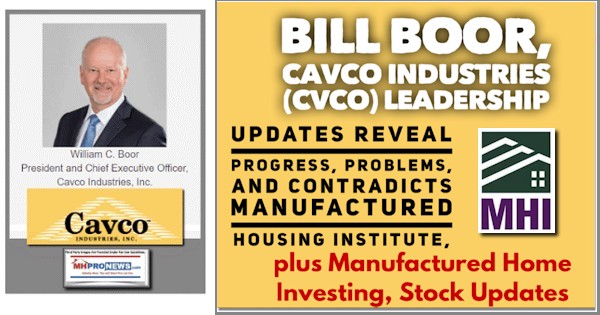

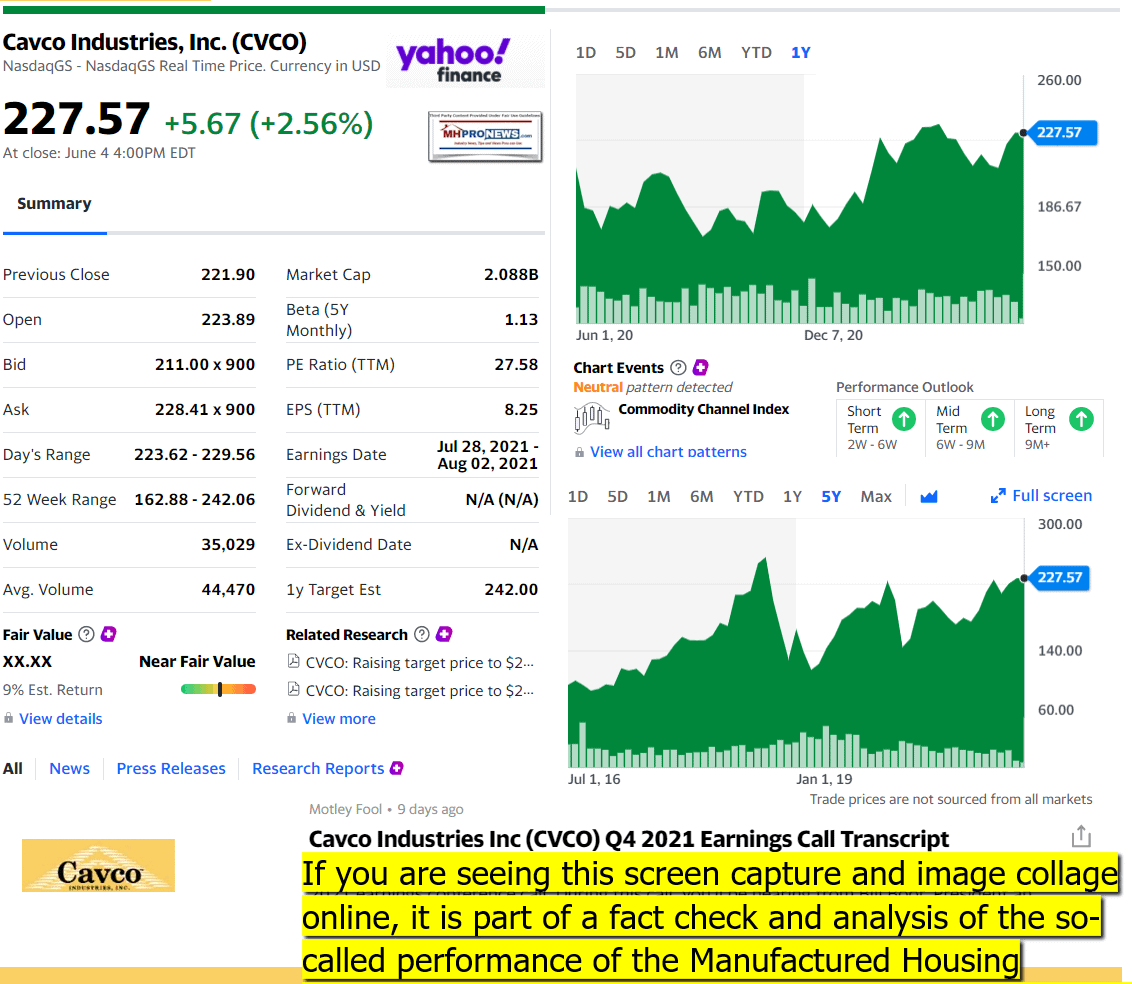

The following transcript of the May 27, 2021 earnings call for Cavco Industries is per Yahoo Finance and the Motley Fool. It is important to note that there are some apparent typos in the transcript that spokespeople for Cavco Industries (CVCO) for whatever reason declined correcting when asked by MHProNews.

The full transcript will be followed by some pull quotes that shed light on progress and problems that continue for the firm, and also shed light on the industry’s broader picture. First time or newer readers should be aware that Cavco’s prior CEO and the firm are still under the cloud of an SEC subpoena, which Cavco admits below has cost them millions in addressing. Despite the scandal that started in the public eye in 2018, the Manufactured Housing Institute (MHI) did not ask then chair Joe Stegmayer, a central figure in Cavco’s imbroglio, to step down. It is one more example of how truth is stranger than fiction when it comes to MHI and some leading brands in our industry.

CVCO earnings call for the period ending April 3, 2021. May 27, 2021 at 3:30PM

Cavco Industries Inc (NASDAQ:CVCO)

Q4 2021 Earnings Call

Contents:

Prepared Remarks

Questions and Answers

Call Participants

Prepared Remarks:

Operator

Good day and thank you for standing by. Welcome to the Fourth Quarter and Fiscal Year 2021, Cavco Industries, Inc. Earnings Call Webcast. [Operator Instructions]

I would now like to turn the conference over to your host, Mr. Mark Fusler, Director of Financial Reporting and Investor Relations. Please go ahead.

Mark Fusler — Director, Financial Reporting and Investor Relations

Good day and thank you for joining us for Cavco Industries’ fourth quarter and fiscal year 2021 earnings conference call. During this call, you’ll be hearing from Bill Boor, President and Chief Executive Officer; Paul Bigbee, Chief Accounting Officer and myself.

Before we begin, we’d like to remind you that comments made during this conference call by management may contain forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995, including statements of expectations or assumptions about Cavco’s financial and operational performance, revenues, earnings per share cash flow or use, cost savings operational efficiencies, current or future volatility in the credit markets or future market conditions. All forward-looking statements involve risks and uncertainties which could affect Cavco’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of Cavco. I encourage you to review Cavco’s filings with the Securities and Exchange Commission including without limitation, the company’s most recent Forms 10-K and 10-Q which identify specific factors that may cause actual results or events to differ materially from those described in the forward-looking statements. Some factors that may affect Cavco’s results include but are not limited to the impact of local or national emergencies including the COVID-19 pandemic and such impacts from state and federal regulatory action that restricts our ability to operate our business in the ordinary course and the impacts on customer demand and the availability of financing for our products, our supply chain and the availability of raw materials for the manufacture of our products, the availability of labor and the health and safety of our workforce, our liquidity and access to the capital markets, the risk of litigation or regulatory action, potential reputational damage that Cavco may suffer as a result of matters under inquiry, adverse industry conditions, our involvement in vertically integrated lines of business, including manufactured housing consumer finance, commercial finance and insurance, market forces and housing demand fluctuations, our business and operations being concentrated in certain geographic regions, loss of any of our executive officers, additional federal government shutdowns and regulations affecting manufactured housing.

This conference call also contains time-sensitive information that is only accurate as of the date of this live broadcast, Thursday, May 27, 2021. Cavco undertakes no obligation to revise or update any forward-looking statements whether written or oral to reflect events or circumstances after the date of this conference call, except as required by law.

Now I’d like to turn the call over to Bill Boor, President and Chief Executive Officer. Bill?

