On the same day that Equity LifeStyle Properties (ELS) late Chairman Samuel “Sam” Zell’s death was reported by one of the corporations that the real estate and investment mogul helped start, Manufactured Housing Properties Inc. (OTC: MHPC) announced their quarterly results. Compared to giant ELS, MHPI is a nascent community aggregator but they are hopeful for their future prospects. In Part I of today’s report is MHPI’s media release, which follows below. Reflections on Zell’s death are found at this link below. Part II has additional information with more MHProNews Analysis and Commentary in Brief. Part III is the signature Daily Business News on MHProNews market report with time saving-insight inspiring left (CNN) right (Newsmax) new source headlines.

Note: MHProNews has no position in this or other reported equities and reporting and analysis should not be construed as an endorsement of a stock.

Part I

Manufactured Housing Properties Inc. Announces Results For the Three Months Ended March 31, 2023

MANUFACTURED HOUSING PROPERTIES INC.

Thu, May 18, 2023 at 11:35 AM EDT·7 min read

MANUFACTURED HOUSING PROPERTIES INC.

Revenues increased by 39%, net loss increased by 168%, and Adjusted EBITDA decreased by 10%.

CHARLOTTE, N.C., May 18, 2023 (GLOBE NEWSWIRE) — Manufactured Housing Properties Inc. (OTC: MHPC), whose principal activities are to acquire, own, and operate manufactured housing communities, today announced operating results for the three months ended March 31, 2023.

Total revenues, net loss and adjusted EBITDA for the quarter ended March 31, 2023 were $4,257,489, $2,117,042 and $959,428, respectively, compared to $3,055,022, $789,690 and $1,071,707, respectively, for the quarter ended March 31, 2022.

As of March 31, 2023, the total portfolio consisted of 57 manufactured housing communities containing approximately 2,723 developed sites and 1410 company-owned, manufactured homes. MHPC acquired two communities during the first quarter of 2023, consisting of 144 lots.

Jay Wardlaw, President of Manufactured Housing Properties Inc. added “We are happy to report another quarter of total revenue increases of 39% which reflects our continued strategic growth strategy. We continue to grow our portfolio and have an additional 1,200 lots under contract that we anticipate acquiring in the 2nd and 3rd quarters of 2023.

Vira Turchinyak, CFO of Manufactured Housing Properties Inc. commented, “We continue to see an upward trend in our revenue with two new acquisitions closed in the first quarter adding to our growing portfolio. We added another 402 pads with our acquisition that closed on April 14, 2023 which brings us over 3,000 sites and an additional approximately 5%(1) in expected revenue on a quarterly basis. Increasing our cash flows and EBITDA continues to be our focus.”

Raymond M. Gee, Chairman and CEO of Manufactured Housing Properties Inc. commented, “We had a strong quarter in growing our total revenue, which reflects the commitment and dedication of our team and our core values in providing affordable housing to our customers while maximizing returns to our investors. The total revenue growth results are in line with the company’s strategy for continued year over year growth.”

Footnotes

(1) To calculate the additional expected revenue, we utilized the property’s rent roll at the date of closing, April 14, 2023, and MHPC’s revenue reported for the three months ended March 31, 2023. Actual additional revenue may vary from this projection.

Reconciliation of Non-GAAP Financial Measures

Manufactured Housing Properties Inc. presents Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) in addition to its Net Income (Loss) reported in accordance with accounting principles generally accepted in the United States (GAAP). EBITDA is a non-GAAP financial measure that differs from Net Income. Non-GAAP EBITDA excludes income tax expense, interest expense and depreciation and amortization, as well as refinancing cost. The table presented below includes a list of items excluded from Net Income (Loss) to reconcile to non-GAAP EBITDA.

| Three Months Ended March 31, | ||||||||

| (Unaudited) | 2023 | 2022 | ||||||

| Net Loss | $ | (2,117,042 | ) | $ | (789,690 | ) | ||

| Adjustments: | ||||||||

| Depreciation & Amortization expense | 1,023,015 | 759,704 | ||||||

| Interest Expense | 1,648,604 | 966,548 | ||||||

| Pref C Dividends Included in Interest Expense on P&L | 404,851 | 135,145 | ||||||

