Business-financial news and views site Barron’s in a recent report ran a headline that said in part that: “…Suit Against Berkshire Challenges Buffett’s Good Guy Image.” Per Bing AI, the late Charlie Munger – Buffett’s longtime vice chairman at Berkshire who died on 11.28.2023 – said about Greg Abel, “Munger has praised Abel’s business acumen and his ability to learn quickly.” “Abel is known for being a micro-manager and is highly regarded among his colleagues at Berkshire Hathaway, including Buffett’s late right-hand man, Charlie Munger.” Also according to Bing AI, which cited left-leaning Wikipedia: “Barron’s is an American weekly magazine/newspaper published by Dow Jones & Company, a division of News Corp. Founded in 1921 by Clarence W. Barron as a sister publication to The Wall Street Journal, Barron’s covers U.S. financial information, market developments, and relevant statistics. Each issue provides a summary of the previous week’s market activity as well as news, reports, and an outlook on the week to come. The publication is aimed at investors and financial professionals, and it provides insights and analysis on stocks, bonds, commodities, and other investment vehicles 1.”

As numbers of manufactured home industry professionals know, Warren Buffett led Berkshire Hathaway (BRK) is a conglomerate that owns companies outright that include several brands involved in manufactured housing. Additionally, Berkshire has billions of dollars in investments in several publicly traded firms, per Bing AI, such as Apple Inc., Bank of America, Coca-Cola Company, American Express Company, and Wells Fargo & Company among others. Wells Fargo, per CFPB data, has been active in manufactured home mortgage lending, among other lending and investments pursuits. Wells Fargo has also been dogged for years by concerns raised over its business practices.

More specifically among the manufactured home industry firms owned by Berkshire?

Note that among the sources cited by Bing AI above for that information on Berkshire involvement in manufactured housing was MHProNews.

This report will lay out several facts that involve Berkshire Hathaway (BRK), including points directly related to manufactured housing.

But this report and analysis will also explore several items beyond the scope of the manufactured housing industry. Why veer beyond the normal focus for MHProNews? In part to paint a more complete picture for manufactured home industry professionals about the parent company to the largest producer and retailer of HUD Code manufactured homes, namely, Clayton Homes.

For example, when Buffett dies, by several indications Greg Abel could well take over. What will happen to Buffett’s decentralized notions and his moat philosophy? How might that impact manufactured housing?

Those are important concerns for a wide range of manufactured housing industry professionals to know.

More on that in Part II of this report, which will provide additional information with more MHProNews analysis and commentary.

Part I. Buffett’s “Good Guy Image?” Litigation and Business Activities Involving Clayton Homes owned Berkshire Hathaway and Other Berkshire Owned Brands

In response to an inquiry about litigation involving Berkshire Hathaway by this writer for MHProNews, Bing AI said the following.

- National Association of Realtors et al. v. Berkshire Hathaway, Inc. et al.: The National Association of Realtors and some residential brokerages, including units of Warren Buffett’s Berkshire Hathaway, were found liable for nearly $1.8 billion in damages after determining they conspired to keep commissions for home sales artificially high. The lawsuit covered home sales that took place between April 2015 to June 2022. The case is being heard in Missouri and the docket number is not mentioned in the search results 12.

- Haslam family v. Berkshire Hathaway: The Haslam family has filed a lawsuit against Warren Buffett’s Berkshire Hathaway, claiming that the company is using improper accounting practices that are driving down the value of the remaining Haslam stake in Pilot truck stops. The case is being heard in an unspecified court and the docket number is not mentioned in the search results 3.

- Berkshire Hathaway subsidiaries accused of denying, delaying payments: Dozens of lawsuits allege the Berkshire-owned companies wrongfully delay or deny compensation to cancer victims and others to boost Berkshire’s profits. The case is being heard in an unspecified court and the docket number is not mentioned in the search results 4.

- Chase Manufacturing Inc. v. Johns Manville Corp.: A federal appeals court has revived an antitrust lawsuit against Johns Manville, a unit of billionaire Warren Buffett’s Berkshire Hathaway, of monopolizing the market for calcium silicate, a substance used in thermal pipe insulation. The case is being heard in the Tenth Circuit U.S. Circuit Court of Appeals and the docket number is not mentioned in the search results 256.