William C. Boor — President and Chief Executive Officer

Welcome and thank you for joining us today to review our results for the fourth quarter and fiscal year. Reflecting on the year, I went back to last year’s call by the time we reported in May of last year we were starting to see some positive demand signs, however, the magnitude of the pandemic was increasingly apparent and it was an incredibly uncertain time. At Cavco we’re already well into the process of implementing policies and approaches to support our employees, while safely keeping all of our operations open to support our customers.

Nobody could have guessed of what was ahead and we said on the call the projections and predictions were meaningless. We set clear principles for the path forward and we remain flexible. We now know that we were in the early stages of a long and very challenging year to be reporting our 11th straight year of increased revenue and operating earnings with that backdrop is remarkable. And it can only be attributed to the people at Cavco who have persevered and remained extremely committed. That’s true for the year and has been demonstrated again in the fourth quarter, when the Texas freeze and power outages impacted people across all of our operations. Again, they found ways to quickly open back up, even while dealing with their personal challenges due to the unprecedented weather event. This results speak for themselves. We’re only possible through extraordinary and very capable effort.

Focusing on a few of the results, we recorded the highest quarterly net revenue in our history. Our manufacturing utilization was approximately 75%, that’s lower than before the pandemic and little constellation given the rapidly growing backlog. It’s very good progress in late of persistent labor and supply challenges that have not let up. At times during the quarter, utilization did reach 80%, despite significantly less hours worked and the supply inefficiencies we’ve discussed before. Backlogs were up again this quarter, growing $131 million to $603 million. That equates to approximately 32 to 34 weeks, but we need to keep pushing to produce more. It’s been the extraordinary order rates that are driving those backlogs. Order rates were up 50% over last year’s fourth quarter and 40% for the year. These incremental orders account for about 85% of the backlog growth this year.

After a dip in product costs in October and November, which favorably impacted our fourth quarter margins, supply costs escalated rapidly. For example, Oriented Strand Board was up 275% over the past year and 48% from the start to the end of the fourth quarter. As we’ve worked to increase inventories where possible to address supply risk, we expect the lag in our manufacturing margins whereby cost of goods sold will continue to drift up even after spot markets hopefully peak and decline. The bottom line here is that I feel we’ve done a good job keeping up with input costs and I expect gross margins will be moving around a bit from quarter-to-quarter, due to this lag in material costs hitting cost of goods sold and the wild changes in input costs that we’ve seen.

Retail operations continue to perform very well, like other retailers, if they could get more homes they could sell them. They’ve done a great job adjusting to the dynamics of the past year, which has meant an emphasis on e-leads and phone ups during the bulk of the year when walk-ins were down. It’s been a consistent story of higher conversion rates, which means people are out to buy not just shop. Traffic and sales continue to follow a seasonal pattern, but at a significantly higher levels in recent years.

Regarding financial services, I want to specifically recognize the outstanding job done by our people at Standard Casualty who responded remarkably to the February Texas Freeze which is in their customers’ time of need. This tremendous commitment made a huge difference for many impacted homeowners. Claims from that event exceeded our reinsurance limit of $2 million. Despite this Financial Services had a strong quarter and year with gross profit of 84% and 12% respectively. As Paul will explain the quarterly comparison as to last year’s period when we had some country place mortgage valuation adjustments and loan loss assumption changes resulting from the late March market with disruptions, regardless of performance in both lending and insurance was strong.

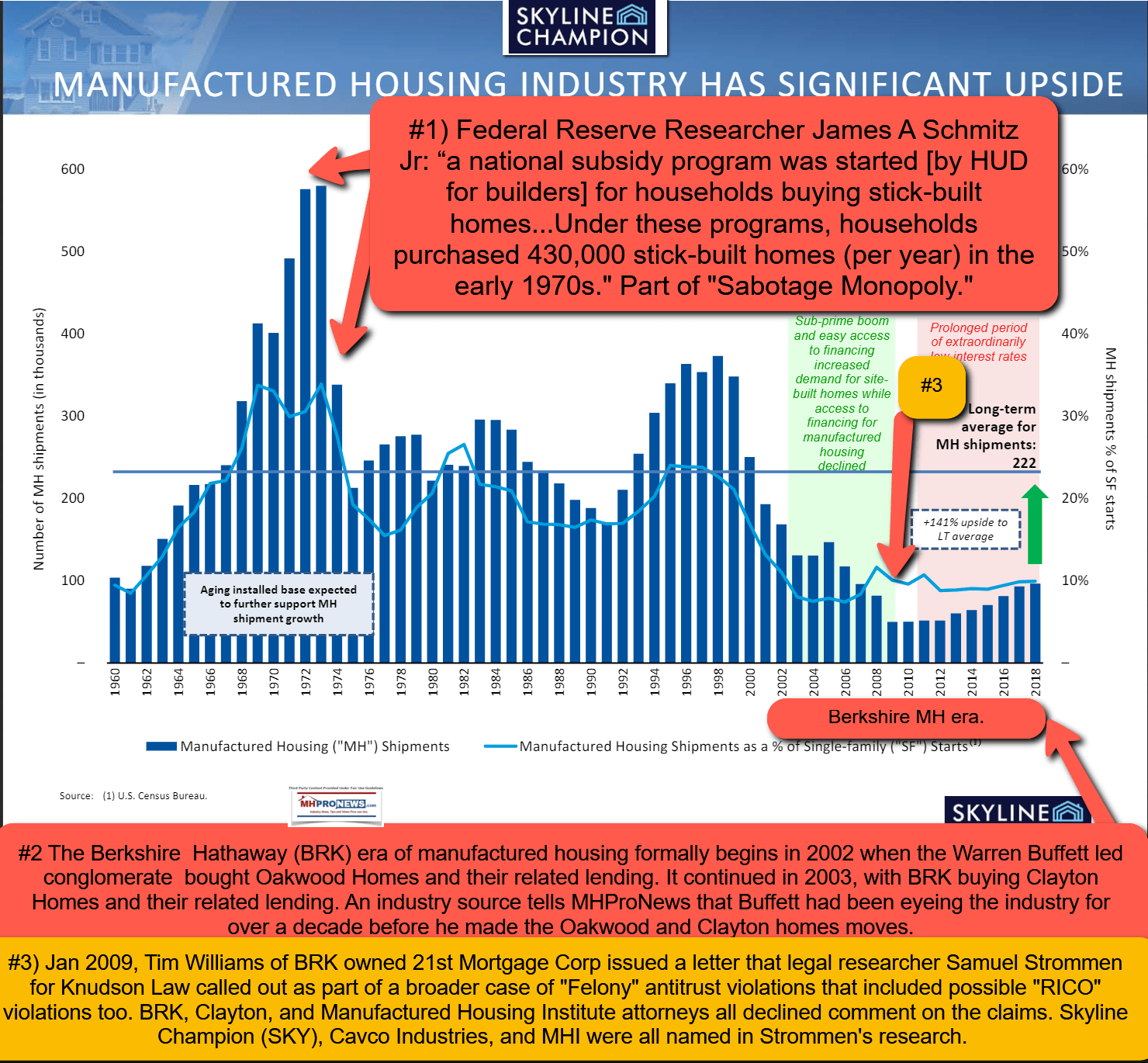

In the broader housing picture the homebuilding industry is only touching the level of new unit starts needed to balance household formations, with supply and labor constraints the country’s pent-up demand for units from a decade of under building is not yet being worked down, while we know there will be cycles driven by interest rates and other macroeconomic drivers, there is a tremendous need for more affordable housing.

Beyond the past years challenges and our need to focus on delivering strong results we stayed focused on the long-term as well. Our strategy of investing in our plants, seeking acquisitions and new growth opportunities and investing in our people is not caused by the pandemic. As one example, during the quarter, we announced the purchase and development of the new park model facility in Glendale, Arizona, that will increase capacity for park model customers and also increase our HUD capacity because it frees up the second line in our [Indecipherable] plant. That project is on schedule to open later this year. We’re investing in improvements to our plants that will increase productivity and improve the workplace for our coworkers. And we’re committing ourselves to training and career programs that will pay off in retention and skills improvement. These are the fundamentals that will enable Cavco to produce more homes and have a bigger impact on affordable housing. With that, I’ll turn it over to Paul to discuss the financial results in more detail.

