little better than survive for three years and we have really been growing at a good pace since 2011.

6) You and your operation has had significant positive media as well as awards. Would you share some of that with our readers? And then tell us what that kind of recognition means in terms of advancing your and ROC USA’s work?

If you think the MHC industry gets too little respect, stop and put yourself in the shoes of your residents. In June 1, 2015, Seattle Times, ROC leader Liz Wood wrote a letter in response to an article about a community closure in the Seattle metro area.

She wrote:

“My heart goes out to them, but I’m comforted knowing this need not happen again.

I live in a similar community and once risked the same scenario — trying to find a new place to take my not-very-mobile home or abandon my largest asset and start over. I applaud the former community owner, who in the article’s comments section, spoke about trying to sell to the city and preserve much-needed affordable housing.

I was lucky because the couple who owned my community twice tried to sell to us before succeeding the third time. We, the 25 homeowners of Duvall Riverside Village, bought the land beneath our community in 2012 with the help of ROC USA and ROC Northwest. As a resident-owned community, we democratically manage our neighborhood. I serve as president of our community board, have been elected to serve on ROC USA’s board and ensure other resident groups can buy their parks.

I urge park-owners to sell to their residents. Give them the security of land ownership to fully realize the American dream.”

It is sincere – we think owning a manufactured home in 2016 ought not be fundamentally the same as owning a trailer in the 1960s. Today, this is clearly homeownership.

My view is that we all can reshape the value proposition and put security and homeownership front and center.

We get a lot of press because we’re an innovator in the space; we help low- and moderate-income homeowners pull themselves up by the boot straps and buy into the American Dream of homeownership.

This is all based on the best of the American spirit – ownership, self-help, community and democracy. It’s taking responsibility for yourself and your community.

With opportunity, these homeowners have proven themselves capable. Not one ROC we helped purchase since 1984 – all 192 of them – has failed, resold, gone bankrupt or been foreclosed upon. Because these are homeowners who are invested in their neighborhood, they do the hard work it takes to be successful. It’s really remarkable. And, remarkable is press-worthy!

Second, we get recognition as a nonprofit because we’re unique. We set out to scale resident ownership and that’s not common in the nonprofit sector.

To that end, we have raised and aligned the specialized capital that is needed to finance ROCs – working with national institutions like the National Co-op Bank and MetLife and many Housing Finance Authorities.

We have organized a great Network of local nonprofit affiliates that work shoulder to shoulder with community members through every step of the process – both pre- and post-purchase. Our current eight Network affiliates are each strong, well-connected organizations in their states and regions and they bring partnerships and resources to the table that really enhance the value brought to every community.

So, for all of that – plus our outcomes with 192 ROCs and 11,835 sites in 14 states – we and our affiliates are recognized with various social venture and social entrepreneurship and affordable housing awards. It helps us because what we do requires a good deal of capital so social investors (like foundations for instance) need to see us getting recognized.

7) Since our first Cup of Coffee, we’ve had the chance to visit one of your ROCs in NH. The residents there clearly took pride in their homes and in the community. Roads were kept up, and one was being repaired. People looking for a home at that co-op were getting tours by volunteers from among the residents. In our video interview with Kim Capen, he told us that people from all walks of life and varied political backgrounds worked together in harmony at Medvil Cooperative. Among the results, their manufactured homes rose in value.

With that backdrop, let’s clarify some issues that come up in the minds of some MH Industry Pros about ROCs. Let’s start with this. For those community owners who feel ‘close’ to their residents, outline the reasons why residents can benefit and thrive by turning to ROC USA for their exit strategy.

Community owners have said it best:

“I felt real good about this sale. This was a feather in our cap.”

Dennis Dunker

Sunrise Villa Cooperative — Cannon Falls, Minn.

5/14/2008

“They’ve been loyal customers for many years, I was glad to help them out.”

Gary Heiberg

Prairie Lake Estates — Kenosha, Wis.

