On October 12, 2023 the U.S. Government Accountability Office (GAO) published a new report entitled “The Affordable Housing Crisis Grows While Efforts to Increase Supply Fall Short.” That GAO report looks specifically at HUD Code manufactured homes. Per the GAO website: “What GAO Does,” “GAO provides Congress, the heads of executive agencies, and the public with timely, fact-based, non-partisan information that can be used to improve government and save taxpayers billions of dollars. Our work is done at the request of congressional committees or subcommittees or is statutorily required by public laws or committee reports, per our Congressional Protocols.”

MHProNews asked Bing AI this question:

> ”Has the GAO allegedly exhibited some level of partisanship?”

The following was Bing’s AI Chat response.

Be that as it may, the information provided ought to broadly be of interest to manufactured housing professionals, investors, and others who believe in the need for a greater access and support for more affordable manufactured homes. There will be more from Bing AI and MHProNews in the analysis that follows in Part II, further below.

While the GAO states their research information differently, which could at times be described as government speak, the GAO findings in several ways confirm concerns raised by the Manufactured Housing Association for Regulatory Reform (MHARR), as well as MHProNews and MHLivingNews on the financing topic.

- Part I (A and B) of today’s report are recent remarks published by the GAO regarding affordable housing and manufactured housing’s role in that arena.

- Part II provides additional information with more MHProNews analysis and commentary.

- Part III is our Daily Business News on MHProNews macro- and manufactured housing connected equities report along with our time saving and insight generating left (CNN) right (Newsmax) ‘market moving’ headline news items.

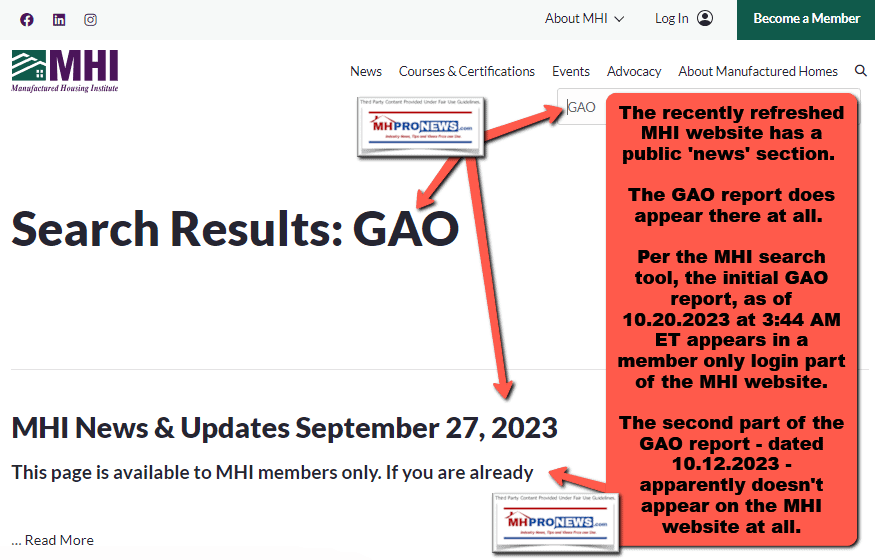

Significantly to some, the GAO’s report could be described as one branch of the Biden Administration run federal government – the GAO – has formally stated that another branch of the federal government – HUD – hasn’t done its job properly. Ouch, but that too confirms several MHProNews/MHLivingNews evidence-packed reports on the overall housing market and manufactured home industry topics. While new conventional housing starts are beginning to adjust to higher interest rates, both conventional housing and manufactured homes are in a year-over-year decline. Note that by contrast, the Manufactured Housing Institute’s ‘news’ section – on this date and at the time shown – does not mention the GAO report at all. Even the ‘members only’ part of the MHI website only has part of the information about the GAO report posted, per their own search tool.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

What follows in Part I are the two related GAO press releases. Meaning, the following is the GAO expressing itself in their own ‘government speak‘ words.

Part I (A) – Per the GAO…

The Affordable Housing Crisis Grows While Efforts to Increase Supply Fall Short

Posted on October 12, 2023

Shortages of affordable housing are a long-standing challenge in the United States. High interest rates and low inventory are contributing to this issue, as is the growing number of millennials, who are looking for larger homes to raise families. For low-income Americans, the hunt for affordable housing can be especially tough.

Increasing the supply of housing is one way to address shortages and provide more affordable options. Today’s WatchBlog post looks at our recent work on efforts to expand affordable housing options.