I hope this helps. Let me know if you have any other questions. …”

Some of this next information per Bing AI appears to be dated and/or inaccurate (for example, per NASDAQ, Berkshire owned: “more than 915 million shares it has, Berkshire currently owns a 5.9% stake in Apple.”) With that cautionary note by MHProNews, the following is bullets are pulled from a reply per Bing AI. It is useful to the extent that it illustrates the diverse reach of Berkshire.

- Apple Inc.: Berkshire Hathaway owned 1.5% of Apple’s outstanding shares as of June 30, 2023 12.

- Bank of America Corporation: Berkshire Hathaway owned 11.9% of Bank of America’s outstanding shares as of June 30, 2023 12.

- Coca-Cola Company: Berkshire Hathaway owned 9.3% of Coca-Cola’s outstanding shares as of June 30, 2023 12.

- American Express Company: Berkshire Hathaway owned 18.9% of American Express’s outstanding shares as of June 30, 2023 12.

- Wells Fargo & Company: Berkshire Hathaway owned 6.0% of Wells Fargo’s outstanding shares as of June 30, 2023 …”

Per left-leaning CNN was the following.

“Warren Buffett’s Berkshire Hathaway-owned HomeServices of America and two subsidiaries, as well as Keller Williams Realty, were among the other real estate groups the jury found guilty of conspiring.” “”A Missouri jury on Tuesday found the National Association of Realtors, a real estate industry trade group, and some residential brokerages liable for nearly $1.8 billion in damages after determining they conspired to keep commissions for home sales artificially high. The lawsuit covered home sales that took place between April 2015 to June 2022.”

According to Barron’s: “It filed a lawsuit against Berkshire filed in late October. In a counterclaim to Pilot Corp.’s lawsuit, Berkshire said that Haslam “secretly promised massive side payments, from his own pocket” to “high-level PTC employees to induce them to prioritize PTC’s short-term 2023 earnings over PTC’s long-term value.”

Reuters reported on 8.21.2023 that: “A federal appeals court on Monday revived an antitrust lawsuit accusing Johns Manville, a unit of billionaire Warren Buffett’s Berkshire Hathaway (BRKa.N), of monopolizing the market for calcium silicate, a substance used in thermal pipe insulation.” (Bold emphasis added above and below by MHProNews).

“Writing for a three-judge appeals court panel, Circuit Judge Gregory Phillips found sufficient evidence that Johns Manville coerced distributors as it exercised monopoly power.”

Phillips also cited an email just after TPS entered the market, in which Johns Manville told sales staff they might need to “bring the sword” and warn distributors that their relationship might change “significantly” if they bought TPS’ product.

“Viewing the evidence most favorably to TPS, we see JM as leaving its distributors with an all-or-nothing choice: stop doing business with TPS or lose access to JM’s enormous thermal-insulation inventory,” Phillips wrote.

Also from that Reuters report: “Berkshire owns dozens of businesses including the BNSF railroad and Geico car insurance, and stocks such as Apple (AAPL.O). It bought Johns Manville for about $1.8 billion in 2001. The case is Chase Manufacturing Inc v Johns Manville Corp, 10th U.S. Circuit Court of Appeals, No. 22-1164.”

In a different case involving a Berkshire Hathaway brand, Reuters reported on 10.26.2023 the following.

The family, including Cleveland Browns football team owner Jimmy Haslam, sold Berkshire a 38.6% Pilot stake for $2.8 billion in 2017 and another 41.4% stake for $8.2 billion in January. It said it has a right to sell the remainder under the same valuation methods on Jan. 1, 2024.

According to a complaint made public on Thursday in Delaware Chancery Court, Berkshire has unilaterally and without consent adopted “pushdown” accounting rules that artificially reduce Pilot’s earnings before interest and taxes, and “grossly” reduce how much the Haslams would receive if they sold their remaining stake.

The complaint said the family objected repeatedly, but Buffett refused to commit not to use pushdown accounting.” …

Pilot is based in Knoxville, Tennessee, and has approximately 800 locations in the United States and Canada.” …

The case is Pilot Corp v Abel et al, Delaware Chancery Court, No. 2023-1068-MTZ.