Closed 7/15/2013

“We owned a mobile home park that was built by our parents 40 years ago, and we lived on property attached to the park for many years. It was a pleasure to see this community being bought by the residents who live there. Our hope is that they can make their community an even better place with the pride that comes from ownership.”

Karl Wajda

Heron Point — Newmarket, N.H.

8/23/2013

8) When an MH Community owner sells one or more properties, they are clearly looking to benefit themselves too. That’s why they’re in business. Does selling to the residents mean the community owner is going to have to accept less money than if they sold to an investor? Paint that picture for us, please.

Market value is market value.

We’ve been successful because we help the buyer – a co-op made up of at least 51% of the homeowners in the community – pay market value.

And, because we help them do that in standard commercial timelines. We make resident purchases effective and efficient. To be successful, the co-ops have to be positioned with expertise and capital so they can participate in the market in ways community owners are accustomed.

9) You’ve had some community owners who have sold to you more than one property, because they liked the process and the outcome once they jumped in and did the first one. Share one or two examples of things that community owners have said or written about selling their community to their residents, through the ROC USA process.

Yes, we have.

The best example is probably Frank Rolfe and his partner, Dave Reynolds. They sold a 97-site Clarks Grove, Minn., community (now called Hillcrest Community Co-op) and are under contract for another deal in Wisconsin. Frank wrote about the experience and his rationale in The Journal in January 2016. He concluded, “Frankly, we can’t come up with any reason why community owners would not want to sell to their residents over an outside party.”

10) There is always ongoing discussions about financing and manufactured homes in a land-lease or other setting using chattel (home only, personal property) lending. The GSEs have been a hot topic this year. Are you working with one of the GSEs? Give us the 411 on that, because I’ll bet many in MHLand don’t have a clue that it’s happening.

Fannie Mae began financing home-only loans in select New Hampshire ROCs in the mid-2000s. Medvil, cited above, is one such Fannie Mae community.

I think the program could be a template for the industry. It’s pretty simple aside from one wrinkle. It involves: 1. Community approval by the GSE; 2. Long-term security of tenure, a lease; and, 3. Recognition of the lender’s rights.

The wrinkle is that it is a home-only mortgage meaning the HUD-code home is treated as real estate under state law. New Hampshire is unique in that all MH are titled as real estate once they’re attached to utilities.

To my mind, the only source of debate here is whether the GSEs can do the same with chattel.

I’ve long been told they can’t but some say they can. Otherwise, community approvals, leases, and recognition agreements are not surprising. The GSEs will want to pick the MHCs they will finance in, have some security of tenure so they’re not financing homes in communities that might close down, and they are recognized as the lender with rights to retain the lease in the event of repossession or foreclosure.

It’s not a big deal. I know community owners who have signed off on this already, and I think it will happen in 2017.

I also like that the New Hampshire program uses traditional seller/servicers – local banks and credit unions. I think our customers ought to be accessing conventional loans and traditional banking services, personally.

11) You see yourself as a centrist, is that a fair statement? You work with people across the political and professional spectrums. So you have connections with those in the non-profit sector, as well as those in the for-profit side. One of your favorite themes is industry cohesion, or the lack thereof. First, walk our readers through that concept, and then tell us what you see as the way for more cohesion to take place in MH.

Yes, that’s fair. We need a song . . . “Where has all the middle gone, in our great country?” OK, I’ll leave that to someone else, but you get my point.

A brand needs cohesion. Usually you apply brand to a product or a company. But, I think it’s useful to think about the MHC sector’s brand or image if you’d rather. There is really very little cohesion. I don’t have to tell you that we have an image problem.

But that can be changed. Let’s use GSE home-only financing for example. If there develops a set of communities rooted in long-term security, community standards and access to conventional residential financing from the GSEs, could that not be branded? I think it could, and it would start with our greatest strength as a sector – affordable homeownership.

Look, I’m a believer. I am helping my mother buy a new Marlette home – a Clayton HUD code product – that is going into the Freedom Village Co-op in Concord, NH. We’ve looked around and this is her most affordable and best option.