Encouraging affordable housing

The Department of Housing and Urban Development (HUD) leads housing efforts at the national level. This includes everything from mortgage programs to construction. HUD has multiple programs that aim to increase the supply of affordable housing. One of these is the Self-Help Homeownership Opportunity Program (SHOP).

The SHOP program provides grants to nonprofits to help develop affordable housing units for low-income buyers. In our July and September 2023 reports, we found that SHOP grants helped build homes in more than 40 states and 140 metropolitan areas between fiscal years 2011 and 2020.

However, rising land and construction costs have put pressure on the program. For example, land prices increased 60% from 2012-2019, and the cost of homes more than doubled from 1998 to 2021. But HUD doesn’t adjust spending limits for grant recipients’ activities to keep pace with these increased costs. We found that the number of units required to be built with grant funding had declined dramatically overtime.

To help HUD make needed adjustments, we recommended that it use relevant data to determine when and how much to adjust spending limits.

Changes in SHOP’s Affordable Housing Development, FY1998–2020

Manufactured homes—homes that are built in factories—can be an affordable option for some, including lower-income homebuyers. Homebuyers can pay for these homes by taking out a mortgage loan, just like for other home purchases. But sometimes traditional loans are difficult to obtain when purchasing manufactured homes. This could mean that some borrowers use other kinds of financing, such as personal property loans, which can have less favorable rates and terms. Our September report found that HUD and several other federal agencies have taken steps to make manufactured housing loans more affordable. But HUD has not fully implemented proposed changes that would improve homebuyer access to loans for manufactured homes.

We recommended HUD implement planned changes, including establishing time frames and milestones for its actions, to provide additional financing options for manufactured homes.

What about renters?

Many low-income renters also face shortages in affordable housing. During the last three years, rents increased about 24%. HUD’s Housing Trust Fund is designed to preserve and increase the number of affordable rental units available to extremely low-income households. Under this program, HUD provides funding to states for affordable housing rental projects. States have received varying amounts of funding for these projects each year since 2015. And, as of March 2022, the Fund’s grantees had developed almost 2,200 rental units in 263 projects.

Like other housing development and federal grant programs, the Fund faces fraud risks that are important for HUD to monitor. For example, grant recipients must submit audits of the project costs to determine that the funds are used properly. However, we found that the majority of selected grantees did not comply with HUD’s requirements for these audits. In our August report, we found ways to improve HUD’s oversight of the Fund, such as implementing a process to monitor grantee compliance with project reporting requirements.

Housing Trust Fund Allocations for 2022, by State

As demand for affordable housing continues to grow, so will the need for affordable options. Learn more about our work on federal efforts to address affordable housing by checking our key issue page.

- GAO’s fact-based, nonpartisan information helps Congress and federal agencies improve government. The WatchBlog lets us contextualize GAO’s work a little more for the public. Check out more of our posts at GAO.gov/blog. ##

Part I (B)

Manufactured Housing: Further HUD Action is Needed to Increase Available Loan Products

Fast Facts

Manufactured housing—prefabricated, factory built homes—can be an affordable option for lower-income homebuyers. But some borrowers may not qualify for mortgages and might have to turn to other kinds of financing with less favorable rates and terms.

Several federal agencies, Fannie Mae, and Freddie Mac have created new or modified existing loan programs to help manufactured home borrowers. But while the Department of Housing and Urban Development has planned program improvements, it doesn’t have a timeline for putting them in place. We recommended it do so.

What GAO Found

Manufactured housing, prefabricated factory-built homes, can be financed with personal property or mortgage loans. The Departments of Housing and Urban Development (HUD), Veterans Affairs, and Agriculture administer loan guarantee programs for manufactured housing. Federal entities also participate in the secondary market to provide housing finance options. Ginnie Mae guarantees securities backed by federally insured mortgages, and Fannie Mae and Freddie Mac (enterprises) purchase mortgages that are not federally guaranteed and securitize them (package them into securities and sell them to investors).

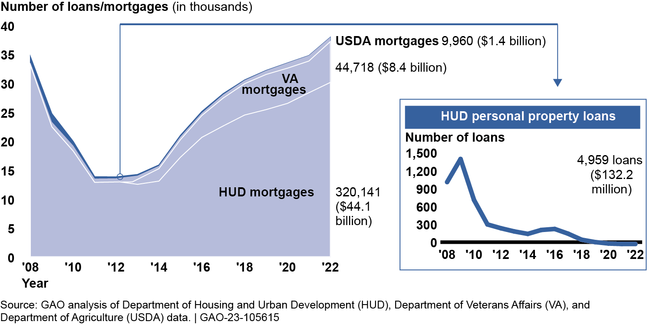

Federal agency financing of manufactured homes increased for mortgages but not for personal property loans in recent years (see figure). Few personal property loans were made because these loans are capped at an amount lower than the average purchase price of a manufactured home. The limited secondary market for personal property loans also may deter lenders from making them.