| EBITDA | $ | 959,428 | $ | 1,071,707 | ||||

Management believes non-GAAP Adjusted EBITDA is useful to investors and other users of our financial statements in evaluating operating performance because it provides them with an additional tool to compare business performance across companies and across periods. Management also believes that non-GAAP Adjusted EBITDA is widely used by investors to measure operating performance without regard to items such as income tax expense, interest expense and depreciation and amortization, which can vary substantially from company to company depending upon, among other things, the book value of assets, capital structure and whether assets were constructed or acquired. Non-GAAP Adjusted EBITDA also allows investors and other users to assess the underlying financial performance of our income producing properties before management’s decision to deploy capital. The presentation of non-GAAP Adjusted EBITDA is intended to complement, and should not be considered an alternative to, the presentation of Net Income (Loss), which is an indicator of financial performance determined in accordance with GAAP. In addition, non-GAAP Adjusted EBITDA as presented in this release may not be comparable to similarly titled measures used by other companies.

About Manufactured Housing Properties Inc.

Manufactured Housing Properties Inc., together with its affiliates, acquires, owns, and operates manufactured housing communities. The Company focuses on acquiring and operating manufactured home communities in high growth markets.

Cautionary Statement Regarding Forward-Looking Statements

Any statements contained in this press release regarding us, our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. Investors are cautioned that these forward-looking statements involve uncertainties and risks that could cause actual performance and results of operations to differ materially from those anticipated. The forward-looking statements contained herein represent our judgment as of the date of publication of this press release and we caution you not to place undue reliance on such statements. Factors that could cause actual results to differ from the forward-looking statements include those factors described in the “Risk Factor” section in our annual and quarterly reports filed with the SEC. Our company, our management and our affiliates assume no obligation to update any forward-looking statements to reflect events after the initial publication of this press release or to reflect the occurrence of subsequent events.

About Manufactured Housing Properties Inc.

Manufactured Housing Properties Inc., together with its affiliates, acquires, owns, and operates manufactured housing communities. The company focuses on acquiring and operating manufactured housing communities in high growth markets and is actively seeking to expand its portfolio.

Forward-Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” “will”, “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on our current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” of the reports that we file with the Securities and Exchange Commission (SEC). Forward-looking statements contained in this announcement are made as of this date, and we undertake no duty to update such information except as required under applicable law.

Regulation A Offering

An offering statement relating to our offering of Series C Cumulative Redeemable Preferred Stock has been filed with the SEC. The SEC has qualified that offering statement, which means that we may make sales of the securities described by that offering statement. It does not mean that the SEC has approved, passed upon the merits or passed upon the accuracy or completeness of the information in the offering statement. You may obtain a copy of the offering circular that is part of that offering statement through this link. You can also obtain a copy of the offering circular by contacting J.R. Thacker at Arete Wealth Management, LLC, the placement agent for the Regulation A offering, by calling (888) 690-3580, by email at jrthacker@centerstreetsecurities.com, or write to Arete Wealth Management, LLC at 2 International Plaza Suite 301, Nashville, TN 37217.

Investing in a Regulation A offering is subject to unique risks, tolerance for volatility, and potential loss of investment, that investors should be aware of prior to making an investment decision. Please carefully review the risk factors contained in the offering circular for this offering. For more information about Regulation A offerings, including the unique risks associated with these types of offerings, please click on the SEC’s Investor Alert.

Neither this press release nor any of its content constitutes an offer to sell, solicitation of an offer to buy or a recommendation for any security by us or any third party. The content of press release is provided for general information purposes only and is not intended to solicit the purchase of securities or to be used as investment, legal or tax advice. A securities offering by us is only being made pursuant to the offering circular described above. The content of this press release is qualified in its entirety by such offering circular. Prospective investors are urged to consult with their own, investment, legal and tax advisors prior to making any investment. ##