Paul Bigbee — Chief Accounting Officer

Thanks, Bill and good afternoon, everyone. I’m going to go through the operating results and I will turn it over to Mark to walk through the balance sheet changes. So, as Bill mentioned, net revenue for the fourth quarter of 2021 was the highest quarterly revenue in the company’s history. We ended up at $306.5 million which is up 20.1% compared to $255.3 million during the prior year’s fourth fiscal quarter. Within the factory-built housing segment, net revenue increased 19.6% to $288 million from $240.8 million in the prior year quarter. The increase is primarily due to a 13.8% increase in average revenue per home sold primarily from product pricing increases and a product mixed shift to slightly more multi section homes, both of which contributed approximately $27.7 million of additional net revenue. Units sold increased 5.2%, which contributed approximately $19.1 million. Home production continues to improve the factory utilization for Q4 2021 coming in approximately 75%. However, we do still continue to face challenges with inefficiencies from unpredictable factory employee absenteeism, hiring challenges and building material supply shortages.

The Financial Services segment, net revenue increased 26.7%, $18.5 million from $14.6 million primarily due to $1.1 million of market gains on equity securities compared to $2.3 million in losses in the prior year quarter. Additionally, the impact of having more insurance policies in force compared to the prior year quarter was partially offset by a reduction in interest income from the formally securitized loan portfolios that continue to amortize within expected levels. Consolidated gross profit in the fourth quarter as a percentage of net revenue was 23.1%, up from 20.3% in the same period last year. Increase is primarily the result of the factory-built housing segment increasing to $20.6 million in Q4 2021 versus 19% in Q4 of 2020. Most factories have been implementing product price increases at a rate greater than the income input cost increases resulting in higher total gross margin dollars for home also expanding the gross margin percentage.

In addition, some incremental margin was provided by expensive raw materials purchased at a relatively lower market price at the beginning of the quarter before times of rapid increases, given our first-in first-out inventory accounting policy. So this means the margins in the early part of the quarter were better than the latter part of the quarter. Improved gross margins as percentage of revenue in financial services was 61.9% up from 42.7% in the same period last year, primarily due to the result of higher unrealized gains on marketable equity securities and the beneficial non-cash valuation adjustments. The prior year included $2.1 million in non-cash valuation adjustment charges, including loan loss reserves from economic conditions stemming from the pandemic, while the current period as a benefit from the same items of $0.7 million. These benefits were partially offset by higher weather related claims from the deep freeze that occurred in Texas in February of 2021.

Selling, general and administrative expenses in the fiscal 2021 fourth quarter was $44 million, a 14.3% of net revenue, compared to $37.4 million or 14.7% of net revenue during the same quarter last year. The cost increases were from higher salary and incentive compensation expense on improved results, increased charges related to paid off time policy vacation enhancements and several — severance expense of $1.3 million related to the separation from the company’s formal Chief Financial Officer. The fourth quarter also included a $1.4 million in expenses related to the SEC inquiry, included a related accrual for the potential outcome of the inquiry. There are really three main drivers on the reported SEC number. One, lawyer fees. Two, insurance recoveries and now this accrual.

I also want to remind you that the previous period included $2.1 million of D&O insurance premium amortization at no expense in the current quarter. Other income this quarter was $3 million compared to a net expense of $631,000 in the prior quarter. The current quarter includes unrealized gains of $2.1 million on corporate equity investments compared to unrealized losses of $2.1 million in the prior year quarter. This increase, partially offset by $0.6 million in reductions and interest income earned on cash and commercial loan receivables, and lower interest rates. Pre-tax profit was up 118.4% this quarter compared to $29.7 million and $13.6 million for the prior year period. The effective income tax rate was 15.2% for the fourth quarter compared to 12% in the same period last year. The higher effective tax rate in the current year period relates to higher income, partially offset by greater tax benefits and stock option exercises. Net income was up 110% to $25.2 million compared to net income of $4 million in the same quarter of the prior year. Net income per diluted share this quarter was $2.71 compared to $1.29 in last year’s fourth quarter.

Now, I’ll turn it over to Mark to go through the balance sheet changes.

Mark Fusler — Director, Financial Reporting and Investor Relations

Thanks, Paul. So comparing the April 3, 2021 balance sheet to March 28, 2020 balance sheet, the cash balance was at $322.3 million, up from $241.8 million a year earlier. Increase is primarily due to four items which include net income offset by non-cash unrealized gains on equity investments and other non-cash items, changes in working capital, including greater accrued expenses and other current liability balances which include higher customer deposits received as a result of higher order rates, principal collection on consumer loans and then sales of consumer loans greater than loan originations. These were offset by purchases of property, plant and equipment, including the purchase of the Glendale, Arizona park model facility, higher inventory purchases and repurchases of our common stock. Investments increased from the recovery of the underlying equity markets during the period.

Inventories increased due to rising prices of raw materials used in production. Prepaid and other assets was higher from the assets recorded in regards to the loan repurchase option for delinquent loans that have been sold to Ginnie Mae, while we are not obligated to repurchase these loans accounting guidance requires us to record an asset and liability for the potential of a repurchase. The balance included, increased from additional loans in forbearance offset by routine amortization of prepaid balances including the additional D&O premiums. Long-term consumer loans receivable decreased from principal collection on loans held for investment that were previously securitized. Operating lease right of use assets and related liabilities increased from five-year lease renewal of our Goodyear manufacturing facility, accrued expenses and other current liabilities increased from deferred payroll tax payments under the CARES Act, higher customer deposits, which have grown with the factory backlogs as well as the delinquent loan repurchase option previously discussed.

Lastly stockholders’ equity was approximately $683.6 million as of April 3, 2021, up $76 million from $607.6 million as of March, 28, 2020 and the balance sheet includes a new treasury stock line item representing the cost of our repurchase Cavco shares during the period.

And with that, I’ll turn it back to Bill.

William C. Boor — President and Chief Executive Officer

Thank you, Mark. I want to follow up on Paul’s comments about the SEC costs and the related accrual. I know given a very long time, the situation has been unfolding. There’s likely to be a lot of interest in this. Though appreciate given that the amount is financially immaterial to our overall results and it pertains to a desired settlement with the SEC, we’re not separately identifying the accrual amount. I also want to clearly say that our decision to accrue does not indicate any change in our view of a possible settlement which remains uncertain. I understand it slightly raises a question then why did you accrue now? This is a process in one that the SEC controls and drives as part of their process, we saw fit to formalize the settlement proposal and from an accounting perspective, this triggered the need for an accrual. You should not interpret this to mean that a settlement is imminent. I also want to caution that legal fees and potentially other costs are likely to continue. While I recognize this is news for reasons that I hope you’ll appreciate, we aren’t in a position to say more about it at this time.

With that Grace, let’s turn it over for questions.

Questions and Answers:

Operator

[Operator Instructions] Your first question comes from the line of Daniel Moore from CJS. Your line is open.

Daniel Moore — CJS Securities — Analyst

Good morning. Good afternoon, I should say our time. Thanks for taking the questions. Just a quick housekeeping to start. How much revenue and gross margin benefit did you see in the quarter from the additional week kind of year-over-year?

William C. Boor — President and Chief Executive Officer

Is there a number?

Daniel Moore — CJS Securities — Analyst

You can certainly estimate if you had it. We can get it offline. It’s not that difficult to back [Indecipherable].

Paul Bigbee — Chief Accounting Officer

Give me just a second.

William C. Boor — President and Chief Executive Officer

We will come back to that.

Mark Fusler — Director, Financial Reporting and Investor Relations

We will come back to it Dan.

