Noteworthy headlines on CNNMoney – IRS impersonators accused of stealing from elderly. 401(k), IRA contribution limits won’t go up in 2017. Murdoch discusses Fox News contract talks. Europe rescues its huge free trade deal with Canada.

Some bullets from MarketWatch – CenturyLink in advanced merger talks with Level3 Communications. U.S. stocks choppy as defensive sectors sell off, earnings mixed. Oil logs first gain in 4 sessions on fresh hopes for an output deal. Gold ends higher as economic data raises uncertainty for interest-rate hike.

Oil up 0.87%. Gold up 0.28.

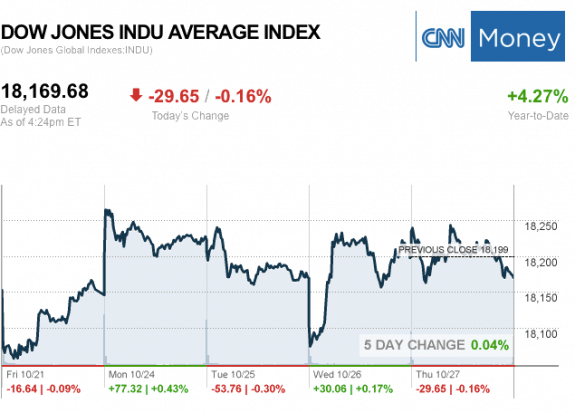

Three Major U.S. Market Tickers and closing numbers at the bell today…

S&P 500 2133.04 -6.39 (-0.30%)

Dow JIA 18,169.68 –29.65 (-0.16%).

Nasdaq 5,215.97 –34.29 (-0.65%).

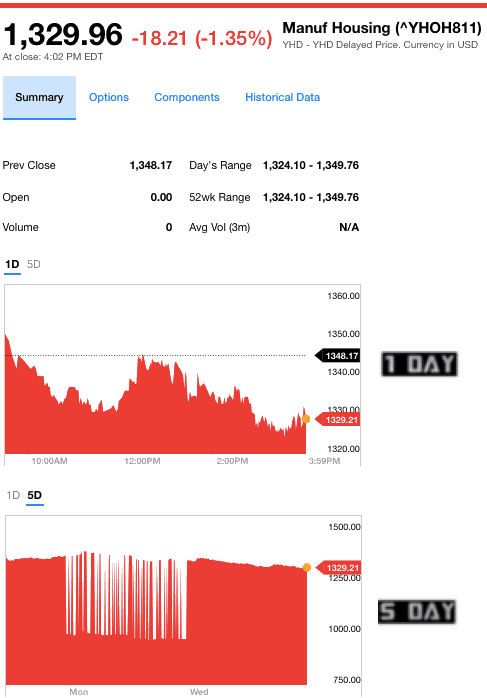

The MH Industry – Today’s Risers and Sliders

Top two gainers for the day were Berkshire Hathaway (BRK/A) and Louisiana-Pacific Corp (LPX). The top two sliders for the day were Drew Industries Inc. (DW) and Patrick Industries Inc. (PATK). Killam and Deer Valley held steady, as those stocks are only being bought/sold periodically. (Notice: ALWAYS look at the date on the Bloomberg chart below, as some stocks aren’t traded daily, etc.).

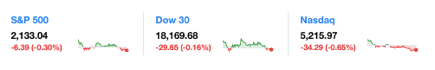

Manufactured Housing Composite Value Ticker

Note: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.