The Biden Administration is apparently named in the transcript below due to the recently announced White House initiative. Biden-Inflation and supply chains are background topics in the Seeking Alpha (SA) transcript of the latest Skyline Champion (SKY) earnings call. Their transcript, complete with audio, is available at this link here. The transcript below includes highlighting by MHProNews not found in the original on SA, which should prove useful to manufactured housing professionals, investors, researchers, and others. The transcript will be followed by additional information, more MHProNews analysis, and commentary.

Skyline Champion Corporation’s (SKY) CEO Mark Yost on Q4 2022 Results – Earnings Call Transcript

May 24, 2022 1:36 PM ET Skyline Champion Corporation (SKY)

Skyline Champion Corporation (NYSE:SKY) Q4 2022 Earnings Conference Call May 24, 2022 9:00 AM ET

Company Participants

Mark Yost – President and CEO

Laurie Hough – Executive Vice President and CFO

Conference Call Participants

Greg Palm – Craig-Hallum Capital Group

Daniel Moore – CJS Securities

Matthew Bouley – Barclays

Mike Dahl – RBC Capital Markets

Operator

Good morning. And welcome to Skyline Champion Corporation’s Fourth Quarter and Full Year Fiscal 2022 Earnings Call. The company issued an earnings press release yesterday after close.

I would like to remind everyone that yesterday’s press release and statements made during this call include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

These statements are subject to risks and uncertainties that could cause actual results to differ materially from the company’s expectations and projections. Such risks and uncertainties include the factors set forth in the earnings release and in the company’s filings with the Securities and Exchange Commission.

Additionally, during today’s call, the company will discuss non-GAAP measures, which it believes can be useful in evaluating its performance. A reconciliation of these measures can be found in the earnings release.

I would now like to turn the call over to Mark Yost, Skyline Champion’s President and Chief Executive Officer. Please go ahead.

Mark Yost

Thank you for joining our earnings call, and good morning, everyone. Joining me on the call is Laurie Hough, EVP and CFO. Today, I will briefly talk about our full year and fourth quarter highlights. Then provide an update on activity so far in our first quarter of fiscal 2023 and wrap up with thoughts about the balance of the year.

I am pleased with the results Skyline Champion achieved in fiscal 2022, as we continue to make progress delivering topline growth and expanding our profitability, while improving our capacity and capabilities to better serve our customers.

For the year, we were able to provide 26,165 customers and families a place to call home, as we grew net sales by 55% and adjusted EBITDA by 163%, expanding margins by 650 basis points. Our results were driven by the rising demand for affordable housing and our ability to increase output at higher profitability levels, despite ongoing supply chain headwinds and inflationary pressures.

From an industry standpoint, demand remains strong as supply side housing shortages, a growing base of homebuyers and higher interest rates and inflationary pressures are converging greatly raising the need for affordable housing solutions.

The current environment has increased the awareness of our housing solutions and our investments in enhancing the buyer experience has allowed us to convert more traditional site buyers and expand our market share.

We ended the year on a strong note with an excellent fourth quarter, results driven by the demand for new housing and our improved operational capabilities. Our affordable price point during these inflationary times continued to generate healthy order demand, with backlogs growing by $127 million during the fourth quarter to reach $1.6 billion.

Fortunately, we were able to increase production during the quarter, allowing us to improve our delivery times to our customers to 35 weeks at the end of the quarter, compared to 43 weeks at the end of the third quarter. As a result of the solid production increases, we delivered 6,980 homes, an improvement of 10% from the prior year and up 13% sequentially.

We improved our U.S. manufacturing facilities capacity utilization to 72% for the quarter, an increase of 4 percentage points from the third quarter, achieving this production gains despite facing operational challenges caused by supply chain disruptions across our manufacturing operations and the industry.

Our improved production efficiencies were helped by the continued progress streamlining our product offerings and allowed us to increase daily production rates. While we were able to add to our workforce, transportation cost availability remains a challenge to output, with truck driver shortages across all regions of the country.

Additionally, our Navasota, Texas plant completed its certification process in March and began shipping homes in April. We have built an incredible team that continues to impress by their pace and dedication in ramping up facility.

In February, we exhibited one of our Genesis homes at the International Builders Show in Orlando and again at the MHI Congress and Expo in March. This home design helps builders achieve a tremendous value to homebuyers for far less than traditional site built homes, stretching the homebuyer’s dollar in a rising interest rate environment. To that end, we recently signed a multiyear agreement with a top 100 builder to provide our Genesis Homes for their development. So that they are able to profitably hit an affordable price point.

During the quarter, we also entered into a Delivery Disaster Relief Order for the production and delivery of FEMA units. The order totals approximately $200 million and will be produced in the first quarter and second quarter of fiscal 2023.

FEMA units generally have more specifications than are typical homes and therefore drive a higher average selling price. We will be producing these units in batches at several of our factories across the U.S., which will help with production efficiencies, as well as minimize the impact to our long-term primary customers.

We are also excited to announce that on May 16th we closed on the asset purchase of maintenance custom homebuilders. With the addition of the 250,000 square foot campus in Laurinburg, North Carolina, and its retail location in Eastern North Carolina, along with our existing North Carolina campuses, we are now better able to serve customers throughout the region with cost effective, streamlined product offerings that are greatly needed in this current economic environment. We anticipate continuing to build out the approximate $15 million of existing backlog as we upgrade and retool portions of the plant.