Daniel Moore — CJS Securities — Analyst

Sure. So a lot of detail on the prepared remarks Bill, I greatly appreciate it. A lot of moving parts in the business. What are your expectations for shipments in fiscal Q1 relative to Q4? And should we think about the levels of potential shipments as we look out to Q2 and Q3 given this supply chain constraints that are well documented and particularly around PVC and siding and disruptions from the Gulf, etc. So, any commentary on how we should think about the cadence of shipments going forward would be helpful?

William C. Boor — President and Chief Executive Officer

Yes, continue to be interesting, I mean the supply situation really is not — excuse me, has not [Indecipherable]. So we’re not really seeing any less supply disruption, than we have in previous quarters. So that risk remains kind of unchanged. For the most part, it hasn’t caused our plants to shut down. We’ve had some very isolated situations where we’ve lost it there. And as we’ve talked before that causes inefficiency rather than necessarily shut down or has so far. So anything that we kind of anticipate as that risk overhanging and it continues to be the case. What we’re going to try to do is what we’ve been doing, which is continue to work our capacity utilization, what we’ve seen, I told you that we are at 75% over the course of the fourth quarter.

Our interim goal is to get back to where we were pre-pandemic, which is in the 80% range and I think that’s achievable. That — we got to the 75% and even spent periods of time in the quarter at 80%, despite less production employee hours. So I feel like we’re doing a good job from a throughput perspective, from an efficiency perspective, we just have to get the numbers let’s say at 80%. So I know I’m not giving you anything specific, demand certainly is in the question. The questions is, can we get the labor hours up and can we get — can we continue to maneuver through the supply issues. So that’s kind of how we’re looking at it and don’t really have a specific projection for you.

Daniel Moore — CJS Securities — Analyst

Okay. It doesn’t sound like you expect daily or weekly production to step back at least on what you’re seeing today materially, it’s just a function of how quickly we can improve it. Is that a fair assessment at least…

William C. Boor — President and Chief Executive Officer

Yes, I mean exactly right. All of our focus in manufacturing is just it is much throughput as we can, hoping that we can turn the tide on this on healthy backlog build. None of us want to be that high.

Daniel Moore — CJS Securities — Analyst

Okay. Are you seeing incremental demand coming from trading down versus site-built particularly given rising raw material inflation. Any anecdotal or other evidence there?

William C. Boor — President and Chief Executive Officer

Yes. I only have anecdotal and maybe even just what we believe to be happening from a logic perspective, we talked in the past as much as we’re struggling with efficiency and supply, we’re more efficient with labor and materials than site builders. So in a way the playing field for MH just keeps growing upward. So — and then you’ve got the rapid increase in housing costs that everyone has heard about and is following. So all that indicates that there’s got to be some segment that — and different times, we’d be looking at site-built that now are kind of in the zone of the higher end of our business. So I believe that’s happening. I don’t have a lot of data to point to. But the flip side of that, you would ask stand with the — flip side of that is concerned about the fact that the folks at the lower end in normal times would have been qualifying for bidding into a home and MH Home, they’re kind of getting priced out of the market right now. So that deficit of supply is just getting worse.

Daniel Moore — CJS Securities — Analyst

Understood, that’s helpful. And labor availability and absenteeism, are you seeing any improvements as the pandemic recedes or just kind of too early to tell?

William C. Boor — President and Chief Executive Officer

Yes, it’s kind of bouncy. Every time we get a little optimistic because we have a good week of net hiring then we get humbled the next week I guess. So I think we’re heading in the right direction. I think some of that, I’m hopeful that in the coming months some of that’s going to just be an improvement on a general economy perspective as far as people going back to work and looking for jobs. And so I think that some of it is attributable to some of the things we’re doing to try to address opportunities for our workplace and our wages. We’re doing a lot of things here that I think are making a difference. So I’m optimistic about getting through that that hiring difficulties that we’re facing.

Daniel Moore — CJS Securities — Analyst

Got it. And lastly and I’ll jump back, but — exciting to kind of hear about or see how the development of the new park model facility takes place? What are the other geographies that you’ve got targeted for potential greenfields where maybe you can open the plant and then increase capacity not only at the new plant, but alleviate a little bit of stress on some existing ones? Or is it, you sort of wait and see how this goes first and then go from there?

William C. Boor — President and Chief Executive Officer

Yes, we don’t really want to wait and see. I mean we want to be relatively aggressive about investing because our view as we’ve talked in past — in the past is very confident as far as demand is going forward. So we’re not sitting on our hands. The challenges with new capacity, obviously, it doesn’t happen overnight. She has got to have the confidence in demand, which we do, but the challenges are the same challenges that face us in our existing operations. Can you get the labor, can you get the supplies in a situation where some supplies are being allocated right now. And the classic challenge in MH also is, how are you going to get kind of the shelf space, the access to market, because most places are already served. So we’ve always said that we’ve got a real interest in the next frontier for us geographically, which is the Northeast geographically and we’re working hard to figure out how we can grow our shipments. So whether that’s acquisition or more greenfield, we’ll have to see how it unfolds.

Daniel Moore — CJS Securities — Analyst

Very good, I’ll jump — hand it over and jump back with any follow-ups. Thanks.

William C. Boor — President and Chief Executive Officer

Thank you.

Operator

Thank you. And your next question comes from the line of Greg Palm from Craig-Hallum Capital. Your line is open sir.

Greg Palm — Craig-Hallum Capital — Analyst

Yes. Great, thanks for taking the questions here. I wanted to start off with just back to the demand environment. Curious what trends have been like in April and May? And I guess any noticeable difference between retail and community channel calendar year-to-date?

William C. Boor — President and Chief Executive Officer

I’ll take the second part first. It’s kind of a short answer. They’re both going strong. I know early on in the fiscal year or when the pandemic was getting under way, communities kind of took a step back, more of a wait and see attitude and the street dealer business just took off. I’d say today, both are very strong hard to separate them. And what is the first part, the demand as far as regional, was that what you’re asking?

Greg Palm — Craig-Hallum Capital — Analyst

No, I was just — current quarter-to-date, what you’re seeing in terms of trends, April-May whether anything has changed since what you saw in your fiscal Q4?

William C. Boor — President and Chief Executive Officer

Generally, continued to be very strong. One of the things and this might be of more information than I need to throw out there that you’re interested in, one of the things we’ve started doing is keeping a really close eye on quotes as a leading indicator of demand and generally, I can just tell you that they remain very strong. The theory being that there should be a correlation between quotes to our manufacturing plants and ultimate orders and from that perspective we just don’t see any letting up right now. Obviously the same things would be the turning points if we see a significant increase in rates, that will change the tide, but right now, there’s just no reason not to be pretty optimistic about continued strong demand.

Greg Palm — Craig-Hallum Capital — Analyst

Yes, makes sense. I was a bit surprised that ASPs were flat quarter-over-quarter. I know it’s still a big jump on a year-over-year basis, and I think you called out mix shift, a bit more toward multi. I don’t know if that comment was specific to the year ago period or sequentially. But I guess what’s — what would be the reason that ASPs won’t continue to go up? Is that your expectation as you’ve continued to take up pricing here in recent months?

William C. Boor — President and Chief Executive Officer

Yes, it’s a little different answer for the sequential quarter-to-quarter in the year. Mark do you want to answer that?

Mark Fusler — Director, Financial Reporting and Investor Relations

Yes. So, this is Mark. Yes, we had a comment that you mentioned was related to Q4-over-Q4 year-over-year. So sequentially we did actually see a little bit the mix shift toward more single section homes. So that was offset by increased prices on the multi-section. So kind of net-net flat, like you mentioned.

Greg Palm — Craig-Hallum Capital — Analyst

So excluding any potential mix shift going forward, is it still safe to assume that like on a like-for-like basis, home prices are still going up. I mean, I think you’ve been taken price increases even more recently, correct?