Federally Guaranteed Mortgage Loans and Personal Property Loans for Manufactured Housing, Fiscal Years 2008–2022

Notes: Based on available agency data. HUD provided calendar year data for personal property loans and fiscal year data for mortgage loans. VA and USDA provided fiscal year data. VA did not track loans for manufactured housing before 2013.

Several federal entities have supported increasing financing options for manufactured housing. For instance, VA and USDA developed new or modified existing loan programs to assist borrowers. The enterprises expanded eligibility requirements and increased purchase targets to help increase the availability of financing. HUD also has taken some steps to address long-standing requirements to improve the financing and securitization of manufactured housing, but has not fully implemented several proposed changes. Implementing these changes and establishing time frames and milestones for its actions would better assure that HUD could promote the availability and affordability of manufactured homes.

Why GAO Did This Study

The U.S. has a shortage of affordable housing, particularly for low- and medium-income households. Manufactured housing is a source of affordable housing. However, some stakeholders have raised questions about the limited options for financing manufactured housing.

GAO was asked to review the federal role in supporting the financing of manufactured housing. Among its objectives, this report examines (1) trends in the use of federal financing for manufactured housing and (2) federal efforts to assess and improve financing options.

GAO examined federal housing data, reviewed regulations, analyzed information on federal financing products, conducted a literature review, and interviewed federal entity officials and lenders, industry groups, and other stakeholders.

Recommendations

GAO is making two recommendations—one each to the Federal Housing Administration and Ginnie Mae (entities in HUD)—to implement planned changes to increase financing options for manufactured homes, including identifying options for greater securitization of mortgage and personal property loans, and establish time frames and milestones for actions. FHA and Ginnie Mae agreed with these recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Housing and Urban Development | The Secretary of Housing and Urban Development should ensure that the Commissioner of FHA implement planned changes to provide additional financing options for manufactured homes, including identifying options for greater securitization of manufactured home mortgages and personal property loans and establishing time frames and milestones for the actions. (Recommendation 1) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Department of Housing and Urban Development | The Secretary of Housing and Urban Development should ensure that the President of Ginnie Mae implement planned changes to provide additional financing options for manufactured homes, including identifying options for greater securitization of manufactured home mortgages and personal property loans and establishing time frames and milestones for the actions. (Recommendation 2) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

Full Report

##

Part II – Additional Information with More MHProNews Analysis and Commentary

So, the GAO has said that HUD’s secretary (currently Marcia Fudge) has not yet ensured “that the Commissioner of FHA implement planned changes to provide additional financing options for manufactured homes, including identifying options for greater securitization of manufactured home mortgages and personal property loans.” So, despite bluster about the Biden Housing Plan, the GAO said that HUD and the FHA’s efforts are lagging in manufactured housing support. Once more, that confirms reporting by MHARR, MHProNews, and MHLivingNews (see links in preface above and more information linked and stated herein below).

Then recall that the GAO previously got involved with HUD with respect to the Manufactured Housing Improvement Act (MHIA).

The GAO also previously reported on financing and manufactured housing. That was some 9 years ago. Congress itself held hearings on the Manufactured Housing Improvement Act of 2000 in 2011 and 2012. So various branches of the federal government have to some degree recognized the problem. While it begs the question of the obvious problem of the federal government not fulfilling its own legal obligations, it also calls into question MHI’s effectiveness in their self-proclaimed advocacy for “all segments” of manufactured housing.