As we look forward, market conditions remain healthy with historically low availability of affordable housing supply, favorable demographics and also migratory factors. With rising interest rates and inflation, we are seeing traditional site built homebuyers moving into a more value oriented factory built home solutions.

Additionally, we see demand from communities and build-for-rent increasing as retail traffic tempers. Our orders in April and so far in May have kept pace with our increased production levels and cancellations due to rising interest rates or price increases have been minimal in most regions and slightly elevated in a few regions.

With the addition of our Navasota, Texas plant, our richest — recent acquisition of Manis Homes and our continued efforts to streamline production at our existing facilities and FEMA production, we expect revenue to increase sequentially by mid-single digits in the first quarter of fiscal 2023.

Despite our efforts of our team and our supply chain partners, we do expect availability of some raw material to become more scarce in the mid to late summertime period. We are planning for this and will continue to manage through these challenges, but it may impact our production during fiscal 2023. These along with the availability of drivers to transport our homes are some of the challenges we will face when increasing production.

We are excited once again to be promoting factory built affordable housing solutions during the innovative housing showcase in Washington, DC in early June. This event is hosted by the U.S. Department of Housing and Urban Development and will showcase the value of factory built homes to policymakers, the media and homebuyers.

Focusing on the longer term, it’s becoming more evident every day that the antiquated system of traditional homebuilding is not sufficient to meet the needs of customers. Due to the early successes we have seen both in manufacturing, technology and digital offerings. We will be ramping up our investments in these areas to make homes more affordable and attainable for our customers.

I will now turn the call over to Laurie to discuss our quarterly financials in more detail.

Laurie Hough

Thanks, Mark, and good morning, everyone. I will begin by reviewing our financial results for the fourth quarter, followed by a discussion of our balance sheet and cash flows. I will also briefly discuss our near-term expectation.

During the fourth quarter, net sales increased by 43% to $638 million compared to the same quarter last year. We saw revenue growth of $180 million in the U.S. factory built housing segment during the quarter, despite the prior year quarter having an extra fiscal week, which accounted for approximately $31 million of sales. The increase in U.S. factory built revenue was driven by an increase in the number of homes sold and an increase in average selling price.

The increase, the number of homes sold was 11% or 657 units for a total of 6,580 homes compared to the same quarter last year. The average selling price per U.S. home sold increased by 31% to $87,800, due to price increases to offset inflation brought on by rising material, labor and transportation costs.

On a sequential basis, revenue in the U.S. factory built segment increased 19% in the fourth quarter compared to the third quarter of fiscal 2022. This increase was driven by a 13% increase in homes sold and a 6% increase in the average selling price per home.

Canadian revenue increased 30% to $46 million compared to the fourth quarter of last year, driven primarily by a 36% increase in the average home selling price, partially offset by a 5% decline in the number of homes sold. The higher average home selling price in Canada of $114,700 was driven by price increases enacted in response to inflationary pressures. The decline in the number of homes sold during the quarter was a result of the prior year quarter having an extra fiscal week of production.

Consolidated gross profit increased to $191 million in the fourth quarter, up 93% versus the prior year quarter due to higher volumes, pricing and improved operations.

Our U.S. housing segment gross margins were 29.6% of segment net sales up more than 700 basis points from the fourth quarter last year. In addition to strong demand and pricing, continued product standardization and material rationalization helped to increase production, enabling us to leverage fixed costs.

SG&A in the fourth quarter increase to $75 million from $52 million in the same period last year, primarily due to higher variable compensation driven by the increase in sales volume and profitability.

The increase in SG&A also reflects our investments in additional capacity and initiatives focused on enhancing the customer buying experience. The online customer buying experience remains a key initiative and we expect incremental investments to continue through fiscal 2023.

Net income for the fourth quarter was $87 million or a $0.51 per diluted share, compared to net income of $35 million or earnings of $0.59 per diluted share during the same period last year. The increase in EPS was driven by higher sales and improved operating efficiencies, resulting in improved profitability.

The company’s effective tax rate for the quarter was 24.8% versus an effective tax rate of 24.5% for the year ago quarter. Adjusted EBITDA for the quarter was $121 million, an increase of 137% over the same period a year ago. The adjusted EBITDA margin expanded by 760 basis points to 19% due to higher sales gross margin improvement and leverage of fixed costs.

Looking forward, we expect inflation on building products, labor and transportation costs to remain persistent through the first half of fiscal 2023. We utilize several levers in response to increasing costs, including price adjustments, product standardization, raw material substitutions and further operational improvements.

Despite our efforts to continue to pass on inflation and make operational improvements, our production may be impacted by the availability and timeliness of raw materials, as well as possible shifts in product mix caused by economic pressures, driving homebuyers to smaller less optioned homes, which will soften margins. While we remain confident in our ability to execute in the current environment, the impact of an elongated inflationary environment does create a natural headwind on our margin progression.

As of April 2, 2022, we have $435 million of cash and cash equivalents and long-term borrowings of $12 million with no maturities until 2029. We generated $224 million of operating cash flows for the year, an increase of $71 million year-over-year.

The increase in operating cash flows is primarily due to the increase in net income and customer deposits, which were partially offset by an increase in inventory balances, accounts receivable and capitalized cloud computing costs.

We remain focused on executing on our operational initiatives and given our favorable liquidity position, plan to utilize our cash to reinvest in the business and to support strategic long-term growth.

I will now turn the call back to Mark for some closing remarks.

