If you listen to Senators Bernie Sanders, Elizabeth Warren, Secretary Hillary Clinton or her supporters – such as Warren Buffett – you’d think that the rich aren’t paying enough in taxes. Their answer?

Raise them.

Tax the rich sounds easy, especially when there are fewer of them to vote against the tax hike.

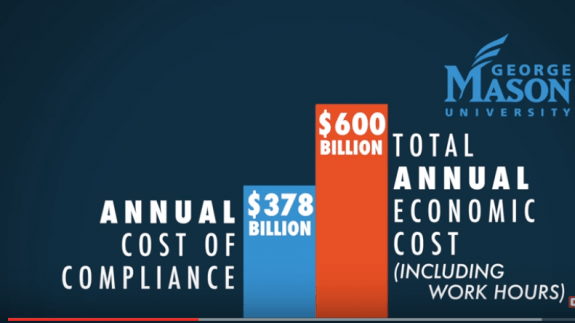

On the other side are those who believe that “The power to tax is the power to destroy,” as Supreme Court Justice John Marshall famously said.

Raise taxes too much, and capital flees. The evidence?

Just look at the trillions parked overseas by big U.S. companies, say tax reform proponents, and you’ll see their point.

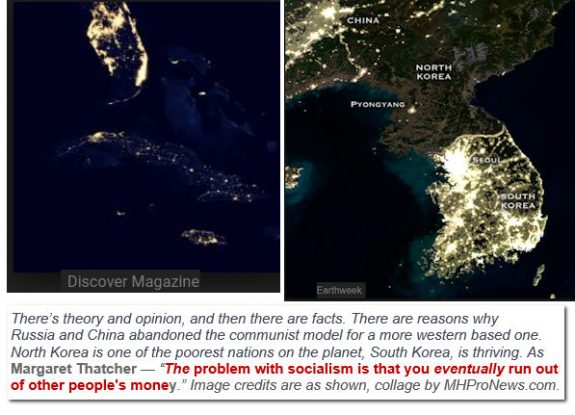

In fact, Sanders – who famously honeymooned in the Soviet Union – should realize that those socialistic programs ultimately fail. A look at a satellite photo of Florida and Cuba, or North and South Korea, makes those points.

Resource rich Venezuela, after a decade of socialist leadership, is teetering on the edge of political and economic chaos. That, say pro-free market, limited-government believers, is a current example of what America faces if changes aren’t made under the Trump Administration.

Yesterday, the Daily Business News reported on concerns that Congressman Louie Gohmert (R-TX) expressed that forces on the left, and also from ‘the right’ – the GOP – were threating tax reform.

Prior GOP candidate for president, publisher and billionaire Steve Forbes has sounded the warning on taxes this week too.

In the two videos on this page, one tees up his general thinking on where tax reform should ultimately head, and why.

Forbes promotes the flat tax as the fairest, most pro-business, pro-jobs, pro-growth way to drain the swamp, even before that term was coined or mentioned.

The second video with Forbes expresses his concerns about tax reform.

For fair and balance, we share the video with Bernie Sanders, who lays out his vision.

Compare, Think

“We Provide, You Decide.” © See which vision makes the most sense in the real world. Ask yourself, why would so many billionaires say they support tax hikes, and then watch as they shift their wealth to foreign countries with lower taxes?

Why do so many of the ultra-rich – like Facebook’s founder – and soon to me factory built housing entry? – Mark Zuckerberg – promote “universal income,” and then use tax loopholes to minimize his own taxes and maximize his own power and wealth?

RC Williams called that “The Evolution of Poverty Pimping.”

There is fake news in manufactured housing, and fake news about manufactured housing, reported RC Williams.

The taxation issue is one that it is time to dig into and deeply understand.

MHProNews will be bringing you periodic stories as part of the effort to get to the root causes of what is holding back not only our industry, but also the majority of Americans. Buckle your seat belts, and hang on for the ride. ## (News, analysis, commentary.)

ICYMI – Buffett focused part of Berkshire Hathaway’s annual meeting, is linked here.

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)