William C. Boor — President and Chief Executive Officer

Yes. That process just continues. I mean as Paul talked about the input costs really shot up during the quarter. So we’re doing our best to kind of keep up with that and we tried to explain the dynamics that we see with margins and the fact that there is a lag between the current pricing of input costs and what flows through our cost of goods. So its something to keep an eye on. I think as I said, we’re going to probably see some balance sheet percent margins.

Greg Palm — Craig-Hallum Capital — Analyst

Yes. And I guess that was going to be my last one, because we obviously have the blended rate for the quarter in terms of the gross margin, but you had mentioned that it sounded like it was higher than that at the beginning and lower than that at the end. Can you at least sort of quantify maybe the gross margin rate exiting the quarter. I don’t know if it was lower by 100 basis points or 150 basis points and I’m specifically asking about the factory-built side, but I’m not sure if that’s what, if you can quantify that specifically or not?

Paul Bigbee — Chief Accounting Officer

Hope we have the quantification. But just give a little more background on that. We looked at the rate of materials for floor in October. And there was really a depth between the end of September and then the [Indecipherable] started in October and continued all the way through November and most of December. And so as those costs or purchased as raw materials those then became cost of sales or expense primarily January and February, which is why we had an increased margin and in the earlier part of the quarter. I don’t have the specific amount of that but just in general, the cost per floor was roughly 20% less in those — that October, November period than we had in another periods on lumber and OSP.

Greg Palm — Craig-Hallum Capital — Analyst

Sure. Okay, all right. Great. I’ll leave it there. Thanks.

William C. Boor — President and Chief Executive Officer

Okay, thank you.

Operator

Thank you. Next up we have Jay McCanless from Wedbush. Your line is open.

Jay McCanless — Wedbush — Analyst

Hey, just to ask one more question on that, should we think normally that there is going to be kind of that two-month lag where you buy raw materials and it takes about two months for them to go into a home or is that lag shorter right now as you all are trying to ramp utilization?

Mark Fusler — Director, Financial Reporting and Investor Relations

I think it’s a pretty good low sum to be honest, because you’re right, we’re trying to ramp utilization, but we’re also trying to make sure we get materials. I mean it’s not only the price, but it’s the physical availability. So we’re not trying to run at a very lean inventory right now in this environment. We’re trying to make sure that we’ve got everything we can get. So I think that’s probably I’m looking at, I think that’s probably a pretty good sum two-month lag.

William C. Boor — President and Chief Executive Officer

Yes, that makes sense. And like you said the change in ramping up production, the factories are very keen on making sure they have enough product to continue to build.

Jay McCanless — Wedbush — Analyst

Okay, great. And then, I understand that you don’t want to comment much on the SEC investigation, but I got a little lost Bill, when you were discussing, why you needed to take the reserve, this quarter. Could you go through that again, please?

William C. Boor — President and Chief Executive Officer

Yes, that’s fair enough. I’d love to talk about everything. I want to talk about it when we can say it’s all wrapped up. Yes, basically in the process of — we’ve said all along, we’re hopeful for a settlement, right. And in the process of working with the SEC this past quarter, we kind of formalized the settlement proposal to them. And when we did that that needed appropriate from an accounting perspective to book an accrual and that’s kind of it, I mean that’s the news really. So I think the difference from the previous quarter was discussions going on, but there was really nothing formalized that had been ratified by our Board. It was similar just discussions between the junior member at the SEC and our external counsel. So the formalization happened in Q4.

Jay McCanless — Wedbush — Analyst

Okay great. Now that makes more sense. Thank you. And then I guess the other question I had is you talked about low end consumers potentially getting priced out — low-end MH consumers and do you guys have any sense of how much of your market is at 5% of the TAM 10%. I mean, how much do you guys think has been priced out on that lower end buyer?

William C. Boor — President and Chief Executive Officer

Yes, it’s kind of a tough question, because we still have such high demand. So we’re not seeing the demand impact from it. I’m just kind of reflecting on what’s obviously going on in the market and the fact that the country has got this affordable housing issue. I believe that’s a low-end of the market issue and that part of the market it just go harder by houses. So, and Jay, I don’t really have a quantification of this. Just I think that while we believe that there is a huge general pent-up demand for housing, it’s disproportionately growing at that low end.

Jay McCanless — Wedbush — Analyst

Yes, understood. Okay. Thanks for taking my questions.

William C. Boor — President and Chief Executive Officer

Thanks, Jay.

Operator

Thank you. Your next question comes from the line of Ian Lapey from Gabelli Funds. Your line is open.

Ian Lapey — Gabelli Funds — Analyst

Hi, Bill. First, congratulations. 11 straight years of growth in revenues and earnings and obviously this year during a pandemic. It’s very…

William C. Boor — President and Chief Executive Officer

Thanks, Ian. Thank you very much.

Ian Lapey — Gabelli Funds — Analyst

A few questions on Financial Services if I could. I guess starting with Standard Chartered. How significant was the excess of claims above the retention limit and did this event the Texas Freeze as that resulted in higher pricing, either for your primary insurance or from your reinsurers? And also any impact on demand for insurance?

William C. Boor — President and Chief Executive Officer

The pricing impact really isn’t apparent if there’s going to be one. It kind of happens periodically on both our rates as well as reinsurance rates. So there is no apparent impact from that perspective. It was an interesting event because it was characterized by a whole lot of relative to, for example, hurricane a whole lot of smaller dollar number of claims. There were a lot of them. So if they go over the $2 million, I don’t know — I mean I don’t think we have any statement about how much over $2 million it went. It was the magnitude of some of the named hurricanes that we’ve had in the past. So I mean, this was a big issue.

Ian Lapey — Gabelli Funds — Analyst

Okay. And then on the commercial lending operations, I know initially this was — you got into the business to fill a void left as national lenders exited, have large lenders come back to floor plan financing for retailers and do you still view this as sort of an area of attractive growth presumably independent retailers will be adding stores given strong demand?

William C. Boor — President and Chief Executive Officer

Yes, I mean there is availability for floor plan lending out there. We continue to do. You’re absolutely right. The initial trust was that years ago is because so many big lenders exited the market. We’re kind of comfort how we manage it and we do think it’s important for some of our relationship with independent dealers. So it’s not something we look to necessarily grow aggressively from a profit perspective, we use it as kind of a way to support those independent dealers and the level has been relatively stable over time.

Ian Lapey — Gabelli Funds — Analyst

Okay, and lastly for country placed any updates on the chattel lending operations and any expansion there?

William C. Boor — President and Chief Executive Officer

Yes, we still think it’s an opportunity. We’ve seen some success in the market with some securitizations of people probably heard about. So that’s encouraging. And we think we’re pretty — we think we’re doing a good job, kind of pricing the risk of chattel lending. As we talked during the past year, the rates really were pushed down surprisingly, at least for me it was surprising that during the pandemic, there was kind of a step change down in rates for chattel lending. But even with that we’re looking at it is something that we might commit more balance sheet to over time.

Ian Lapey — Gabelli Funds — Analyst

Okay, thank you.

William C. Boor — President and Chief Executive Officer

Thanks Ian.

Operator

Thank you. Next up. We have Bill Wolfenden from Cottonwood Investments. Your line is open sir.

Bill Wolfenden — Cottonwood Investments — Analyst

Good morning. A couple of questions please. You guys announced a share buyback a couple of quarters ago, it looks like you bought –only bought back 6,000 shares. We’re getting it looks like over $375 million of cash and investments on the balance sheet. So could you just discuss your capital allocation priorities looking out over the next few years please?