According to sources to MHProNews, there were indications that Kevin Clayton, CEO of Clayton Homes, may have played a role in bringing Pilot to Berkshire. With that in mind, here is an inquiry by this writer for MHProNews to Bing AI.

> “There are sources that have indicated that Kevin Clayton may have played some part in the Pilot J deal with Berkshire Hathaway. Can you elaborate on that?”

In a story by Andrew Bary for Barron’s via MSN are the following pull-quotes.

So it comes as a surprise that truck-stop operator Pilot is suing Berkshire Hathaway (ticker: BRK.B), claiming that Buffett’s company is using accounting adjustments to potentially shortchange the family that formerly controlled it.

Knoxville-based Pilot was owned by the Haslam family until it sold an 80% stake to Berkshire Hathaway in two stages in 2017 and early 2023 for a total of $11 billion, with $8.2 billion paid in the second tranche for 41.4% of the business.

It was Berkshire’s largest purchase of a private company during Buffett’s 62 years at the helm.

The Haslam family, which also owns a majority stake in the Cleveland Browns pro football team, now holds 20% of Pilot, and the suit involves a dispute about how to value that remaining interest. The family has the right to sell that 20% Pilot stake to Berkshire Hathaway starting on Jan. 1, 2024, for a 60-day period under what’s known as a put agreement.

Pilot suggests a fair price for the remaining 20% is around $3.2 billion, the same valuation that Berkshire Hathaway assigned to the remaining stake in its second quarter 10-Q.

But Pilot alleges in its lawsuit filed in Delaware last week that Berkshire Hathaway is positioning itself to pay less by changing the accounting for Pilot’s financial results without its consent.

Berkshire Hathaway didn’t respond to a request for comment.” …

The suit names Berkshire Hathaway Vice Chairman Greg Abel, Buffett’s heir apparent as CEO, as well as four other executives at Berkshire Hathaway who are on the seven-member Pilot board.

After the family was rebuffed by Abel, who was installed as the chairman of Pilot in March, Pilot’s 92-year-old founder, Jim Haslam, spoke directly to Buffett by phone in mid-October in an effort to resolve the matter but was unsuccessful, the suit says.” …

Buffett and Vice Chairman Charlie Munger have positioned Berkshire Hathaway as a benevolent acquirer of private companies that often leaves management in place, doesn’t slash costs and jobs, and holds the businesses indefinitely. Berkshire Hathaway is decentralized with the company historically doing little meddling at subsidiaries.

Buffett has been quoted as saying: “You can sell it to Berkshire, and we’ll put it in the Metropolitan Museum; it’ll have a wing all by itself; it’ll be there forever.” He contrasted that with the approach of private equity, which he likened to a “porn-shop operator.”

The Haslams were eager to sell to Berkshire. “Because of their respect for Berkshire, the Haslam family chose to engage seriously only with Berkshire as a possible acquirer of PTC (Pilot),” the suit states.

The suit could make private businesses less willing to sell to Berkshire Hathaway. One issue is that sellers know that Buffett won’t be around indefinitely, and that they will need to deal with his likely successor, Abel, who has taken a more assertive approach to running Berkshire Hathaway’s subsidiaries than Buffett.

In a CNBC interview earlier this year, Buffett said: “Our managers like autonomy, but they also get lonesome. I give ‘em the autonomy, but Greg gives ’em both [autonomy and supervision], and he gets somewhat more discipline out of the managers with our hands-off-type operation. He gets more discipline than I would get.” When asked if it was a “good-cop, bad-cop” situation with himself and Abel, Buffett said “No.”

Pilot could find support for its position from Buffett’s own words. In his 2015 annual letter, Buffett wrote that he thought it was appropriate to exclude certain noncash amortization from acquisitions when evaluating Berkshire Hathaway’s financial results.”