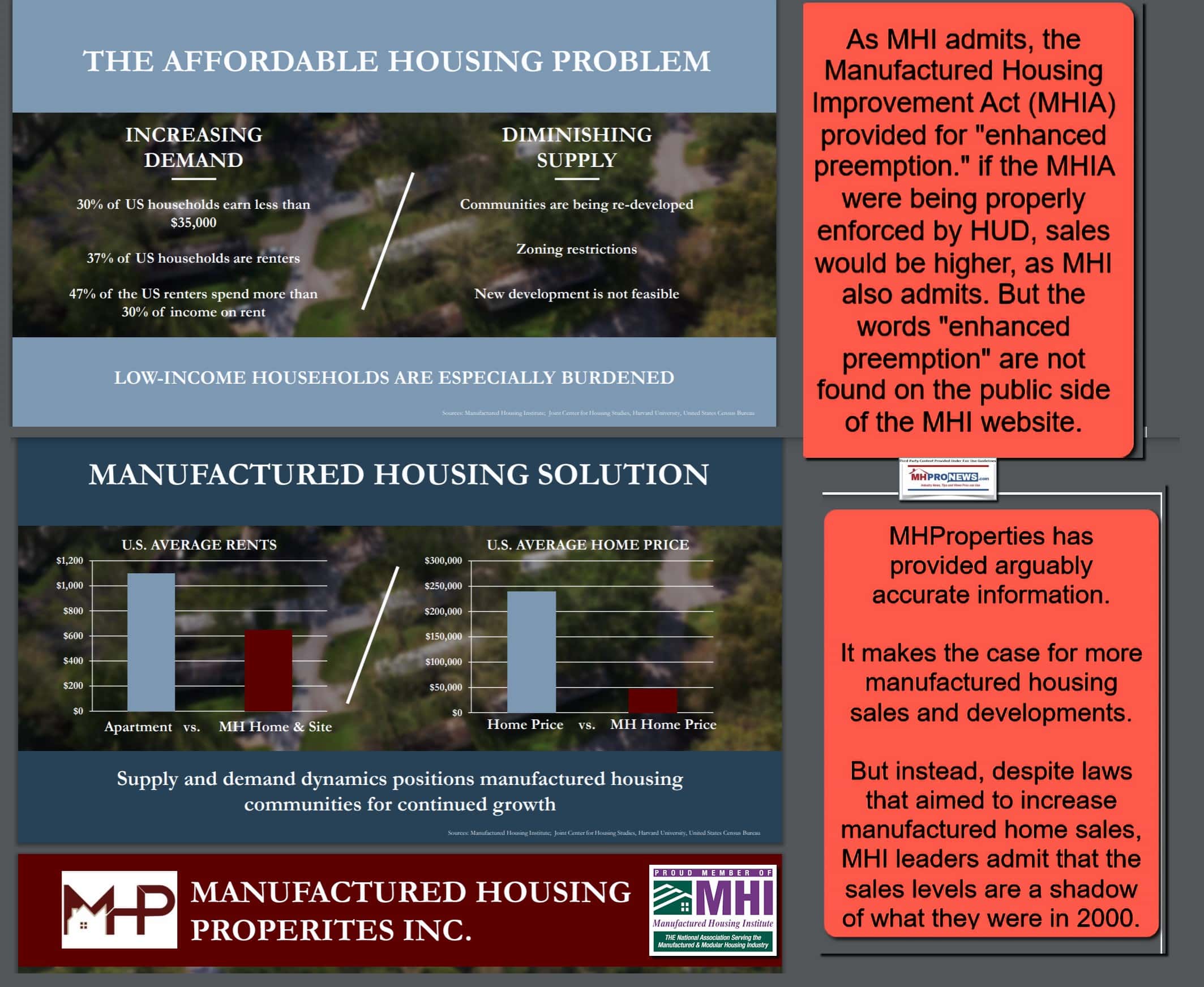

MHProNews Note: the graphic below is not part of their report above, but rather, is part of Part II that follows.

Part II Additional Information with More MHProNews Analysis and Commentary in Brief

MHPC is reportedly a Manufactured Housing Institute (MHI) member. The report above is a reminder that even for an experienced group of professionals, it must not be thought that someone who owns a manufactured home community is automatically guaranteed to make money. If they wanted to be candid, someone could ask fellow MHI members to MHPC – “Frank and Dave” (Frank Rolfe, Dave Reynolds, Impact Communities, Mobile Home U, et al), do they know of people who didn’t make it in the manufactured home community business? They may say, yes. Some of those ‘mobile home parks’ and land lease manufactured home communities that Rolfe, Reynolds, and others buy from are properties that are marginal or are losing money. Someone could ask former “Community Investor” George Allen about the experience of his daughter. MHPC is buying, but they are reportedly not yet profitable.

