If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

- SPAM maker Hormel gets burned by tariffs

- How McDonald’s solved its Happy Meal problem

- VW accused of ruining Mexican crops with ‘hail cannons’

- Trump says impeachment would crash the market. Really?

- Sony’s cute — and super smart — robot dog is coming to the US

- Tesla investor to Musk: Don’t go private. Stock could be worth $4,000

- Sears is closing another 46 stores. Here’s where

- Apple’s Tim Cook is about to get a $120 million payday

- Airbnb adds its first female board member

- Why the IPO of Saudi Arabia’s crown jewel has stalled

- Facebook removes Syrian war page it believes is linked to Russian intel, Twitter keeps it online

- European airlines are scrapping flights to Iran

- Starbucks will start paying employees to give back

- Dozens of CEOs ask Trump administration not to change immigration policy

- Goldman Sachs is offering savings accounts to Brits

- As California firefighters battled the state’s largest wildfire, Verizon throttled their data

- Huawei: Australia has banned us from selling 5G tech

- Gig economy workers need benefits. These companies are popping up to help

- Trump is wrong: We need quarterly earnings reports

- Trump is right: Quarterly earnings reports should go

- Facebook has suspended over 400 apps after Cambridge Analytica scandal

- Texas Gulf Coast exports more oil than it imports for first time

- This is the longest bull run in American history

- Time Magazine’s latest Trump cover shows president drowning in Oval Office

- Let’s play softball: Read all 18 questions Fox News asked Trump

- Russia is buying lots of gold to shield itself from sanctions

- How crazy rich are Asia’s wealthiest families?

- Tencent’s troubles are far from over

- Alibaba is ready for a trade war

Select Bullets from Fox Business…

- Google deletes 58 accounts linked to Iran for misinformation campaign

- Stocks lower as trade dispute escalates

- Would the market crash if Trump were impeached?

- Tariffs hurting American boating industry[overlay type]

- Tariffs hurting American boating industry

- Impeachment could be a dangerous political strategy for Democrats: Varney

- Monsanto slammed with 8,000 lawsuits after Roundup cancer verdict

- After historic market run, here’s what to expect next

- All Orchard Supply Hardware stores to be closed within months

- Sears adds to closures – shares fall to record low

- 1962 Ferrari worth $45 million may set auction record

- NASA chief: Building a rocket larger than the Statue of Liberty to travel to Mars

- Smoked watermelon ‘ham’ creators wanted to try something a ‘little different’

