For those who need the reminder, “Bain Capital is a private investment firm based in Boston, Massachusetts. It specializes in private equity, venture capital, credit, public equity, impact investing, life sciences and real estate. Bain Capital invests across a range of industry sectors and geographic regions. As of 2018, the firm managed more than $105 billion of investor capital.” So said Wikipedia. As longtime readers here know, MHProNews at times uses brown and bold text to make direct quotes ‘pop,’ but otherwise the copy is as in the original as cited.

Bain Capital was made more widely known in the U.S. by former Governor (now Senator) Mitt Romney during his 2012 presidential contest against former President Barack H. Obama.

To give a deeper sense of Bain, consider this partial list of firms that the investment fund has made financial bets on.

According to Wikipedia, “The firm was founded in 1984 by partners from the consulting firm Bain & Company. Since inception it has invested in or acquired hundreds of companies including AMC Theatres, Artisan Entertainment, Aspen Education Group, Brookstone, Burger King, Burlington Coat Factory, Canada Goose, DIC Entertainment, Domino’s Pizza, DoubleClick, Dunkin’ Donuts, D&M Holdings, Guitar Center, Hospital Corporation of America (HCA), iHeartMedia, KB Toys, Sealy, Sports Authority, Staples, Toys “R” Us, Warner Music Group, Fingerhut, The Weather Channel, and Apple Leisure Group, which includes AMResorts and Apple Vacations.”

MHProNews has had sources that have said that Bain and Romney previously invested in the manufactured housing sector, specifically mentioning land lease manufactured home communities. When asked about that, Bain’s media relations would not confirm that claim. While their response implied a denial, it was also carefully phrased, leaving that possibility open. Rephrased, it is possible that what follows isn’t a one-off for professionals directly connected to Bain.

Also, when Amazon, Google, Facebook, Microsoft, and other tech giants are exploring or have made investments or are otherwise involved in various forms of prefabricated housing, would it be any surprise that Bain Capital has a ‘former’ associate who has jumped into the prefab housing business?

Specifically, it is John Geary and Abodu. Let’s look further.

Granny Flats, Accessory Dwelling Units (ADUs), and Manufactured Homes in California

“Bay Area–based company Abodu has developed a permitting program to spur lightning-fast build-outs of backyard houses,” said Dwell in a Sept 5, 2019 article entitled “These Affordable Backyard Homes Can Be Installed in Two Weeks, and They Start at $199K.”

That price point is useful information, because the homes are reportedly only about 500 square feet.

This video report by CBS affiliated KPIX didn’t mention a price in the video interview and tour of Abodu’s cofounders John Geary.

Geary worked for Bain Capital, according to his LinkedIn profile.

Dwell went on to say that “In San Jose, homebuilder Abodu has developed a deal with the city to incentivize homeowners to install turnkey backyard rentals—and the synergy is in the pudding.”

They added that “Buyers can now skirt hurdles in the building process and plop down a 500-square-foot standalone house in just two weeks. Most of that time is dedicated to prep work for the build site—the home itself can be assembled in a day. The units will bolster affordable housing throughout San Jose while adding value to homeowners’ properties.”

That source said that San Jose is pushing to develop 10,000 new affordable housing units by 2022. Abodu is a boon for city, according to Mayor Sam Liccardo.

“When the legislature voted in 2017 to encourage granny units on existing home sites, there was a lot of interest from the public but that cooled off once homeowners discovered the difficulty of the permitting process,” KPIX reported.

Now ponder for the next few moments the notion that 500 square foot prefabs selling for about $400 per square foot installed is being viewed as ‘affordable.’

From the Abodu website, “Off-site construction allows us significant cost savings, which we pass right through to you. A traditional site-built contractor process will cost you nearly 2x for a unit of similar quality and finish to Abodu – believe us, we checked.”

Note too that Geary and Abodu have had significant free media for some time about this project. The Google search results below gives you an idea of how positive that coverage has been.

Here is part of the pitch from the Abodu website. Manufactured and modular home builders, ponder how many of these same claims could be made by your firm? The next four subheadings are from their website. So too are the photos shown.

Extra Space

More square feet means more options:

- A place to stay for visiting friends and family.

- Allow yourself to age-in-place, or house a live-in-nurse.

- A place for your post-grad…that’s not under the same roof.

- A place for your nanny, or an Au Pair.