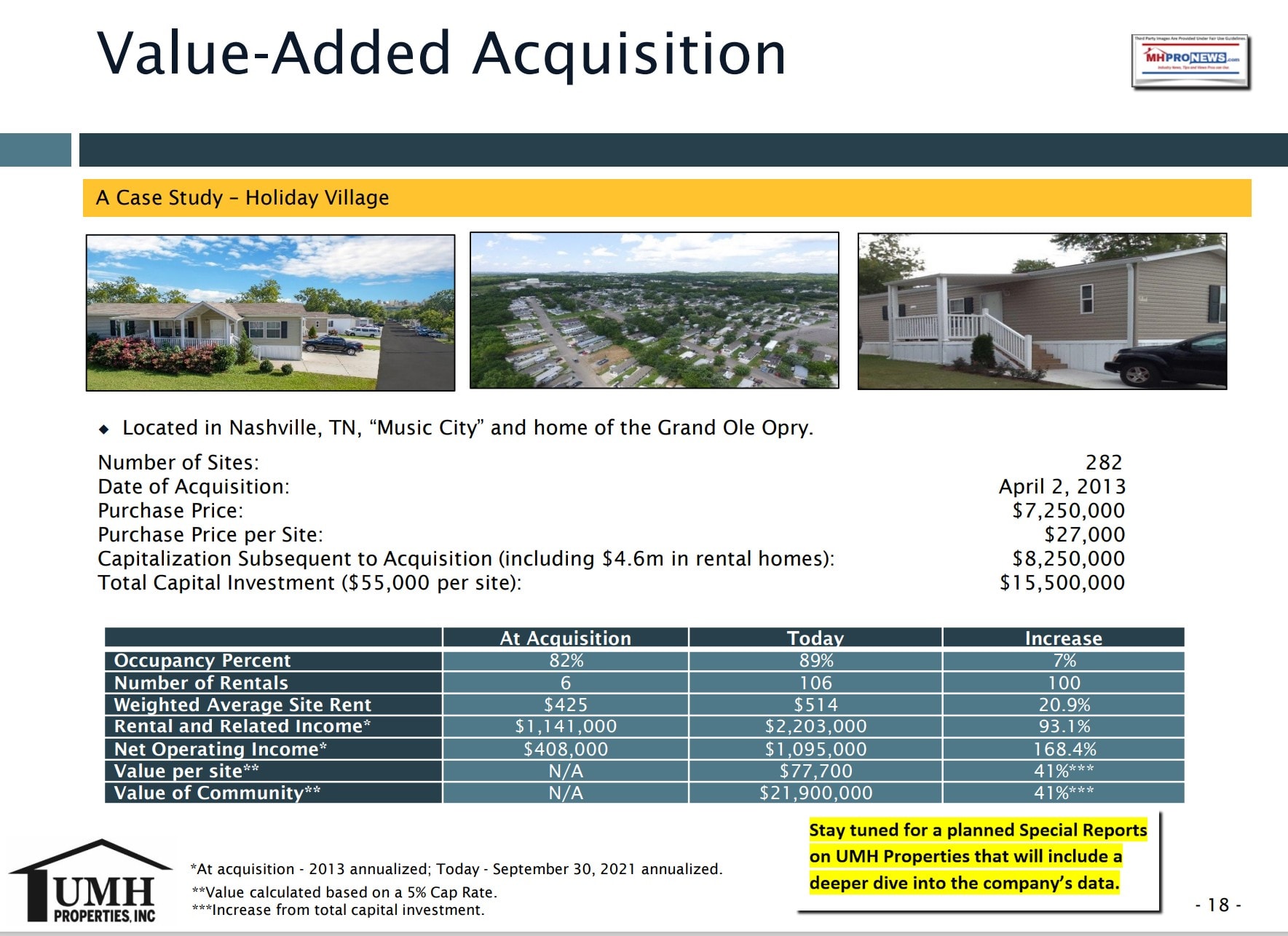

UMH Properties (UMH) and some of the larger real estate investment trusts (REITs) that are operating in the manufactured home community space have bought properties with high vacancies, which are often a sign that the property was not profitable. Through sufficient investment and efforts, once struggling communities can be turned around. So, MHPC’s current financial losses may at some point turn into nice returns, given the proper alignment of efforts and other related circumstances.

Here below (see the above) is are investor relation’s pitch deck slides that reflect key elements of MHPC’s investment thesis.

Operations such as MHPC potentially could, with the correct tweaks to their business model, find and new level of success that would increase profits, build resident satisfaction, attract new investors, and more. For all of his strengths, and weaknesses, too many fail to consider how important this Zell remark is.

