The TRD national weekend edition reported on 9.5.2020: “Hot commodity: Investors bet on mobile home parks [SIC] Sales volume increased 23% in the second quarter, year-over-year.”

Citing left-of-center Bloomberg, they said: “More than $800 million worth of mobile home parks traded during the second quarter, according to Bloomberg. That’s 23 percent more than the volume sold in the second quarter of 2019.”

TRD said, “Meanwhile, total commercial trades declined 68 percent year-over-year in the second quarter to $45 billion. During April — so far the worst month economically of the coronavirus pandemic — deal volume fell 71 percent year-over-year, or by $11 billion. Not a single commercial property type saw an increase in sales volume.

Investors are willing to pay more for property leased to mobile home owners than they were last year. Valuations of those properties were up 26 percent, year-over-year, in the second quarter.

Institutional investors accounted for 28 percent of the deals, according to JLL. That’s the largest share since the firm started tracking mobile home park deals a decade ago.”

Reuters states that “Jones Lang LaSalle Incorporated (JLL) is a financial and professional services company specializing in real estate. The Company operates through four business segments: Americas; Europe, Middle East and Africa (EMEA); Asia Pacific, and LaSalle.”

Real Estate Investing online, Real Deal and other commercial real estate focused publishers cited similar data and Bloomberg. “As returns fade and uncertainty reigns in traditional commercial real estate sectors, investors are moving money into mobile home parks. More than $800 million worth of mobile home parks traded during the second quarter, according to Bloomberg. That’s 23 percent more than the volume sold in the second quarter of 2019. Meanwhile, total commercial trades declined 68 percent year-over-year in the second quarter to $45 billion.”

TRD elaborated on manufactured home communities, but also on another trend that MHProNews has periodically reported on: build-to-rent single family housing. The most recent report including that build-to-rent topic is linked here.

“JLL’s Scott Belsky said that mobile home parks generate stable returns for investors because residents usually own their own homes and rent the ground they’re on.

Single-family rentals and the companies that invest in them are also attracting a ton of capital.

JPMorgan Chase more than doubled its investment in American Homes 4 Rent to $625 million in May.

Koch Industries made a $200 million preferred-equity investment in Amherst Holdings’ single-family rental business. And Invitation Homes plans to double its portfolio of single-family rentals. [Bloomberg]” — so wrote Dennis Lynch.

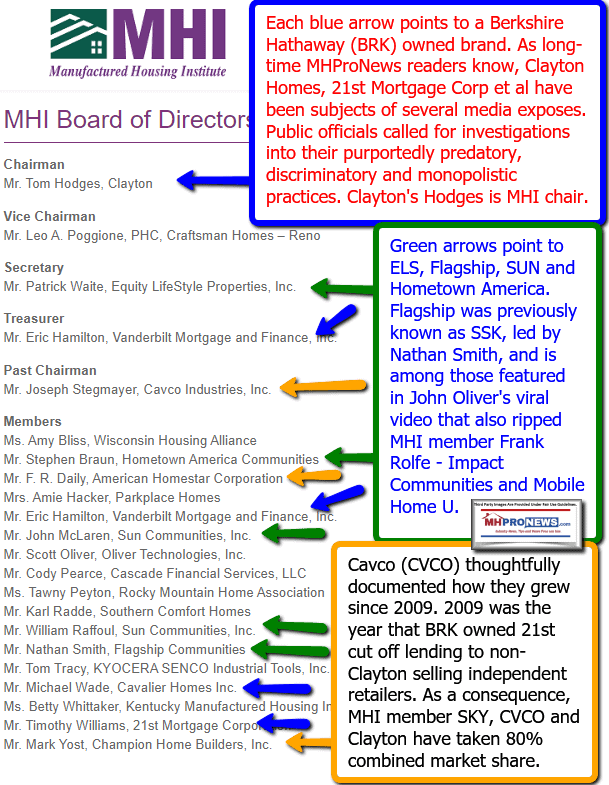

Note that JP Morgan has Berkshire Hathaway as a major shareholder. Berkshire Hathaway is the parent company to Clayton Homes and others influential in the Manufactured Housing Institute (MHI).