William C. Boor — President and Chief Executive Officer

Yes. The small amount of buybacks its almost regrettable in that quarter just because it kind of wasn’t that significant, but we got going. So we still see that as an important tool to trying to manage the cash balance going forward. As I’ve said before we recognize we’ve got to manage that cash and we are frankly kind of surprised in the early days in the last fiscal year, that we build cash flow we did just because we started the year, we didn’t know all was going to transpire. So I think that little bit of a pause, to see what happens with the pandemic and we just kind of accelerated the issue. As far as priorities, we are investing in our plants and we’re investing in some organic growth as you’ve seen with Glendale, Arizona facility that we’re working on and cash was — there was a big use of cash this quarter for that. We are continuing to be in the market for acquisitions and I hope that we’ll be able to do something there. I’d talked — based on Ian’s question I talked, we’re willing to use some capital for chattel lending as long as the risk rewards rate for us. So the priorities kind of remain the same and we know we’re going to get some cash put to work here.

Bill Wolfenden — Cottonwood Investments — Analyst

So based on those comments, you anticipate the buyback potentially picks up then looking forward as we sort of get through the pandemic and tends to the SEC issue. And just seems like you’re buying your own shares might be more beneficial than earning zero in cash?

William C. Boor — President and Chief Executive Officer

Yes, I mean we got the authorization and tended use it to try to help manage the cash flows. So that is still is the case now.

Bill Wolfenden — Cottonwood Investments — Analyst

Great. And then just a housekeeping question, Can you elaborate on exactly what the non-marketable equity investments entail?

Paul Bigbee — Chief Accounting Officer

Yes. So those are our joint venture in retail operations that we’ve partially owned.

Bill Wolfenden — Cottonwood Investments — Analyst

Okay, great and then has there been any new proposals that we may have missed from the new administration in Washington that could potentially benefit the manufactured housing industry?

William C. Boor — President and Chief Executive Officer

Yes, nothing I would really say is noteworthy on the call here, no.

Bill Wolfenden — Cottonwood Investments — Analyst

Thank you.

William C. Boor — President and Chief Executive Officer

All right, thanks.

Operator

Thank you. And we have a follow-up question from Daniel Moore from CJS. Your line is open.

Daniel Moore — CJS Securities — Analyst

Thanks again. Bill, just wondering any update at all or color around CFO search?

William C. Boor — President and Chief Executive Officer

Yes, it’s ongoing. I wish it was done, but we’re doing well kind of holding down the foot, so it’s like a — like any recruiting effort. It’s kind of ongoing until the day, you got it done and we’re not quite there yet. So anxious to get there though. Thanks for asking.

Daniel Moore — CJS Securities — Analyst

Understood, thanks.

Operator

Thank you. I’m showing no further questions at this time, I would like to turn the conference back to Mr. Bill Boor, President of — and Chief Executive Officer for any closing remarks.

William C. Boor — President and Chief Executive Officer

Thanks Grace. Just in summary, we continue to operate through some very real challenges and risks. But, most notably the supply and labor that we talked about and the year was so much to work through its beyond gratifying to be able to report the strong financial results. And as I’ve said a few times its due to a tremendous amount of hard work by a very capable and committed people across the company. So we’re all very mindful that there is a lot of work ahead, we want to reduce the backlogs. We want to provide more quality affordable homes, loans and insurance coverage to the folks out there that we try to serve. So really appreciate everyone’s time today. Thank you for that. And thanks for your continued interest in the company.

Operator

[Operator Closing Remarks]

Duration: 45 minutes

Call participants:

Mark Fusler — Director, Financial Reporting and Investor Relations

William C. Boor — President and Chief Executive Officer

Paul Bigbee — Chief Accounting Officer

Daniel Moore — CJS Securities — Analyst

Greg Palm — Craig-Hallum Capital — Analyst

Jay McCanless — Wedbush — Analyst

Ian Lapey — Gabelli Funds — Analyst

Bill Wolfenden — Cottonwood Investments — Analyst

…

##

Additional Information, MHProNews Analysis and Commentary from the Above

For now, just 3 pull quotes from above. The first makes clear that our prior report, linked above, is still apt. but the second and third bullets are newsmakers to those who grasp the details of the manufactured home industry.

- “…the risk of litigation or regulatory action, potential reputational damage that Cavco may suffer as a result of matters under inquiry.”

- Bill Wolfenden — Cottonwood Investments – Analyst “Okay, great and then has there been any new proposals that we may have missed from the new administration in Washington that could potentially benefit the manufactured housing industry?”

- William C. Boor — President and Chief Executive Officer “Yes, nothing I would really say is noteworthy on the call here, no.”

What does that last quote matter? As a major brand at MHI, Cavco may well be privy to insider information at their trade association that others there are not being told about. When Cottonwood Investments Wolfenden says is there any new potential benefit coming from Washington for HUD Code manufactured homes, Cavco’s Boor says “no.” Nothing “noteworthy.”

That stands in stark contrast to the purported pabulum, posturing, and consolidation focused efforts of MHI, on behalf of their bigger brands. MHI keeps talking about progress, but Boor flatly said “no.”

It is one more piece of evidence that supports the concerns of some past and present MHI members, as well as those outside of the trade group that are hoping for real progress. Because Boor was quite correct in his last investor call when he said there is a chance for real progress.

To learn more about the disconnects involving MHI, see the related linked reports above and below. The ones that follow will then be trailed by the various market report and left-right headline news summaries for yesterday evening.