Part II – Additional Information with More MHProNews Analysis and Commentary

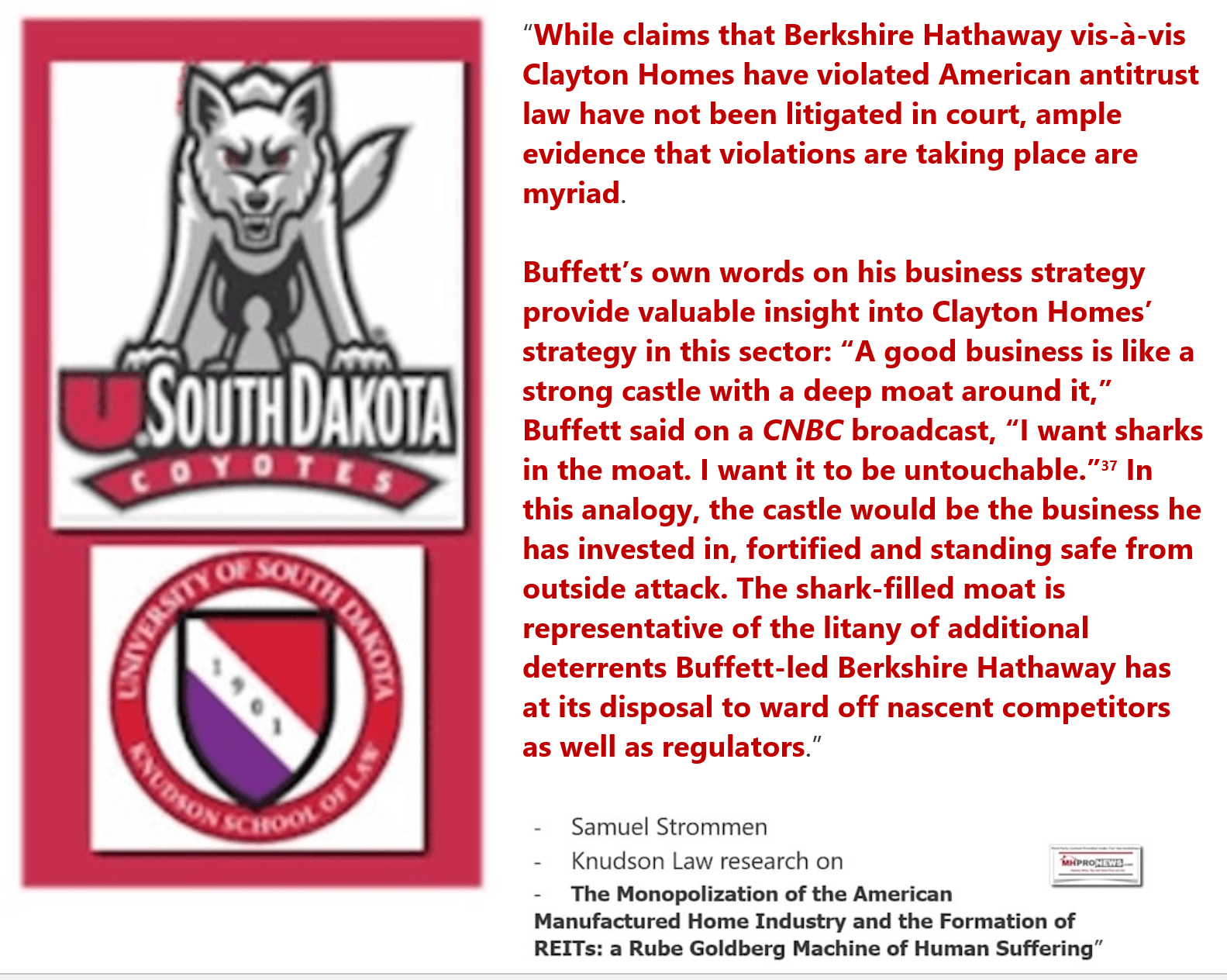

Anyone who has been paying close attention to the facts, evidence, analysis and commentary on MHProNews or MHLivingNews in recent years would not be surprised by any of these developments.

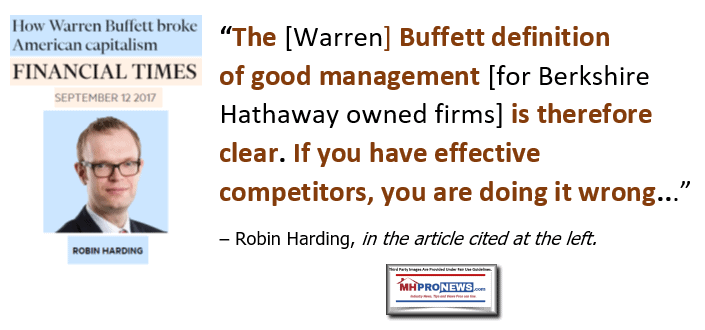

While Buffett has long cultivated a ‘good guy’ image, arguably using tools such as so-called ‘philanthropy’ to buttress his character, a closer look at the evidence reveals that Buffett often says things that may sound good, but then may not in fact do those things himself. The terminology that may be used by MHProNews in such scenarios include paltering, posturing, and propaganda. Here is what investment analyst Michael Lebowitz had to say about Buffett after he explored Buffett’s methods.