There are scores of MHC operators that are running a very similar business model. They are routinely state association and MHI members.

MHPC could be positioned for leadership. Will they stay in the rut, or will they pull a breakout win-win strategy? MHProNews plans to monitor and report as necessary.

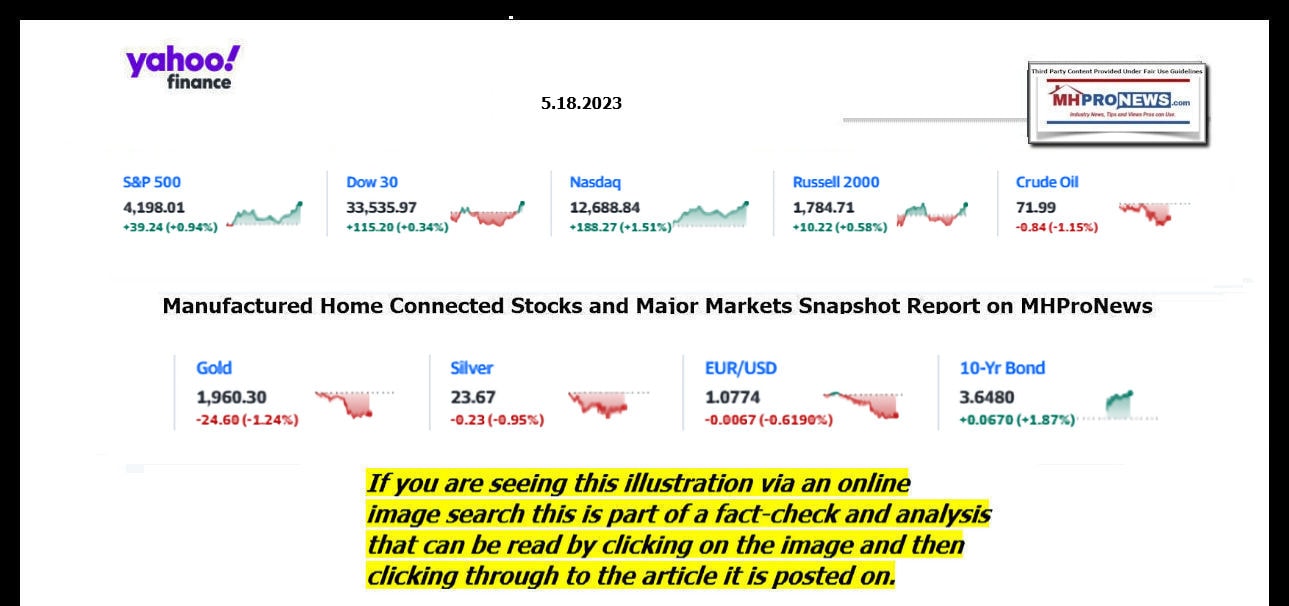

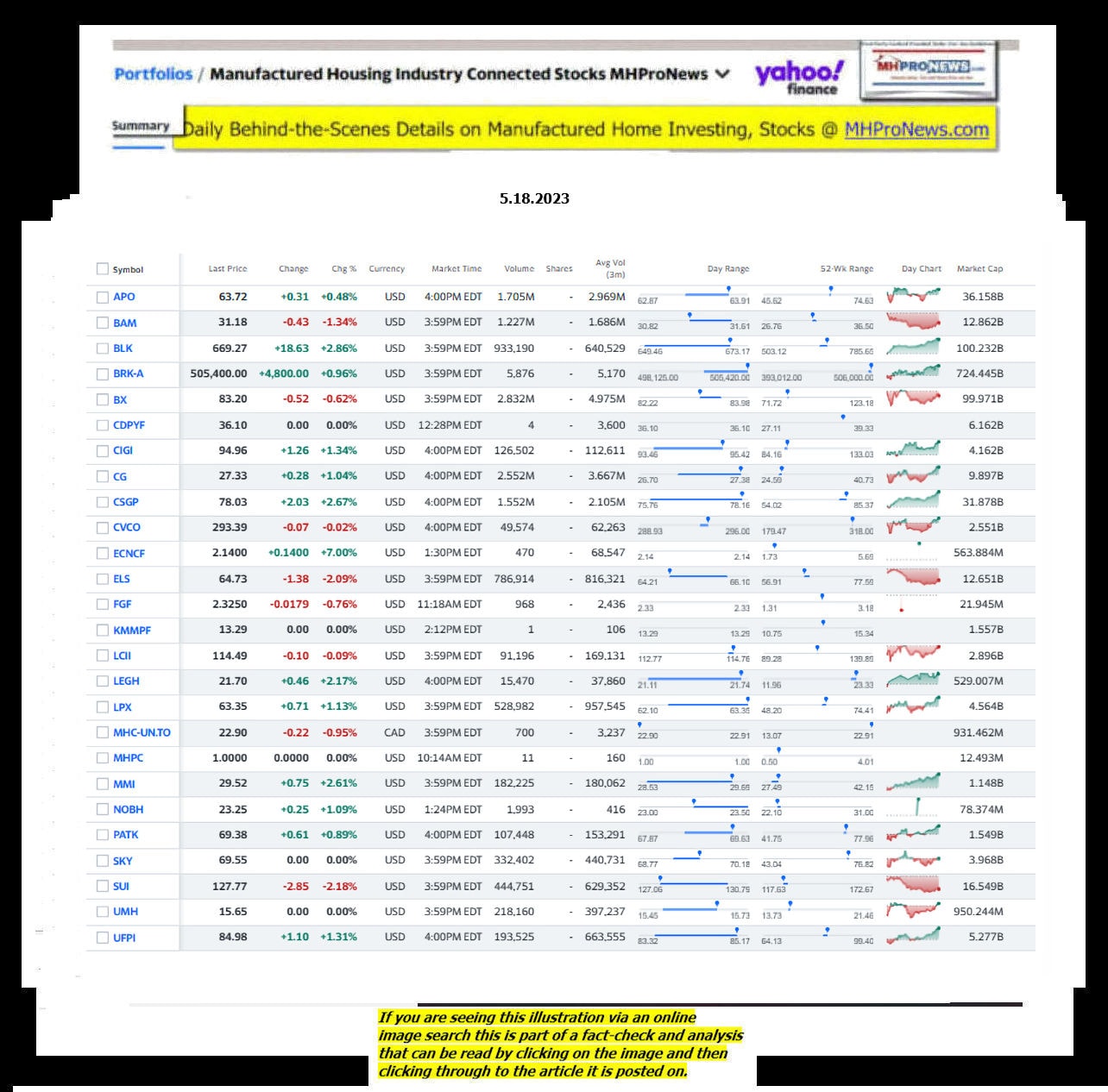

Part III – Daily Business News on MHProNews Markets and Headline News Segment

The modifications of our prior Daily Business News on MHProNews format of the recap of yesterday evening’s market report are provided below. It still includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines. The macro market moves graphics will provide context and comparisons for those invested in or tracking manufactured housing connected equities.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 5.18.2023

- Disney scraps Florida expansion

- The company had planned to build a new Florida campus that was expected to add 2,000 jobs

- Starbucks is changing its ice cubes

- Mortgage rates bounce back up after falling for two weeks

- A growing number of sports bras, shirts and leggings brands found with high levels of toxic chemical, watchdog warns

- Sam Zell, billionaire real estate investor, dead at 81

- Montana governor bans TikTok

- Africa may need its own central medicines agency, says Aspen Pharmacare CEO

- US home prices fall by most in 11 years but sales are down

- Dr Pepper Float ice cream is here