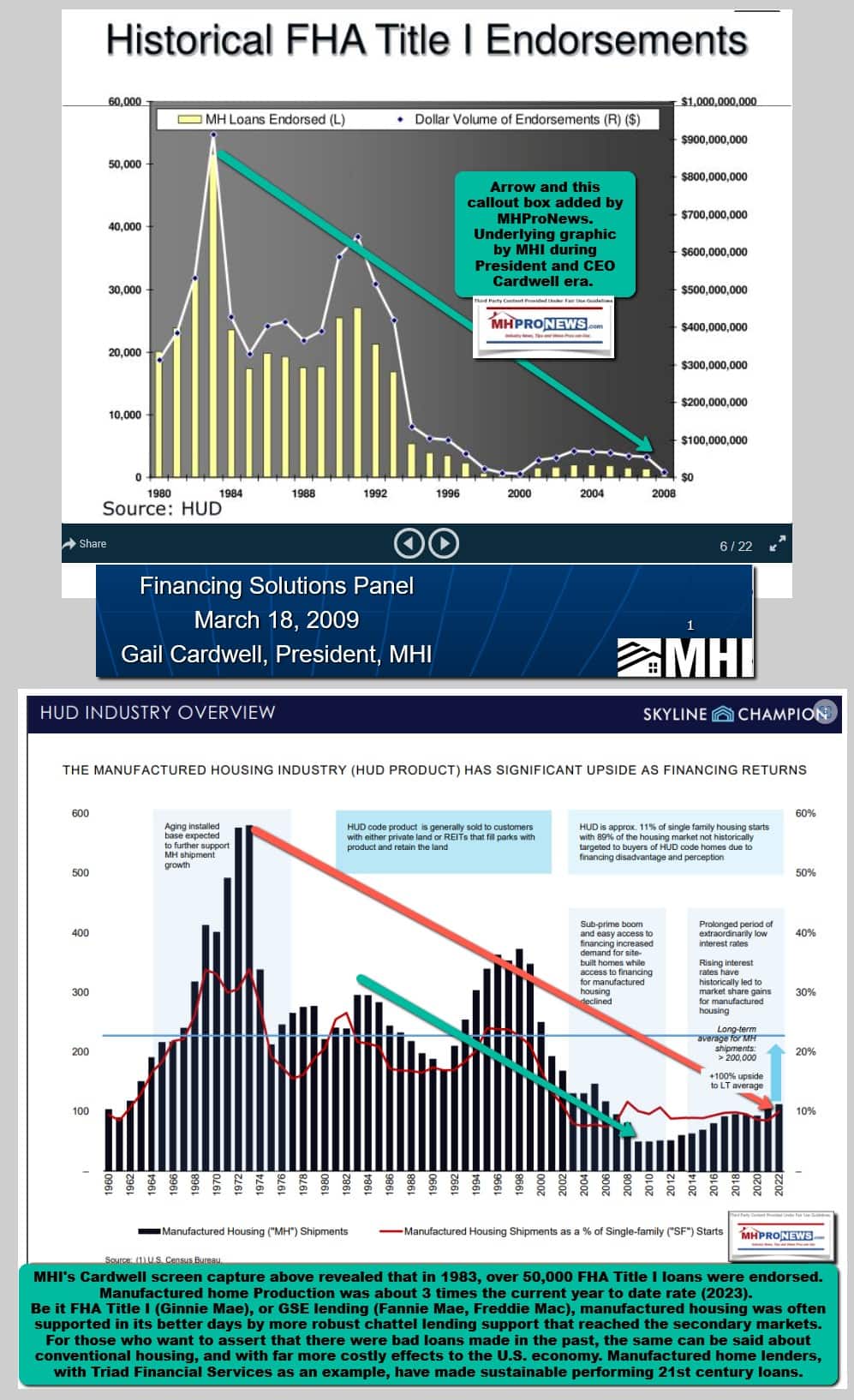

The good news, to some degree, is that the GAO has done such research, which points out information that is potentially useful for savvy manufactured housing professionals and advocates. Both MHProNews and MHLivingNews have used the illustrations above periodically for some years.

MHProNews recently produced a report that raised some of the same issues that the GAO has now reported.

For instance, according to information generated by prior MHI President and CEO Gail Cardwell, the number of FHA Title I endorsements of HUD Code manufactured home loans cratered years ago. Is it a factor in the 21st century decline of HUD Code manufactured housing? Look at the two graphics that follow and decided for yourself.

Compare and Contrast MHI and with MHARR on the Financing Issue

On paper, the Manufactured Housing Institute (MHI) and the Manufactured Housing Association for Regulatory Reform (MHARR) both appear to support the call for FHA Title I/Ginnie Mae loan reforms, such as removing the so-called 10/10 rule that essentially limited the potential for most manufactured housing lenders from accessing this chattel lending program that once financed tens of thousands of HUD Code manufactured homes.