- A home office, a home gym, or a home studio.

- The possibilities are endless — it’s your Abodu, it’s your space.

Rental Income

- The Bay Area is a high-rent market. You know that.

- Have savings or home equity? Expect to net more than $2,000 per month.

- Need financing? Even after financing costs, most homeowners net more than $1,000 per month from ADU rentals.

- Want even more? Move into the ADU, and rent out your main home.

- Contact us to receive a personalized rental estimate for your area.

Increased Property Value

By exactly how much is up for debate, but people generally agree it’s significantly more than the cost of construction. We’ve done our best

to estimate this for you below.

Community Benefits

Adding livable space will help solve the local housing crisis. Want to go even further? Talk to us about how you can help house someone who needs it most.

MHProNews Fact-Checks and Analysis – Manufactured Home Industry Takeaways?

There are tens of thousands of ADUs that could be built in the coming years. California, as it is currently configured, could use millions of affordable housing units. Who says?

“Since about 1970, California has been experiencing an extended and increasing housing shortage, such that by 2018, California ranked 49th among the United States in housing units per resident. The shortage has been estimated at 3-4 million housing units (20-30% of California’s housing stock, 14 million as of 2017),” per Wikipedia.

How many of those might be built to the HUD Code, if the enhanced preemption clause of the Manufactured Housing Improvement Act of 2000 (MHIA) was being fully enforced?

How many ADU’s could be built to the HUD Code, if the enhanced preemption clause of the MHIA was being fully enforced?

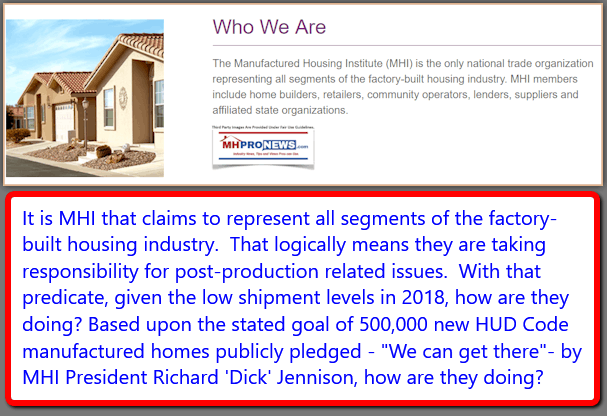

It is hard to find the words that can politely but accurately say just how poorly our manufactured home industry’s post-production sector has done in addressing the huge opportunities. For those that say that it isn’t MHI’s fault, they need but consider their own claims. Neither MHI, nor their backers, can have it both ways. They are either representing all segments of factory-built housing, including HUD Code manufactured homes, or they aren’t.

MHI are either doing a good job of representing manufactured housing, or they are not.

Yesterday, there was an extended call from a non-MHARR firm that is a member of MHI to MHProNews. That call was off the record but could be aptly summed up by saying that the president of that firm flatly stated that MHI was not benefiting their operation.

That dovetails with what another non-MHARR MHI member company leader said last week to MHProNews. That firm’s executive said that he was confident that Clayton Homes would love to see his company put out of business.

The View from a Berkshire Hathaway Board Member

We’ve spoken about the Omaha-Knoxville-Arlington axis for some time. Less than 48 hours ago, about a one-page emailed message from a Berkshire Hathaway board member was sent to MHProNews.

It was laid out as a defense of Clayton Homes, their affiliated lenders, and their business practices. It should be noted that much of it dealt with controversies surrounding the communities sector.

The reply our publisher gave was in part as follows. It has been paraphrased in the following fashion. The ‘he’ below is a reference to the Berkshire board member, as if a third person was being addressed in the reply. As noted, important parts of the board-members message was about land-lease communities and the impact of Berkshire and Warren Buffett on that aspect of the industry. With that caveat, ponder our publisher L.A. ‘Tony’ Kovach’s reply.

Interesting. That said, a few thoughts.

- While some of what he says is accurate, it is an incomplete picture. [Warren] Buffett, so it is said, had Clayton [Homes] spin off their land-lease communities (Clayton owned dozens of them at the time Berkshire [Hathaway] bought Clayton in 2003), but that doesn’t mean that they are no longer indirectly involved. Indeed, they are in several ways.

- Many of those former Clayton owned locations are now owned by YES Communities. My understanding is that they do quite a bit of business with Clayton and 21st.