- This could become the most expensive car ever sold at auction

- VW to launch all-electric car sharing in Berlin

- New Mexico utility seeks to join western energy market

- Putin says latest US sanctions senseless

- Young entrepreneurs ditching Silicon Valley for these US cities

- Small business optimism at 35-year high

- States where $100 goes furthest: report

- 2 out of 5 Americans are unable to handle an emergency $400 expense

- Top 10 highest-paying jobs in the US

Today’s markets and stocks, at the closing bell…

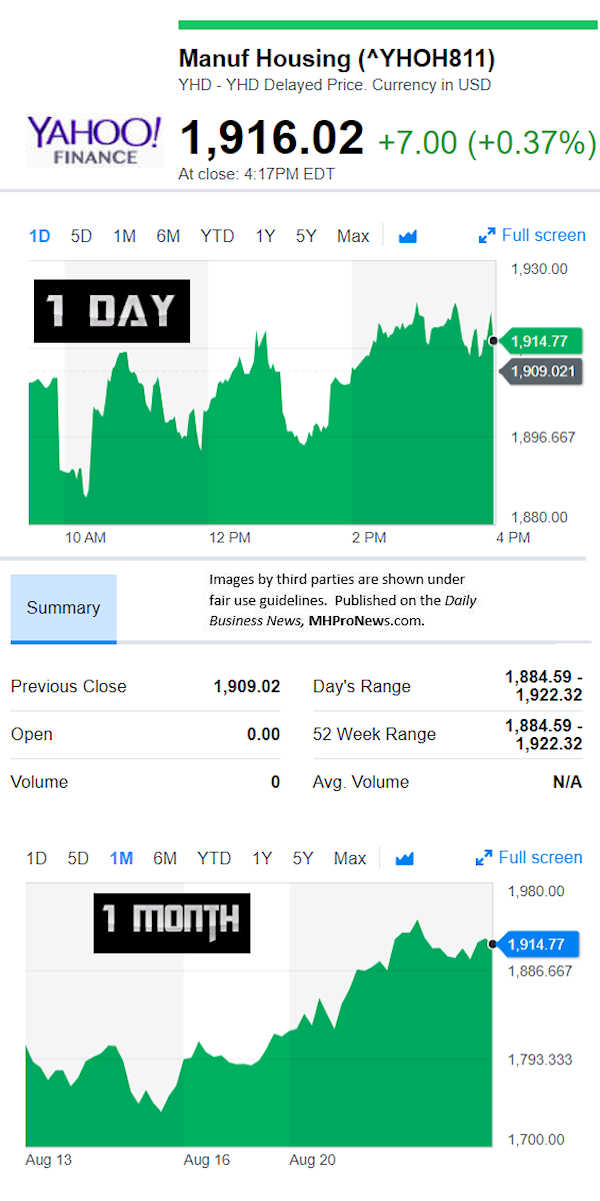

Manufactured Housing Composite Value (MHCV)

Today’s Big Movers

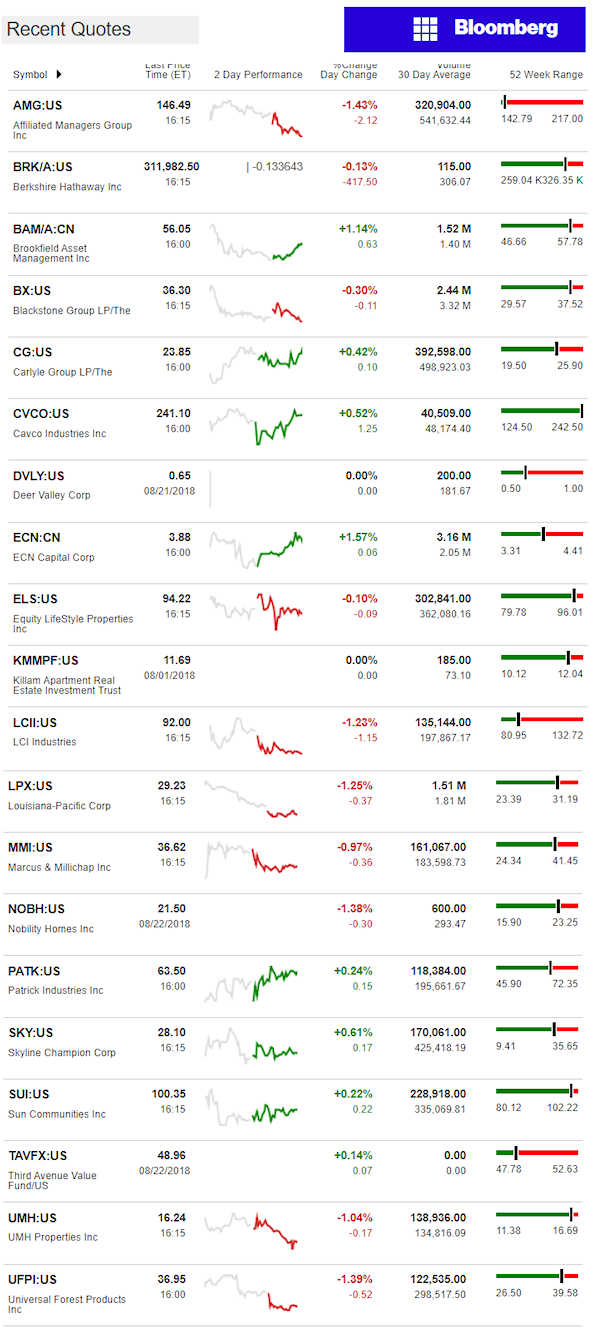

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

One can disagree with or question the ethics or legality of the Warren Buffett moat, while still gaining a tremendous insight from the chairman of Berkshire Hathaway.

Among some of the Buffett/Charlie Munger principles:

He likes a bargain.

He likes industries that make good sense.

He likes companies that are well run.

He plans to invests long term.

With those thoughts, listen to what Bill Gates has to say in this CNBC interview.

Then consider the motivation for Warren Buffett being in manufactured housing. Alan Amy said it well.

Warren Buffett Would be Okay With Clayton Homes Losing Money, Says Kevin Clayton – But Why?

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.