Mark Yost

Thanks, Laurie. The solid momentum we continue to see in our business is being driven by our focus on the customer and ability to execute, which has strengthened our position to satisfy the demand for affordable homes.

Before we open up the lines for Q&A, I want to take a moment and thank the entire Skyline Champion team as our consistently strong performance is a result of our focus, hard work and ability to increase output for our customers in this very challenging environment.

And with that, Operator, you may now open the line for Q&A.

Question-and-Answer Session

Operator

Thank you. [Operator Instructions] Our first question is from Greg Palm with Craig-Hallum Capital Group. Please proceed.

Greg Palm

Thanks for taking the questions. Good morning and congrats on the good execution in the quarter.

Mark Yost

Good morning, Greg. Thank you.

Greg Palm

I wanted to first dig into the demand environment a bit more, given everyone is worried about the consumer these days. So it sounds like demand still remains fairly strong even quarter-to-date. So curious what you attribute that to, maybe just talk about the profile of some of the newer buyers that you are seeing compared to maybe a few years ago?

Mark Yost

Yeah. Thanks, Greg. Demand does remain strong. Our new orders — incoming orders are matching production right now in April and May. So they are actually higher than they were in the third quarter. So demand remains good overall.

Really it’s — we are seeing a few things in the buyer demographic. One, generally a better quality buyer with higher down payments. We are also seeing traditional homebuyers who can’t afford a traditional site built home or existing home move into a better value proposition in buying our homes, a larger amount of cash buyers as well coming into the market. So I think we are definitely seeing a shift of what I call — what I would consider first time homebuyers and better quality buyers come to the market for us.

Greg Palm

Makes sense. And in terms of the opportunity within builder developer, I know there’s several ongoing projects out there, I think maybe some of them have been completed already. But can you just talk about, how those are going, what the feedback is, and then in terms of that win that you disclose with a top 100 builder, can you give us some sense on potential volumes there, are they shifting some of their production to offsite, are they using you as an additional supplier, what’s really going on behind the scenes?

Mark Yost

Yeah. Greg, I am very excited about Genesis in that segment of the market and part of the reason we diversified into that segment a little more is, we have seen success with our Genesis subdivisions. Just recently there’s a subdivision, the first MH Advantage subdivision in the State of Texas that we completed. That subdivision is for a small localized builder.

But what I think is really important is that builder is selling comparable homes to some of the biggest builders in the country and is selling them for about 20% to 25% less when you take a look at what they are selling on Zillow.

So in that comparable, we are able to allow that builder to make a good margin at an affordable price point that’s without having the economies of scale like obviously a large builder would have. So I think that really speaks to the value proposition for the builders.

But I think what’s also important there and it goes back to the demand situation is, just recently we have seen that the average mortgage rate for a 30-year mortgage, I think is now $29,000 a year, according to Redfin.

And so, if we can save the customer 20% to 25% off of that amount, it equates to roughly $6,000 of savings for that customer, which today with inflation happening, the cost of food, gas, electricity, everything else is costing the average customer about $4,000.

So if they can get into our Genesis product and save $6,000, they can offset all their other inflationary costs and put another $2,000 in their pocket, which I think is meaningful for today’s average customer.

So we are seeing more interest in that product and this builder developer that we have signed a multiyear agreement with, it’s a meaningful amount of product for us. It will definitely add to our builder developer channel growth in the future. We are not disclosing the amount right now. It’s — but it’s definitely a good deal and will add a good portion of revenue for the company over the next three years to four years or five years.

Greg Palm

And I guess just this is a last one is a follow-up to that. Do you guys a sense of…

Mark Yost

Okay.

Greg Palm

…whether if backlogs start to come down from current levels, do you get a sense for whether that builder developer opportunity starts to ramp off? I mean, what’s the biggest kind of pushback or constraint you get, because it sounds like at least initially things are going pretty well in that space?

Mark Yost

Yeah. I think timing of subdivisions and getting builders comfortable with it. I think it’s important in today’s market to be diversified. So, we signed the FEMA contract. That’s the government channel. We are building up the genesis. Our ADU market is building. The community channel is very strong.

So I really see a little bit of, I will call it, softness or temporary on the retail channel in the short-term, just with down payments and other things. So it’s — but we are seeing large increases in demand from the REIT’s significant increases from the REITs, and then, obviously more, both for rent and builder developer interest is out there.

Greg Palm

Okay. Great. All right. I will hop back in the queue. Thanks and good luck.

Mark Yost

Thank you, Greg.

Operator

Our next question is from Daniel Moore with CJS Securities. Please proceed.

Daniel Moore

Yes. Thank you, Mark and Laurie. Again congrats on really solid numbers. Maybe just FEMA first, first we have heard from them in a while. Sometimes it comes in multiple tranches. Do you — would you expect additional orders behind this or from what you gather is this likely would satisfy their needs at least in the short-term?

Mark Yost

We don’t have any indications of future orders, Dan. But I will say, we are heading into what is typically viewed as the hurricane season in the U.S. and I know inventories are low. So there could be some need for future housing, but it — there’s really no indication of that currently.

Daniel Moore

Got it. And appreciate the color from a margin perspective. You gave guidance, mid single-digit growth going sequentially on the topline. How should we think about margins vis-à-vis your performance in Q4 over the next, say, quarter or two? And then, looking out mid-term, Laurie, are we in the sort of mid-to-high 20s, is that a more the sort of new normal for the near-term at least. If you can just put any more granularity around some of your commentary there from a gross margin perspective, would be really helpful?