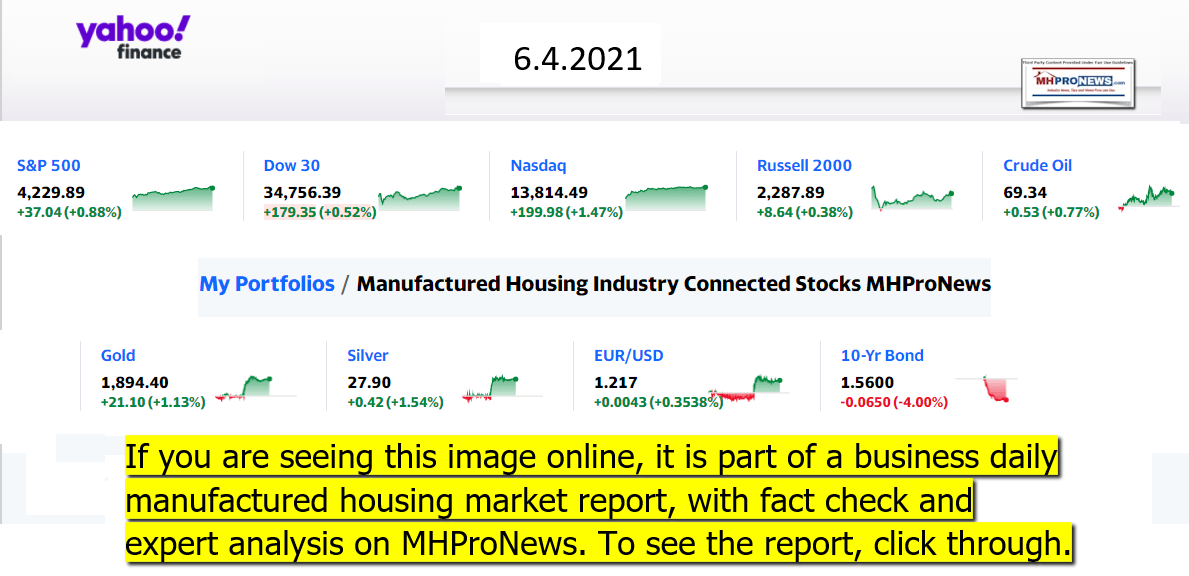

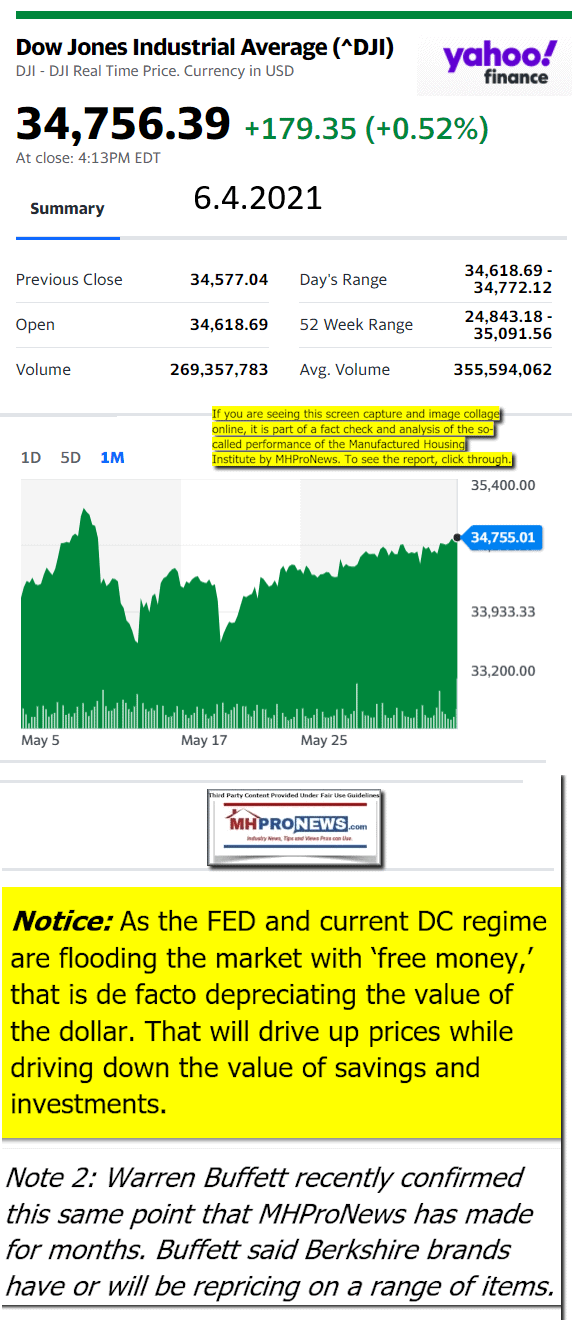

Stock Market Updates and Business Daily Market Moving Left (CNN) – Right (Newsmax) Headlines Snapshot. While the layout of this business daily report has recently been modified, several elements of the basic concepts used previously are still the same. The headlines that follow below can be reviewed at a glance to save time while providing insights across the left-right media divide. Additionally, those headlines often provide clues as to possible ‘market moving’ items.

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Headlines from left-of-center CNN Business = evening of 6.4.20

- Food prices surge

- A sales assistant arranges fruit at the fresh produce section in the supermarket at the SM City Bacoor shopping mall in Bacoor, Cavite province, the Philippines, on Thursday, June 3, 2021.

- The cost of everything from cereal to vegetables is at its highest level in nearly a decade

- Bitcoin tumbles after Elon Musk tweets breakup meme

- US adds 559,000 jobs in May as the recovery gains steam

- Why everyone is hyping up the US jobs report

- ‘This is historic progress’: Biden on new jobs added in May

- Stocks pop as solid jobs report soothes investor fears

- China’s stronger currency means difficult choices for Beijing

- Republicans’ main attack on Biden’s infrastructure plan doesn’t work

- Biden wants a global minimum tax. The G7 could provide a crucial boost

- How to invest in IPOs

- This discount chain thinks rising prices are a good thing

- Opinion: After 444 days, I went back to the movies. Here’s why everyone else will too

- Ford could get hit with $1.3 billion penalty for importing vans from Europe

- Hackers have a devastating new target

- WASHINGTON, DC – JUNE 18: U.S. President Donald Trump put his phone in his pocket during a roundtable at the State Dining Room of the White House June 18, 2020 in Washington, DC. President Trump held a roundtable discussion with Governors and small business owners on the reopening of American’s small business.

- Facebook suspends Trump until January 2023

- A person wearing a protective mask exits from a GameStop Corp. store at a mall in San Diego, California, U.S. on Thursday, April 22, 2021. California officials plan to fully reopen the economy on June 15, if the pandemic continues to abate, after driving down coronavirus case loads in the most populous U.S. state. Photographer: Bing Guan/Bloomberg via Getty Images

- Meme madness: Bank of America stops covering GameStop

- A bartender pours beers for fully vaccinated customers at the bar inside Risky Business, that was once The Other Door but closed during the Covid-19 pandemic in the North Hollywood neighborhood of Los Angeles, California on May 21, 2021. – In order to go inside Risky Business, members must present their original vaccination card after being fully vaccinated, paying a small membership fee, signing a risk release form with penalties for lying, and waiting a full two weeks after competing their shots. While the policy is strict, once inside customers can enjoy an experience knowing that everyone else has been 100-percent vaccinated with an lively pre-pandemic atmosphere with people up close and personal – talking, hugging, playing pool and drinking without rules for masks or social distancing.

- Americans are buying lipstick and condoms. Here’s how bars are prepping for a big summer

Headlines from right-of-center Newsmax – evening of 6.4.2021

- Senate GOP Slams Biden Infrastructure Plan, Preparing a New Offer

- Senate Republicans on Friday panned President Joe Biden’s latest infrastructure proposal and are expected to make a new offer as talks grind toward next week’s deadline for progress on a bipartisan deal.

- Related Stories

- Biden Infrastructure Plan Endangered by Dire US Shortages

- Biden to Reconvene With GOP Sen. Capito in Race to Salvage Infrastructure Deal

- Biden Wants $1T New Infrastructure Spending, Offers Change to Corporate Tax Hike

- Newsmax TV

- Michael Oren: ‘It’s Always Premature to Eulogize Benjamin Netanyahu Politically’

- Chinese Virologist to Newsmax: Fauci’s Emails Prove COVID Was Engineered |

- Nunes: COVID Likely a Lab Leak, but Not Purposeful |

- Nunes: Big Tech Backed Biden, He’s Not Inclined to Go After Them

- Nicole Malliotakis: ‘National Disgrace’ to Fly Black Lives Matter Flag at Embassies |

- Hagedorn: Fauci Could be ‘Covering’ for China |

- Newsfront

- Trump Slams Facebook Over 2-Year Suspension

- Former President Donald Trump lashed out at Facebook Friday after the social media giant announced it would suspend his account for at least two years as it enforces new “protocols to be applied in exceptional cases.”…

- Senate GOP Rejects Biden Infrastructure Plan, Prep New Offer

- Senate Republicans on Friday panned President Joe Biden’s latest

- White House: Report on Strange Aerial Objects Not Yet Finalized

- The White House declined comment on reports on Friday about a series

- Related

- Former Sen. Harry Reid Glad He ‘Blew The Horn’ on UFOs

- Leisure and Hospitality Pay Surges to a Record. Now Will Workers Come?

- Hotels, restaurants and other businesses are boosting pay as they try

- Trump’s Former Counsel Don McGahn Testifies to House Panel

- Former White House Counsel Donald McGahn was questioned for hours

- COVID Vaccine Incentives Now Include Beer and Guns

- Leaders nationwide are pushing perks – including booze and bullets –

- Pentagon Says LGBTQ Pride Flag Still Not Allowed at Military Bases

- The rainbow flag that symbolizes the LGBTQ community will not be

- Durham’s Delays on Trump-FBI Report Are ‘Inexplicable’

- Members of the legal community and a former Trump administration

- GOP Lawmakers Rip Biden Over Jobs Report

- Republican congressional leaders are blasting President Joe Biden

- Putin Signs Law Aimed at Crushing Russian Opposition

- Russian President Vladimir Putin signed a new law Friday that critics

- SPONSOR: Opens arteries, boosts energy, and restores circulation

- Former British Intel Chief: China Would Have Destroyed Evidence If COVID-19 Came From Lab

- The former head of British intelligence said this week that if

- Trump Likely to Pillory Fauci at Rallies Over Wuhan Lab

- Anthony Fauci will likely become former President Donald Trump’s

- SPONSOR: A drastic, unexpected effect on the U.S. stock market

- Biden Claims ‘Historic Progress’ Despite Modest Jobs Report

- Unemployment is down and wages are up, President Joe Biden said on

- Job Growth Up in May, Unemployment Falls to 5.8%

- S. employers boosted hiring in May as the easing pandemic, helped

- Last week President Trump was on Newsmax TV for special interviews

- Pompeo: NIH, Some in State Department Suppressed COVID Probe

- Ex-Secretary of State Mike Pompeo is accusing the National Institutes

- Fauci Urges China to Release Medical Records of Bat Cave Patients: Report

- Anthony Fauci has urged China to release the medical records of

- UFO Report Inconclusive; China, Russia Tech Possible

- The upcoming U.S. government report on Unidentified Aerial Phenomenon

- Nearly $2B Targeted For Busiest Border Wall Section Goes Unused

- Thousands of illegal immigrants enter the U.S. daily while much of $2

- Feds Didn’t Pursue Trump on Cohen Revelations, Why Is New York?