- LIVE UPDATES

- Elizabeth Warren slams regulator who signed off on JPMorgan’s bid for First Republic

- How top execs get a bigger tax break on retirement savings than the rest of us

- Chipmakers look to Japan as worries about China grow

- Xi Jinping says no to ‘street stall economy’ in Beijing

- Deutsche Bank to pay $75 million to settle lawsuit by Epstein accusers

- Initial jobless claims fell last week as fraudulent activity in Massachusetts clouds data

- Chick-fil-A’s first-ever restaurant is closing

- America has an umpire shortage. Unruly parents aren’t helping

- Inflation-weary shoppers flock to Walmart

- Global wheat prices fall as Russia-Ukraine grain deal extended

- Investors shouldn’t ignore this recession indicator

- BT will shed as many as 55,000 workers by 2030

- Manhattan rents reach (another) record high

- Christiane Amanpour voices dissent over Trump town hall, says she had ‘very robust exchange’ with CNN chief

- US senator introduces bill to create a federal agency to regulate AI

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Headlines from right-of-center Newsmax 5.18.2023

- Whistleblower Issues Stark Warning: ‘The FBI Will Crush You’

- From right, FBI whistleblowers Marcus Allen, Steve Friend and Garret O’Boyle, testifying during the House Judiciary Select Subcommittee on the Weaponization of the Federal Government to “examine abuses seen at the Bureau and how the FBI has retaliated against whistleblowers.”