Laurie Hough

Thank you, Dan. Yeah. I expect gross margins to be relatively flat sequentially in the next couple of quarters and then start to compress somewhat later in the year to the range, as you mentioned, as smaller less optioned homes move through the backlog.

Daniel Moore

Got it. And then maybe one more and I will pass it on. But Biden — the adminis — current administration recently outlined a series of proposals to help close the gap between demand and supply for affordable housing. Are there specific proposals in there be it Freddie Mac and chattel loans or others that you think could move the needle a little bit more than maybe some of the duty to serve or some of the other proposals have in years past? Thanks.

Mark Yost

Yeah. I mean, there’s definitely some good long-term traction in what they have proposed. I don’t think it will impact anything in the very near-term. Some of the bond cap limits are 50% hurdle rates and other things. That could — if that’s done right, that could between new builds and existing refurbishment of stock could impact — have a good impact.

Chattel, in their proposals on channel, that gained traction, but I think in the interim, it’s really about getting that through Congress, getting things passed and see what they actually take action on. So it’s a little too early in the cycle to rely upon or count.

But it’s definitely a great longer term tailwind and I think we are going to see more and more benefits and emphasis on regulatory relief, because of the need for affordable housing. So there’s definitely going to be things like the ADU zoning relief and things like that passed at a more accelerated rate. So there’s definitely longer term opportunity, but it’s not going to impact anything in the very, very near-term.

Daniel Moore

Makes sense. Appreciate the color. I will follow up with — circle back if any follow-ups. Thanks.

Mark Yost

Thank you.

Operator

Our next question is from Matthew Bouley with Barclays. Please proceed.

Matthew Bouley

Good morning, everyone. Thank you for taking the questions and congrats on the results. I have to ask the cancellation question, because you day lighted at the top mark that you said cancellations have become a little elevated in a few regions, although low in most places. Should we take that as a signal that cancellations could actually worsen here, given what’s going on with rates, and if that’s the case, how does that kind of impact you guys from a financial and production efficiency standpoint?

Mark Yost

Yeah. Thanks, Matt. No. I think cancellations really are driven by rates. Really there’s two things happening both related to rates and cancellations. The first is with our retail inventory, floor plan interest rates are also elevating, not just end consumer rates and so as floor plan interest rates increase, it becomes more costly for our retailers to carry stock units.

So we will see some just destocking of the channel to kind of keep their largest expense at bay as interest rates tick up. So you are going to see kind of a — what I would consider a one-time adjustment in terms of stock at our retail inventory across the country just because interest rates are going up and they are going to hold less, they are going to carry less on their loss as interest rates accelerate.

And then the second piece is really about interest rate and inflation stabilization for the retail customer. So I think you are going to see a little bit of increased cancellations really due to the fact that when we change price due to inflation to the end customer, it can open up their loan, which allows kind of for another trigger, which is then the lender can increase the interest rates. So I think we are going to see kind of a batch of cancellation. The magnitude of that is not material, though, in the overall scheme of our backlog.

So it’s not a concern. I think it’s just going to be a one-time cleanup as interest rates increase. Like I said, we are very laser focused on new incoming orders because we somewhat expected as interest rates increases happen, the lower end customer would have some cancellations, because they might not qualify with both the inflation interest rate, and two, we expected some destocking to happen just because retailers are not going to want to have the carrying cost.

Matthew Bouley

Got it. Okay. No. That’s really helpful color there, Mark. Thank you for that. And secondly, I wanted to follow-up on the discussion on the builder developer order because I think in the past few quarters you had spoken to sort of turning away orders and really trying to focus on your long-term customers. But in a market where there could be either retail destocking or just otherwise consumer pressure, is there sort of sufficient demand from that builder developer channel or the build-to-rent and community channel? Just some of those sort of big one-time one-off orders that you had previously been turning away, is there room for some of those customers to now sort of absorb what might be then missing from the rest of the retail channel?

Mark Yost

Yeah. Definitely. I think we are seeing a much larger interest from the community and the REITs to builder developers. So I think that’s meaningful. It definitely has the potential to more than offset the retail softness.

I think geography just to be transparent and honest, geography will play into that a little bit, because some of the builder developer and REIT activity is very geographically focused. So we will have to make sure to adjust production levels in the right regions to accommodate that over time.

Matthew Bouley

Got you. All right. Well, thank you and good luck, guys.

Mark Yost

Thank you.

Operator

[Operator Instructions] Our next question is from Mike Dahl with RBC Capital Markets. Please proceed.

Mike Dahl

Good morning. Thanks, Mark and Laurie for taking the questions. I want to follow-up on some of the demand questions. The first one, I was wondering if you could provide orders in terms of units and change year-on-year both in your quarter and the comments you are making for April and May, because just back of the envelope, if I back out the FEMA order, it does seem like orders in dollar terms were down year-on-year, obviously, some tough comps, but down — units maybe down quite a bit. So I am trying to reconcile that with your comments about orders then matching supply in April and May. So any unit commentary year-on-year would be great?

Mark Yost

Yeah. Mike, we don’t give the unit comps, but what I would say is that, our order rates quarter-over-quarter increased by or our production and shipment rates increased quarter-over-quarter sequentially by 13%. So part of the backlog delta I think you are seeing is the fact that we were able to very successfully and dramatically increase production quarter-over-quarter.

So I think you have to take that into consideration as you are looking at those numbers and I think the point is that the new orders that we are seeing today, new incoming orders are matching our higher elevated production rates that we are at today. So we are kind of running on par with production in orders.