She’s really excited and her friends are excited for her – the 19th-century “age in place unfriendly house” will be gone. Her new home is a beautiful 3BR, 2BA double-wide EnergyStar and universal design home that she’s buying through the Next Step Retail Direct verified retailer, Concord Homes in Epsom, NH. Concord Homes is a local retailer who’s placed a lot of homes in co-ops here. Next Step helps consumers make smart decisions. Together they have allowed her to take residence for well under $100,000. I am a happy son!

So, that’s brand cohesion – mine. I’m not the only one who would help move their mother into an MHC. And, were it you, what would you be looking for? A good affordable home with security of tenure in a safe neighborhood would not surprise me. Now, imagine a segment of the industry who could stand up and say that. That’s cohesion. That can be branded.

12) What do you consider to be the largest challenges facing the manufactured housing industry in general today? What do you see as possible solutions to those challenges?

For 16+ years, home-only financing has been the issue in the Land Lease Community sector. The Duty to Serve is a viable solution to bring more conventional-type housing financing into the sector. It’s not the be all and end all but for many LLCs, it could make conventional residential loans available for new and existing MH in communities. What a difference that would make!

Two programs of the mid-2000s – what we put in place with Fannie Mae and what Freddie Mac initiated – offer blueprints. The fundamentals are the same in the two programs and both worked. At their core, both programs required community standards and a community approval, a long-term lease and Recognition Agreement, and GSE seller/servicers. They both also required homes titled as real estate – something that is already possible in 37 states for homes in LLCs – but on this issue, the GSEs might be persuaded to accept chattel. I don’t know, I have heard arguments on both sides. I have long been told that the GSEs only finance real estate and take mortgages but I support trying a chattel loan product.

Regardless, what’s been done should be done again on a larger scale and we should look for chattel first. If it turns out that real estate titling is needed, the Uniform Law Commission has already approved an “opt-in” MH titling law that states can implement. When Freddie Mac operated its program, LLC operators did sign up and in Arizona, for instance, industry players lobbied the Legislature for opt-in titling. It’s been done before.

The Fannie Mae program operates in Resident Owned Communities (ROCs) only but the fundamentals are the same and it makes sense. Long-term security of tenure and community standards are the basis for a long-term residential lender.

The motivation of DTS for the two GSEs could be the difference. Ultimately, a large percentage of LLCs and their customers will benefit, and in my view, the image of the industry can then be reframed as true homeownership with a straight face.

13) Team building is something every CEO deals with, and you’ve said before that having a crack team is a big part of ROC’s success. Shed some light on some key people in your organization, and how you like to work with others, in or outside of ROC USA.

Four new front-line technical assistance (TA) providers – from CASA of Oregon, Northcountry Cooperative Foundation in Minn., Cooperative Development Institute in Massachusetts, and ROC-NH in New Hampshire – were in our offices last week for 3.5 days of training.

Straight from my heart, I told them they inspire me. They are smart and experienced and they’ve joined an affiliate to work with community members and leaders to help make resident ownership successful in every community in which we work. We are attracting some incredible people who are here for the mission, purpose and values that we represent.

Our new National Acquisitions Manager, Marc Smith, joined us on Sept. 6. He moved his family up from Virginia where he ran a real estate investment company for two local attorneys. He’s done all sorts of commercial and industrial deals, and a few MHC deals.

We hired Daniel Ostenso to run our digital bridge and online training program – to help more members access online training resources and to interact with one another – and help stretch ourselves and our TA providers more efficiently. Daniel just returned from Cambodia where he was doing computer-aided training.

Along with new staff, both the national office and our local affiliates continue to retain high-quality staff. They’re the recognizable faces from Vegas and elsewhere that you’ve come to associate with ROC USA – Mary O’Hara, Michael Sloss, Mike Bullard, Warren Kramer, Kevin Walker, Andy Danforth, Kaia Peterson, Matt Fast, Chelsea Catto, Mark Lundgren, Andrea Miller, Tara Reardon, Chris Clasby – the list goes on. With another 15-16 new ROCs in 2016, we continue to see steady growth and that requires retaining and attracting talent. Same as in any growing business.