- The advantage of a New York courtroom potentially stocked with [

- Biden Infrastructure Plan Endangered by Dire US Shortages

- The biggest threat to President Joe Biden’s vision of energizing the

- Former Sen. Harry Reid Glad He ‘Blew The Horn’ on UFOs

- Former Senate Majority Leader Harry Reid, D-Nev., said he was glad he

- FBI Director Wray Compares Ransomware Challenge to 9/11 Attacks

- FBI Director Christopher Wray compared the recent ransomware attacks

- DeSantis at Odds With CDC Over Cruise Ship Industry

- Florida Gov. Ron DeSantis’s efforts to get cruise safety rules from

- Study: COVID-19 Lockdowns Contributed to Global Drop in Crime

- COVID-19 lockdowns had at least one welcome upside: a significant

- Supreme Court Urged to End Pandemic Eviction Ban

- A group of landlords asked the U.S. Supreme Court on Thursday to

- Pence May Never ‘See Eye to Eye’ With Trump on Jan. 6

- Former Vice President Mike Pence said Thursday he was not sure

- Pennsylvania Democrats Veer Hard Left

- Less than a month after key Democratic primaries in Pennsylvania,

- Facebook to Bar Politicians From Posting Content Deemed ‘Deceptive’: Report

- Facebook plans to eliminate an exemption for politicians that allows

- Ocasio-Cortez: Not Acceptable to Use Jails as Garbage Bins for Humans

- Alexandria Ocasio-Cortez, D-N.Y., says if the U.S. wants to]

- More Newsfront

- Finance

- US Labor Market Worse than it Appears, Fed Paper Suggests

- S. labor market signals are conflicting to an “unprecedented” degree, but those suggesting labor market slack should be given more weight than those pointing to tightness, according a paper prepared by the San Francisco Federal Reserve Bank.

- Cybercrime ETFs Sputter as Meme Stocks Absorb Market’s ‘Oxygen’

- Biden Infrastructure Plan Endangered by Dire US Shortages

- AMC’s Dot-Com-on-Steroids Week Ends With More Dizzying Gyrations

- Fed to Keep ‘Invisible Presence’ in Bond Market, Citigroup Says

- More Finance

- Health

- ‘Next Big Wave’: Radiation Drugs Track and Kill Cancer Cells

- Doctors are reporting improved survival in men with advanced prostate cancer from an experimental drug that delivers radiation directly to tumor cells. Few such drugs are approved now, but the approach may become a new way to treat patients with other hard-to-reach or…

- Just Two Daily Fruit Servings Lowers Diabetes Risk

- Drug Helps Fight Early-Stage Breast Cancer

- Early Risers at Reduced Risk for Depression

- Surprising Number of Hospital Workers Refuse the COVID-19 Vaccine

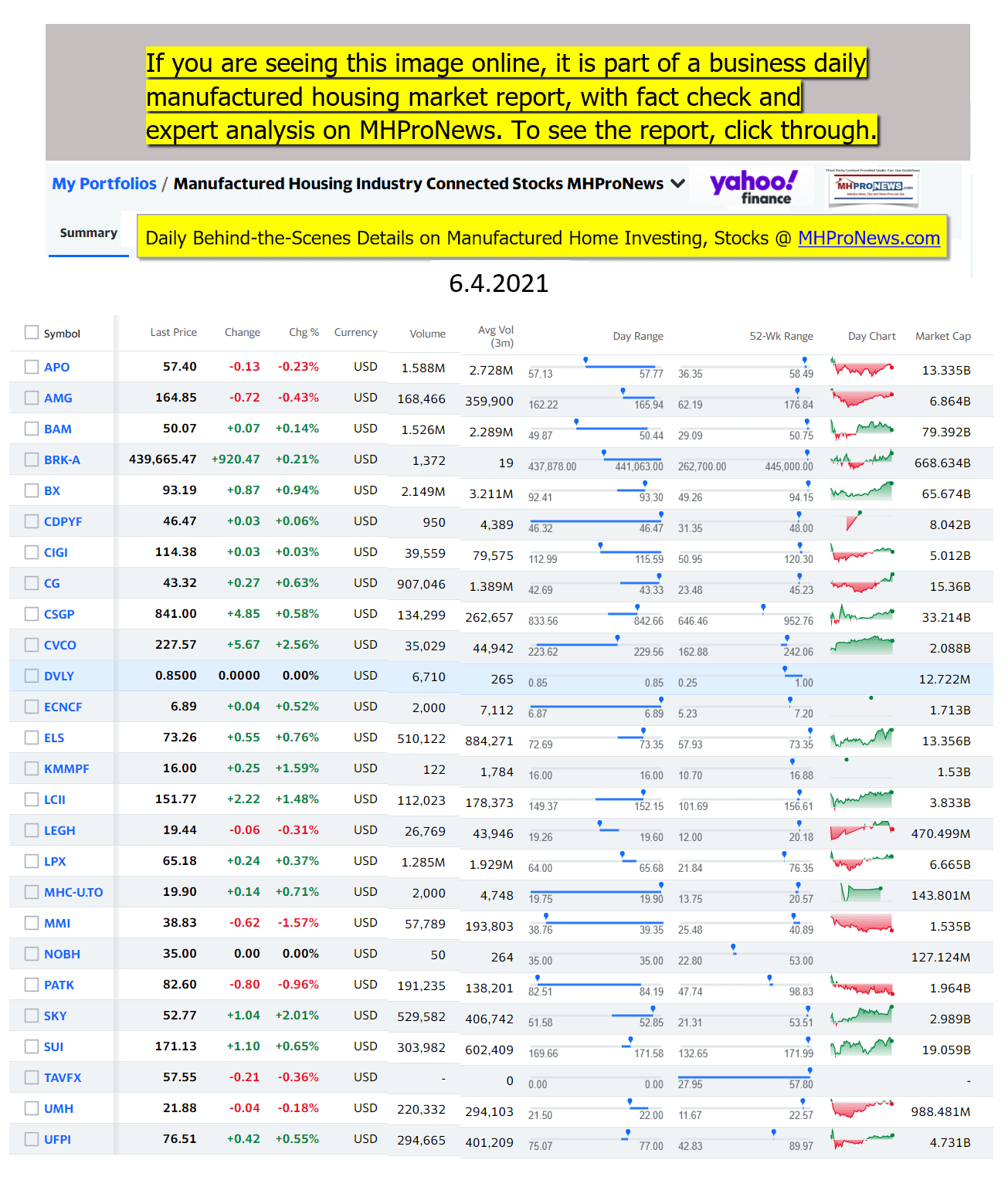

Manufactured Housing Industry Investments Connected Equities Closing Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

-

-

-

-

-

-

-

-

-

-

-

Spring 2021…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12the year of serving the industry as the runaway most-read trade media.

Sample Kudos over the years…

It is now 11+ years and counting…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.