Mike Dahl

Okay. Right. And the other follow up I had just on the cancellation topic, I think you had characterized it in your opening remarks as it being somewhat regional specific. So what regions are you seeing the most pronounced cancellations in right now?

Mark Yost

Generally I would say the mid-south region and that’s predominantly, because they generally sell a lower ASP or lower end product. So the interest rates are going to have the most meaningful impact, one, on retailer’s ability to stock those units. In other words, because of their generally lower ASP, lower margin profile stocking more of those is more cost prohibitive as floor plan interest rates go up.

And secondly, that customer base, that kind of lower end customer is probably the one that’s feeling the most inflationary pressure as well. So you are going to see higher retail cancellations as interest rates and inflation are passed on to that customer, you will see probably a lower ability to qualify. So mid-south generally were lower end sales value.

Mike Dahl

Okay. That makes sense.

Mark Yost

Okay.

Mike Dahl

Got it. Okay. One last question, just the comments around mix, Laurie or Mark, I wasn’t sure if we should take those comments on mix of kind of the lower endless optioned models as being indicative of you are already seeing that in the incoming order rates and it just takes a while to flow through a backlog or that that’s just your expectation for how things will progress just given what’s happening with prices and rates. So are you already seeing that or that’s just kind of hedging a bit on future expectations?

Laurie Hough

Mike mix is a bit geographic as well kind of to Mark’s point earlier, but we are starting to see that in order. So that’s a timing issue coming through backlog.

Mike Dahl

Okay. Appreciate it. Thank you.

Mark Yost

Thank you.

Operator

Our next question is from Daniel Moore with CJS Securities. Please proceed.

Daniel Moore

Thank you again. Maybe just one more modeling on SG&A, just how do we — should we think about that growth, I guess, sequentially, and obviously, you have been investing aggressively in technology customer facing platforms. Can you give us a sense of that, the incremental spend in dollar terms that we saw in Q4 and whether that level of spend is likely to continue to grow. Any commentary there would be really helpful.

Laurie Hough

Yeah. Dan, I don’t remember specifically what the number was in Q4. I think it’s in a few million dollar range historically over the last few quarters running through operating expense. We do expect that to increase incrementally in fiscal 2023.

Daniel Moore

Got it. And then one of the real quick, we spoke to a number of dealers recently that kind of struck our ears, so that they expected too, many were looking at adding additional locations given the strength in demand. That obviously sounds a little bit counter to some of the pressures that you described here. Is that something that you are seeing as well or are you seeing more sort of pulling back on inventory versus expansion? Thanks.

Mark Yost

Yeah. No. I think it’s more geographic in that sense. So I think dealers are looking to expand their location, really to be closer to the customer. I think, as we mentioned, trucking is becoming slightly an issue. Transportation costs are elevated because of gas prices.

So I think, what I would expect is, there’s a handful of dealers who are looking at, what can we do to open up more locations, but have maybe a more curated set of inventory on those locations. So that one the transportation of the customer coming to visit, because more and more of their lead generation is coming online.

So they might have customers who are 500 miles away, because that’s where the lead generation online is coming from. So the more distribution points some of the retailers can have, I think, the closer to the customer they can be making it more convenient.

So there’s kind of both things happening at the same time. They might have a sales center with 10 units on it. They might bring that down by a few units, but then open up another sales center and build inventory. But that will take time. So there’s going to be kind of a short-term, long-term impact.

Daniel Moore

Makes sense. Appreciate the color again.

Mark Yost

Thank you.

Operator

We have reached the end of our question-and-answer session. I would like to turn the conference back over to management for closing comments.

Mark Yost

Thank you for participating in today’s call. We appreciate the time and your continued interest. We look forward to updating you on our progress on our next call. Take care and be safe.

Operator

Thank you. This does conclude today’s conference. You may disconnect your lines at this time and thank you for your participation. ##

Additional Information, More MHProNews Analysis and Commentary in Brief

Among the insights in the above that can be found are by making a comparison to the Cavco Industries (CVCO) earnings call and transcript, found at the link below.

For example. Boor and Cavco assert they are now at some 80 percent of plant utilization capacity. By contrast, Skyline Champion is at only 72 percent plan utilization, per their own statement cited above. That begs the question: what explains that disparity between the two large, manufactured home producers on plant utilization?

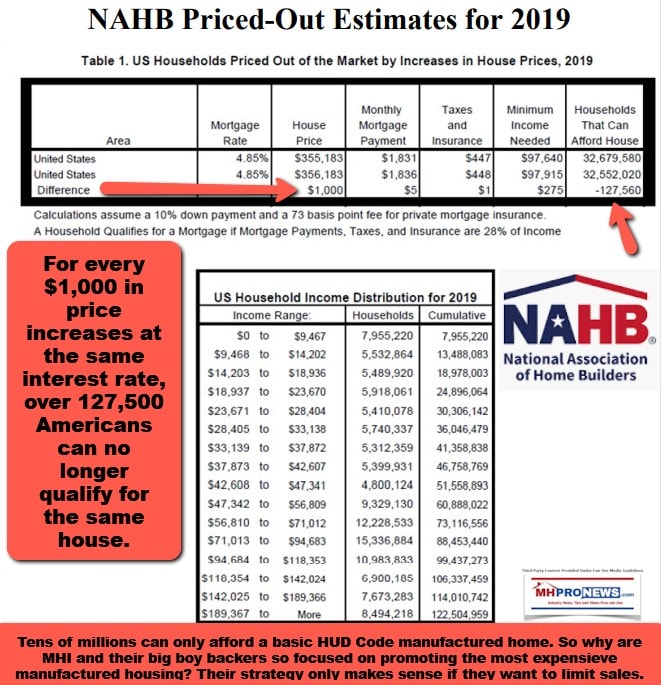

Both Cavco and Skyline-Champion (SKY) are talking about the migration of site-built customers into the manufactured housing market. That is driven in good measure by inflation and interest rates. What is occurring, both have indicated, is that ‘lower end’ customers and sales are being squeezed out of qualifying for a manufactured home.