- Vanderbilt has begun brokering loans on land-lease communities, as I understand it, using the GSEs to make the loan.

- Clayton and the Berkshire brands dominate the Manufactured Housing Institute (MHI), which has been so hammered by our reports, that they recently sent out a reminder to their members on the MHI code of ethical conduct. It is rather comical, in this sense, that it is Clayton and MHI member firms that were in that Last Week Tonight with John Oliver video. It is Warren Buffett’s donations through one of his nonprofits, and through it to the Tides [nonprofit] that the report hit the light of day with the Washington Post, and then John Oliver.

None of what he said changes a single concern we’ve raised…

I think you know the [information in these researched] links:

By the way, the lady who brokered that sale in the article linked below works for a Berkshire brand.

We are careful…in making our reports accurate so that they stand up to scrutiny. We don’t take quotes out of context. We don’t use straw man arguments. Thanks again for the share…

##

A follow up was invited. We’ll see what happens.

Stating the Obvious, Using Facts, Evidence, Logic vs Mere Opinion

A senior official of an MHI member brand said that the Arlington based trade group is ‘afraid’ that if Clayton pulled out of MHI, that the association would quickly become financially unstable. So, what Clayton and the Berkshire brands want from MHI, they get.

MHI recently claimed that they have ‘for years’ promoted “enhanced preemption.” That is at best a half-truth. They have at times mentioned it, but as MHProNews has routinely checked and reported, those words are not found on the MHI website. You can find the word ‘preemption,’ but that isn’t legally the same as ‘enhanced preemption,’ as MHI’s attorneys surely ought to know.

Sources and logic have said that the Omaha-Knoxville-Arlington axis has not pushed “enhanced preemption,” nor taken other seemingly reasonable steps to promote a correct understanding of manufactured housing or enforce good existing laws precisely to de facto foster consolidation of the industry into ever fewer ‘big boy’ hands.

If MHI and Clayton Homes are truly serious about industry growth, then they will immediately begin to take steps to see to it that HUD fully enforces the MHIA law.

If MHI and Clayton Homes are serious about the industry’s growth, they will promptly ask FHFA to demand that the GSEs to fully enforce the Duty to Serve Manufactured Housing under the Housing and Economic Recovery Act (HERA) of 2008.

But instead, after consistent pressure from MHARR, MHProNews, MHLivingNews and some others, MHI periodically throws a metaphorical bone to their members.

Under Pressure, MHI Pivots “HUD Must Implement and Enforce its Enhanced Preemption Authority”

Examples of that are linked above and below.

Abodu is an example of how others with connections to capital outside of our industry are seeing the potential of factory-built housing. Investors contact MHProNews in part due to follow up questions on reports that they say ‘make sense,’ and are ‘the only logical explanation for the industry’s underperformance.’

That the industry underperforms is demonstrated by several investor relations packages. See the example, with commentary by MHProNews, from Skyline-Champion below.

MHI, Clayton, 21st and their inside and outside counsels have been asked to comment on such issues. They routinely decline. Instead, they arguably use their surrogates or their own emails to effectively propagandize their own followers.

Time will tell if Abodu or others will surpass HUD Code home sales in California or elsewhere. But it would be a failure of industry members and public officials if the issues outlined and linked from reports herein aren’t explored and addressed. Why? Because millions can’t afford $400 per square foot housing.

On both sides of the left-right political spectrum there have been leading voices that have said that there is a ‘rigged system’ in America. While their solutions differ, examples including Senators Bernie Sanders, Elizabeth Warren and President Donald J. Trump.

Perhaps the most researched and proven form of permanent affordable housing in America is manufactured homes. Democratic and Republican lawmakers that have studied the issue agree on the value of manufactured homes.

So why is the industry underperforming? Could it be as simple as ‘a rigged system’ that aims to consolidate the industry until the powers that be decide to take their foot off the brake and put it on the gas pedal instead?

See the related reports below the byline and notices for more.

Friday Federal Follies – Deep State, Revolving Door at HUD, MHI?

That’s your Saturday edition for the industry’s top and most-read source for accountability, fact-checks, and growth-focused manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and and here.

Related Reports:

Click the image/text box below to access relevant, related information.

Pam Danner’s Replacement Announced, MHARR Rips HUD Leadership, More

“Revolving Door” – 2019 Research by Public Citizen Spotlights Swampy Problems