Additional Information, MHProNews Analysis and Commentary

The growing consolidation of the commercial real estate side of the land-lease community segment of manufactured homes is a multiple year trend. Manufactured home communities outperformed in the 2008 downturn, according to many analysts. Something similar appears to be occurring in the Wuhan Chinese coronavirus pandemic-related downturn of 2020.

There were some modest to higher profile fails in the wake of the 2008 downturn. For instance, blogger George F. Allen’s daughter Susan McCarty reportedly failed in an early attempt to follow in her father’s footsteps. Allen himself admitted in writing some time ago that he didn’t practice what he preached in his blog and that one of his last communities had high vacancy rates as a result.

Understanding the Modern Realities of MHVille – Winners, Losers, Profits, and Loss

Failure need not be a permanent condition, as the history of Abraham Lincoln, McDonald’s billionaire Ray Kroc, or Kentucky Fried Chicken’s (KFC) “Colonel Sanders” all came to prove during the course of their lives. History, one’s own or that of others, are there to learn from.

As manufactured home communities continue to move toward full occupancy, there is a growing – and vastly underreported problem – looming in the manufactured housing industry. That would be the dearth of new land-lease communities and other developments being brought on line.

This writer raised that vexing issue with several during the last Manufactured Housing Institute (MHI) meeting I attended during the early days of what would be the Trump Presidency. Along with questions about MHI’s posture toward Pam Danner, and other topics, MHI apparently decided that they had enough of my questions and observations. They refunded that year’s membership and told me via an unsigned letter that our enterprise didn’t fit into any of their membership categories. After some 7 years at MHI, including some of that time as an elected board member in their Suppliers Division, they suddenly discovered a ‘reason’ – which was arguably pure BS, as others in MHI claim to do something similar to what we do – for parting ways. After having praised us for years, and having utilized our services, their leaders apparently had their fill when our questions and observations became too much for them to duck or dodge.

That disclosure made, there was a series of slow ‘aha’ moment awakening for this writer and our publication. If MHI truly wanted to advance the interests of “all segments” of manufactured housing, why was it that it was routinely the big boys that benefited while smaller companies were there for acquisition and other purposes?

Prominent MHI member Frank Rolfe raised the point that the community sector may be overheating. Time will tell, but there is an argument for that concern.

But what is beyond doubt is that if roughly 1/3 of all manufactured homes are going into land-lease communities, according to the U.S. Census Bureau and other sources. So as those remaining vacant homesites fill and with too few new communities coming on line, what will happen to numerous independent producers of HUD Code manufactured homes currently supplying that dwindling market?

MHI is arguably a brilliantly deceptive or hopeless inept organization. MHI leaders are inept if they claim to be promoting growth when the industry is in the second year of decline during an affordable housing crisis. Or MHI leaders are brilliantly deceptive – meaning, in a black hat, sinister manner – if their goal is to use smaller ‘white hat’ operations as cover for bigger or often black hat brands that seek to acquire smaller ones at discounted valuations.

Given the education of the MHI leaders along with other evidence, it is harder to make the argument that they are inept. For instance, if the ‘big boys’ behind MHI wanted to grow, then why have they tolerated so many years of underperformance by MHI staffers?

Using the principle of Occam’s Razor, it is easier to make the case that MHI are a con-game that benefits insiders while largely harming the interests of independents. In doing so, MHI has contributed to costing untold thousands of independents millions if not billions in lost value and profits. It is amazing how mixers, smiles, and drinks can go a long way toward convincing people that someone or some group are different than what they purport to be.

The Freddie Mac video below is where the featured image at the top originated.

To learn more, see the related reports linked above or further below the byline, offers, and notices.

Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.