While that may be somewhat positive for the industry, it is terrible news for the millions of Americans who are being ‘priced out’ of manufactured housing, and thus the dream of home ownership.

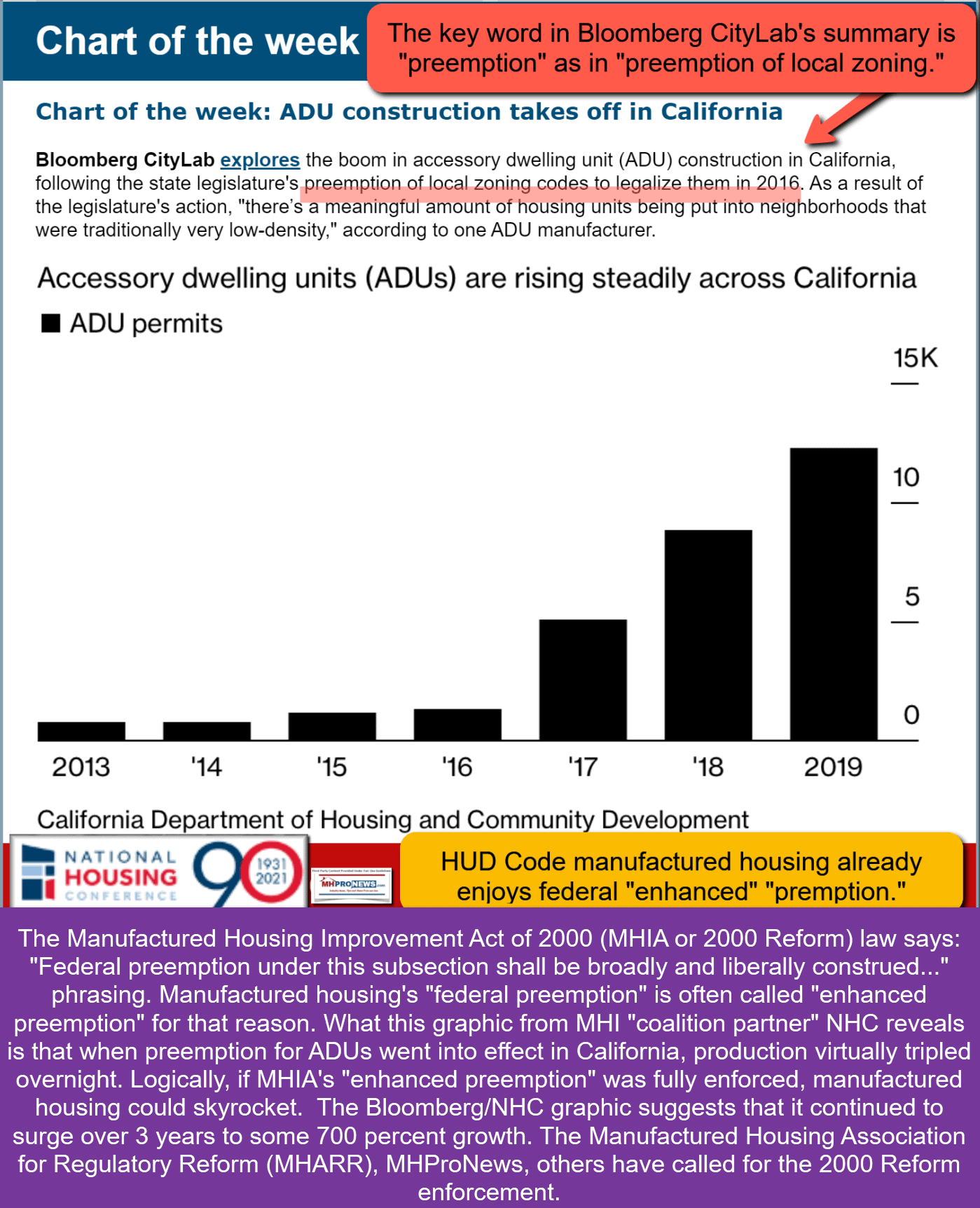

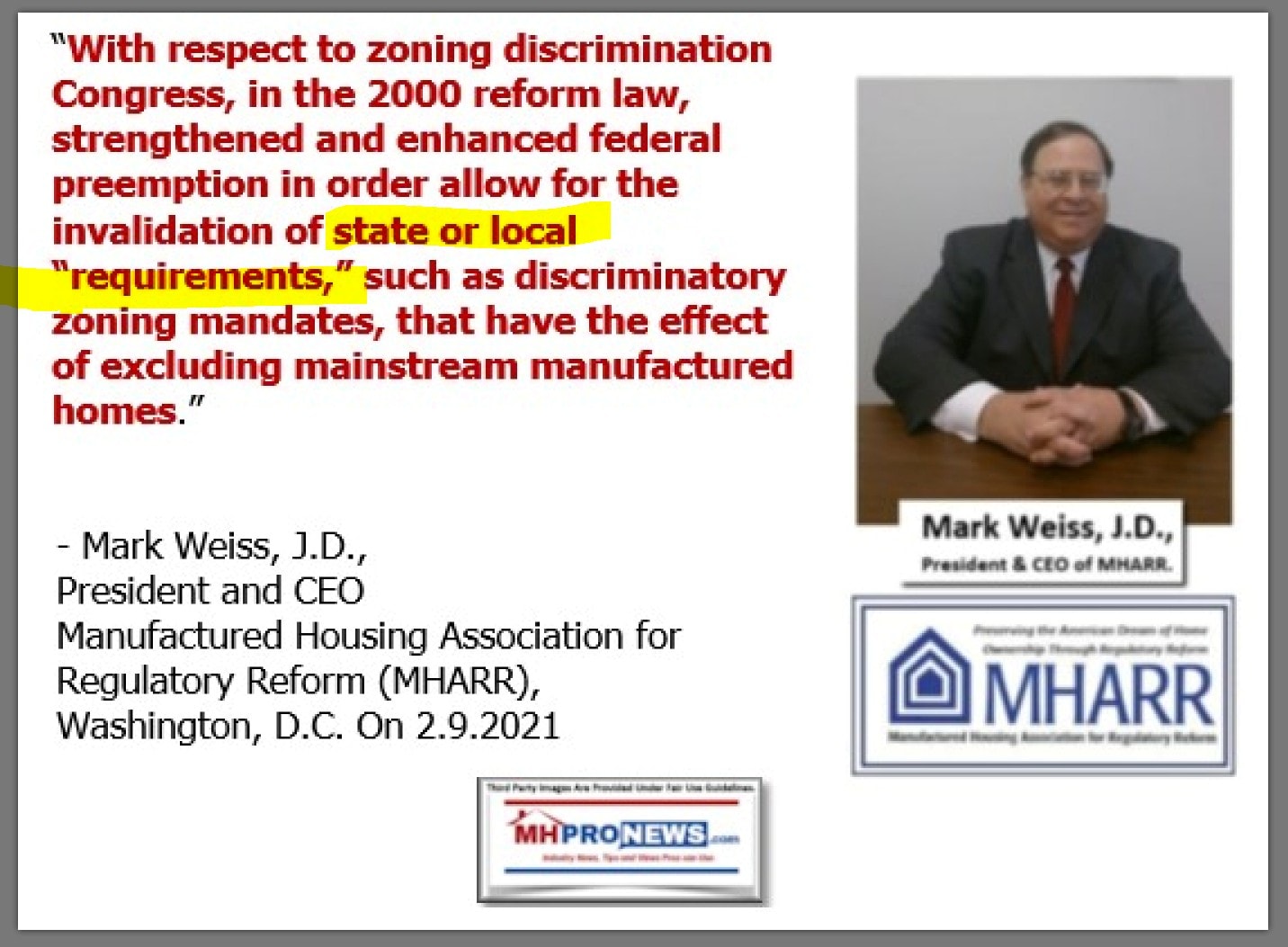

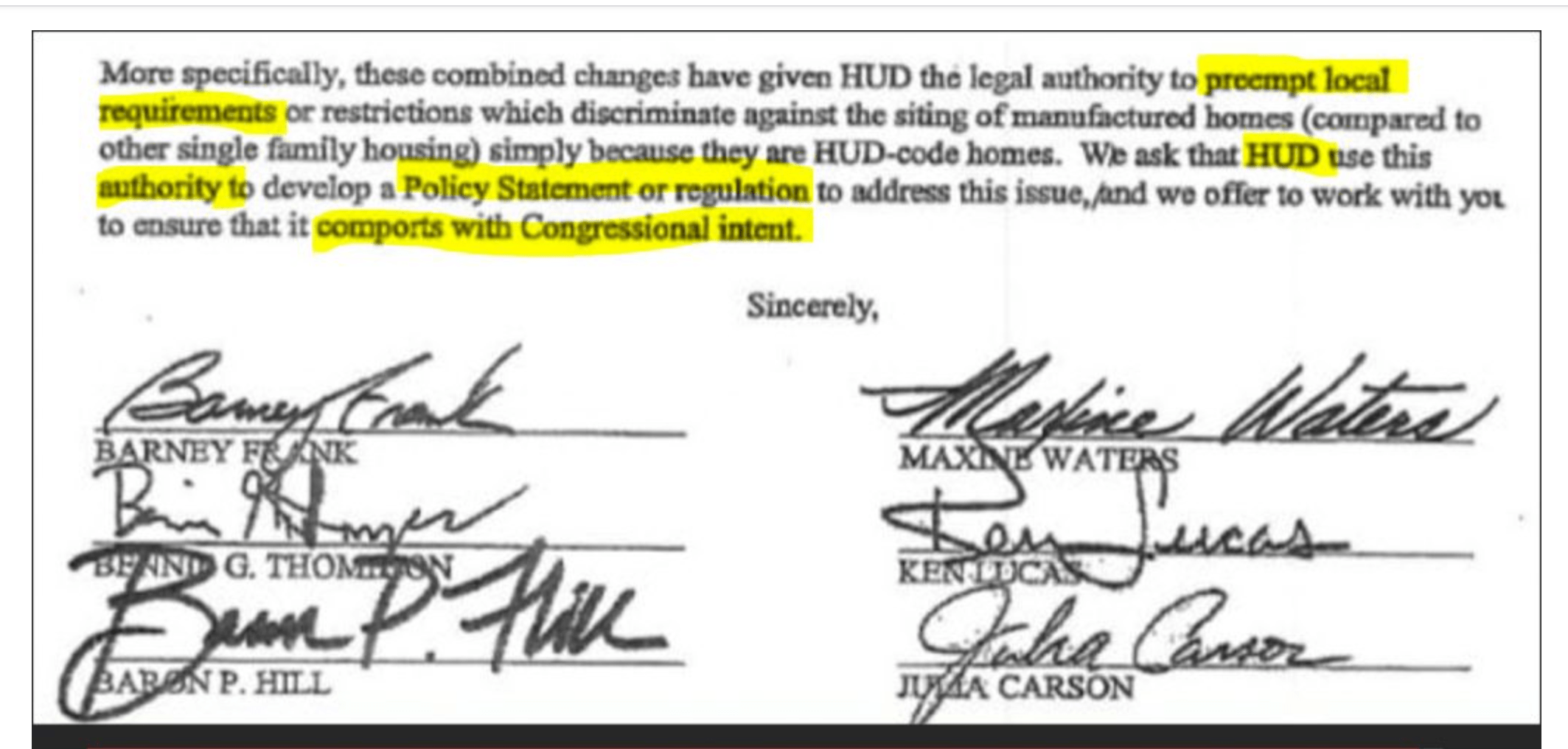

ADU – accessory dwelling units, sometimes known as ‘granny flats’ – placement efforts were raised in official Skyline Champion earnings call transcript the above. ADUs are often factory-built units. So, hmm, fair enough. But where is the discussion of relief for placement of HUD Code manufactured homes? While there may be oblique references to that, there is no explicit mention of the Manufactured Housing Improvement Act (MHIA) of 2000 or its so-called “enhanced preemption” provision. Why not?

MHProNews led the charge in manufactured home trade media space to spotlight the potential relationship or indicators that ADU preemption in California could signal for manufactured housing nationally if the MHIA and federal preemption were being properly enforced.

Given that potential for 600 percent or greater growth from current levels, that could propel manufactured home production to a historic record of about 700,000+ new homes a year. It would take that type of production, or greater, to begin to seriously close the gap between housing demand and the build-rate required to meet those needs. After all, millions of housing units are needed, depending on what source is cited.

In the transcript above, we see Skyline Champion CEO Yost admitting there is nothing short term expected to come the industry’s way out of Washington, D.C. Yet, his company spokesperson previously said that they are fine with supporting the Manufactured Housing Institute (MHI) for their advocacy.