13) How do you personally like to respond to challenges that come up for you professionally? (In other words, how do you try to tackle problems and arrive at effective solutions?)

Standard stuff, really.

I ask questions, listen, engage others, and give people space to do their jobs.

I am focused on getting the big stuff right, making sure our goals are clear while welcoming adaptations on strategy. I don’t shy away from making a decision when a decision is needed. I like organization and structure, but with wide rails.

14) There are some in our industry’s ranks that don’t seem to understand the value of a robust discussion about challenges and their possible solutions. Dr. Stephen Covey, of 7 Habits for Highly Successful People fame, liked to say, “Good! You see it differently!” Explain from your vantage point the value for having healthy, respectful discussions that can result in solutions that might otherwise be elusive.

As an industry, we are not in a position to lock and load. There’s too much that needs to be fixed to ascend to a valued brand in the U.S. housing industry.

What’s remarkable to me is how many people have their heads in the sand with respect to how the LLC sector’s fundamentals impact customers. Are we selling homeownership? Why don’t we take that seriously? Dirty little secrets don’t play well in the information and social media age.

Let’s own up and get down to building a robust housing sector with a strong value proposition. Industries thrive when they provide a strong value proposition for the customer. We have the makings of a strong value proposition. Let’s get on with it.

15) Since we last interviewed you, the affordable housing crisis just continues to grow. Manufactured housing is a solution that’s hiding in plain sight, most never give our industry and product a second thought. Do you have ideas on how the MH solution might be better advanced with reluctant planners, public officials, the media and general public? What has to happen so that more people can understand the modern realities vs. what happened with the mobile homes built decades ago, and thus explore and benefit from manufactured home living?

Much of what I’ve already said is in response to this question.

Putting the customer first is a good start.

Re-positioning MHCs as Land Lease Communities with affordable and secure opportunities for homeownership in the true sense of the word is what’s needed to move planners and regulators, open home financing options, and unleash new LLC development. More of the same won’t get it done.

It’s a choice. Are we slowly shrinking or are we going to grow the sector? Planners and regulators are people and they won’t be fooled. Let’s just be real.

16) How many properties are in the ROC USA portfolio, with how many homesites?

We provide services to now 192 ROCs and 11,835 homeowners in 14 states.

17) Correct me if I’m wrong, but isn’t it true that all of your ROCs have been a success? What do you attribute that amazing success rate to?

Every community that ROC USA, including the NH work by ROC-NH that pre-dates ROC USA, has assisted through the purchase process is still in business! Not one has sold, been foreclosed upon, gone bankrupt or in any manner lost their property.

I owe that success to several things: The capacity of community leaders and members first and foremost. People like Lois Parris, Natividad Seefeld, Kim Capen, Liz Wood and thousands more who have stepped up and provided leadership in their ROCs. These are talented and dedicated people.

I also like to think that our training, systems, tools and leadership development that follows the purchase has contributed to their success. We spend more money on post-purchase services than on any other part of our budget because we – like these communities – are in this for the long haul. Successful ownership in every community is the goal and so far – between the programs of our ROC USA Network affiliates and ROC USA – that goal has been met.

Last, I would say it’s the financing.

We carefully underwrite each ROC deal and our affiliated TA providers are careful project managers in planning and development. So, all the lenders who come into a ROC financing package benefit from careful work and planning and motivated homeowner groups. Thankfully, the strong performance has brought about more attractive capital and resources over time. We need to keep that going!

18) Beyond the GSE angle, why do you think privately owned properties would benefit from providing long term land leases to their residents?

I think LLC owners can differentiate themselves by offering homebuyers secure tenure.

“This community won’t be closed down” sounds like a strong pitch to someone who is looking to buy a $50,000 or $100,000 house. Maybe I see too much but it just makes basic sense to me: Security of land tenure is fundamental to homeownership. ##