- FBI whistleblower Garret O’Boyle, one of three testifying Thursday before the House Select Subcommittee on the Weaponization of the Federal Government, had a warning for former colleagues who may be thinking about testifying against the agency: Don’t do it. [Full Story]

- Related Stories

- Dershowitz to Newsmax: ‘Probable Cause’ for FBI Reform Clear

- Dershowitz: FBI Not Anti-GOP, It’s ‘Anti-Trump’

- Dems Push Back: Hearing a Political Play for Trump

- Committee Report: FBI Whistleblowers Exposed Abuses

- Jim Jordan: FBI Targeted Whistleblowers, Americans

- Dershowitz: ‘Probable Cause’ for FBI Reform ‘Very Clear’

- Dershowitz: FBI Not Anti-GOP, It’s ‘Anti-Trump’ | video

- T. McFarland: Biden Must ‘Instill Confidence’ at G-7 | video

- Comer: FBI Trying to Obstruct Congress | video

- Waltz: Republicans Fulfilling Campaign Vows | video

- Reschenthaler: FBI Needs ‘Accountability’ | video

- Johnson: Durham Exposes Long Line of Corruption | video

- Nehls: Blame Biden for Migrant Deaths | video

- Jeff Clark: ‘Accountability’ Must Follow Durham | video

- NY Times: Feinstein’s Illness More Serious Than Stated

- Dianne Feinstein, D-Calif., who returned to Washington in May after a months-long absence due to shingles, suffered more complications from the illness than were publicly disclosed, The New York Times reported Thursday…. [Full Story]

- Montana Judge Blocks State Abortion Ban

- A Montana judge on Thursday temporarily blocked the state from [Full Story]

- Whistleblowers Testify on FBI’s Retaliation Methods

- FBI whistleblower Garret O’Boyle, one of three testifying before the [Full Story]

- Jim Jordan: FBI Targeted Whistleblowers, Americans

- Dems Push Back: Hearing a Political Play for Trump

- Committee Report: FBI Whistleblowers Exposed Abuses

- Newsmax Beats CNN Again in Ratings for Key Shows

- It happened again. Newsmax topped CNN in the ratings during Tuesday [Full Story]

- Hunter Biden Associates May Testify in Child Support Case

- Hunter Biden’s business partners and associates are set to testify in [Full Story]

- MLB Team Drops Plan to Honor Anti-Catholic ‘Hate Group’

- The Los Angeles Dodgers, apparently realizing they were about to [Full Story] | Platinum Article

- Donohue: LA Dodgers Strike Out by Rewarding Anti-Catholic Hate Speech

- Disney Pulls Plug on $1B Florida Complex

- Walt Disney Co. is scrapping a $1 billion office complex in Florida [Full Story]

- Ukraine Claims 29 of 30 Russian Cruise Missiles Shot Down

- Russia fired 30 cruise missiles against different parts of Ukraine [Full Story]

- Retired Green Beret Killed in Eastern Ukraine |video

- Russia Expects Progress After Renewing Grain Deal

- China Says Ukraine Envoy Met with Zelenskyy During Talks in Kyiv

- Study Finds 2 Doses of Mpox Vaccine More Effective

- The U.S. Centers for Disease Control and Prevention is urging people [Full Story]

- Top Harvard Expert: Putin Will Use Nuclear Weapon in Ukraine

- With a looming Ukrainian counteroffensive that could prove formidable [Full Story] | Platinum Article

- 63 Percent in Oregon Want Drugs Criminalized Again

- Oregon residents are reconsidering their vote for decriminalizing the [Full Story]

- Justice Kagan in Scornful Dissent Over Sotomayor Ruling

- Supreme Court Justice Elena Kagan published on Thursday her scornful [Full Story] | video

- Texas House Approves Collegiate Trans Athlete Bill

- The Texas House of Representatives gave final approval Thursday to a [Full Story]

- Andrew Cuomo: Should Have Supported Percoco

- A week after the U.S. Supreme Court overturned the bribery conviction [Full Story]