If Yost and Skyline Champion want more growth, those statements are seemingly contradictory. MHI vacillates between self-praise and admitting that their stated goals are not yet achieved.

MHI CEO Lesli Gooch seems unable to issue two op-eds – published in the same month – without apparent contradictions between her own statements and positions.

Another disconnect between what Yost-Skyline Champion is presenting as factual relates to the issue previously raised by Mike Dahl, RBC Capital Markets Managing Director. Dahl asked why they aren’t doing more to expand production to “aggressively to bring on new capacity?”

Dahl’s prior inquiry is just as valid now as when he asked it months before.

Warning Signs?

Skyline Champion is talking up a program that could be seen as a threat to manufactured housing sales professionals.

Digital channels with this company could replace humans, in a fashion not unlike what Clayton Homes has stated before that they are working toward too.

Statements made by corporate officials merit this type of 360-degree testing and analysis. If Yost and his colleagues are serious about maximizing opportunities for their shareholders, then why are they backing MHI which has failed to implement the laws that were enacted to support and grow manufactured housing as a channel for affordable home ownership for more Americans.

Like the Boor-Cavco earnings discussion, there is no mention of the start of the countdown clock on the DOE energy rule. Why not?

The data coming out of mainstream housing points to headwinds for them that ought to spell opportunities for manufactured housing.

The bottom line could be these.

- There are several questions that need to be asked and answered about disconnects between manufactured home industry opportunities and corporate behaviors.