MHProNews recently reported anew on the deal that made Clayton Homes part of the still-growing Berkshire Hathaway empire. It also involved litigation, in a suit that Kevin Clayton referred to as “ugly.”

MHLivingNews and MHProNews have repeatedly brought to the attention of manufactured home industry readers and others peering into the otherwise perplexing world of manufactured housing how Buffett’s so-called “philanthropy” is more akin to the notions of philanthro-feudalism, philanthro-capitalism, and the philanthro-industrial complex. Who says? See the discussion with Buffett’s son Peter Buffett in the reports which pack far more evidence, shown below.

> “What ties did former Manufactured Housing Institute (MHI) president and CEO Richard Dick Jennison have with the brick industry and/or Acme Brick?”

Learn more:

With some prompting, additional follow up questions finally brought this inquiry and response.

> “Is Acme Brick owned by Berkshire Hathaway? Is Acme Brick a larger firm in the Brick industry? Is Acme Brick a member of the Brick Industry Association?”

Learn more:

What Good Guy Image?

When their former president and CEO Richard “Dick” Jennison was repeatedly exposed by MHProNews/MHLivingNews reporting, eventually the Manufactured Housing Institute (MHI) moved on to what they dubbed MHI 2.0.

But MHI 2.0 CEO Lesli Gooch, Ph.D., has her own image issues to deal with. Perhaps akin to Buffett’s burnishing his credential with so-called “philanthropy” – that when closely examined benefits his firm and presumably cuts down on income tax payments – Gooch has been ‘nominated’ for awards. But even if she gets one, how does that change the various evidence-based allegations against her or the organization she leads?

Berkshire owned-Clayton has long had a board position at MHI. As the report and analysis linked immediately above details, Berkshire brands wield significant influence at MHI.

MHProNews has provided several opportunities for Berkshire Hathaway linked attorney Ron Olson to respond to concerns related to alleged “felony” antitrust and other concerns in manufactured housing. MHI linked attorneys have also been given repeated opportunities to respond to the growing evidence.

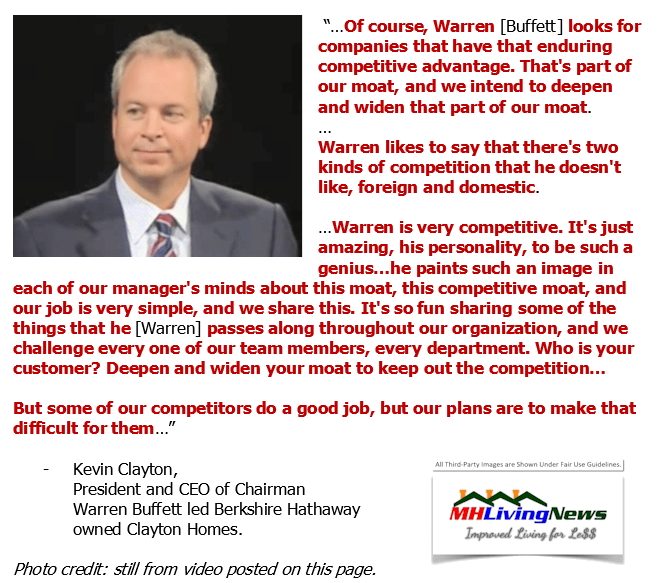

Kevin Clayton is on record saying that they intended to make it hard on their competitors, and cited Warren Buffett’s moat philosophy.

What this relatively focused survey of 2023 litigation and other insights reflects is this. While Buffett-led Berkshire has cultivated what Barron’s called a “good guy image,” the reality is something quite different. A follow up report will dive deeper into these issues. That follow up may be published as soon as this week. Stay tuned for those details from the runaway #1 leader in manufactured housing “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.”© ##

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’