- Despite Vows to Impeach Mayorkas, House GOP Can’t Act Yet

- Despite months of repeated calls to impeach Homeland Security [Full Story] | Platinum Article

- Senate Dems: Use 14th Amendment to Avoid Default

- Senate Dems: Use 14th Amendment to Avoid Default

- A group of U.S. Senate Democrats called on President Joe Biden to [Full Story]

- Sources: DeSantis to File Election Papers Next Week

- Florida Gov. Ron DeSantis is expected to officially enter the 2024 [Full Story]

- San Francisco Office Values Collapse 75%

- Office values in San Francisco have plunged 75% on a per-square foot [Full Story]

- WHO: COVID Shots Should Target Only XBB Variants

- A World Health Organization (WHO) advisory group on Thursday [Full Story]

- CNN’s Amanpour: Disagree With Way Trump Town Hall Handled

- CNN veteran journalist Christiane Amanpour during an address to [Full Story]

- Supreme Court Hands Twitter a Win, Protects Companies From Terror Suits

- The U.S. Supreme Court on Thursday refused to clear a path for [Full Story]

- Related

- US Supreme Court Tosses Challenge to Internet Legal Shield

- Johnson: Dems’ Arguments on Whistleblowers Obscure Hearing

- Arguments from Democrats on the House Select Subcommittee on the [Full Story]

- Accused Pentagon Leaker Warned Over Mishandling of Classified Info

- Superiors of the Massachusetts Air National Guard member charged with [Full Story]

- Queen Elizabeth II’s Funeral Cost UK $200 Million

- Queen Elizabeth II’s funeral and lying-in-state last year cost [Full Story]

- Bill Will Require Cars to Be Sold With Free AM Radios

- A bipartisan group of lawmakers is seeking to require automakers to [Full Story] | video

- Rafael Nadal Pulls Out of French Open, Weighs Retirement

- Rafael Nadal announced Thursday that he is pulling out of the French [Full Story]

- Baldwin Cast in Film About 1970 Kent State Shootings

- Alec Baldwin has his next project lined up days after filming wrapped [Full Story]

- Girl, 8, Dies in Border Patrol Custody in Harlingen, Texas

- An 8-year-old girl died Wednesday in Border Patrol custody, [Full Story]

- Warhol Estate Loses Supreme Court Case Over Prince Art

- Warhol’s estate lost its U.S. Supreme Court copyright fight with [Full Story]

- GOP Rep. Luna: Expel Schiff From Congress

- Anna Paulina Luna, R-Fla., is calling for the expulsion of Rep. [Full Story]

- IRS Flags 1.1 Million Tax Returns for ID Fraud

- The IRS flagged 1.1 million 2023 tax returns by early March as [Full Story]

- Finance

- ChatGPT Makes Its Debut on Apple iPhones

- ChatGPT is now a smartphone app, which could be good news for people who like to use the artificial intelligence chatbot and bad news for all the clone apps that have tried to profit off the technology…. [Full Story]

- A Government Default Could Be Worse Than a Shutdown

- VP Harris, Brainard Warn of Recession if US Defaults

- Google, WA Reach $39.9 Million Privacy Settlement

- Meta Announces AI Training, Inference Chips

- More Finance

- Health

- Gallup: 17 Percent of Adults Being Treated for Depression

- According to a recent Gallup survey, clinical depression rates in America have risen noticeably, exacerbated by the COVID-19 pandemic, and the social isolation and job losses it spawned…. [Full Story]

- Fatty Muscles More Harmful to Health Than Obesity

- Teen Vaping Linked to Cannabis Use, Binge Drinking

- How to Protect Against Ticks During Peak Lyme Season

- Study: Mpox Virus Survives on Surfaces for Days

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

2022 was a tough year for many stocks. Unfortunately, that pattern held true for manufactured home industry (MHVille) connected stocks too.

See the facts, linked below.

====================================

Updated

-

-

- NOTE 1: The 3rd chart above of manufactured housing connected equities includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry finance lender.

- NOTE 2: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE 3: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

- Note 4: some recent or related reports to the REITs, stocks, and other equities named above follow in the reports linked below.

-

2023 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

- Manufactured housing, production, factories, retail, dealers, manufactured home, communities, passive mobile home park investing, suppliers, brokers, finance, financial services, macro-markets, manufactured housing stocks, Manufactured Home Communities Real Estate Investment Trusts, MHC REITs.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.