- Something similar could be said about certain manufactured housing industry trade association behaviors vs. what should be their commonsense action steps. How can the Manufactured Housing Institute (MHI) explain the notion that they have used attorneys to threaten some who were currently their own members, but failed to use attorneys to get good existing laws enforced?

- More specifically, credible allegations have been made that Skyline Champion, Cavco Industries, and Clayton Homes – using the MHI – are working in some form of collusion to limit the market in a fashion that allows them to consolidate their competitors.

These corporate and association leaders duck that charge. Why? If it is untrue, why not simply deny it? Or why not deny the claims of Samuel Strommen or James A. Schmitz Jr. and point to evidence that disproves their respective thesis? Or is it a case that Strommen and Schmitz and other critics are correct? And a denial would only increase their risk and liability? These inquiries can no longer be ignored as merely whimsical or theoretical musings. Federal and other pending legal actions make them quite relevant to industry business leaders, management, and thousands of manufactured home industry employees.

Keep in mind that there was a Skyline Champion contact involved in the case laid out by the Securities and Exchange Commission (SEC). MHProNews will continue to monitor and shed light on the questions that earnings calls, broader manufactured housing industry and housing data, and other statements logically demand. Stay tuned to this unique source for “Intelligence for Your MHLife.” © ##

Again, our thanks to you, our sources, and sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.