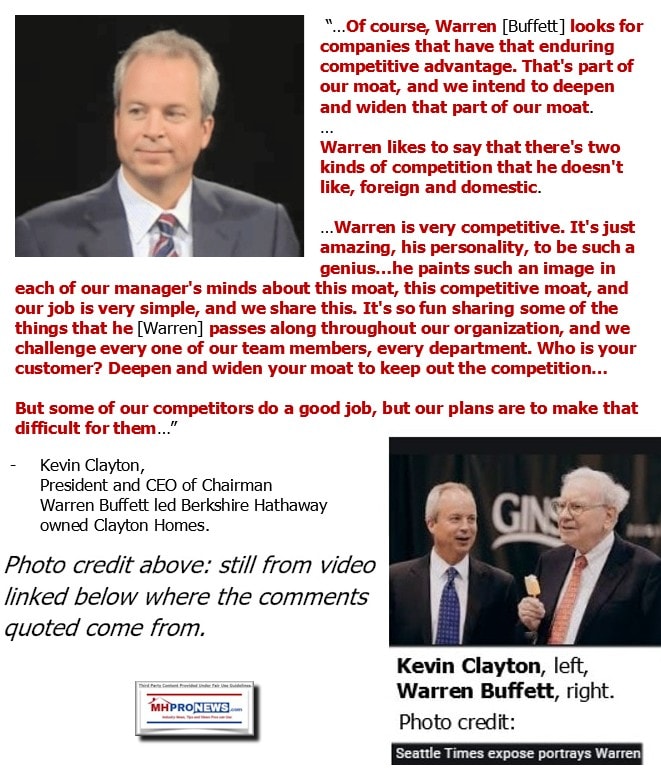

But upon closer examination, what emerges is a picture that if more FHA Title I loans were being originated (or if the Duty to Serve – DTS – personal property/chattel/home only loan financing from the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac were being properly implemented), that would in turn cost Berkshire Hathaway (BRK) lenders in manufactured housing money. Those Berkshire owned lenders – 21st Mortgage Corporation and Vanderbilt Mortgage and Finance (VMF) are MHI member companies, as is Clayton Homes. Warren Buffett himself said during a Q&A at a Berkshire Hathaway annual meeting that the GSEs originating DTS loans would be good for manufactured housing, as the video posted below reflects.

On the governmental support for manufactured housing lending side, flashback to the MOU – the Memorandum of Understanding – by HUD Secretary Marcia Fudge and then-acting director Sandra Thompson.

Recall too that the Manufactured Housing Association for Regulatory Reform (MHARR) offered to assist HUD and the FHFA in the implementation of that plan so as to provide the maximum possible benefit to manufactured housing. But no known outreach in response to that offer from MHARR has occurred. Once more, despite the media fanfare, the GAO report above illustrates one side of the federal government responsible for “accountability” directly saying that another part of government hasn’t done its job. In this instance, failing to do the job is harmful to the interests of affordable housing shoppers, those buyers that were pushed into higher cost loans for a lack of financing options, and these issues play some role in the lack of affordable housing. Government agents tout their efforts, yet fail to do what they claim, as HUD researchers Pamela Blumenthal and Regina Gray have both stated in their own words. With one of the largest ‘peace time’ (to the extent that the U.S. itself is supposedly not officially at war) spending and budgets since World War II (as measured by the ratio of spending vs. GDP), these are examples of federal government researchers pointing out in polite and perhaps ‘politically correct’ words (government speak) that the federal government is simply not efficient at carrying out its own stated goals.

Recall that Doug Ryan with CFED (since rebranded as Prosperity Now) said in an op-ed on American Banker that MHI was not pushing for lower cost chattel lending options because that would cost Berkshire Hathaway owned Clayton Homes and their affiliated lending at 21st Mortgage Corporation and Vanderbilt Mortgage and Finance (VMF) profits. Here is how Ryan said it.

If that sounds vague and perhaps ‘conspiratorial’ at first, Ryan clears up who he is saying is benefiting from “the system” as it stands.

“The Moat” and Manufactured Home Financing

But to illustrate the points made by Ryan, there are the remarks by Buffett-Berkshire “moat” fan, Bud Labitan. The book is entitled: “Moats The Competitive Advantages Of Buffett & Munger Businesses” By Bud Labitan First Edition 2012.

Labitan uses these pull quotes in the book.

- “A truly great business must have an enduring “moat” that protects excellent returns on invested capital. ~ Warren Buffett

- “How do you compete against a true fanatic? You can only try to build the best possible moat and continuously attempt to widen it.” ~ Charlie Munger

Follow along on a highly relevant segue on “the moat” and the lack of manufactured home lending.

MHProNews asked Bing AI the following.

> “Who published Moats the Competitive Advantages Of Buffett & Munger Businesses By Bud Labitan First Edition 2012 and what did Labitan and his researchers say about Clayton Homes and their lending moat?”