Noteworthy headlines on CNNMoney – Trump taps Wall Street’s Jay Clayton for SEC. Apple invests $1 billion in massive tech fund. Fully repealing Obamacare will cost $350 billion. The weirdest tech from CES 2017’s opening day.

Some bullets from MarketWatch – Macy’s announces plan to close 68 stores, cut 6,200 employees in 2017. “Perfect storm” could lead to historic bursting of bond bubble, warns Harvard academic. Kohl’s shares plunge after retailer lowers fiscal 2016 guidance. U.S. stocks close near record levels after moderate gains.

Crude Oil 53.19 0.86 (1.64%) Gold 1,164.60 2.60 (0.22%) Silver 16.47 0.06 (0.37%)

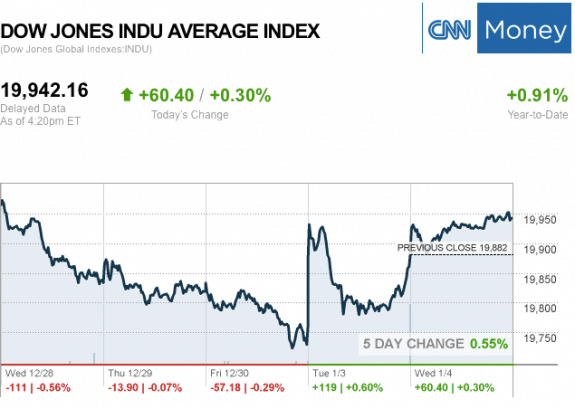

The markets at the Closing Bell…

S&P 500 2,270.75 12.92 (0.57%)

Dow 30 19,942.16 60.40 (0.30%)

Nasdaq 5,477.00 47.92 (0.88%)

Russell 2000 1,365.49 8.36 (0.62%)

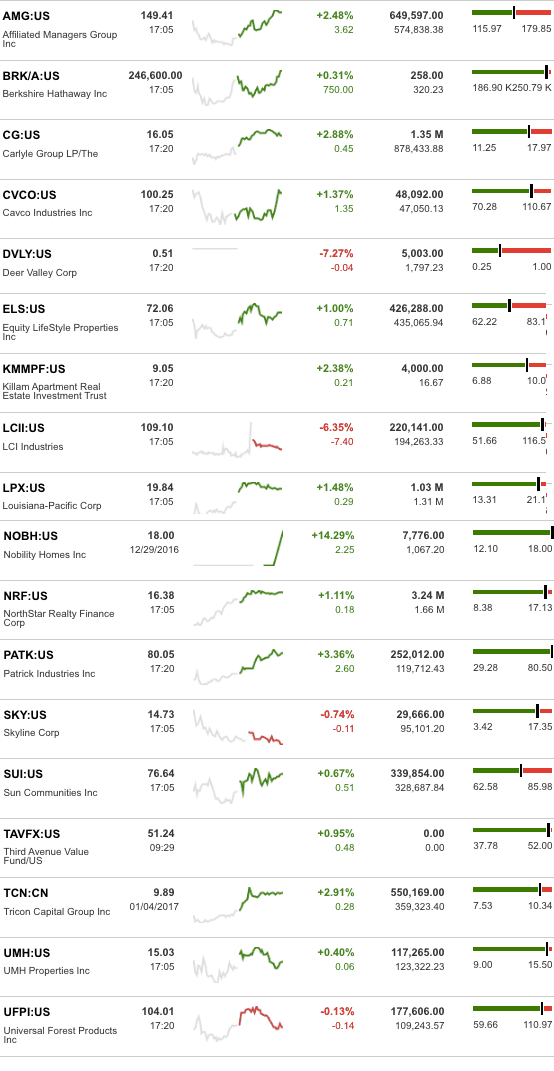

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Patrick Industries Inc. (PATK) and Tricon Capital Group Inc (TCN).

The top two sliders for the day were Deer Valley Corp. (DVLY) and LCI Industries (LCII). Note: LCI was previously known as Drew.

Nobility last moved on 12.29.2016, which is why it isn’t listed above as the top mover for the day.

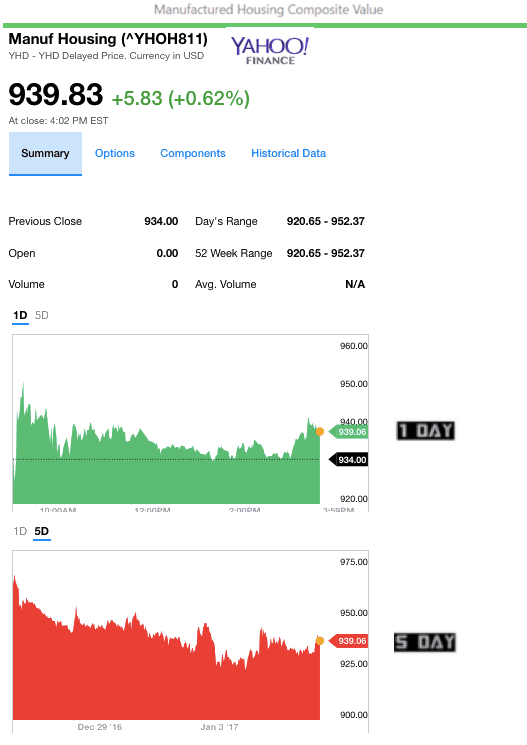

Manufactured Housing Composite Value (MHCV) Ticker

Note: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, LCI, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.