When manufactured housing professionals that have direct or indirect ties to new HUD Code manufactured home sales reflect objectively, there are numerous examples of research that point to opportunities for sales growth.

One of the obvious opportunities for new HUD Code manufactured home sales is the rental population. Per Apartment List, there are an estimated 111 million renters. The U.S. population is rising, due to births as well as immigration, legal and otherwise. That growing population, with potentially some 28 million households among renters alone, represent several opportunities for manufactured housing professionals to serve.

As some in the land-lease community sector know, rentals have become more popular in manufactured home communities. So there are several angles that data like this report, properly understood, point to for higher occupancy, opportunities for development, as well as more new unit orders from factories.

MHProNews recently spotlighted a new research report by Marcus and Millichap (MMI) as the featured item in the evening market recap linked from the text/image-box below. That linked research relates to this new and distinct topic that follows, both from the same source.

MMI Report – Job Housing Retail Correlations July 2019, plus Manufactured Housing Equities Updates

As a forward-looking statement, today’s MMI rental research – coupled with the prior one linked above – will tee up what ought to be eye-popping news from the rental housing front. There is new research that will speak volumes to forward-looking manufactured home marketers. It is unlikely that any others in our industry will cover these topics, so stay tuned here. If you don’t logon daily on MHProNews – as literally thousands of industry professionals and investors do – you can sign up in seconds for the 2x weekly industry-leading headline news linked here to get a notice in your inbox when those new rental resident surveys and other reports are published.

With that backdrop, here is another new MMI research report on rental housing that the firm provided to MHProNews. MMI is involved in a variety of commercial real estate, including manufactured home communities. After their snapshot, we’ll provide closing manufactured housing related thoughts.

Rental Demand Elevated in 2Q; Home Refinancing Intensifies as Rates Fall

Mortgage rates falling but home sales still soft.

Though mortgage rates have declined 80 basis points since they peaked last November, single-family home sales remain sluggish. An increased preference for rentals, the limited number of entry-level homes for sale and caution surrounding the economic outlook are restraining buyers. Move-up homebuyers are less active in the market than in previous cycles, while renters are choosing to remain in apartments. Rentals are also attracting some baby boomers who favor urban locations and amenity packages. This has weighed on the single-family housing market as a broad spectrum of households are showing signs of a transitional shift toward rental housing.

Low borrowing rates spark surge in refinancing. With the 30-year mortgage rate well below 4 percent, many owners are refinancing their loans. Refinances are up roughly 90 percent on an annual basis, while purchase originations are down 3.5 percent. With fewer people buying homes, apartment demand has remained strong, compressing vacancy 40 basis points year over year to 4.2 percent through the second quarter.

Consumer preferences support ongoing apartment performance trends. The ownership rate for people 35 and younger dropped 110 basis points to 35.4 percent during the first quarter as lifestyle changes and evolving preferences steered housing demand toward multifamily rentals. Strong job growth and tight unemployment have bolstered household creation, enabling more people to move out on their own. Robust demand and the slowing pace of inventory growth will support rent increases while keeping apartment vacancy low. At the end of the second quarter, the average effective rent increased 3 percent on an annual basis to $1,390 per month.

Developing Trends

Young people choose to start families later in life. The median age for marriage is nearing 30 years old, approximately three years older than the median age in 2000. This delay is impacting single-family home sales as first home purchases are commonly aligned with a transition to family life.

Home-related retail supported by refinancing activity. Homeowners are electing to stay put rather than swapping out for upgraded homes. Instead, owners are refinancing at low mortgage rates and are dedicating some of the savings to enhance their current homes.

Affordability gap highlights cost benefits of renting. While falling interest rates have decreased the mortgage payment of a median priced home, there is still a $248 difference between that and the average effective rent. This disparity paired with the limited flexibility of homeownership has many would-be buyers choosing to rent.

##

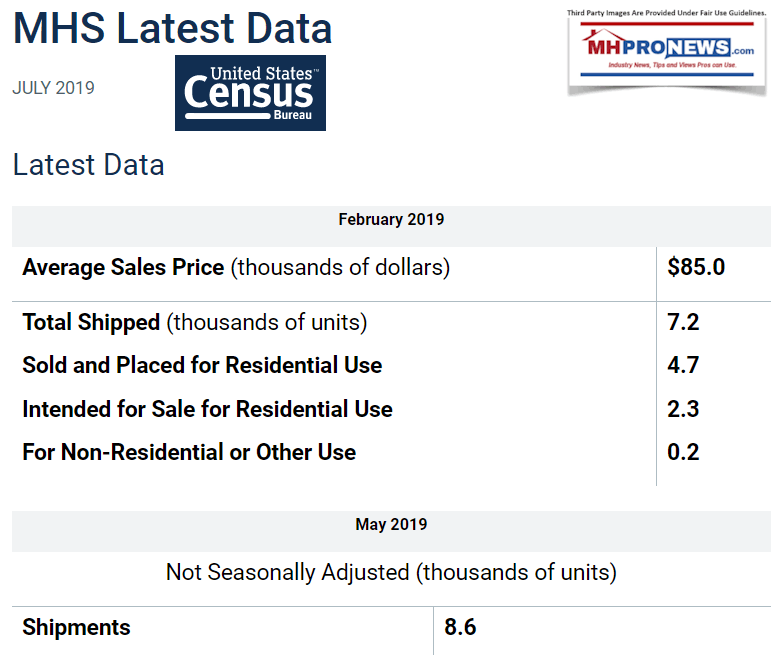

As MMI’s own graphics noted, the cost differential of existing housing, when compared to the investment in a new manufactured home, is quite stunning. While the manufactured home doesn’t include the cost of a home site, that also means that there is a measure of flexibility in selecting a home site.

The latest Census Bureau survey data reflects that cost differential.

These facts are among the reasons why zoning, placement, and development issues must be successfully addressed by the manufactured home industry. See the related reports linked below for more.

But as noted, another upcoming report will reveal why the opportunities to attract more renters to become manufactured homes may be even stronger than data like the above reflects. That’s not a slam on the data, rather, it is looking at a variety of research reports through the lens of growth opportunities for manufactured home sellers and investors. To sign up in seconds for our twice weekly industry-leading headline news, click the link here. You will get notices in your inbox when those profitable opportunities reports are published.

That’s a wrap on this hump-day installment of manufactured home “Industry News, Tips, and Views, Pros Can Use” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

Related Reports:

Click the image/text box below to access relevant, related information.